Dividend Repatriation: Limits and Tax Considerations in China

For foreign companies with subsidiaries in China, repatriating cash from their subsidiaries has always been an important and challenging issue. China maintains a strictly regulated system of foreign exchange controls, meaning funds flowing into and out of China are tightly regulated. It is important to incorporate a profit repatriation strategy into the set-up planning for a subsidiary in China to ensure one’s ability to access the profits earned. Adopting the right strategy to optimize profit repatriation from China can result in significant cost savings.

There are several ways of repatriating cash from China, the most obvious being for a company’s entity in China to pay dividends directly to its foreign parent company. However, this is subject to certain prerequisites – only profits that have undergone annual audit can be repatriated using this channel, ensuring that the gross profit will be subject to a 25 percent Corporate Income Tax (CIT). Further, a foreign-invested enterprise (FIE) can only distribute dividends out of its accumulated profits, which means that its prior accumulated losses must be more than offset by its profits in other years, including the current year.

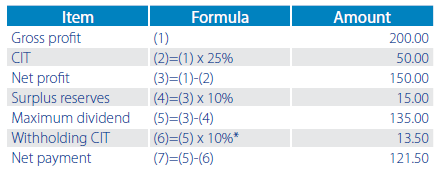

An FIE also has to place 10 percent of its annual after-tax profits into a reserve fund until it reaches 50 percent of the FIE’s registered capital. The dividends are subject to a further 10 percent withholding CIT when distributed to foreign investors. The chart below illustrates the tax burden and reserve requirement applicable to dividends in China before they can be remitted abroad.

* If a double tax avoidance agreement (DTA) is available and the parent company qualifies as the beneficial owner, a preferential dividend withholding CIT rate of 5 percent may apply.

Based on the abovementioned constraints, many multinational corporations have adopted certain implicit policies, such as minimizing their profits in China in a legitimate manner via intercompany payments, i.e., charging their Chinese unit royalty or service fees. Although these transactions will be subject to turnover tax, and, possibly withholding income tax, the fees are deductible from the CIT taxable income and exempt from the 25-percent CIT, resulting in significant cost savings.

This article is an excerpt from the June 2014 edition of China Briefing Magazine, titled “Strategies for Repatriating Profit from China.” In this issue, we guide you through the different channels for repatriating profits, including via intercompany expenses (i.e., charging service fees and royalties to the Chinese subsidiary) and loans. We also cover the requirements and procedures for repatriating dividends, as well as how to take advantage of lowered tax rates under double tax avoidance treaties.

This article is an excerpt from the June 2014 edition of China Briefing Magazine, titled “Strategies for Repatriating Profit from China.” In this issue, we guide you through the different channels for repatriating profits, including via intercompany expenses (i.e., charging service fees and royalties to the Chinese subsidiary) and loans. We also cover the requirements and procedures for repatriating dividends, as well as how to take advantage of lowered tax rates under double tax avoidance treaties.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Repatriating Profits and Dividends from China

Getting Cash Money RMB Out of China

- Previous Article No Ban on Audit Documentation from Leaving China, Says Ministry of Finance

- Next Article Remitting Royalties from China: Procedures and Requirements