The China Alternative – Bhutan

The China Alternative is our series on other manufacturing destinations in Asia that are now starting to compete with China in terms of labor costs, infrastructure and operational capacity. In this issue we look at Bhutan.

The China Alternative is our series on other manufacturing destinations in Asia that are now starting to compete with China in terms of labor costs, infrastructure and operational capacity. In this issue we look at Bhutan.

By Jane Shi

Apr. 4 – Even as one of the world’s smallest and underdeveloped countries, Bhutan offers positive potential in its tourism and financial services industries; especially after a recent government restructuring has changed the country from an absolute monarchy to a parliamentary monarchy.

In 2008, the Kingdom of Bhutan transitioned from an absolute monarchy to a constitutional monarchy, with the constitution being drafted by the king in 2003 and officially adopted by parliament in 2008. After centuries of absolute rule, continuing even after independence from British India in 1907, Bhutan’s democratic change is still in experimental infancy. January 2011 saw the first local elections for mayors in Bhutan’s four largest cities. The fifth king of Bhutan, Jigme Khesar Namgyal Wangchuck, will oversee the nation’s adjustment towards its new political and economic goals. However, the nation’s slow movement in during its transition process has garnered a bottom-quotient ranking in the Economist Intelligence Unit’s 2010 Democracy Index, ranking it 102nd out of 169 countries.

Hydroelectricity, Bhutan main’s export to India, will continue to be the main driver of the nation’s real GDP (in 2010, it grew by 6.8 percent) while new economic policies to increase employment, economic diversity, exports, and fast-growth sectors such as financial services and tourism will accompany continued government attention to the nation’s “gross national happiness (GNH).” GNH is an index created in 2008 by the Center for Bhutan Studies to “reflect GNH values, set benchmarks, and track policies and [the] performance of the country.” National GDP in 2010 was estimated at US$1.3 billion, and for the most part has paralleled the growth rates of other Asian nations.

The national currency, the ngultrum (Nu), is pegged at parity to the Indian rupee (Rs). The average exchange rate in 2009 was Nu48.4:US$1. The Economic Intelligence Unit predicts that as the Indian rupee appreciates against the U.S. dollar, the Nu will rise in nominal terms with the Indian rupee by 1.5 percent by 2012.

India is Bhutan’s largest international trade partner (95.1 percent of exports and 73.8 percent of imports in 2007/2008), while relations with China continue to be more political than economic. Bhutan is a landlocked nation, and sits right at the southwestern border of China. It also neighbors Nepal, Bangladesh, and India. Though it has no direct access to major waterways or ports, Bhutan is positioned at a strategic location between India and China, controlling several important Himalayan mountain passes. During Prime Minister Jigme Thinley’s January 2011 visit to Bangladesh, two memorandums of understanding were signed to promote cooperation in cultural fields and recruitment of doctors from Bangladesh to Bhutan. The governments also discussed the recruitment of labor from Bangladesh to Bhutan to ease the latter’s labor shortage, and the use of sea ports at Chittagong and Mongla, Bangladesh, by Bhutanese traders.

The CIA World Factbook estimates the current total population of Bhutan at 708,427, based on the country’s 2005 census. Bhutan’s abundance of young workers (65.3 percent are between ages 15-64, with the median age around 25 years) is ideal for providing the labor support that will be needed for the new developments throughout the nation’s economic reforms. Roughly 35 percent of the population lives in urbanized areas.

Though agriculture and forestry are a large component of Bhutan’s economy, and support over 60 percent of the population, only 2.3 percent of its land is arable, and also faces continued soil erosion and other environmental issues. Bhutan is a member of the following international agreements on environmental concerns: biodiversity, climate change, climate change-Kyoto Protocol, desertification, endangered species, hazardous wastes, and ozone layer protection. The rugged terrain of the country has also impeded the major development of navigable roads and other infrastructure in the country, but will work to Bhutan’s advantage in the progressive development of environmentally-friendly tourism aimed at attracting upscale tourists.

Some of Bhutan’s main agricultural and industrial products include rice, corn, root crops, citrus, food grains, dairy, eggs, cement, wood products, processed fruits, alcoholic beverages, calcium carbide, and tourism. Major exports include electricity, ferrosilicon, cement, calcium carbide, copper wire, manganese, and vegetable oil. Major imports include fuel, cars, machinery, fabrics, and rice.

According to the World Bank’s Doing Business 2011 Index, Bhutan ranks 142nd out of 183 countries for the ease of doing business—in the same bottom-quotient as its neighbors Bangladesh, Nepal, and India. Interestingly, the country scores 33rd for enforcing contracts. Historic dependency on India for trade, monetary policies, labor, and financial assistance coupled with complex and often vague policies has so far held back significant foreign investments in the country. However, the new government, despite moving slowly, is expected to enact policies that will encourage foreign investment.

The Financial Services Bill, currently awaiting joint approval by the National Assembly and National Council, includes provisions for new reinsurance companies and mutual funds to establish in Bhutan. The resulting Financial Services Act will succeed the Financial Institutions Act of 1992. Once passed, the act will allow domestic enterprises to set up independent or joint venture reinsurance companies or mutual funds with foreign investors. The hope is to keep more funds flow within the country as more infrastructural projects are in the works by increasing the number of Bhutanese reinsurance companies.

Currently Bhutan’s largest insurance companies, Royal Insurance Corporation of Bhutan and Bhutan Insurance, are reinsured by international entities in Thailand and India. Similarly, the Royal Monetary Authority will require mutual funds to invest new funds in Bhutanese developments to lessen overall risk in the market, prevent outflows of funds, and encourage flows to domestic companies. Currently the government and financial institutions are the main reliable sources of funding. By introducing mutual funds, the RMA hopes to create a more active capital market.

In December 2010, the Bhutan National Bank and the Asian Development Bank (ADB) signed a trade-finance agreement to provide further loans and guarantees to develop international trade. The EIU predicts the trade deficit in Bhutan to narrow in 2011-12 as strong levels of grants facilitating construction of new hydropower projects are expected to continue and development aid from foreign nations is expected to drop. The agreement opens the doors for participant banks in Bangladesh, China, India, Nepal, and others in the Asia and Australasia region to provide financing to small and medium-sized companies in Bhutan.

After granting licenses to two new private banks, T-Bank and Druk Punjab National Bank, the RMA announced in November 2010 that it will hold off on giving any new approvals for five years. It will allow the new establishment of branchless banks that use networks of agents to carry out financial services rather than physical branches.

To set up a branchless bank in Bhutan:

- Foreign direct investment is capped at 49 percent of total paid-up capital

- Minimum paid-up capital of Nu20 million (approximately US$440,000) is required

- Only foreign companies already operating branchless banking services in other countries are eligible

- Minimum paid-up capital is required to increase to Nu50 million within five years of operations in Bhutan

There is also an ongoing dispute regarding the public offering of the Bank of Bhutan, the oldest and largest bank in the country. Established in 1962 in a joint venture between the State Bank of India (40 percent stake) and the Bhutanese government (60 percent stake), the government currently holds 80 percent of the bank. The bank was commanded to go public, and ownership by the government was to be capped at 24 percent by RMA regulations that required all banks in Bhutan to be public limited companies. The Bank of Bhutan has been paying fines of Nu5,000 per day since November 2010 for continually failing to do so.

In light of the pending Financial Services Act, the National Assembly recommends that the government’s holdings be capped at 75 percent while the National Council wants a cap of 100 percent. Either way, the decision would significantly affect the bank’s transition into a public limited company. On the other hand, one of Bhutan’s newest banks, T-Bank, released its IPO in December 2010 for a total of Nu88 million, 40 percent of the bank’s paid-up capital, and expects to conduct a second release soon.

Related Reading

The China Alternative

The China Alternative

Our complete series on other manufacturing destinations in Asia that are now starting to compete with China in terms of labor costs, infrastructure and operational capacity.

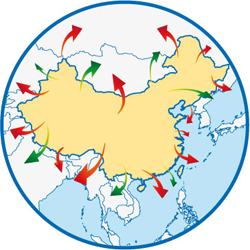

China’s Neighbors

China’s Neighbors

This unique book is an introductory study of all 14 of China’s neighbor countries: Afghanistan, Bhutan, India, Kazakhstan, Kyrgyzstan, Laos, Myanmar, Mongolia, Nepal, North Korea, Pakistan, Russia, Tajikistan and Vietnam.

Operational Costs of Business in China’s Inland Cities

Operational Costs of Business in China’s Inland Cities

It is widely held that land and labor costs in inland provinces offer quite significant cost savings over major east coast and southern cities. In this issue, we take a quick look at the numbers behind these beliefs.

Coastal China, Inland China, India or Vietnam for Your Sourcing Business?

- Previous Article Founder of Dezan Shira & Associates Chris Devonshire-Ellis on Chinalogue

- Next Article 12th Five Year Plan Hailed as ‘Greenest FYP in China’s History’