Australia is among countries around the world making long-term strategic investments to internationalize the rare earths supply chain currently dominated by China.

China’s dominance in sourcing and refining rare earth minerals has emerged as a new security issue in international relations in recent years. Rare earths are needed for a wide variety of products, ranging from smartphone to defense technology. According to the US Geological Survey, China was responsible for 80 percent of rare earths imports in 2019, underscoring its control of the market.

China’s stranglehold on rare earths has led to international calls to diversify supply chains to make countries and businesses less reliant on one country for rare earths products. Among others, Australia has been deepening its involvement in the rare earths production to dilute China’s influence in this sector.Here, we first introduce rare earths and its value to global trade and spotlight the well-established scope of China’s rare earths industry, before delving into how Australia is making investments in the sector and what it could mean for businesses.

Importance of rare earths and their value in global manufacturing

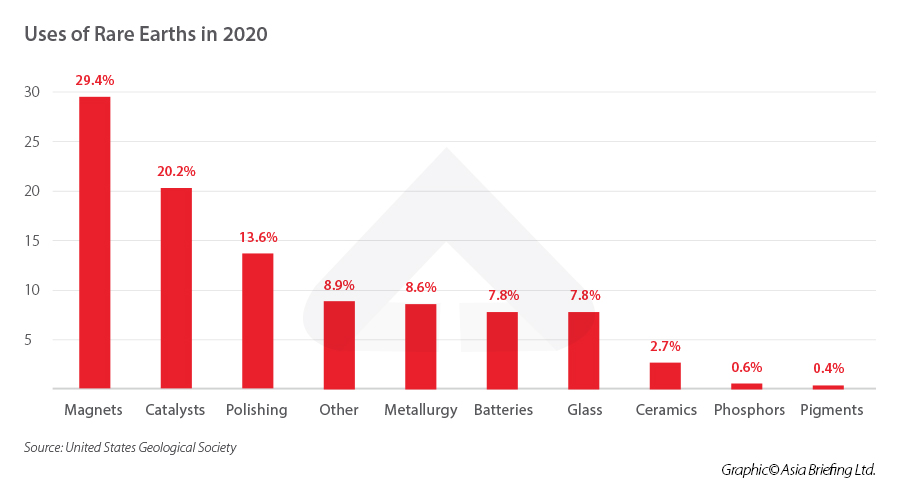

Rare earths, or rare earth elements (REE), are a category of 17 minerals, 15 of which are in the lanthanide series in the periodic table of elements and two of which – scandium and yttrium – that are not lanthanides but have similar properties.Rare earths are essential for manufacturing components of electronic products, like magnets, catalysts, and batteries. The innumerable products containing components made from rare earths include smartphones, computers, electric vehicles, motors, high-tech batteries, wind turbines, medical devices, and many others.

Contrary to their name, rare earths are plentiful in the earth’s crust, but their minable concentrations are lower than most other minerals. Because they appear in low concentrations, are chemically similar to one another, and often occur in difficult geological formations, they are expensive and polluting to extract, process, and refine.

Breaking down China’s position in the global rare earths supply chain

China is by far the world’s largest producer of rare earths. In 2020, China produced about 140,000 tons of rare earths, or close to 60 percent of the world’s total.China dominates global rare earths production in large part because of its huge investments in refining facilities, ownership of intellectual property surrounding refinement and production, historically cheap production costs, and low environmental standards.

How China replaced the US to dominate the global rare earths industry

The development of rare earth production in China is a direct result of the country’s industrial policy. The US was the world’s largest producer of rare earths until the 1990s, when China invested heavily in the sector.Then, until 2012, China produced almost the entire global supply of rare earths. Since then, China’s share of global production has declined significantly, falling from 92 percent in 2010 to 58 percent in 2020.

Rare earths production in China is dominated by six state-owned enterprises (SOEs). They are referred as “Big Six”, which include:

- China Minmetals Rare Earth Co.

- Aluminum Corporation of China (CHALCO)

- Guangdong Rising Nonferrous

- China Northern Rare Earth Group

- China Southern Rare Earth Group (Ganzhou Rare Earth Group Co., Ltd being the controlling shareholder)

- Xiamen Tungsten

While China firmly leads rare earths production, ownership of rare earths reserves is more diffuse. China still leads the world, with nearly 40 percent of rare earth reserves, but there are also numerous countries with significant reserves and little domestic production.

Because rare earths production is difficult and resource-intensive, countries without domestic facilities will typically export their reserves abroad for refinement. In addition to reserves, measured and indicated resources of rare earths are found around the world, including 2.7 million tons in the US and 15 million tons in Canada.

Rare earths production by country

| Ranking | Country | Thousand tons | Percentage of total |

| 1 | China | 140.0 | 57.5% |

| 2 | United States | 38.0 | 15.6% |

| 3 | Myanmar | 30.0 | 12.3% |

| 4 | Australia | 17.0 | 7.0% |

| 5 | Madagascar | 9.0 | 3.3% |

| - | Rest of world | 10.3 | 4.2% |

Rare earths reserves by country

| Ranking | Country | Million tons | Percentage of total |

| 1 | China | 44.0 | 38.0% |

| 2 | Vietnam | 22.0 | 19.0% |

| 3 | Brazil | 21.0 | 18.1% |

| 4 | Russia | 12.0 | 10.4% |

| 5 | India | 6.9 | 6.0% |

| 6 | Australia | 4.1 | 3.5% |

Quad countries, including Australia, invest in building up their rare earths production capacity

The Australian government, with the support of the US and other countries, is investing in capacity to produce rare earths, having identified it as a strategic industry. In September 2021, a meeting of the “Quad” group – Australia, India, Japan, and the US – agreed to improve supply chain security for rare earths. Per the agreement, the Quad countries will use subsidies, incentives, and regulatory congruence to encourage the development of rare earths extraction and refinement outside China, including in countries outside the Quad, like European countries and South Korea.On March 16, 2022, Australian Prime Minister Scott Morrison announced close to AUS$500 million (US$360 million) in funding for critical minerals, including rare earths. As part of this funding, Australia will build just the second rare earth separation plant located outside China, as well as a battery material refinery, a vanadium processing plant, and support to commercialize government research and bring new companies to market. Overall, Australia has made AUS$2 billion (US$1.5 billion) in financing available to the rare earths industry.

Angus Taylor, the Minister for Industry, Energy, and Emissions Reduction, said about the funding, “China currently dominates around 70 to 80 per cent of global critical minerals production and continues to consolidate its hold over these supply chains. This initiative is designed to address that dominance.”

Earlier, on February 2, 2022, the Australian government agreed to an AUS$140 million (US$100 million) project financing loan to Hastings Technology Metals’ Yangibana rare earths mine in the Gasgoyne region of Western Australia.

Implications for foreign investors

Australia, with its strength in mining, is taking the lead in developing rare earths production outside of China. In addition to its own economic and security concerns, Australia’s efforts can be seen as part of a concerted global effort by governments and businesses to diversify rare earths supply chains, as evidenced by efforts to build the supply chain in the US, Europe, India, South Korea, and elsewhere.Need for extensive capital investments and international cooperation means China is not getting displaced atop the rare earths ecosystem any time soon but over the longer term, key shifts currently underway will result in strategic industrial diversification.Diversifying the rare earths supply chain has become a growing priority over the last decade. In 2010, the Japanese government accused China of blocking rare earths shipments amid a diplomatic dispute. This event caused concern among government and businesses, given that China controlled almost all rare earths production at the time.

Since then, worries about the Chinese government withholding rare earths for political reasons have only heightened, particularly as China has had trade disputes with Australia, Canada, the US, and South Korea in recent years.

Given the ubiquity of high-tech products, demand for rare earths will only accelerate going forward. At a global level, more production should lead to more supply, lower prices, cheaper transportation, and lower risks for manufacturers.

Building a new rare earths supply chain, however, is an expensive, resource-intensive, and lengthy process that will take years – and potentially decades – to truly come to fruition. Accordingly, while sourcing options of rare earths and rare earths products stand to gradually become more diversified, China is well placed to remain the dominant and unavoidable player in the space for years to come.