The China Alternative – Singapore

The China Alternative is our series on other foreign investment destinations in emerging Asia that may soon be competing with China in terms of labor costs, infrastructure and operational capacity. In this issue we look at Singapore.

The China Alternative is our series on other foreign investment destinations in emerging Asia that may soon be competing with China in terms of labor costs, infrastructure and operational capacity. In this issue we look at Singapore.

By Joshua Gill and Martino di Nola

Background

Jul. 17 – In a global economy dominated by huge industrial powers, the city-state of Singapore has carved out its competitive niche as a destination for regional headquarters, branch offices and holding companies for doing business all across Asia.

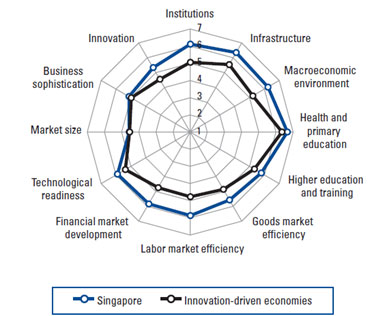

Singapore offers foreign investors a highly skilled workforce, English-speaking business environment, business-friendly legal and tax systems, immense logistics and transportation capacities, and over 60 double taxation avoidance agreements. Furthermore, the city-state consistently takes measures to align its policies with the international standards emanating from the World Trade Organization, the Organization for Economic Co-operation and Development, and even issue-centric organizations like the International Accounting Standards Board.

Singapore has consistently been ranked first on the World Bank’s Ease of Doing Business Index, with particular strengths in “protecting investors” and “trading across borders.” In fact, the single-party dominated government that took power when Singapore separated from Malaysia in 1965 runs the city-state so efficiently that it has been said to run like a corporation; “Singapore Inc.”

Key Features of Singapore’s Market

Protection of intellectual property rights

Intellectual property rights in Singapore have been standardized with international conventions such as the World Trade Organization’s Trade-Related Aspects of Intellectual Property Rights (TRIPS) Agreement, the Berne Convention for the Protection of Literary and Artistic Works, and the Paris Convention for the Protection of Industrial Property.

Consistent legal system

Singapore’s legal system is inherited from colonial times and it maintains the English common law system. It consistently upholds and enforces business contracts.

Enforcement of anti-corruption laws

The 2011 Corruption Perceptions Index by Transparency International ranks Singapore as the fifth least corrupt country in the world. Additionally, Singapore has the Corrupt Practices Investigation Bureau which enforces the Prevention of Corruption Act.

Developed infrastructure

The World Economic Forum ranks Singapore number two in its Networked Readiness Index 2012. Singapore’s port is one of the busiest in the world and it handles about one-fifth of all the worlds shipping. Additionally, Singapore’s Changi International Airport has consistently been ranked in the top three of the world’s airports.

Efficient and stable government

The World Bank’s Worldwide Governance Indicators put Singapore in the top 10th percentile for “Political Stability and Absence of Violence” in its global statistics.

Competitive tax rates

Singapore has one of the most competitive tax environments in the Asia-Pacific region, as well as a broad network of more than 60 double tax agreements with countries worldwide.

Established financial sector

Singapore serves as a financial hub for the entire Southeast Asia region, as well as for all of Asia. The World Economic Forum ranks Singapore first in the world for financial market development in its 2011 – 2012 Global Competitiveness Report. The system is well regulated and in Global Finance Magazine’s recent World’s 50 Safest Banks 2012 report, three of Singapore’s top banks ranked in the top 20. China has recently designated banks in Singapore as clearing banks for Chinese renminbi.

Transparent regulatory environment

Ease-of-business is a priority in Singapore and the government makes regulations with both the interests of local companies and the interests of foreign companies in mind. All procedures for permits and licenses are fairly straightforward.

Highly-skilled workforce

There is a big talent pool with many skilled graduates in Singapore. Approximately 66 percent of the population has a secondary degree or higher and the literacy rate is over 96 percent.

Central geographic location

Singapore is situated at a key intersection of major shipping routes and its port is one of the busiest in the world. It also has a close relationship with ASEAN countries (Indonesia, Malaysia, the Philippines, Thailand, Brunei, Burma, Cambodia, Laos and Vietnam) and benefits from free trade access under the ASEAN Free Trade Agreement.

Accessible e-governance

In the 1980s, Singapore introduced the Civil Service Computerization Program to improve internal operations. Today, the program has evolved to include the computerization of government services and platforms. The Institute of e-Government at Waseda University in Japan ranks Singapore number one in its 2012 World e-Government Ranking.

Social Indicators

Population growth

Singapore has one of the lowest fertility rates in the world – at a resident fertility rate of 1.15 . To counter this trend, the economy relies heavily on a foreign workforce, especially for low wage jobs.

Transportation

Singapore has an extensive public transportation system that extends across the entire island. The Land Transit Authority has taken action to double the kilometers of Mass Rapid Transit train lines from 2008 to 2020. Taxes on owning a car are extremely high due to the government’s attempt to slow the increase of cars on the road.

Demographic mix

The island is historically a country of immigrants and the population mix reflects this.

In 2011, the total population of Singapore was 5.2 million people, with the non-resident population accounting for 1.4 million – a number representing just fewer than 27 percent of the population. The ethnic make-up of the resident population as defined by the Singaporean government is as follows: 74.1 percent Chinese, 13.4 percent Malay, 9.2 percent Indian, and 3.3 percent other.

Home ownership rates

Due to the scarcity of land in Singapore, the government designated the Housing Development Board responsible for managing the living situation of the population and insuring the affordability of housing for residents. In 2010, the percentage of the population who lived in HDB housing was 82.4 percent. On the whole, the rate of home ownership in Singapore is 88.6 percent (2011).

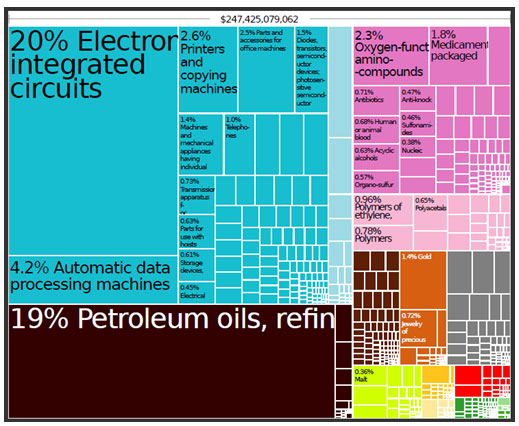

Economy

The Singaporean economy is a mixed economy with a large degree of government oversight. Its highly liberalized market coexists with specific sectors of the economy where government intervention is quite strong. The extent and strength of the public hand is clearly evident in the sectors that are thought to require extra attention by the government, such as housing, land, labor resources, and FDI management.

Government foresight led to the implementation of economic policy that fashioned the Singaporean economy from a mere low-end production economy into one that produces high value-added technology, goods and services. Many of these sectors require highly trained workers. Realizing the need for an educated and skilled workforce, the Singaporean government developed its national universities into global and regional powerhouses for education. In addition to the nurturing of local talent, the country also attracts foreign talent through incentives and other schemes, making the Singaporean workforce extremely qualified and versatile.

Despite being one of the highest ranked countries on the global Ease of Doing Business report, Singapore’s approach to the economy is hardly laissez faire. In fact, the country has gained its rapid development and growth from the exact opposite of a hands-off approach. Through a combination of government agencies and government-linked corporations, the Singaporean economy is directed at nearly every turn.

A central role in the country’s economic policy goes to the Economic Development Board (EDB), a government agency with the declared objective of “planning and executing strategies to enhance Singapore’s position as a global business center.” The role of EDB is based on three main pillars:

- Attracting and promoting investment

- Growing industry verticals

- Enhancing business environment

The EDB constantly reevaluates which industries are beneficial to the Singaporean context and actively works to promote those industries locally. For instance, the EDB views solar and renewable energy as a potential boon for the Singaporean market, so they have partnered with local universities to create R&D institutes to train Singaporean workers for the field. They also built green energy industrial parks and provided generous incentives for foreign companies to set up shop in Singapore. This story can be repeated for almost any sector the government views as a target investment sector.

The activities of the EDB are performed across all economically relevant sectors with some of the funds coming from independent equity investment sources (joint ventures, venture capital, and private equity). The objective of these partnerships is the long-term generation of high returns in specific investment sectors that, under the government’s point of view, deserve special attention (such as biotech, engineering, and finance).

The EDB is not the only public agency aimed at fostering long-term economic development, and a considerable number of other public agencies, each with its own specific mission, have been created. These include International Enterprise Singapore (promoting Singapore’s external economic wing), the Agency for Science Technology and Research (promoting scientific R&D), and SPRING Singapore (promoting innovation and productivity growth).

The Government also pursues economic development through government-linked corporations (GLCs). The most well-known GLC, Temasek Holdings Pt. Ltd., is basically a global investment firm wholly owned by the Ministry of Finance. It has a S$198 billion investment portfolio and controls, either directly or indirectly, many of the companies that lie at the backbone of the Singaporean economy, from the Development Bank of Singapore to some of the major construction companies. Collectively, the government’s role in the economy, both directly and indirectly, account for between 40 percent and 60 percent of the country’s economy .

Doing Business in Singapore

The ease of doing business in Singapore, along with its myriad other attractive qualities, make it an ideal base for international holding companies. Bearing the legacy of its British colonial history, the country is well-adapted to making Western businesses feel at home. In many instances, its laws attempt to adopt international conventions, so that when foreign firms arrive in Singapore, they find a familiar regulatory environment that is well-enforced by the country’s court system.

Corporate establishment in Singapore is a relatively easy process that requires almost zero capital investment and the time span of only a few days to a few weeks. Foreign firms have few requirements that local firms don’t also have.

Most businesses in Singapore are registered as private limited companies (a type of LLC). If a foreign entity wishes to set up a subsidiary company in Singapore, they essentially set up a private limited company, but maintain control of the majority of the shares therein. Therefore the rules for setting up a subsidiary company are the same as those for setting up a private limited company. The basic requirements are as follows:

- One director of the company must be either: a Singapore citizen, a Singapore permanent resident, an employment pass-holder, an approval-in-principle employment pass-holder, or a dependent pass-holder.

- Directors cannot be bankrupt.

- There must be one shareholder and one director who can be the same individual. Banks usually require two signatories, so most companies opt to have two directors.

The process of establishing a private limited company is as follows.

- Register for SingPass to gain access to the online company name and business registration portals (must be done by a resident Singaporean)

- Check availability of name of company with the Accounting and Corporate Regulatory Authority (do this at www.bizfile.gov.sg/ using SingPass).

- Register company with the Accounting and Corporate Regulatory Authority (do this at www.bizfile.gov.sg/ using SingPass). A local address and a Singapore Standard Industry Classification Code (from the ACRA) are also required for registration.

The person registering the foreign company is advised to engage a professional firm (e.g. lawyers, accountants, chartered secretaries) or a service bureau to assist him or her in the preparation and filing of the application for registration.

Singapore Holding Companies

Considering the aforementioned positives concerning the regulatory and investment climates in Singapore, it is clear that setting up a Singaporean holding company could rival the process of setting up in China. The benefits that Singaporean holding companies bring to a foreign investment generally far outweigh their costs. They are quick and inexpensive to set up and maintain.

Holding companies allow for an additional layer of distance between the Chinese subsidiary and the parent company. Setting up a holding company in Singapore as a buffer between a company’s subsidiaries and operations in China and the actual company itself protects it from the potential risks and liabilities associated with the Chinese operations. Additionally, if the investors wants to sell its Chinese business, or introduce a third party partner or shareholder into the structure, the administrative changes can also be done at the holding company level, rather than at the China level, where the regulatory environment is tougher and procedures more time-consuming.

Due to the secure legal and banking systems in Singapore, a holding company can provide a good solution for companies wishing to hold their China-earned profits offshore. This frees up capital and allows for a greater ease of reinvestment. Subject to the parent country’s anti-avoidance tax rules, this method is often used as a tax deferral mechanism for foreign companies who do not want to remit the China profits back to the home country immediately. A holding company can reduce withholding tax rates on the repatriation of profits as well as limit tax exposure on capital gains.

Labor

Singapore’s “tripartism” approach to labor laws and regulations involves the Ministry of Manpower, the National Trade Union Congress and the Singapore National Employers Federation. In addition, the Workforce Development Agency (WDA) offers funding schemes that encourage employers to train and upgrade the skills of workers, and provides advice and tools to assist employers in recruiting employees.

Regulating the immigration flow has been, and still is, one of the major concerns of Singapore’s government. The basic rule underlying the release of visas and work passes is to attract highly skilled and highly talented workers. For short trips to Singapore, citizens from most countries are able to get visitors visas upon arrival. These can then be extended or turned into other types of passes.

The easiest way for a foreigner to be eligible for a long-term employment pass is to earn a high salary (say above S$3,000 per month). Even in these cases, visas and work permits are subject to prior approval from the Ministry of Manpower, which is bound by employment sector-specific quotas decided on by the government.

Legislation on the release of work passes can be found jointly on the websites of the Ministry of Manpower and the Immigration and Checkpoint Authority.

In addition, the government charges a monthly levy on each foreign worker. The amount of monthly levy per worker depends on the business sector, the workers’ skill level and the percentage of foreigner workers in a company’s total workforce (with a higher level correlated to a higher percentage of foreign workers in a company). For example, the service sector has an average monthly levy of S$330 per skilled foreign worker and S$403 per unskilled foreign worker. The Singaporean government has said that by July 2013, it will increase the levy for the service sector to an average monthly levy of S$433 per skilled foreign worker and S$500 per unskilled foreign worker.

Conclusion

While Singapore cannot compete with China in terms of cost, Singapore has value both strategically and for high-value goods and services. In the long term, the ease and simplicity of doing business in Singapore may be worth the extra cost. Clearly Singapore is an ideal location for companies looking for an alternative to setting up in China, both for regional headquarters and for holding companies. Whether the motivation of set-up is for expansion into Asia or for a buffer against the complexities and uncertainties of regulations in China, Singapore offers simple solutions worth considering.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com or singapore@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across China by subscribing to The China Advantage, our complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

The China Alternative

The China Alternative

Our complete series on other manufacturing destinations in Asia that are now starting to compete with China in terms of labor costs, infrastructure and operational capacity.

Hong Kong and Singapore Holding Companies

Hong Kong and Singapore Holding Companies

In this issue of China Briefing Magazine, we take a closer look at the benefits of both Hong Kong and Singapore holding companies, how to establish and maintain a company in each of these jurisdictions, and the relevant double tax agreements.

The Asia Tax Comparator

The Asia Tax Comparator

Asia Briefing devotes this issue of China Briefing to providing a practical comparison of taxation throughout Asia. In particular, this issue takes a look at the taxes most applicable to foreign businesses and individuals in Asia, i.e., corporate income tax, value-added tax, goods and service tax, standard tax on dividends and individual income tax.

- Previous Article China Releases 12th Five-Year Plan for Animation Industry

- Next Article China Clarifies Export Refund Policies