In today's rapidly evolving technological landscape, digitalization has emerged as a pivotal strategy for businesses aiming to enhance efficiency and adaptability. At its core, digitalization refers to the integration of digital technology into all aspects of a business, fundamentally changing how you operate and deliver value to customers.

While concepts like ERP (Enterprise Resource Planning) systems play a crucial role in managing resources within an organization, digitalization is a broader initiative that encompasses not just resource management but also advancements such as cloud computing, artificial intelligence, and big data analytics. These tools collectively enable businesses to streamline operations, make informed decisions, and deliver superior customer experiences.

The relevance of digitalization is underscored by the continuous evolution of technology, making it essential for companies to adopt these tools to stay competitive. Key benefits include time-saving, cost reduction, improved decision-making through enhanced data insights, and an elevated customer experience.

However, embarking on a digital transformation journey isn't without its challenges. Businesses often grapple with employee resistance to change, the upfront costs of implementing new systems, and ensuring robust data security measures. Addressing these issues is crucial for a successful transition.

In summary, digitalization is about leveraging technology to transform how your business operates, offering significant advantages while presenting unique challenges that require strategic planning and management.

In this article, we will explore how businesses can effectively navigate this transformative journey by sharing some on-the-ground experiences for successful localization

What to localize?

Considering the objectives, we classify localization into two categories—mandatory configurations for compliance and non-mandatory integrations with local and international modules for optimized performance and user adoption.

Mandatory localization features

Although ERP covers almost all core business processes, the mandatory improvements necessary for the system to align with China’s regulations predominantly revolve around finance and tax modules. Three key documents chiefly guide these functionalities:

- Accounting Law of the People’s Republic of China (amended in 2024, hereinafter referred to as the “PRC Accounting Law”)

- Notice on Promulgation of the Specification for Accounting Informatization published by Ministry of Finance on Cai Kuai [2024] No. 11 (effective from January 1st 2025)

- Notice on Promulgation of the Specification for Basic Functions and Services of Accounting Software published by Ministry of Finance on Cai Kuai [2024] No. 12 (effective from January 1st 2025)

Broadly speaking, the system must possess the capability to handle accounting data and generate financial reports that adhere to China's accounting standards (hereinafter referred to as “China GAAP”). Besides, additional requirements exist regarding:

- Language for information input;

- Reports generation, and interface;

- Distinct name;

- Date format;

- Address formats;

- Data storage and backup provisions within mainland of China.

In the table below, we provide an itemized list to be followed to meet China's standards for effective ERP localization. For each item listed in the table, there are more detailed requirements to meet considerations based on relevant regulations and local compliance practices. Take VAT settings within the ERP system as an example. In addition to the basic setting (input VAT rates, output VAT rates, VAT rebate rates) in each operational module, such as the purchase and sales modules, there are further requirements regarding settings for journals in the finance module.

|

Functionality |

Specific functionality |

Items to localize |

|

Chart of Accounts (COA) and Ledgers |

COA compliance |

Continued alignment with China GAAP; enhanced automation for three-ledger systems (general ledger, sub-ledger, management ledger). |

|

Fixed Assets & Depreciation |

GAAP alignment |

New rules for accelerated depreciation under green tech incentives; mandatory disclosure of environmental depreciation costs for qualifying assets. |

|

Inventory Management |

Cost allocation |

Enhanced tracking of imported goods per new customs integration policy; support for new barcode-based inventory classification. |

|

Value Added Tax (VAT) |

Tax compliance |

Support for real-time e-fapiao integration with Golden Tax System Phase IV; adaptive VAT rates based on updated product-service classification. |

|

Display & Printing |

Format compliance |

Enforced support for electronic accounting documents (electronic signatures, QR codes); upgraded print formats conforming to 2024 State Tax templates. If company implement e-file archiving solution, it is not necessary to print the electronic supporting document and vouchers any more. |

|

Report Production |

Statutory reports |

Inclusion of ESG-related financial disclosures; multi-year comparative reporting now mandated for some sectors. |

|

Sub-ledger Reports |

Audit support |

New mandatory reports supporting Digital Tax Administration audits; expansion from 17 to 20 required reports for compliance. |

|

Chinese Language Settings |

Interface support |

Enhanced AI translation support for non-native ERP users; character encoding support for minority languages in some regions. |

|

Screen Interface Localization |

UX/UI |

Mandated full Chinese UI for all publicly used systems; new standards for accessibility (e.g., simplified screen readers). |

|

Data Backups |

Data residency |

Stricter enforcement of China Cybersecurity Law: backups must be stored in mainland data centers with monthly audit trails. |

|

Operation Logs |

IT compliances |

Requirement to store logs for no less than 6 years; integration with local Security Operations Centers (SOCs). |

According to Regulations on the Accounting Treatment of Value-added Tax (Cai Kuai [2016] No. 22), the ERP system shall set up the three-level accounts for VAT as required and make sure journals can be generated according to the regulatory stipulations. Besides, a cross-check between the account in the accounting system and the data in the VAT return should be done to ensure the account balance numbers are correct, as the VAT accounts are also linked to the VAT filing return submitted to the tax authority every month.

To achieve this, considering input VAT information is basically generated and extracted from purchase transactions within the procurement module or expense management module of the ERP system, the ERP system needs to set up a mechanism to mark/separate the verified input VAT in the tax system and the unverified input VAT, then set the correct accounting entries in the general ledgers. The debit amount of each month's “Input VAT” account should be consistent with the verified input VAT in the tax system. Similar requirements exist for output VAT as well.

Moreover, companies and ERP vendors can find corresponding rules regarding the billing information the ERP system needs to output, the VAT invoice issuing rules, and the written back of key VAT invoice information to the corresponding ERP invoice report, etc.

Integrations for optimized performance

When expanding and localizing a global ERP for your China operations, it’s commonplace to receive suggestions for integrating specific external local or non-local modules into the system. Typically, these integrations are not mandatory in the sense that failing to integrate them won’t impede your ERP system’s approval with the local tax bureau or hinder compliance with statutory mandates. However, these integrations can hold equivalent, if not more, importance for your organization. They play a pivotal role in enhancing your company’s back office automation, freeing employees from performing frequent yet cumbersome manual tasks, boosting accuracy and efficiency, and achieving streamlined business management. Consequently, your organization will be better equipped to navigate China’s demanding compliance landscape.

Considering your business’s unique circumstances, commonly integrated local modules are listed in the table below. We also provide an example by demonstrating the considerations for integration with China’s Golden Tax System.

|

Local modules |

Objectives for integration |

Suitable enterprises |

|

Golden Tax System |

• Reduce manual work for issuing VAT invoices; |

Enterprises that issue a large number of VAT invoices monthly. |

|

Expense Management System |

• Easier for managers to review and approve from anywhere with transparency; |

Companies with frequent and high-volume expense applications. |

|

Bank System Integration |

• Reduce manual bank transaction workload; |

Enterprises with high-frequency, high-volume bank transactions. |

|

Office Management (OA) System |

• Enable efficient HR and internal workflow automation; |

Organizations with a large China-based workforce or complex HR workflows. |

|

CRM Integration |

• Provide local sales teams with visibility into customer history; |

Companies aiming for strong local customer engagement and streamlined sales operations. |

|

MES (Manufacturing Execution System) |

• Real-time shop-floor control and feedback; |

Manufacturers with local production facilities in China. |

|

Advanced Warehouse Management |

• Optimize inventory movement and layout; |

Enterprises with large or complex warehouse operations. |

|

Finance E-File Archiving System |

• Meet Chinese compliance rules for digital storage of accounting documents; |

Enterprises subject to regular audits or required to store digital financial data locally. |

|

Low-code / No-code Applications |

• Enable fast development of localized workflows without full-scale IT involvement; |

Enterprises seeking agile adaptation to evolving China-specific business or regulatory needs. |

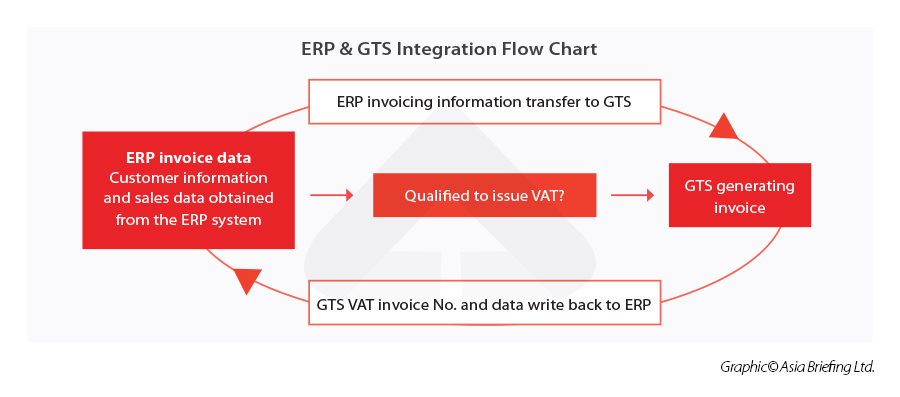

Under the PRC tax laws and regulations, Chinese enterprises are required to issue fully e-invoice (i.e., the fapiaos) in a very specific format stipulated by the tax authorities when selling products or providing services to their customers. Such VAT invoices cannot be generated from an ERP system or other accounting software. Correspondingly, only VAT invoices issued in this way can be used as supporting documentation for income recognition and tax filing by their customers. In practice, during VAT invoice issuance, many companies capture the sales details from their ERP or other sales systems, then manually input them into the online GTS for fapiao issuance. The procedure is time-consuming and easily causes the waste of blank VAT invoices due to typos or other errors. This especially inconveniences companies that must issue large numbers of VAT invoices each month.

To address this situation, the China State Taxation Administration requested that the GTS vendor develop a public interface and enable enterprises to integrate their ERP or sales systems with the GTS. This has facilitated the automatic import of sales data into the GTS for fapiao issuance. Under the proactive promotion of the GTS by the tax authorities, ERP and GTS integration have garnered increasing adoption among Chinese enterprises. Many enterprises have added this function to the task list for their ERP implementation projects.

In addition to the local integrations, it’s also not rare for companies to integrate some other international apps, such as MicrosoftPower BI, Sharepoint Online, PowerApps, manufacturing execution system (MES), product lifecycle management (PLM), client relationship management (CRM), and bar code scanner or radio frequency identification devices (RFID), to their ERP systems based on their specific business needs and priorities.

Tips for successful localization

Building upon these collective insights, it becomes evident that ERP localization is a highly specialized undertaking. Engaging a proficient ERP and financial service provider is key to ERP localization and integration success. Typically, the vendor standards listed below are regarded as significant, based on our experience:

- The vendor ought to possess extensive experience in the realm of ERP localization, spanning service provision and advisory roles, which encompasses comprehensive expertise in the following domains:

» IT;

» Accounting standards and financial reports;

» Human capital management and HR and payroll administration; and

» Legal and compliance management and advisory. - The vendor should be familiar with the local business environment and industry best practices and thoroughly understand your company’s business processes.

- The vendor should have bilingual working capabilities and be able to cooperate seamlessly with the company's HQ and China subsidiaries efficiently and flexibly.

- The vendor should have certifications and qualifications applicable to the ERP implementation, such as Project Management Program (PMP) Certified Information Systems Security Professional (CISSP) in the information security field, and vendor-specific ERP certifications (Microsoft Dynamics 365, XERO, Microsoft 365, etc.).

Furthermore, considering that ERP localization is a choice that aligns with headquarters and overseas teams, but might not necessarily be in the best interest of China-based staff and operations, it is advisable for overseas headquarters to engage in comprehensive discussions regarding the ERP localization strategy with their China teams. It is essential to listen to their demands and considerations in a productive manner.