Foreign Investment into China Rose 6% in 2019, High Tech Industries Surged Ahead

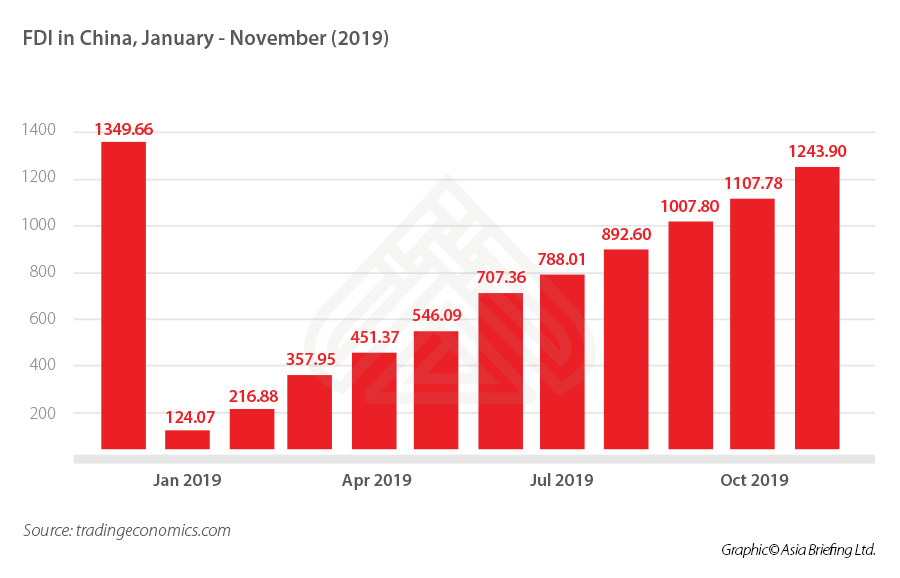

Foreign direct investment into China rose six percent in the 11-month period from January to November 2019, according to data released by Trading Economics.

The increase means that China direct FDI reached RMB 845.94 billion (US$124.39 billion) in the first eleven months of 2019.

In November 2019 alone, it increased 1.5 percent over the previous month, with inbound foreign investment into China at around the US$140 billion a month mark.

Foreign investment in China’s high tech industries led the way, jumping 27.6 percent year-on-year to reach RMB 240.7 billion and accounting for 28.5 percent of all total China FDI.

“The media coverage of the US-China Trade War has negatively influenced perceptions about China as a foreign investment destination,” says Chris Devonshire-Ellis of Dezan Shira & Associates “and it is true that US investors making product in China for resale in the US were badly hit.

However, China’s investment fundamentals are far more diverse than just that one market sector, as is its investor portfolio. The US is not the be all and end all for China investment.”

The data contradicts other points of view. China Law Blog’s most recent article China Manufacturing; Elvis has Left the Building along with many other recent China negative articles on the blog suggests that the US trade war in some way “helped drive a long list of big-name companies out of China” and that “US tech giants (have told a supplier) that they should plan to leave China if they were to be kept on as a supplier.”

Devonshire-Ellis states: “No-one I know in China takes these types of comments seriously. I guess China Law Blog’s clients are mainly old-style China investors, such as low-end manufacturers or sourcing companies – the blog is written from Seattle, not China. We are on the ground in China and can report an upsurge in revenues from companies wishing to establish operations in the country. These are diverse and have rather different agendas than the simple ‘buy low in China and sell high in US’ model – which became outdated over a decade ago.”

He adds: “Today’s investors in China are invested in the Chinese consumer market – which reached an all-time confidence high last year or are part of a wider global manufacturing supply chain that also includes other countries in Asia and beyond. Being fixated purely on the US-China angle distorts the reality and prevents people such as China Law Blog and many other American commentators from seeing where the real opportunities are. They are failing to adapt to the new China realities – high tech and a huge consumer market coupled with increasing opportunities for export along the Belt and Road Initiative.”

Trading Economics graphic displays the steady flow of FDI into China during 2019 as seen below:

With FDI into China on an upward trend, making money and progress in 2020 depends on getting your China strategy right and understanding where the opportunities are as well as where the risks lie.

It also means being a bit smarter and seeing what is coming up along the horizon. China Briefing, and our associated practice, Dezan Shira & Associates, aim to provide just that.

Readers can subscribe, free of charge to China Briefing here or contact our firm concerning investments into China here.

Related Reading

- China Cuts Import Tariffs on Select Goods in 2020, Rates Lower than MFN

- Prospects For a 2020 US-China Bilateral Investment Treaty

- In China, For China – Limiting Tariff Risks, Serving Chinese Consumers

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, and Thailand in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Setting Up an LLC in Indonesia, Trends in India’s HR Industry – China Outbound

- Next Article US-China Phase One Deal: Washington Wants to Meet 30% of China’s Import Needs, Non-US Suppliers Will Need to Conduct Damage Assessments