Dezan Shira’s 2016 Hong Kong Report – a Hub for the Maritime Silk Road

I should begin this with a disclaimer – I am the Chairman of the firm that produced An Introduction to Doing Business in Hong Kong 2016. That said, I had nothing to do with its creation – the content has come purely from professionals within the firm’s Hong Kong office, and I hadn’t seen the text until very recently. What I will suggest, however, is that it makes for important reading when one considers the position the territory has found itself in as concerns mainland China.

While the report focuses on the foreign investment and tax aspects of doing business in Hong Kong – which frankly is what Dezan Shira & Associates does best and has done since 1992 – I have been a bit wary of the direction Hong Kong has been taking over the past few years. Its population doesn’t quite see eye to eye with Beijing, and calls from the CCP for Hong Kong residents to “love” China have been greeted in some quarters with a certain amount of ridicule. Hong Kong has recently been inundated with millions of mainland tourists, who while encouraged by the tourism and retail industries, have also stripped local supermarket shelves bare of hard to come by products in China – incidents of Hong Kong mothers not having baby milk to purchase in local shops due to mainlanders buying all imported products up created a barrier between local Hong Kongese and mainland Chinese. Beijing’s reaction to these tensions caused it to reference Hong Kong locals as ‘splittists’, while the local government wisely stepped away from that rhetoric and named such complainants as ‘localists’. The upshot of all this is that, socially, Hong Kong’s citizens are not enjoying the best of relations with China right now. Understandably, it is this aspect that has garnered much media attention.

But stepping aside from those issues, where does Hong Kong really fit in with global, and mainland China, business? How can it assist international companies that do business in China?

Firstly, Hong Kong is the world’s eighth largest trading economy. That’s pretty impressive for what is essentially a city with a population of about 7 million. Also, Hong Kong handles a significant portion of mainland China’s external trade – about 12 percent of the total, valued at some US$278 billion. Just that trade alone is equivalent to the entire annual GDP of Pakistan. On top of that, it handles 13 percent of all China’s imports, valued at US$ 251 billion, and these figures are just for mainland China trade.

Part of this is due to the “Closer Economic Partnership Agreement” (CEPA), a trade deal between Hong Kong – which maintains its own currency, business laws, taxes and import-export system – and Mainland China, which the Dezan Shira report comments on. Basically put, the CEPA agreement gives Hong Kong registered companies priority and preferred status when trading with mainland China. As Hong Kong incorporations can be wholly owned by foreign nationals, this means there are significant benefits in using a local Hong Kong incorporation to handle your China trade than a company based in your country of origin. We originally commented on the CEPA Rules of Origin regulations here.

So far, so good. Hong Kong is also a Free Port, meaning zero import taxes on many items being brought into the territory. With no VAT either, it can be cheaper to source products in Hong Kong, then reship to many other jurisdictions, including Mainland China.

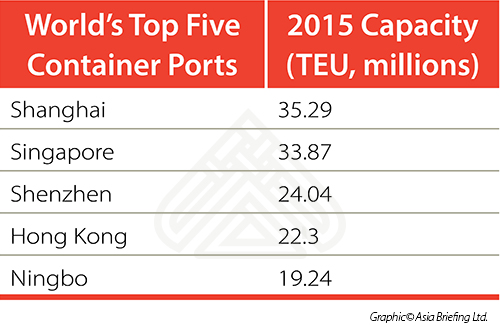

Yet Hong Kong has also been developing infrastructure ties with Southeast Asian nations as well, mainly to support Beijing’s Maritime Silk Road initiative. Hong Kong can do this through its status as the world’s fourth largest container port.

Hong Kong has an upcoming Free Trade Agreement with ASEAN, and investment is already underway to improve port links between Hong Kong and Southeast Asia, India, the Middle East and Africa. In this sense, Hong Kong has finally regained an initiative over Singapore after years of purely concentrating on China trade. With Beijing’s political and financial clout, Hong Kong is set to emerge rather more strongly as an axis between China and Southeast Asia than it has in the past. That is good news for China based manufacturers and exporters looking to sell to new, developing markets such as India and beyond. It means that Hong Kong remains a core destination for handling goods into and out of China – and increasingly to other Asian and international destinations. It remains the only true gateway into China, and businesses both looking to sell into the Chinese market and export from it should be looking at Hong Kong very seriously as a services base.

The Dezan Shira & Associates’ Introduction to Doing Business in Hong Kong 2016 contains a wealth of practical information concerning corporate set up, the tax regime – including updates from the recent Hong Kong budget – and how to operate a business trading with China and Asia from the territory.

The guide has also been endorsed by Mike Rowse, the Former Head of Invest HK, the Hong Kong government agency responsible for attracting investment into the territory. He states: “The Dezan Shira & Associates’ 2016 Hong Kong Guide is the most comprehensive document of its kind I have ever seen. It begins with an overview of Hong Kong’s political and economic situation since China took the city back from British administration in 1997, and in the process corrects many misperceptions. This is followed by a realistic assessment of economic prospects in 2016. Then down to all the practical ins and outs of setting up and operating a business. How to establish a company (including what kind of structure to adopt), then a detailed section on tax and accounting including information on Hong Kong’s many Double Taxation Agreements. The section on employing staff is comprehensive and HR departments everywhere will be grateful for its detail. Finally there are informative assessments of three industries (retail, offices and logistics) which would be of general interest. I can strongly recommend this guide as a definitive introduction to Hong Kong.”

An Introduction to Doing Business in Hong Kong 2016 can be downloaded for free here.

|

Chris can be followed on Twitter at @CDE_Asia. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

|

![]()

An Introduction to Doing Business in Hong Kong 2016

An Introduction to Doing Business in Hong Kong 2016

An Introduction to Doing Business in Hong Kong 2016 is designed to introduce the fundamentals of investing in Hong Kong. Compiled by the professionals at Dezan Shira & Associates, this comprehensive guide is ideal not only for businesses looking to enter the Hong Kong market, but also for companies that already have a presence here and want to keep up-to-date with the most recent and relevant policy changes.

Hong Kong and Singapore Holding Companies

Hong Kong and Singapore Holding Companies

Hong Kong and Singapore both offer very similar tax incentives for foreign companies, but there are differences between the two and tax rates differ, as do the strategic nuances and their use of various double tax treaties.

Trading with China

Trading with China

In this issue of China Briefing, we focus on the minutiae of trading with China – regardless of whether your business has a presence in the country or not. Of special interest to the global small and medium-sized enterprises, this issue explains in detail the licensing framework concerning trading with the most populous nation on Earth – plus the inevitable tax, customs and administrative matters that go with this.

- Previous Article China Stock Market Suspension Ushers In A Tough 2016

- Next Article Meet Yong Bao, and His Impact on Child Product Sales to China