Foreign investors may decide to close their business for multiple reasons. To legally close a business, investors need to go through a series of procedures to liquidate and deregister the company, which involves dealing with multiple government agencies, including the respective market regulatory bureaus, foreign exchange administrations, customs, tax departments, banking authorities, and more.

Failing to follow the prescribed procedures will lead to serious consequences for the legal representatives and the company’s future.

Reasons for closure

The most common reasons an enterprise may choose to deregister are voluntary liquidation, a declaration of bankruptcy, the expiration of time-bound business activity defined in the company’s articles of association, merger and subsequent disbandment and dissolution, or relocation.

Procedure

Investors are strongly advised not to "walk away" without following the prescribed procedures. Simply walking away has severe repercussions for the legal representatives and the company's future in China. This includes attracting civil liability due to credit owed or even criminal culpability, difficulty during immigration, loss of property and assets, or inability to make future investments due to damage to reputation and financial status.

Close a WFOE: Step-by-Step

Timeframe: Typically, between six to 14 months.

A WFOE company structure is subject to special attention during its closure procedure, involving more steps and authority involvement than that of its representative office and Chinese company counterparts.

The deregistration process can vary depending on the nature of the WFOE (manufacturing, trading, or service WFOE), its associated business scope, the size and health of the company, and the duration of company operations.

There are some general steps that each WFOE must follow.

Form a liquidation committee and prepare an internal plan

The liquidation committee of a limited liability company should comprise of company’s shareholder(s). In practice, the shareholder(s) always designated several people to act on its/their behalf. All the legal documents for the liquidation shall be signed by the person in charge of the liquidation committee.

Throughout the liquidation process, the committee will handle several matters directly concerning the deregistration process, including – notifying the creditors of the business closure, preparing the liquidation report to submit to authorities, as well as more administrative tasks, such as preparing the balance sheet and recording a detailed list of all assets and evaluating properties, conduct the company deregistration formalities with different competent authorities.

The 2023 Company Law, coming into effect from July 1, 2024, clarifies that directors should serve as liquidators in the case of liquidation. Article 232 stipulates that directors shall form a liquidation group within 15 days of the date on which the cause of dissolution arises. The company directors are also members of the liquidation group by default. If the liquidation obligor fails to perform the liquidation obligation in time and causes losses to the company or creditors, they shall be liable for compensation.

Liquidate the assets

The liquidation committee should also begin liquidating the company’s assets and allocate the returns from the sale in the following order:

- Liquidation expenses;

- Outstanding employee salary or social security payments;

- Outstanding tax liabilities; and

- Any other outstanding debts owed by the WFOE.

The company should refrain from settling creditors’ claims until the liquidation plan in step one has been made and approved by the board of shareholders. After the debts have been discharged, the liquidation committee can distribute the remaining returns among the shareholders. If the company’s assets are unable to settle the debts, it will file a bankruptcy declaration with the court.

File the liquidation committee with SAMR while notifying creditors through SAMR’s official website

After the liquidation committee is formed, the WFOE must file a record with the State Administration for Market Regulation (SAMR) notifying SAMR of its intent to close the WFOE. This can be completed by submitting a shareholder resolution, which reflects the shareholder(s)’ decision to close the business and announces the names of the members that have been appointed to form the liquidation committee. Meanwhile, WFOE shall make a public announcement on SAMR’s official website to notify its creditors. The notification period is 45 days. If the WFOE is qualified for a simplified deregistration process with SAMR, the notification period is 20 days.

Begin terminating employees

Businesses are advised to begin terminating employees as early as possible as many adjoining issues may arise once this process is initiated. The WFOE is obliged to pay statutory severance to each employee due to the closing of the WFOE.

Tax clearance and deregistration

A general tax deregistration process will usually take around four to eight months. During this process, the tax authority will collect a series of relevant documents including:

- The signed board resolution;

- Evidence of lease termination; and,

- Tax filing records for the previous three years.

All outstanding tax liabilities will be identified and required to be settled before deregistering the business from its value-added tax (VAT), corporate income tax (CIT), individual income tax (IIT), and stamp tax obligations.

Businesses that have been operating for more than one year will then be required to complete an audit with a local certified public accountant (CPA) firm to obtain a liquidation report. This liquidation report, along with the unissued invoices, VAT invoices, and equipment, can then be brought to the tax bureau for review. In some instances, the tax bureau may visit the office in person to learn more of the company’s intentions and reasons.

If the review is successful, the tax clearance certificate will be issued, in which case the business will have successfully deregistered from all its tax obligations. The business will incur ongoing tax liabilities throughout the business closure process.

SAMR deregistration application

Once the official tax clearance certificate has been obtained, the SAMR deregistration process can begin. To do this, the liquidation committee must submit the liquidation report, signed by the shareholder (or its authorized representative), which needs to confirm the following – the completion of tax clearances, the termination of all employees, and that all creditor claims have been settled. A shareholder resolution on the liquidation of the WFOE also needs to be submitted at this stage.

Deregister with other departments

At the same time, the business must deregister at the following departments (where relevant):

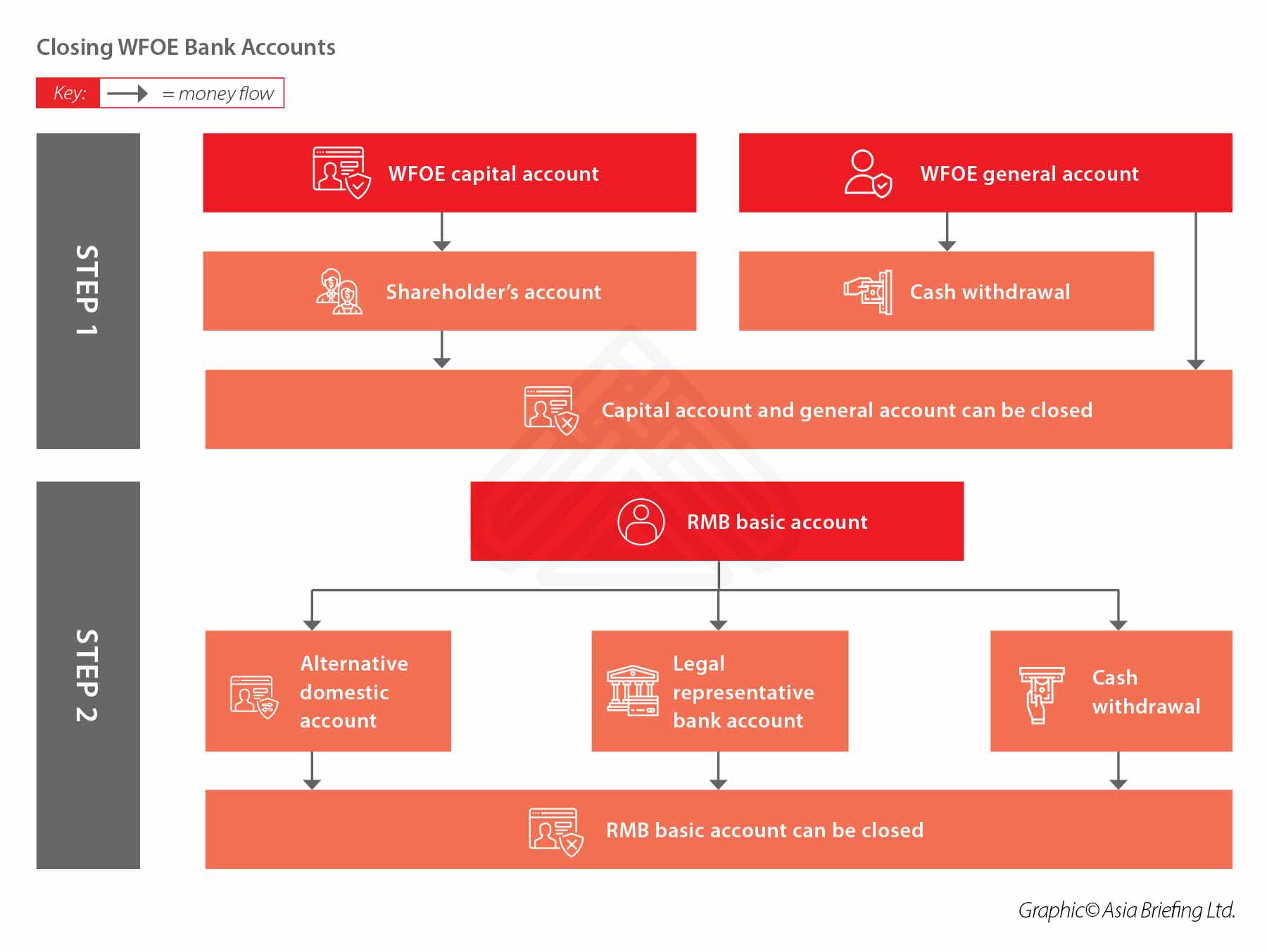

- State Administration of Foreign Exchange (SAFE): This needs to be completed through the bank rather than SAFE. The WFOE must make an application at the bank in which their capital account was opened.

- Foreign Capital Account and RMB general account(s): This shall be conducted together with SAFE deregistration. The balance in the foreign capital account and RMB general account(s) shall be transferred to RMB basic account.

- Social insurance bureau: The SAMR deregistration notice needs to be brought to the HR bureau for deregistration.

- Customs bureau: An application letter stamped by the company, along with the original custom registration certificates needs to be submitted to the customs bureau for deregistration. If the WFOE never obtained a registration certificate from the customs, only an application letter is required.

- Other licenses: Production licenses, food distribution licenses, and others need to be deregistered with the relevant authorities.

Obtain Deregistration Notification from SAMR

RMB basic and RMB general account closure

When closing an RMB general account, its balance can only be remitted to its RMB basic account and is not allowed to be returned to its overseas shareholder/investor or its local affiliates.

All bank accounts of a company shall be “prohibited to conduct any operation” within seven days upon its deregistration of business license. Neither payment nor receiving money is allowed. Given this, in most cases, it’s safer for businesses to close the RMB general accounts properly before deregistering the business license.

The RMB basic account must always be the final account to close as it is the WFOE’s primary account and is most closely monitored by PBOC. Here, a few options are there:

- In principle, the balance must be directly transferred to the shareholder; and

- The balance in the account shall not exceed the liquidation income indicated in the liquidation report.

The individual bank branches may have their own policies.

Cancel company chops

Once all the other steps are completed, the WFOE can cancel WFOE's chops by itself or by the public security bureau, mainly depending on local policy.

Close an RO: Step-by-Step

Timeframe: Typically, between six months to one year, or longer if irregularities are found.

For a variety of reasons, there may come a time when foreign headquarters need to close their ROs. For example, when a foreign headquarters looks to transform its RO to a WFOE to expand for-profit businesses, it will need to deregister its RO first.

From a legal perspective, China’s regulations stipulate that a foreign enterprise must, within 60 days, apply to the SAMR to deregister the RO when any of the following circumstances occur:

- The RO is required to shut down in accordance with the law;

- The RO no longer engages in business activities upon the expiration of residency;

- The foreign enterprise terminates its RO; or

- The foreign enterprise terminates its business (meaning the parent company is being closed).

The processes of closing an RO and closing WFOE share similarities, but the former is much simpler, as there are no complex liquidation procedures or large-scale employee terminations.

Employee termination

When preparing the documents for the RO’s deregistration, the foreign enterprise can start dismissing the RO’s employees. An RO typically employs fewer people, making the dismissal process a little easier than for a WFOE.

However, there are a few points that need to be taken care of:

RO’s local employees: RO’s local employees are dispatched by a labor dispatch agency, such as the Foreign Enterprise Human Resources Service Company (FESCO).

The local employees have to sign labor contracts with the dispatching company instead of with the RO and the RO does not have any direct employment relationships with its local employees. As a result, the RO needs to work together with the labor dispatch agency to deal with the employee termination process when laying off a local employee.

The severance shall be paid to each employee due to the closing of RO by the labor dispatch agency, but such money is ultimately paid by RO or its HQ.

RO’s foreign employees including one chief representative and one to three general representatives of the RO – their dismissal must be handled by the RO’s headquarters.

Tax audit

The formal deregistration of an RO starts with the application to the relevant tax bureau for tax clearance and tax deregistration. This step is often considered the longest – around six months – and perhaps the most difficult part of the entire deregistration process, as the tax bureau will ensure that the RO properly and fully pays all the taxes.

As part of the tax deregistration process, the RO must hire a local Chinese-certified public accountant (CPA) firm to audit its accounts for the last three years. The latter will then generate a three-year tax clearance audit report for submission to the tax bureau.

During this phase, it is important to note that the monthly tax filing of the RO shall still be carried as an ongoing activity until all tax closures are completed with the tax bureau.

Tax deregistration

The RO will then need to submit the three-year tax clearance audit report (up to the current month), the tax deregistration application form, the tax registration certificate, vouchers, tax filing records, and other tax-related documents to the tax bureau for review.

If all the taxes are cleared, the tax bureau will issue a tax deregistration certificate to the RO. However, if any unpaid taxes or irregularities are found, the tax bureau may conduct tax clearance for outstanding tax issues or possible on-site inspection of the RO.

The RO may then be required to settle the unpaid taxes, submit additional documentation, or pay penalties.

Deregistration with SAFE and customs

After the tax deregistration is done, the RO will also need to deregister the foreign exchange certificate with the SAFE and deregister the customs certificate with the customs authority. If RO has a general foreign exchange bank account, this account shall be closed together with the SAFE deregistration, and the balance in the account must be transferred to RO’s RMB basic bank account.

Obtaining the deregistration certificates from both the SAFE and the customs authorities is a mandatory step of the RO deregistration process, irrespective of whether the RO has ever obtained a registration certificate from either of these two authorities.

Deregistration with SAMR

The next big step is to officially deregister the RO with the local branch of the SAMR with the following documents:

- The deregistration application letter;

- The tax deregistration certificate;

- Proofs issued by the customs authority and SAFE proving that the RO has deregistered the customs and foreign exchange or has never gone through any registration procedures; and

- Other documents as the SAMR prescribed.

After review, the local SAMR will then issue the ‘notice of deregistration’ stating the official registration and termination of the RO. An announcement of the RO’s deregistration will be listed on SAMR’s official website. At this point, all the registration certificates will be cancelled, as well as the chief representative’s work certificate.

Bank account closure

Last, the RO will need to close its RMB basic bank accounts. Unissued checks and deposit slips should be returned to the bank and money in the account must be transferred to RO’s headquarter.

After the deregistration

After the RO has completed the deregistration, it is important that the parent company requests the return of and keeps all accounting records and business documents to safeguard the interest of the parent company.

Finally, the RO’s chops must be destroyed by the RO or its HQ.

Simplified procedures for company deregistration

The SAT has issued the Notice on Further Optimizing the Procedures for Dealing with Enterprise Tax Deregistration (henceforth Notice) to ease the difficulties of enterprise deregistration. The Notice takes measures to reduce enterprises’ repeated errands and to issue tax clearance certificates on the spot even when some enterprises submit incomplete documents.

In particular, the newly introduced commitment system presumes the integrity of the enterprise, which may be reflected in a positive inspection record, high tax credit ratings, and no tax or fines owed. In such situations, the tax clearance time will be unaffected, and only a commitment is needed from the legal representative deregistering the company to provide all tax-related information within a stipulated time period.

New government reforms will follow three directions.

- Simplifying the SAMR deregistration. This aims to see improvement in the general deregistration system for enterprises;

- Simplifying tax, social security, business, customs, and other deregistration procedures as well as document submission requirements; and

- Setting up online service platforms for enterprise deregistration and carrying out “one-stop” online services (or “one website”) to facilitate this.

Through the above measures, the cancellation time of enterprises can be reduced by at least one-third. At the same time, the government will strictly investigate business entities indulging in the evasion of debt. The names and information on enterprises that have lost credibility due to non-compliance or debt evasion will be jointly published by the respective government agencies.