Jing-Jin-Ji: The Biggest City in China You’ve Probably Never Heard Of

By Rainy Yao and Emily Liu

BEIJING — On June 23, the General Administration of Customs (GAC) released an announcement on integrating the customs procedures of Beijing, Tianjin, and Hebei (GAC Announcement [2014] No. 45), marking an important milestone in the integration of the three jurisdictions into a single “megaregion” in China’s northeast. Under the integrated customs system, enterprises established in any of the three jurisdictions can choose between importing/exporting goods via the Customs of their original business registration or alternatively, the Customs through which the goods are actually shipped. The integrated system came into effect in Beijing and Tianjin on July 1, 2014 and will begin in Shijiazhuang, Hebei on October 1, 2014.

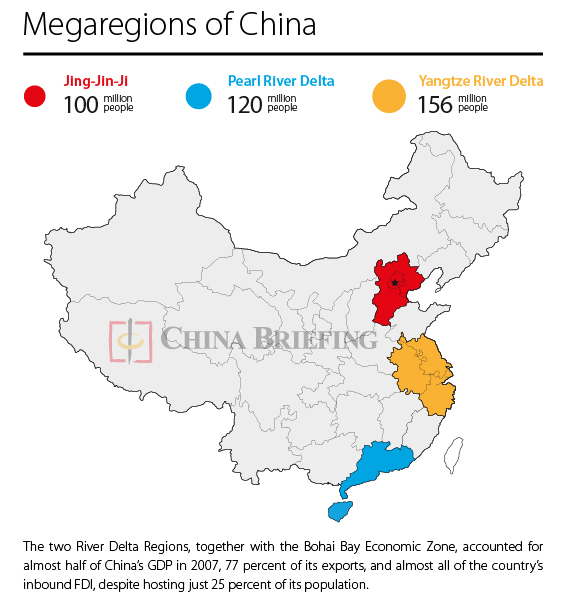

This is just the latest in a series of measures announced by the National Development and Reform Commission (NDRC) towards the realization of the Beijing-Tianjin-Hebei megaregion, covering 216,000 square kilometers and home to more than 100 million people. Ultimately, the Chinese leadership has plans to create 10 megaregions around the country, including inland areas such as Shandong and Liaoning.

As the consequences of decades of high-speed economic growth begin to catch up with the world’s most populous country, China is looking to the megaregion as its prime model for sustainable growth in the future. Analysts have identified the so-called Jing-Jin-Ji (an abbreviation of the Chinese names of Beijing, Tianjin, and Hebei) unification plan as both an economic as well as political move, with proponents dubbing it as a cure-all for China’s acute problems of environmental pollution, overcrowding, water-shortage and uneven development.

In fact, the idea for Jing-Jin-Ji regional integration has been floated by Chinese politicians for many years, though progress has been slow. Interest in the project picked up this year following a call by Chinese president Xi Jinping for the integrated and coordinated development of the region around Beijing in February. Three months later, the NDRC announced that plans would soon be released for the megaregion, a decade after work on the project was first begun in 2004.

According to the plan, Beijing will reorganize its industry structure and divert some of its population to neighboring cities (i.e., Hebei and Tianjin) to ease population pressure in the capital. A Beijing-Tianjin-Hebei Free Trade Zone (FTZ) was also rumored to be in the works, though this is likely now on hold following a blanket suspension of additional FTZs in China.

Next, on June 26, the Hebei Provincial Office of Traffic and Transport announced that the “Beijing Seventh Ring Road” will soon be completed in 2015. The first step toward building an integrated regional transportation network, the 940km ring road will run through the Hebei cities of Langfang, Zhangjiakou and Chengde, among others. It will also serve as a corridor joining the province to Beijing, where it is expected to partially alleviate traffic congestion and PM2.5 emissions.

The Jing-Jin-Ji region, part of the larger Bohai Bay economic zone, will be China’s third megaregion, following the success of the Yangtze River Delta (YRD) and the Pearl River Delta (PRD). The former, centered on Shanghai and spanning across Zhejiang and Jiangsu provinces, is the largest megaregion in the world, with a population of 156 million in 2010. In the past decade, the region has been at the forefront of China’s economic growth, led by Shanghai’s booming finance sector and large inflows of foreign direct investment (FDI) into second-tier cities like Suzhou.

China’s third megaregion, the Pearl River Delta, consists of nine cities concentrated in Guangdong Province, whose coordinated development has greatly boosted efficiency in the region. One of the earliest regions in China to open up to foreign trade under Premier Deng Xiaoping, the PDR was the original driver of explosive growth in the Chinese economy, though this has slowed in recent years. An expanded version of the region, including Hong Kong and Macau, was estimated to be home to 120 million people in 2010.

The two River Deltas, together with the Bohai Bay economic zone, accounted for almost half of China’s GDP in 2007, 77 percent of its exports, and almost all of the country’s inbound FDI, despite hosting just 25 percent of its population. Building on the experiences of its predecessors, the Jing-Jin-Ji plan hopes to take regional integration one step further, establishing not just an economic heavy weight, but a unified cultural and political center. Many challenges remain, however, for achieving these goals.

Currently, Jing-Jin-Ji lags significantly behind the Yangtze and Pearl River Delta regions in terms of economic development and its level of integration. Although the two delta regions benefit from a considerable head start, analysts are concerned about the unprecedented economic disparity between Beijing and Hebei. Beijing’s drain on resources from the surrounding areas has created what analysts call a “ring of poverty” around the capital, with income inequality on the rise since 2005.

Another barrier towards integration are the differences in industry focus between Beijing, Tianjin and Hebei. Beijing is dominated by state-owned enterprises and high-tech companies, while Tianjin is the export gateway of the region, specializing in highly skilled manufacturing. Hebei, on the other hand, remains firmly grounded in heavy industry, such as steel and concrete, and lags behind the other two jurisdictions in many aspects of development.

Nevertheless, officials remain optimistic about the future of the region. In an interview, Mayor of Beijing Wang Anshun said, “We must leave the bubble of Beijing and look at developing the city based on regional cooperation. This means steering Beijing’s development within the framework of JJJ regional integration.”

Hardly unique to China, megaregions are an increasingly global trend, particularly in Asia, where urbanization rates continue to soar. For foreign investors with operations in these regions, the prospect of streamlined administration, integrated logistics networks, and mass consumer markets should come as a welcome future.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Adapting Your China WFOE to Service China’s Consumers

Adapting Your China WFOE to Service China’s Consumers

In this issue of China Briefing, we look at the challenges posed to manufacturers amidst China’s rising labor costs and stricter environmental regulations. Manufacturing WFOEs in China should adapt by expanding their business scope to include distribution and determine suitable supply chain solutions. In this regard, we will take a look at the opportunities in China’s domestic consumer market and forecast the sectors that are set to boom in coming years.

Guide to the Shanghai Free Trade Zone

In this issue of China Briefing, we introduce the simplified company establishment procedure unique to the zone and the loosening of capital requirements to be applied nation wide this March. Further, we cover the requirements for setting up a business in the medical, e-commerce, value-added telecommunications, shipping, and banking & finance industries in the zone. We hope this will help you better gauge opportunities in the zone for your business.

- Previous Article Hong Kong and South Korea Sign Double Tax Agreement

- Next Article Ausländische Führungskräfte müssen sich mit der Korruption in China auseinandersetzen