Conducting a Company Health Check in China 2025: Essential Steps and Checklists

Conducting a company health check in China in 2025 is essential for businesses to navigate the evolving economic, regulatory, and technological landscape. This proactive assessment enables companies to identify potential risks, ensure compliance, and capitalize on emerging opportunities.

Operating a business in China has become increasingly complex due to shifts in the economy, geopolitical factors, diversifying supply chains, and evolving regulatory frameworks governing corporate operation, taxation, data compliance, and other areas. These changes, combined with the country’s competitive landscape and more targeted policy implementation, underscore the critical importance of adhering to best practices in business management and ensuring compliance with China’s laws and regulations.

Under such circumstances, health checks are a crucial tool for the continued success of foreign-invested companies in China. Performing routine health checks can help businesses identify hidden tax, legal, or other operational risks, compliance issues, and inefficiencies. If left unattended, these issues can lead to significant penalties and increased costs.

In this article, we explore the factors that necessitate company health checks in China and provide a practical roadmap for conducting these checks for your China business.

Special Offer: Free Business Health Checks for Businesses in Shanghai – by Dezan Shira & Associates

For a limited time, Dezan Shira & Associates Shanghai team is offering complimentary health checks to Shanghai-based foreign-invested companies that have not worked with Dezan Shira & Associates before. Please see the details of this offer or contact Shanghai@dezshira.com for more information.

Key factors necessitate company health checks in China 2025

In 2025, conducting a comprehensive company health check in China is not merely a best practice but a strategic necessity. By systematically evaluating and addressing key operational areas, businesses can enhance their resilience, ensure compliance, and position themselves for sustainable growth in a competitive market.

- Regulatory compliance: The Chinese government has introduced stricter regulations across various industries. Ensuring compliance with these regulations is crucial to avoid penalties and maintain operational licenses.

- Economic environment: China’s economic landscape in 2025 is characterized by moderate GDP growth, fluctuating interest rates, and evolving trade patterns. Companies need to regularly assess their financial health to adapt to these economic changes and remain competitive.

- Geopolitical factors: Geopolitical tensions, particularly with the United States and other major economies, have significant implications for businesses operating in China. These tensions can affect trade policies, tariffs, and overall market stability, making it crucial for companies to stay informed and agile.

- Diversifying supply chains: The need to diversify supply chains has become more pressing due to geopolitical uncertainties and the desire to reduce dependency on any single country. Companies are exploring alternative sourcing and manufacturing locations to enhance resilience and mitigate risks.

- Competitive landscape: The competitive landscape in China is becoming increasingly dynamic, with new entrants and technological advancements reshaping industries. Companies must regularly evaluate their market position and competitive strategies to stay ahead.

- Targeted policy implementation: The Chinese government is implementing more targeted policies to stabilize foreign investment and promote high-quality economic growth. These policies include expanding pilot programs in sectors like telecommunications, healthcare, and education, and improving the national comprehensive demonstration zones for expanding opening-up in the services sector. Companies need to align their strategies with these policies to capitalize on new opportunities.

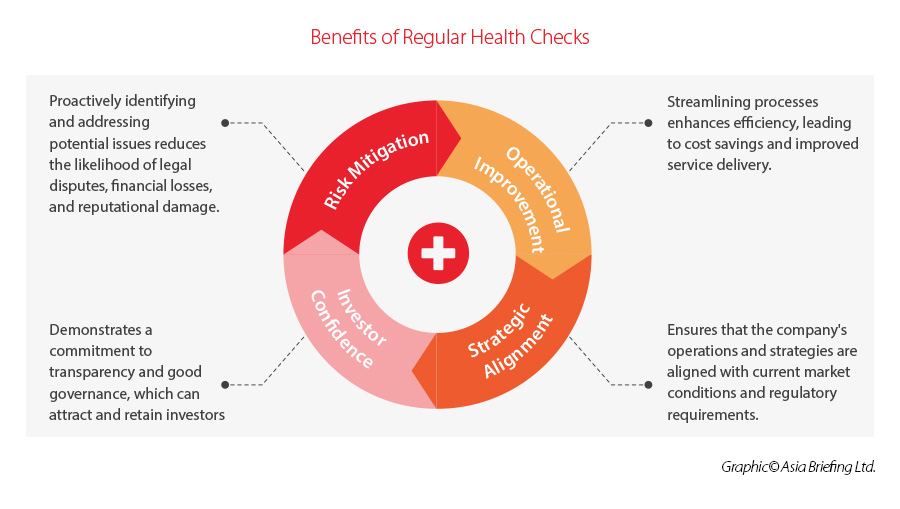

Benefits of regular health checks

How to make a company health check in China: A checklist

When conducting a company health check in China, it is crucial to assess several key areas to ensure the business’s overall health and sustainability:

- Regulatory compliance: Ensuring adherence to local laws, including tax regulations, labor laws, and industry-specific standards, is paramount. Non-compliance can result in severe penalties and operational disruptions, making it essential to stay updated with the latest regulatory changes and maintain thorough documentation.

- Financial health: Evaluating financial statements for accuracy and transparency helps identify potential financial risks and ensures the integrity of financial reporting. This assessment provides a clear picture of the company’s financial stability and highlights areas that may require attention.

- Operational efficiency: Analyzing supply chain processes, production workflows, and service delivery mechanisms can help identify inefficiencies and areas for improvement. Streamlining these operations can lead to cost savings and enhanced productivity.

- Market positioning: Understanding the company’s competitive standing within the Chinese market is vital. Assessing factors such as market share, brand recognition, and customer loyalty provides insights into the company’s strengths and areas where it can improve to maintain or enhance its market position.

- Human resources: Reviewing HR policies, employee satisfaction, and compliance with labor laws ensures a motivated and legally compliant workforce. Addressing any issues in this area can lead to better employee retention and overall organizational health.

Below is a comprehensive checklist:

|

Company Health Check Checklist |

|

| Categories | Items |

| Section 1:

Corporate Governance |

1. China Compliance

• Do you have a clear understanding of the legal structure of your Chinese entity? (e.g., Joint Venture, Wholly Foreign-Owned Enterprise, Representative Office) • Did you apply for all the licenses/permits that allow your company to operate in China lawfully?

2. Governance Structure • As a senior executive, do you have a clear understanding of the specific legal liabilities of your position? • Do you keep the name of your senior executive who left the company on the government authority’s record? • Did you update the Articles of Association according to the new Company Law? • Did you file the information of your Ultimate Beneficial Owner (UBO) with the local authority?

3. Operation and Controlling • Do you fund your entity in China legally? If a Chinese entity received loans from an overseas company, did you report it to the local authority in China? • As a majority shareholder of JV, do you really have controlling power over your Chinese entity? • As a minority shareholder of JV, do you have access to your company’s accounting book, financial statements, audit reports, and board resolutions? • Have you received any dividends from your company in China? If so, were there any legal or regulatory hurdles in the process? Have you experienced difficulties in remitting dividends back to your HQ? • Have you encountered any difficulties in managing and controlling the company seals? • Do you really know your business partner in China? Have you done full due diligence on your business partner in China? • Do you protect your IP rights well in China? • Do you have any difficulties in overseas expansion? |

| Section 2:

Finance and Tax |

1. Sales revenue and China VAT invoice management

• Is there a mismatch between VAT invoice limitation and business needs? • Is there a distinction between accrual-based revenue recognition and the timing of VAT invoice issuance? • Are there any unusual fluctuations in monthly income?

2. Goods exports and imports • Is the export record of the customs consistent with the income declared for the export tax rebate? • Does there exist the problem that the process of export rebate is complex and the application is difficult? • Is there any situation where exports are made in the name of other companies, resulting in the inability to apply for export tax rebates? • Is the import VAT fully deductible?

3. Overseas receipts and payments under non-trade items • Has the obligation of tax declaration been correctly fulfilled or have the corresponding tax preferences been enjoyed? • Has the obligation of foreign exchange declaration been completed correctly? • Is there any concern about the compliance of tax deduction of enterprise income tax? • Does the company know the procedure of profit repatriation? Any finance and tax impact? 4. Accounts Receivable • Is there an aging analysis report? • Has the collection been accurately settled against the corresponding sales invoice? • Are there any long-term issues associated with accounts receivable? Is there a potential risk of bad debts?

5. Accounts Payable and Employee Reimbursements • Is there a corresponding supplier management process? • Is it difficult for both employees and the company to distinguish the validity of value-added tax invoices when claiming reimbursements and arranging vendor payments?

6. Inventory Management and Cost Accounting • whether inventory data cannot be obtained in a timely manner or is obtained wrongly • whether there are asset losses due to poor management

7. Other issues • Does the company depreciate the Fix Asset in a proper methodology? • Does the company have concerns regarding the double tax issue for cross-border business? • Are you often confused by the explanations of Chinese accounting and taxation from your finance and tax consultant? |

|

Section 3: HR and Payroll |

1. Recruitment

• Do you have the right labor contract to sign with your employees in China? • Do you know how to hire a part-time employee? • What kind of package can be prepared for foreign expatriates to lower their tax burden in China? • Do you handle employees’ personal information lawfully in China? 2. Termination • Do you know how to mitigate the risks when terminating a high-level employee? • Are you aware of key points and procedures for mass layoffs in China? • What should you do if your employee copies confidential files/documents from the Company’s server?

|

| Section 4:

IT Systems and Compliance |

1. Regulatory

• Have you considered how changes to China’s data regulations will impact your business? • Do you have an internal data compliance program? • China’s cross-border data transfer regulations are constantly evolving. Are you prepared? 2. Technical • Have you audited your IT infrastructure recently? • Do you know what hardware/software you are allowed to deploy in China? • Do you have concerns about data leaks due to infrastructure configuration? • Do you have a well-defined, compliant procurement program?

|

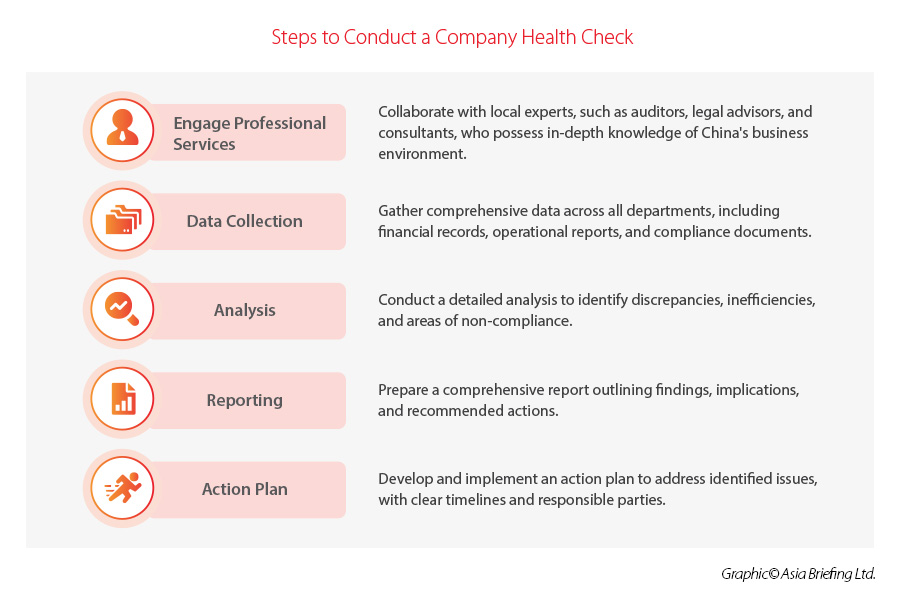

Steps to conduct a company health check

Potential challenges

While conducting a company health check offers numerous advantages, businesses should be aware of potential challenges that may arise during the process.

Among others, resource allocation is challenging for a lot of businesses operating in China, particularly for smaller organizations. The process of conducting a thorough health check requires substantial time and resources, including the involvement of various departments and external experts. Smaller companies may find it difficult to allocate the necessary resources without straining their operations. It is essential for these businesses to plan carefully and prioritize the most critical areas to ensure a comprehensive yet manageable assessment.

Besides, data sensitivity is another critical concern. Handling sensitive information, such as financial records, employee data, and proprietary business information, necessitates strict confidentiality and adherence to data protection laws. Companies must implement robust data security measures to protect this information from unauthorized access and breaches. Ensuring compliance with data protection regulations, such as China’s Personal Information Protection Law (PIPL), is crucial to avoid legal repercussions and maintain stakeholder trust.

Last but not least, regulatory complexity also presents a significant challenge in navigating China’s multifaceted regulatory landscape. The country has a vast array of regulations that vary by industry, region, and even specific business activities. This complexity requires specialized knowledge and expertise to ensure full compliance. Companies must stay updated with the latest regulatory changes and seek guidance from local experts to navigate this intricate environment effectively. Failure to comply with these regulations can result in severe penalties and operational disruptions.

By acknowledging and addressing these challenges, businesses can better prepare for and conduct effective company health checks, ultimately enhancing their resilience and positioning themselves for long-term success in the Chinese market.

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article The Annual IIT Reconciliation in China in 2025: Appointment Booking Opens February 21

- Next Article China’s Fertility Services Market: Navigating Growth, Challenges, and Opportunities