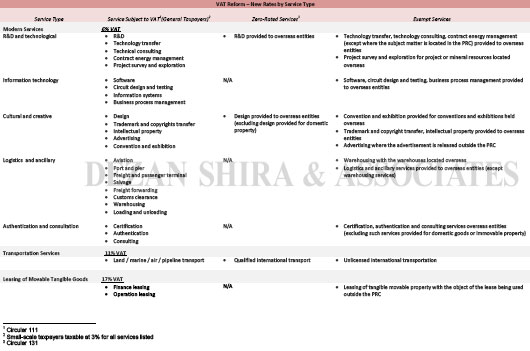

VAT Reform Rates by Service Type

Jun. 20 – Following the State Council’s decision in October 2011 to launch the VAT reform pilot program in Shanghai, the Ministry of Finance and the State Administration of Taxation jointly issued circulars 110 and 111 in November 2011, laying out the details of the VAT pilot program.

Please click here (or click on the image below) for a PDF summary of the new VAT rates by service type, as described in these two circulars.

For more on China’s VAT reform, stay tuned for the July/August issue of China Briefing Magazine on the topic set to be released July 1, titled “Value-added Tax Reform.”

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across China by subscribing to The China Advantage, our complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

China’s SAT Issues Measures for Claiming Zero-Rated VAT

Following Shanghai, Beijing to Roll out VAT Reform in July 2012

Shanghai Offers Fiscal Support to Promote VAT Reform

China Specifies Services Eligible for Zero VAT Rate and VAT Exemption

Beijing Applies for Implementation of VAT Reform Pilot Project

China’s VAT Reform: General Taxpayer Status and Tax Filing Issues

- Previous Article Hong Kong Amends Mandatory Contribution Levels for MPF

- Next Article Accounting and Bookkeeping in China