E-Invoicing in China: National Rollout of Fully Digitalized E-Fapiao Starting December 1

In this article, we discuss the expansion of e-invoicing in China as the digital e-fapiao program widens its pilot roll-out with unique features.

Latest updates

- On November 24, the State Taxation Administration (STA) announced the official nationwide rollout of fully digitalized electronic invoices (e-fapiao) through its website. This decision follows the successful pilot program, which has been implemented smoothly across various regions. The pilot program has delivered notable achievements, including optimizing the business environment, improving administrative efficiency, and facilitating the digital transformation of the economy and society. The nationwide rollout will take effect on December 1, 2024.According to the STA, digital invoices are classified as a type of “electronic invoice” under the Regulations on the Administration of Invoices of the People’s Republic of China and hold the same legal validity as traditional paper invoices. Unlike paper invoices, digital invoices exist solely in digital format and are issued as single-copy documents. Each digital invoice features a unique 20-digit number, structured to include the last two digits of the calendar year, a regional code for the provincial tax authority, a digit indicating the issuance channel, and a sequential code.

To support the rollout, the STA has established a nationally unified electronic invoice service platform. This platform will provide taxpayers with free services for issuing and managing digital invoices. Tax authorities will determine the invoice quotas available to each taxpayer based on factors such as tax risk level, tax credit rating, and actual business operations. These quotas will be subject to dynamic adjustments to ensure they align with the taxpayer’s circumstances.

- On November 6, 2024, the State Taxation Administration announced the promotion of fully digitalized electronic invoices (e-fapiao) for civil aviation passenger transport. The announcement, made in collaboration with the Ministry of Finance and the Civil Aviation Administration of China, will take effect on December 1, 2024. This announcement specifies that public air transport companies and registered air transport sales agencies in China are permitted to issue electronic invoices for domestic passenger transport services. The electronic itinerary serves as a fully digitized invoice, containing essential information such as the invoice number, domestic and international identification, passenger ID details, itinerary information, fare, fuel surcharge, VAT amount and rate, and the Civil Aviation Development Fund. For travel dates prior to September 30, 2025, passengers can still use the original paper itinerary for reimbursement. However, it is important to note that paper itineraries, electronic itineraries, and other invoices cannot be issued multiple times.

- On October 18, 2024, the State Taxation Administration announced the promotion of fully digitalized electronic invoices (e-fapiao) for railway passenger transport. This announcement, made in collaboration with the Ministry of Finance and China State Railway Group Co., Ltd., will take effect on November 1, 2024. The announcement outlines the key features of electronic invoices (railway e-tickets), including rules for invoice numbers and codes, as well as procedures for passengers and organizations to query, verify, download, and use these invoices. After completing their journey or processing ticket refunds or changes, passengers can obtain electronic invoices through the Railway 12306 website and mobile app, allowing them to query, download, and print their invoices. Organizations can use their digital tax accounts to query, verify, download, print, and confirm the use of electronic invoices. They can also verify invoices through the national VAT invoice verification platform. For general VAT taxpayers, electronic invoices will serve as VAT deduction vouchers, with the input tax amount determined according to current regulations. A transition period has been established until September 30, 2025. During this time, both paper and electronic invoices will be used concurrently. Passengers can continue to use paper tickets (reimbursement vouchers) for reimbursements, and organizations can account for these paper tickets and calculate the deductible VAT input tax as per regulations.

- On November 29, 2023, the local branch of the State Taxation Administration (STA) in the Tibet Autonomous Region issued announcements on conducting the pilot program for fully digitalized electronic invoicing. Accordingly, starting December 1, 2023, Tibet will carry out fully digitalized e-fapiao pilot programs among selected taxpayers. That is to say, as of December 1, 2023, all regions in the country, will allow pilot enterprises to issue fully digitalized e-fapiao through the electronic invoice service platform. The pilot program of fully digitalized e-fapiao has expanded nationwide.

- In October 2023, the local branches of the State Taxation Administration (STA) in seven provinces and cities, including Beijing、Hunan、Shandong、Anhui、Qinghai、Ningxia, and Guizhou, successively issued announcements on conducting the pilot program for fully digitalized electronic invoicing. According to these announcements, starting from November 1, 2023, these seven provinces and cities will carry out fully digitalized e-fapiao pilot programs among selected taxpayers. That is to say, as of November 1, 2023, all regions in the country, except Tibet, will allow pilot enterprises to issue fully digitalized e-fapiao through the electronic invoice service platform.

- Starting from March 30, 2023, the pilot program of issuing fully digitalized e-fapiao was expanded to selected taxpayers in Shenzhen (Guangdong province), Ningbo (Zhejiang province), Fujian province, and Yunnan province.

- Starting from March 22, 2023, the pilot program of issuing fully digitalized e-fapiao was expanded to selected taxpayers in Henan and Jilin provinces.

- Starting from January 28, 2023, the pilot program of issuing fully digitalized e-fapiao was expanded to selected taxpayers in Chongqing, Qingdao, Dalian, Tianjin, and Shaanxi provinces.

- Starting from January 20, 2023, the pilot program of issuing fully digitalized e-fapiao in Shanghai was expanded to cover all newly registered taxpayers. It is clarified that taxpayers in Shanghai will not need to use special or ordinary VAT electronic invoices from the dates when they are included in the pilot program.

- Starting from November 30, 2022, the pilot program of issuing fully digitalized e-fapiao was expanded to selected taxpayers in Xiamen.

- Starting from October 28, 2022, the pilot program of issuing fully digitalized e-fapiao was expanded to selected taxpayers in Sichuan province.

Fully digitalized e-fapiao, which are electronic invoices (e-invoices), is a completely new type of electronic invoice, which is different from the previously introduced normal value-added tax (VAT) e-fapiao and the traditional paper fapiao but has the same legal effect.

The pilot program of fully digitalized e-fapiao kicked off on December 1, 2021, when selected taxpayers in Shanghai, Guangdong (Guangzhou, Foshan, Guangdong-Macao Intensive Cooperation Zone), and Inner Mongolia (Hohhot) started to issue and accept fully digitalized e-fapiao.

In 2022 and 2023, the pilot program of fully digitalized e-fapiao keeps expanding, with a broader scope of taxpayers being able to issue and accept fully digitalized e-fapiao. As of December 1, 2023, the pilot program of fully digitalized e-fapiao has been rolled out nationwide, with Tibet being added to the scope of issuance. It is almost two years earlier than the original timeline.

Under the fully digitalized e-fapiao programs, a national unified e-invoicing service platform (to be launched yet) will provide pilot taxpayers 24-hour online services to issue, deliver, and verify fully digitalized e-fapiao free of charge. This means the special tax control equipment, such as golden tax USB disk, tax control USB disk, and tax UKey, are no longer needed. Following the introduction of the normal VAT e-fapiao and the construction of the Golden Tax System Phase IV, the fully digitalized e-fapiao marks the latest effort by the Chinese government to promote the digital upgradation and intelligent transformation of tax collection and administration and reduce the cost of tax management.

In this article, we’ll introduce the key features of fully digitalized e-fapiao, walk you through the pilot fully digitalized e-fapiao programs in 2022 and 2023, and explain the potential impacts of fully digitalized e-fapiao on your businesses.

What is fully digitalized e-fapiao?

The fully digitalized e-fapiao is a completely new type of electronic invoice. It has the same legal effect and usage as the existing paper fapiao but has no sheets. Like other VAT electronic fapiao, it has no invoice copies (normal paper fapiao consists of the stub copy, the deduction copy, and the account-keeping copy for the fapiao issuers and receivers to keep and use).

The fully digitalized e-fapiao will also look neater, with only 17 items of content: dynamic QR code, invoice number, issuance date, buyer information, seller information, project name, specification and model, unit, quantity, unit price, amount, tax rate/levy rate, tax amount, total, ad valorem and tax total (in words and figures), remarks, and invoice.

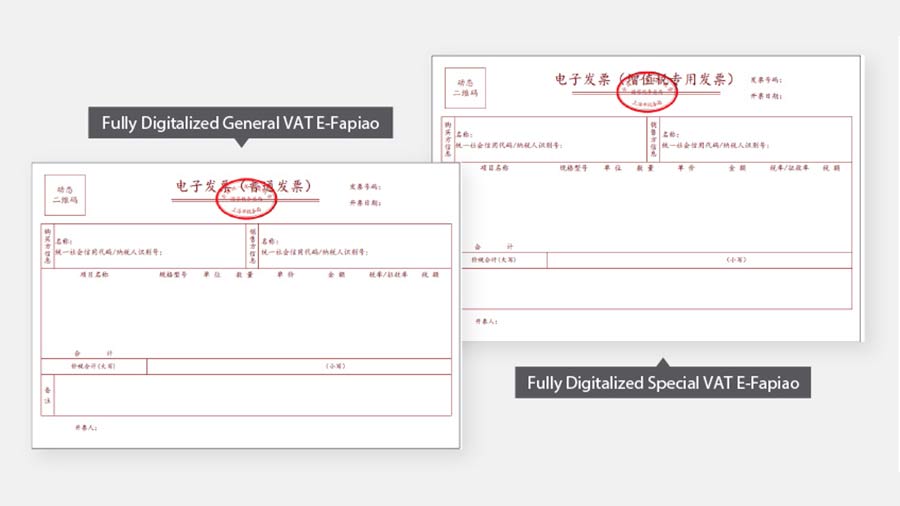

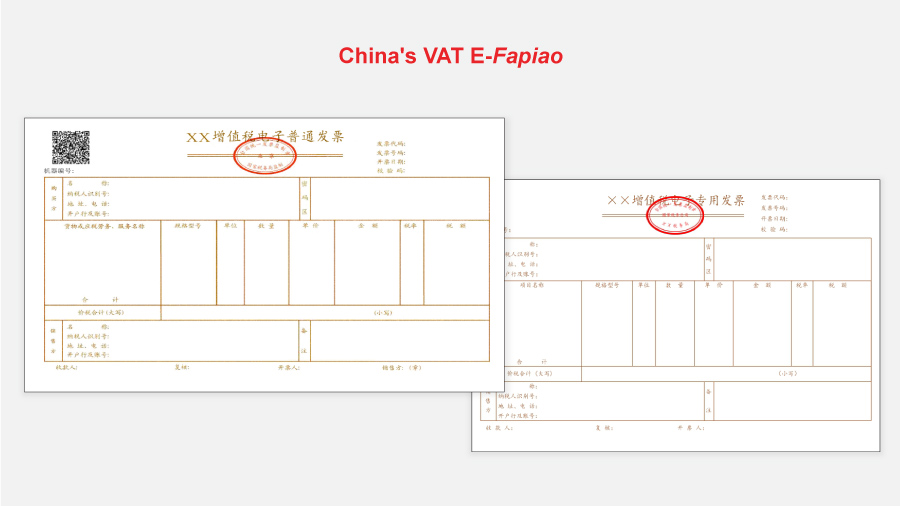

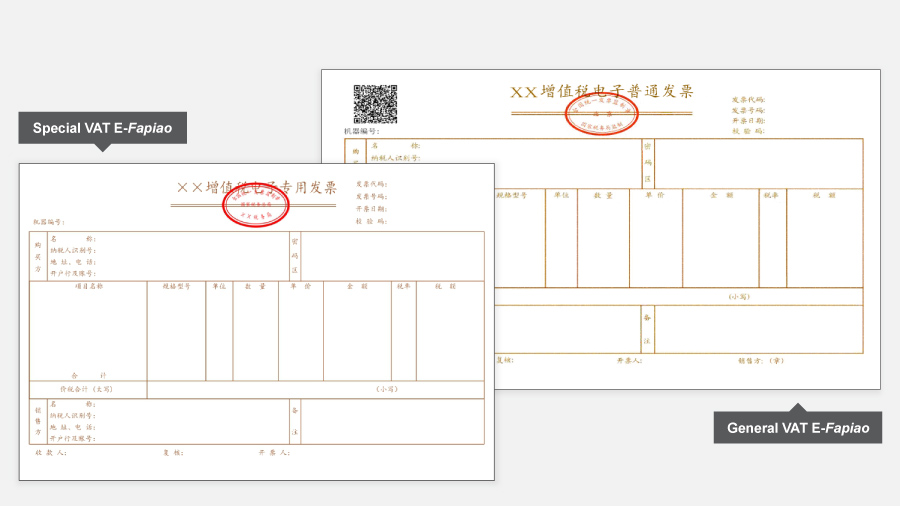

With their introduction, there will be a total of six kinds of fapiao co-existing in China during the country’s ongoing fapiao system reforms. The six types are special VAT fapiao, general VAT fapiao, special VAT e-fapiao, general VAT e-fapiao, fully digitalized special VAT e-fapiao, and fully digitalized general VAT e-fapiao. The samples of the fully digitalized electronic fapiao can be found below:  In comparison, the normal VAT electronic fapiao and conventional fapiao looks more complicated as below:

In comparison, the normal VAT electronic fapiao and conventional fapiao looks more complicated as below:

What are the new features of fully digitalized e-fapiao?

As a new type of electronic invoice, the fully digitalized e-fapiao will have unique features as explained below.

Simplified procedures to obtain and issue fully digitalized e-fapiao

- “No medium”: Taxpayers under the pilot program will not need to get the special tax control equipment (the medium) in advance to issue fapiao; Instead, they can issue the fully digitalized e-fapiao through the national e-invoicing service platform.

- “Fapiao number automatic assignment system”: Taxpayers under the pilot program will not need to obtain the fapiao through application to the tax bureaus; Instead, they can obtain the fully digitalized e-fapiao through the e-invoicing service platform, which will automatically assign a unique fapiao number when the fapiao information is generated.

- “Managing the total amount of fapiao based on taxpayers’ credibility”: The tax authorities will determine the initial maximum amount of invoices issued by the taxpayer in a calendar month and make dynamic adjustments thereto – based on the risk level, taxpaying credit rating, actual operating conditions, and other factors of a taxpayer. The maximum invoices amount refers to the upper limit of the total invoice amount the pilot taxpayer’s invoice issued within a natural month, excluding VAT. Different from traditional paper fapiao, the fully digitalized e-fapiao is not limited by the number of fapiao pieces or the maximum among of a single fapiao.

Eventually, newly established taxpayers can issue a fully digital e-fapiao as soon as they start the business and there will be no conventional ‘prepositive procedures.’

More convenient ways to issue, deliver, and verify fapiao

- Diversified channels to issue fapiao: Pilot taxpayers can issue the fully digitalized e-fapiao through the unified e-invoicing service platform. In future, they may be able to issue such e-fapiao through a terminal or the mobile app. This way they will no longer require special tax control equipment.

- One-stop e-invoicing service platform: After logging onto the platform, pilot taxpayers can issue, deliver, and verify fapiao on the single one platform, instead of completing related operations on multiple platforms as before.

- More widely applicable fapiao data: Pilot taxpayers’ tax digital accounts on the e-invoicing service platform will automatically collect invoice data for inquiry, downloading, and printing by pilot taxpayers. Once the fully digitalized e-fapiao is issued, the fapiao information will automatically be sent to the tax digital accounts of both the issuer and the receiver for them to check and download. The issuers can track the invoice usage of the receiver in real time through the tax digital account ((such as whether the VAT has been deducted or not). These digitalized fapiao data will also lay a foundation for taxpayers to pre-fill the ‘one integrated form’ for tax declaration.

- No specific digital formats required: Unlike normal VAT e-fapiao, which has to be in PDF or OFD formats, fully digitalized e-fapiao is not required to be saved in a specific digital format. Pilot taxpayers can deliver fully digitalized e-fapiao through their tax digital accounts on the e-invoicing service platform, or deliver fully digitalized e-fapiao by email, QR code, or other means. This will reduce fapiao delivery costs and make it easier for taxpayers to process fapiao.

- Unblocked channel to access tax services: The e-invoicing service platform will incorporate more interactive features, such as smart consulting and objection submission functions.

In addition to the above, in the future, the e-invoicing service platform is expected to support the direct connection with ERP and other financial software of the majority of enterprises to realize the integrated operation of invoice reimbursement, entry, and filing.

The expansion of the pilot fully digitalized e-fapiao programs

After the first round of trial in Shanghai and selected cities of Guangdong and Inner Mongolia, the pilot fully digitalized e-fapiao program keeps expanding the scope of issuers and recipients in 2022 and 2023:

- Starting from April 1, 2022, the pilot program in Guangdong province was further extended from the original three cities and zones to cover more selected taxpayers in the whole province (excluding Shenzhen).

- Starting from April 25, 2022, the pilot program in Inner Mongolia was extended from Hohhot to selected taxpayers in the whole autonomous region.

- Starting from May 10, 2022, taxpayers in Sichuan province have been allowed to receive invoices (including fully digitalized e-fapiao) issued by selected taxpayers in Inner Mongolia Autonomous Region, Shanghai municipality, and Guangdong province (excluding Shenzhen) via the electronic invoice service platform.

- Starting from May 23, 2022, the pilot program for fully-digitalized e-fapiao has been conducted among selected taxpayers in Shanghai following the updated rules.

- Starting from June 21, 2022, the scope of fully digitalized e-fapiao recipients has been further expanded to Beijing, Shenzhen, Jiangsu province, Shandong province (excluding Qingdao), and Zhejiang Province. Meanwhile, Shanghai, Guangdong (excluding Shenzhen), and Inner Mongolia have started to accept fully digitalized e-fapiao issued by all three pilot cities/provinces, rather than only accepting the fully digitalized e-fapiao issued within their respective jurisdiction.

- Starting from June 25, 2022, the pilot program in Shanghai was extended from Xuhui District to selected taxpayers in the whole city.

- Starting from July 18, 2022, the scope of fully digitalized e-fapiao recipients has been further expanded to Chongqing, Hebei, Henan, Fujian, Anhui, Jiangxi, Shaanxi, Hunan, and Hubei.

- Starting from July 31, 2022, the scope of fully digitalized e-fapiao recipients will further be expanded to Qingdao, Ningbo, and Xiamen.

- Starting from August 28, 2022, the scope of fully digitalized e-fapiao recipients will further be expanded to Tianjin, Shanxi, Gansu, Ningxia, Qinghai, Xinjiang, Liaoning, Jilin, Heilongjiang, Yunnan, Guizhou, Guangxi, and Hainan.

- Starting from October 27, 2022, Guangdong shall expand the pilot program for the issuance of fully-digitalized e-fapiao to cover newly registered taxpayers in the whole province (excluding Shenzhen). It will also cover other taxpayers in batches by industries and regions so that they can issue fully digitalized e-fapiao via the electronic invoice service platform.

- Starting from October 28, 2022, the pilot program of issuing fully digitalized e-fapiao was expanded to selected taxpayers in Sichuan province.

- Starting from November 30, 2022, the pilot program of issuing fully digitalized e-fapiao was expanded to selected taxpayers in Xiamen.

- Starting from January 20, 2023, the pilot program of issuing fully digitalized e-fapiao in Shanghai was expanded to cover all newly registered taxpayers. It is clarified that taxpayers in Shanghai will not need to use special or ordinary VAT electronic invoices from the dates when they are included in the pilot program.

- Starting from January 28, 2023, the pilot program of issuing fully digitalized e-fapiao was expanded to selected taxpayers in Chongqing, Qingdao, Dalian, Tianjin, and Shaanxi provinces.

- Starting from March 22, 2023, the pilot program of issuing fully digitalized e-fapiao was expanded to selected taxpayers in Henan and Jilin provinces.

- Starting from March 30, 2023, the pilot program of issuing fully digitalized e-fapiao was expanded to selected taxpayers in Shenzhen (Guangdong province), Ningbo (Zhejiang province), Fujian province, and Yunnan province.

- In October 2023, the local branches of the State Taxation Administration (STA) in seven provinces and cities, including Beijing、Hunan、Shandong、Anhui、Qinghai、Ningxia, and Guizhou, successively issued announcements on conducting the pilot program for fully digitalized electronic invoicing. According to these announcements, starting from November 1, 2023, these seven provinces and cities will carry out fully digitalized e-fapiao pilot programs among selected taxpayers. That is to say, as of November 1, 2023, all regions in the country, except Tibet, will allow pilot enterprises to issue fully digitalized e-fapiao through the electronic invoice service platform.

- Starting from December 1, 2023, Tibet will carry out fully digitalized e-fapiao pilot programs among selected taxpayers. That is to say, as of December 1, 2023, the pilot program of fully digitalized e-fapiao has expanded nationwide.

| Scope of issuers* | Selected taxpayers in all regions nationwide |

| Scope of recipients* | Taxpayers nationwide |

| The Latest Scope of Issuers and Recipients of Fully Digitalized E-fapiao | |

*Taxpayers who do not use or have the Internet are temporarily excluded from the pilot fully digitalized e-fapiao program.

How will the pilot fully digitalized e-fapiao program affect businesses?

Fully digitalized e-fapiao is expected to greatly reduce the workload of enterprises’ financial and accounting staff and increase the efficiency of issuing a fapiao in the long run.

However, businesses may face short-term challenges regarding the processing and archiving of fully digitalized e-fapiao, as the corresponding financing processes need to be adjusted based on the new features of the fully digitalized e-fapiao. Companies are suggested to take this chance to consider adopting technologies to facilitate their e-fapiao management, reimbursement management, accounting, tax, and supply chain management processes, step by step, as the added value of e-fapiao, is deeply associated with the automation level of the relevant processes.

On the other hand, under the pilot program of the fully digitalized e-fapiao and the promotion of the Golden Tax System Phase IV, businesses might be exposed to bigger tax risks as the tax bureau’s ability in spotting incompliance tax behavior will be enhanced by big data technology.

Businesses are suggested to arrange regular tax health checks and pay more attention to their internal controls. A regular tax health check, either conducted internally or by a professional third party, will help identify the weak points in the business’s daily operations and reduce the risk of triggering worse tax investigations from the tax bureau. Considering third-party service firms are usually more professional on relevant matters and more confidential when reviewing financial and operational documents, it is highly recommended if the company’s budget allows.

To conclude, it is important for businesses to get prepared and develop a thorough strategy for e–fapiao to alleviate operational risks and get the most out of the e-invoicing system.

(The article was first published on June 27, 2022, and was last updated on December 1, 2023.)

About Us China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China Expands Unilateral Visa-Free Policy to 9 Additional Countries Including Japan, Extends Stay to 30 Days

- Next Article China’s New Renewable Energy Plan: Key Insights for Businesses