How Can Expats Complete Annual Individual Income Tax Reconciliation in China?

The recent lockdowns in multiple cities in China make it difficult for foreign residents stranded abroad to return, while many within China decide to leave. Nevertheless, foreign residents need to pay attention to the annual individual income tax (IIT) reconciliation requirements, the failure of which may cause unnecessary consequences.

In this article, we provide guidance on how expatriates can complete their annual individual income tax reconciliation in China. For more information about annual IIT reconciliation in China, please contact Fuki Fu, Manager of Human Resources based in Shanghai Office at Fuki.fu@dezshria.com.

Under China’s tax laws and regulations, individuals who stay in China for 183 days or more during a calendar year should complete the annual IIT reconciliation process during the period of March 1 to June 30, regardless of being Chinese or foreigners.

Annual IIT reconciliation, or annual IIT settlement, is a process applied to individual taxpayers on their comprehensive income (an individual’s combined income of wages and salaries, remuneration from labor services, author’s remuneration, and royalties), to make sure their IIT paid in the previous tax year is accurate.

During the process, individual taxpayers will need to recheck their IIT paid and deducted in the tax year, calculate the refundable or supplementary tax payable, report to the tax authorities, and make the tax settlement.

The annual IIT reconciliation for the year 2021 started on March 1, 2022. There are three main methods for individual taxpayers to proceed the annual IIT reconciliation as explained below.

Method 1: Annual IIT reconciliation via the IIT app or the e-tax system by individual taxpayers themselves

Individual taxpayers, including foreigners, can make IIT reconciliation via the IIT app or the e-tax system by themselves. This method is especially suitable for those who have other sources of income in addition to wages and salaries and do not want to disclose this information to their employers.

The IIT app (个人所得税app) is a mobile application of the official tax management and individual tax declaration system launched by the State Taxation Administration (STA) in 2019. After real-name registration, individual taxpayers can fill out special additional deduction information, download tax payment record, and make annual tax reconciliation, among others.

E-tax system, also called “Online Tax Bureau for Natural Persons” (自然人电子税务局), is the web version of the IIT app, which is also developed and managed by the STA and offers similar functions to the IIT app.

During the annual IIT reconciliation period, i.e., March 1 to June 30, the IIT App will open the IIT reconciliation function and individual taxpayers will be able to declare the IIT return for the previous year.

To be able to make annual IIT reconciliation through the IIT app or e-tax system, the first and essential step is to register with the IIT app or the e-tax system. While Chinese citizens and those with Chinese permanent residence certificate can complete the registration for the IIT app and the e-tax system through face recognition and verification, other foreigners need to obtain a register code from the local tax bureau in charge for the registration.

Normally, foreigners can obtain the register code for the IIT app or the e-tax system by physically visiting the local tax bureau and submitting the required documents for real-name authentication.

If the foreigners are currently not in China, given current travel restrictions and lockdowns implemented during the COVID-19 pandemic, they can entrust their employer to obtain the register code for the IIT app or the e-tax system.

According to the official guidance released by some local tax bureaus, the entrusting party (individuals) and the entrusted party (the employer) need to sign a power of attorney, which stipulates the specific entrust matter. The entrusted party will also need to submit a photocopy of the entrusting party’s identification document and the original copy of the entrusted party’s identification document.

To be noted, different local tax bureaus may have different rules. Foreigners who want to obtain the register code in this way are well advised to double check with their tax bureau in charge for the local practices.

After successful registration, the individual taxpayer can make annual IIT reconciliation easily by following the step-by-step guidance provided by the IIT app or the e-tax system. Upon the completion of the IIT reconciliation, if the individual taxpayer is found to have paid IIT that is more or less than the IIT amount they should pay, the tax refund or supplementary tax will be transferred into or deducted from the individual bank account that is binding to the IIT app or the e-tax system.

Example of the IIT App and the E-Tax System

Method 2: Annual IIT reconciliation via the employer

Individual taxpayers, including foreigners, can also fulfill their annual IIT settlement obligation through the employer.

This method is suitable for those who do not mind disclosing their private information to their employers, such as the income information other than wages and salaries from the employer, marriage and family information for special additional deductions, and other information for enjoying tax incentives.

To enable annual IIT reconciliation via the employer, the individual taxpayers usually need to let the employer know their choice and confirm the authenticity, accuracy, and completeness of relevant information that they have provided for the annual IIT reconciliation before April 30 of the year. In some circumstances, the confirmation deadline could be extended by the tax bureau. For example, due to the ongoing COVID-19 lockdowns in Shanghai, the confirmation deadline will be extended to June 30. The confirmation can be made by writing, email, text message, or even WeChat message.

Helping employees do annual IIT reconciliation is a legal obligation of the employer as stipulated in relevant laws and regulations. That is to say, once the employee has raised the request of making IIT reconciliation via the employer, the employer has no right to decline.

On the other hand, the employer is not allowed to make annual IIT reconciliation on behalf of its employees without the employees’ prior confirmation.

Moreover, the individual taxpayer needs to inform the employer of the bank account (usually the bank account for receiving wages and salaries) for potential tax refund and determine the method of paying supplementary tax should tax makeup be needed.

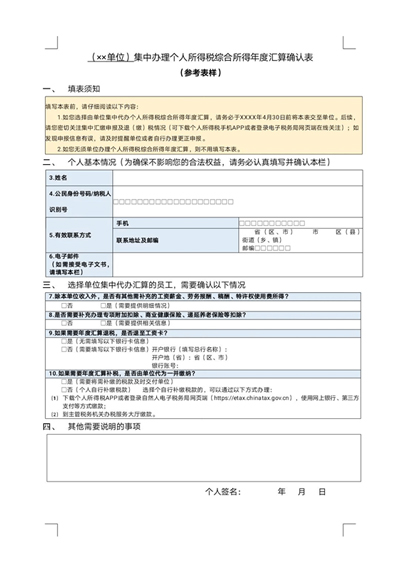

Template for Confirming Annual IIT Reconciliation Information via the Employer

Method 3: Annual IIT reconciliation via professional tax service agencies, other units, or other individuals

Individual taxpayers, including foreigners, may also entrust professional tax service agencies, other units, or other individuals (hereinafter referred to as the entrusted party) to handle annual IIT reconciliation, based on their own circumstances and conditions. This method is suitable to those who do not have employers or those who do not want to make IIT reconciliation by themselves or via their employers.

In this way, the entrusting party shall sign a power of attorney with the entrusted party to clarify the rights, responsibilities, and obligations of both parties.

To be noted, the entrusted party should let the entrusting party know the results of the annual IIT reconciliation in a timely manner. If the entrusting party notices any error existing in the annual IIT reconciliation, they can make the rectification by themselves or ask the entrusted party to make the correction.

Other methods

In addition to the above three methods, the annual IIT reconciliation can also be done by mailing the required documents to the tax bureau in charge or physically visiting the tax bureau onsite. However, these two methods are rarely used in practice.

IIT declaration: The steps after the IIT reconciliation

Following the annual IIT reconciliation, certain taxpayers will need to make an IIT declaration.

In accordance with the relevant tax laws, taxpayers who fall under one of the following categories are required to make an IIT declaration:

- Where the taxpayer’s prepaid tax amount in the previous tax year exceeds the annual tax payable amount and he/she applies for tax refund; and

- Where the taxpayer’s comprehensive income of the previous tax year exceeds RMB 120,000 (US$16,915) and the tax amount to be made up retrospectively exceeds RMB 400 (US$56.4).

This includes the scenario where the taxpayer has derived income from two or more sources, and the comprehensive income amount falls in a higher tax rate bracket, resulting in the prepaid tax amount being less than the annual tax payable amount.

However, taxpayers who fall under the following categories are exempt from carrying out IIT declaration:

- Where the taxpayer’s annual IIT reconciliation shows that they are required to pay tax retrospectively, but their annual consolidated income amount does not exceed RMB 120,000 (US$16,915), except those who do not withhold or pay IIT in advance;

- Where their annual IIT reconciliation shows that their tax amount to be paid retrospectively does not exceed RMB 400 (US$56.4), except those who do not withhold or pay IIT in advance;

- The taxpayer’s prepaid tax amount matches the annual tax payable amount; or

- The taxpayer is qualified for tax refund but is not applying for tax refund.

To be noted, there are other circumstances under which the individual taxpayer needs to make IIT declaration. For example, taxpayers now need to make an IIT declaration upon emigration. For the purpose of this article, we have not discussed the other circumstances.

What are the consequences of simply walking away?

As mentioned earlier, annual IIT reconciliation is a legal obligation for all who have stayed in China for 183 days or more during a calendar year. This includes foreigners who have left or plan to leave China.

If a foreigner fails to complete their annual IIT reconciliation, there might be administrative penalties imposed by the tax bureau, such as fines. The incompliance record may also take a toll if the foreigner plans to return to China for employment in the future.

Accordingly, foreigners are advised to properly manage their annual IIT reconciliation and declaration obligations.

For those who estimated their stay in China to reach or exceed 183 days at the beginning of the year but are planning to leave or have already left China before reaching the 183-day threshold, they are suggested to make timely adjustment by themselves or via the employer – to change their taxpayer status from resident taxpayer to non-resident taxpayer. This action will exempt them from the annual IIT reconciliation obligation.

If you have more questions on annual IIT reconciliation, need assistance for annual IIT reconciliation, or seek other professional tax services, please contact china@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, and Bangladesh.

- Previous Article Human Genetic Resources in China: New Draft Regulation

- Next Article How to Deal with Labor Disputes Under the Shanghai Lockdown: FAQs