China’s Internal Control and Audit Regulatory Framework

By Eunice Ku

Mar. 9 – Internal control and audit efforts in China are often criticized for only meeting compliance requirements, with little or no benefits to the business – form over substance. This is not, however, because the country lacks a related regulatory framework.

Mar. 9 – Internal control and audit efforts in China are often criticized for only meeting compliance requirements, with little or no benefits to the business – form over substance. This is not, however, because the country lacks a related regulatory framework.

While relatively young in comparison to guidelines and organizations recognized internationally, China has an evolving regulatory framework for internal control and audit.

Internal Control

The Basic Standard

China SOX, China’s version of the Sarbanes-Oxley Act of 2002 (the U.S. federal law that details requirements promulgated to improve risk management and prevent financial scandals such as Enron and Worldcom), was issued in 2008, with supporting guidelines issued in 2010.

The Basic Standard for Enterprise Internal Control (caikuai [2008] No. 7, “Basic Standard”) mirrors its American counterpart in many ways as it aims to enhance the quality of financial reporting by listed companies.

The supporting guidelines started applying to companies that are concurrently listed in the domestic and overseas markets from January 1, 2011 onwards, and to companies listed on the main board of the Shanghai Stock Exchange and the Shenzhen Stock Exchange from January 1, 2012 onwards.

Companies listed on the small and medium-sized enterprise board and the Growth Enterprise Market will be required to adopt these guidelines “when appropriate.” Non-listed large and medium-sized enterprises are merely encouraged to adopt the guidelines.

Supporting Guidelines

To implement the Basic Standard, in April 2010, the five Chinese governmental departments issued the Supporting Guidelines for Internal Control of Enterprises (caikuai [2010] No.11, “Supplementing Guidelines”).

The Supplementing Guidelines consist of three guidelines:

- Application Guidelines

- Evaluation Guidelines

- Audit Guidelines

The Supplementing Guidelines require listed companies and non-listed large and medium-sized enterprises governed by the Basic Standards and the Supplementing Guidelines to disclose an annual self-evaluation report on the effectiveness of their internal control as well as engage an accounting firm to issue an auditor’s reports on the effectiveness of their internal control in financial reporting.

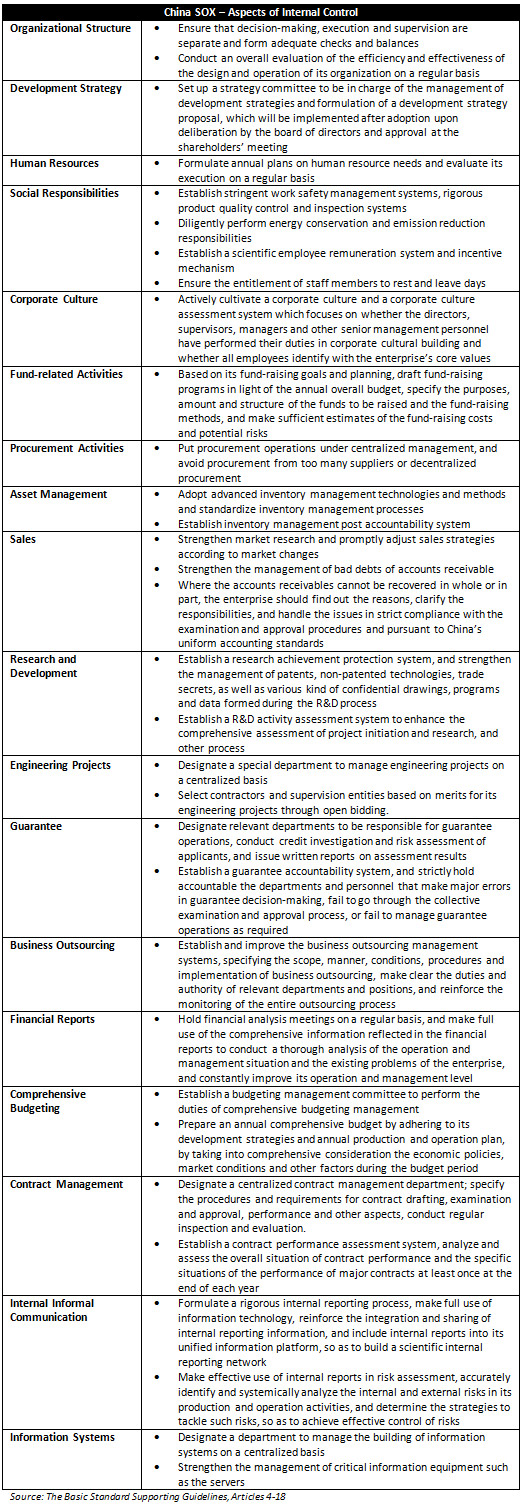

The Application Guidelines include 18 aspects for enterprises to focus on in establishing internal controls, along with definitions and examples (please see table below), while the Evaluation Guidelines provide an outline for enterprises to perform comprehensive assessments on the design and operation of their internal controls. These guidelines are generally in line with international materials.

Finally, while the audit section of the Supplementing Guidelines outlines basic requirements for performing internal control audits for enterprises, China has a number of other laws and regulations on this topic.

Internal Audit

China joined the Institute of Internal Auditors (IIA) in 1987 and established The Chinese Institute of Internal Auditors the same year. Since then, the country has gradually established the basic framework of a standard internal audit system by promulgating basic guidelines for internal audit, codes of practice for internal audit practitioners, and specific rules and directories for internal audit practices, including implementing the Internal Audit Regulations in 2003.

One key difference in China’s internal audit framework, compared to its international counterpart, is a more narrow, financial audit-focused definition of internal audit.

IIA defines internal auditing as:

“An independent, objective assurance and consulting activity designed to add value and improve an organization’s operations…(that) helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes.”

China’s Internal Audit Regulations, on the other hand, define internal auditing as:

“An activity that consists of independent supervision and evaluation of the authenticity, validity and benefit of the fiscal and financial income and expenses and economic activities of an enterprise and its affiliated organizations, in order to enhance and strengthen its economic management and realization of economic goals.”

While internal auditors are expected to examine and evaluate risk management and the soundness and effectiveness of the internal control system, IIA’s definition of internal audit is clearly broader than that provided under China’s regulations; while the former is concerned with improving risk management, control, and governance processes.

This article was taken from the March issue of China Briefing Magazine, titled “Internal Control and Audit.” The issue is devoted to understanding effective internal control systems in the Chinese context and the role of audits in detecting and preventing fraud. It is temporarily available as a complimentary download this month on the Asia Briefing Bookstore.

This article was taken from the March issue of China Briefing Magazine, titled “Internal Control and Audit.” The issue is devoted to understanding effective internal control systems in the Chinese context and the role of audits in detecting and preventing fraud. It is temporarily available as a complimentary download this month on the Asia Briefing Bookstore.

Dezan Shira & Associates is a boutique professional services firm providing foreign direct investment business advisory, tax, accounting, payroll and due diligence services for multinational clients in China, Hong Kong, India, Singapore and Vietnam. For further information on steps to take regarding internal control and audits in China, please email china@dezshira.com, visit our web site at www.dezshira.com, or download our brochure here.

Related Reading

Doing Business in China

Doing Business in China

Our 156-page definitive guide to the fastest growing economy in the world, providing a thorough and in-depth analysis of China, its history, key demographics and overviews of the major cities, provinces and autonomous regions highlighting business opportunities and infrastructure in place in each region. A comprehensive guide to investing in the country is also included with information on FDI trends, business establishment procedures, economic zone information, and labor and tax considerations.

The China Tax Guide (Fifth Edition)

The China Tax Guide (Fifth Edition)

This popular book, fully updated with all recent tax changes and amendments, details all taxes in China affecting businesses and individuals, how to calculate the amounts due, tax registration and filing procedures, tax minimization techniques, and claiming VAT rebates. It also details good financial management techniques, handling negotiations with the tax bureau and annual audit and compliance procedures.

Annual Compliance for FIEs

Annual Compliance for FIEs

Prior to distributing and repatriating profits, foreign-invested enterprises must complete annual compliance, involving an audit, tax filing and inspection. These procedures are not only required by law, but are a good opportunity to conduct an internal financial health check. Also in this issue, we take a look at individual tax filing procedures for expatriates living and working in China.

The Foreign Corrupt Practices Act and its Impact on China Subsidiaries

The Foreign Corrupt Practices Act and its Impact on China Subsidiaries

This issue of China Briefing Magazine is dedicated to helping companies understand the Foreign Corrupt Practices Act and establish controls to prevent (and, if necessary) resolve FCPA noncompliance.

- Previous Article Consumption Trends and Targeting China’s Female Consumers

- Next Article Six Key Points Regarding China’s Tax Reforms in 2012