China’s Social Security System: An Explainer

China’s social security system constitutes five different types of insurance and contributions to the mandatory housing fund. China Briefing explains how social security in China is calculated, what are employer obligations, and how it impacts foreign workers and migrants.

Social security is a complicated but unavoidable issue in employer-employee relationship management for businesses operating in China.

With labor costs continually rising and economic growth slowing, it is not uncommon that companies may endeavor to look for ways to circumvent social security obligations.

Frequently, business commentary in the region debates whether China’s social security contributions are burdensome for companies.

Other commonly asked questions are – can companies exempt social security obligations by reaching agreements with employees? What are the risks of non-compliance? How does the system affect foreign workers?

In this article, we answer frequently asked questions about China’s social security system as well as key compliance norms that employers should pay attention to.

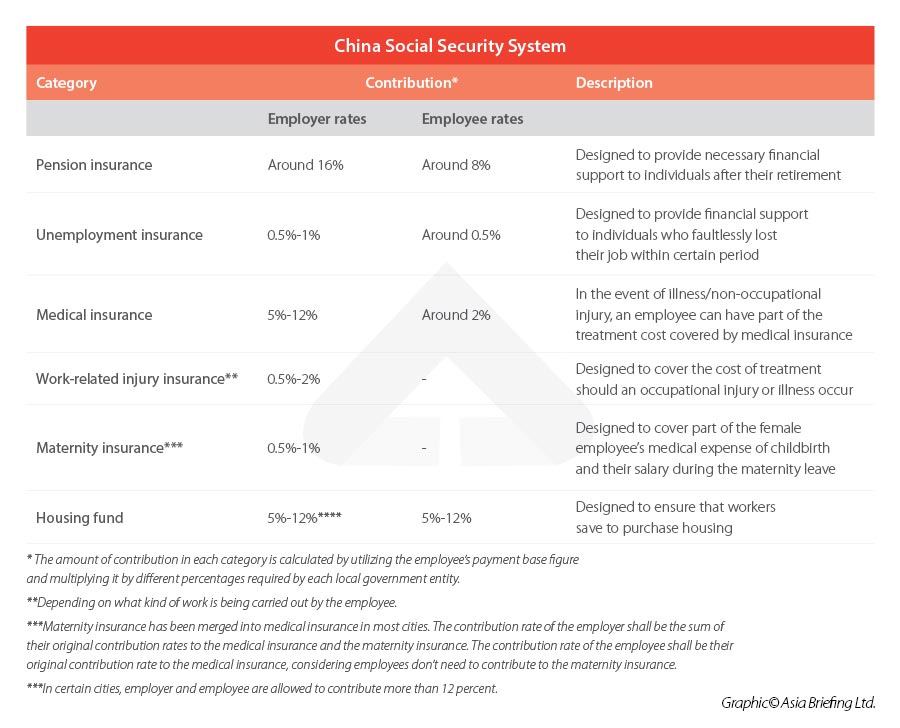

China’s social security system at a glance

China’s current individual employment contract-based social security system gradually emerged in the late 1990s and the 2000s. Before that, the government provided a welfare system (pension, healthcare, and housing) for urban workers.

The new system emerged through a series of specific regulations and provisions in the 1994 Labor Law and 2008 Labor Contract Law. It was not until 2011 that these separate parts were codified into a comprehensive national framework under the Social Insurance Law, in which the basic principles of China’s social security system are outlined.

Generally speaking, China’s social security system is made up of five different kinds of insurance, plus one mandatory housing fund as shown in the table below.

What are key employer obligations in China?

To maintain compliance, the first and most important thing for foreign investors to know is what the employer’s obligations are in the social security scheme.

Under China’s system, it is not enough that employers are simply willing to pay. Whenever hiring new staff, employers need to register them with the local Social Insurance Bureau and the Housing Fund Bureau to initiate or reactivate their corresponding accounts.

Further, although both employer and employee are obligated to make contributions, it is generally the employer’s responsibility to correctly calculate and withhold the payments for both parties.

Meanwhile, employers are obliged to make timely payments for themselves and their employees. A late contribution can result in a fine, while failure to contribute may lead to onerous labor disputes.

In case of severe and multiple violations, the company might be put on an HR “name and shame” list, which can do significant reputational damage and create barriers to future recruitment.

One thing to be noted is that the employer’s obligation to make adequate and timely contributions cannot be alleviated or exempted by reaching a mutual agreement with employees.

In practice, employers and employees (especially those whose gross salary is not high) may mutually agree not to contribute to the social security schemes or to make contributions on a smaller basis, to save labor costs and maximize the employee’s take-home payment.

However, the court would consider such an agreement to be invalid in the case of a labor dispute between the employer and the employee. The employer might be required to repay the social security evaded or pay extra severance payment to its employee in case of termination.

How to calculate the contribution base?

To correctly calculate the monthly social security contribution amount, employers need to understand the basic rules for deciding the contribution base figure.

Firstly, rather than the actual payment that employees get for each month, the social security contribution base is a figure that is determined by the employee’s average income in the previous year (that is, January to December). The calculation method is as follows:

Social security contribution base = Previous year’s total income / 12*

*For new hires, the starting salary may be used as the social security base during the first year.

Secondly, the base figures for social security contributions have floors and ceilings. Generally, the contribution base is capped at 300 percent of the average local salary. And the minimum contribution base is usually decided either by the local minimum wage or a certain percentage of the average local wage.

For example, Guangdong’s average salary in 2018 was RMB 6,338 (US$894.04). The maximum monthly contribution base for an employee who works in Guangdong is three times this amount – RMB 19,014 (US$ 2,682.11) and the minimum contribution base is 60 percent of this amount – RMB 3,803 (US$ 536.45). (US$1 = RMB 7.09).

Local governments generally update the average local salary benchmark and minimum wage once per year, which updates the social security floor and ceiling in kind. Considering that the timing for the release of these figures varies per city and per year, it is challenging but critical for investors to obtain accurate and up-to-date information for their operations in each region.

Are there local variances in how the social security system works across China?

To understand China’s social security system, foreign employers need to consider local variances.

Although there are national guidelines issued by the central government as mentioned above, local levels of government manage the specifics and administration of the system.

That is to say, the contribution base ceiling and floor, the contribution rates, the social insurance, and housing fund registration, as well as other compliance requirements, might be very different from one city to another.

Local variance in administration, though at times inconvenient, maybe a practical necessity for a country as diverse as China, as any rigid system could not be expected to be suitable for Lhasa, Harbin, and Shanghai at the same time.

However, given the sheer size of China in terms of geographic area and population – employers and those who maintain operations in multiple locations – may find it confusing to determine how much they should contribute to each employee.

Under China’s current framework, employers cannot simply believe they are in compliance by referring to the national guidelines. It is very common that the local social insurance bureaus only accept instructions from the local authority that directly manages them.

As such, employers should conduct social security research on a city-by-city basis or consult third-party professional services to ensure compliance.

How does the social security system impact foreigners and migrant workers?

While the former social security system only covered urban workers, rural workers who moved to cities to work (or “migrant workers”) have gradually been included over time.

In most cities, rural workers are now treated the same as urban workers – they are subject to the same contribution rates and the same contribution floor and ceiling. However, in certain cities, the system still treats rural and urban workers differently.

While employers are still required to make full contributions in these cities, rural workers may only need to contribute to the pension and medical insurance, rather than the pension, medical insurance, and maternity insurance.

Foreign employees working in China have been required to participate in China’s social insurance scheme starting from 2011 when the Ministry of Human Resources and Social Security (MOHRSS) released the Interim Measures for the Participation in Social Insurance of Foreigners Employed in China.

However, since social security is managed at the regional level, a range of inconsistencies exist among cities.

Foreign employees are also eligible for social insurance exemptions if they come from countries that have social insurance exemption agreements with China.

To date, 12 countries have reached such agreements with China and 11 such agreements have been implemented between China and the following countries: Germany, South Korea, Denmark, Canada, Finland, Switzerland, the Netherlands, Spain, Luxembourg, Japan, and Serbia. China has signed agreements with France, but it is not yet in effect.

The exemption scope and qualifications may vary from one agreement to another, and the local social insurance bureaus may have different policies toward the implementation of the exemptions. Employers should consult and apply with the local bureau in charge before they decide not to contribute for their foreign employees.

Notably, expatriates are generally not required to contribute to the housing fund scheme. Nevertheless, many cities allow foreigners to make housing fund contributions on a voluntary basis. This is a measure to attract talent.

Is social security a burden on China’s employers?

With labor costs in China increasing at the same time as economic growth is slowing, it is easy for foreign investors to consider social security contributions to be burdensome and without benefit. However, things appear differently upon deeper examination.

Firstly, the employer’s mandatory social security payments for its employees can be treated as reasonable salary expenses and thus can be deducted from corporate income tax.

Secondly, social insurance can protect businesses from risks and save costs in certain circumstances.

For example, where an employee suffers an injury or illness at work or during work time, work-related injury insurance can cover the costs of the treatment. If work-related insurance has not been paid, the company will be liable for treatment expenses itself, which could be very costly in case of severe illness and injury.

Thirdly, social security is critical when recruiting talent, especially for companies that rely heavily on professionals and skilled workers in big cities. For example, in Shanghai, many companies are even willing to make extra housing fund contributions for their valuable employees, even though this extra payment is not tax-exempt.

Overall, China’s social security system is complex and managed inconsistently across cities and can be costly with labor costs rising continuously. Nevertheless, it is not necessarily a burden for businesses considering its role in recruiting talents and avoiding work-related injury risks.

Most importantly, employers’ mandatory social security contribution obligations cannot be exempted by mutual consensus between employers and employees. Late or inadequate payments will put employers in an even worse position.

Foreign employers should therefore have a thorough understanding of the social security system or seek professional services to ensure full compliance.

Editor’s Note: This article was originally published in September 2017. Parts of the article have been updated to reflect the latest legal developments.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Embracing Sustainability: How Businesses Can Contribute to the ‘Beautiful China’ Initiative

- Next Article China’s FDI Trends 2023: Sources, Destinations, and Key Sectors