China’s Foreign Investment Information Reporting System: How Does it Work?

Foreign investors and foreign invested enterprises in China are subject to foreign investment information reporting obligations under the Foreign Investment Law, which came into effect on January 1, 2020. The new foreign investment information reporting mechanism is different from previous record-filing requirements regarding foreign investment upon incorporation and changes to the business.

Considering the penalties for reporting incompliance and the potential impact on the social credit of relevant parties, foreign investors and FIEs are advised to get familiar with China’s latest foreign investment information reporting obligations and manage their compliance in an accurate and timely manner.

On March 15, 2019, China passed the Foreign Investment Law (FIL), a new guiding document governing foreign investment in China. Article 34 of the FIL introduced a foreign investment information reporting system. Compared to the previous foreign investment requirements, this system introduces multiple changes including the timing, format, information to be submitted, and reporting method for investors.

To facilitate the implementation of the system, China released two regulatory documents in December 2019 to provide further guidance on how the foreign investment information reporting administration works in the country:

- Measures on Reporting of Foreign Investment Information (Ministry of Commerce, State Administration for Market Regulation Order No. [2019] No. 2, Circular No.2); and

- Announcement of the Ministry of Commerce on Matters Relating to Reporting of Foreign Investment Information (Ministry of Commerce Announcement [2019] No. 62, Circular No.62).

Both the Circulars came into effect – alongside the FIL – from January 1, 2020. Yet, two years on, many investors still find the new foreign investment information reporting system confusing.

In this article, we aim to improve understanding of China’s foreign investment information reporting system by explaining how it works and what are the legal consequences of incompliance.

What is the foreign investment information reporting system?

The foreign investment information reporting system is an administrative system set up under China’s Foreign Investment Law to provide information to the government. The government uses the information collected for “making and improving foreign investment policy measures, enhancing precision services, and delivering effective investment promotion and protection”. The system is not a precondition for businesses to process business registration procedures or other such matters, nor is it a new administrative approval targeting foreign investors or FIEs.

How does the foreign investment information reporting system work?

From the investors’ perspective, the foreign investment information reporting system requires foreign investors and foreign invested enterprises (FIEs) to submit the relevant investment information to the competent commercial authorities through the Enterprise Registration System, which is managed by respective local authorities, (see Shanghai example) and the Enterprise Credit Information Publicity System.

As the Enterprise Registration System and the Enterprise Credit Information Publicity System are managed by the State Administration for Market Regulation (SAMR) and its local branches, the market regulatory authorities are required to promptly forward the investment information submitted to the commerce authorities who can then share it with other relevant authorities. This shall then be received and handled by the centralized Foreign Investment Information Reporting System established by the Ministry of Commerce (MOFCOM).

Such submission of relevant information by FIEs after incorporation through an online system is not new in China – it has been implemented in some form since 2016. The new foreign investment information reporting mechanism, however, ensures that the reporting is done in a comprehensive and consolidated manner in which duplicate reporting with multiple government agencies can be avoided.

What foreign investors or FIEs are subject to the foreign investment information reporting system?

The FIL generally stipulates that foreign investors and FIEs are subject to foreign investment information reporting requirements. Under the FIL, foreign investors refer to foreign natural persons, enterprises, or other organizations that directly or indirectly carry out investment activities in China and FIEs refer to enterprises incorporated under Chinese laws within the territory of China, and with all or part of its investment from foreign investors.

Moreover, the FIL defines four circumstances that are regarded as foreign investment:

- A foreign investor establishes a FIE within the territory of China, either alone or together with any other investor.

- A foreign investor acquires shares, equities, property shares, or any other similar rights and interests of an enterprise within the territory of Chin.;

- A foreign investor invests in any new project within the territory of China, either alone or together with any other investor.

- A foreign investor invests in any other way stipulated under laws, administrative regulations, or provisions of the State Council.

Circular No.2 and Circular No.62 provide further clarifications on which types of entities must report information regarding foreign investment. This is summarized as below:

| Foreign Investors or FIEs Subject to the Foreign Investment Information Reporting System | |

| Reporting entity | Legal basis |

(“Foreign Direct Investors”) |

Article 9 of the Circular No.2

Article 1 of the Circular No.62 |

(collectively “Foreign Enterprises”) |

Article 1 of the Circular No.62 |

(“Foreign-invested Investment Enterprises”) |

Article 1 of the Circular No.62 |

(“FIEs”) |

Article 11 to 14 of Circular No.2 |

(“FIEs invested enterprises”) |

Article 28 of Circular No.2

Article 4 of the Circular No.62 |

|

Article 33 of the Circular No.2 |

What kind of investment information should be submitted and how?

In addition to reporting entities, Circular 2 and Circular 62 also stipulates the reporting method and reporting content in different situations. Based on incorporation and the term and operation of relevant entities, they might be required to submit four types of reporting. This is explained below.

1) Initial report

In the following circumstances, relevant foreign investors and FIEs should submit the initial report, which includes the basic information of the enterprise, the investor, its actual controller, and investment transaction through an online Enterprise Registration System:

- Foreign investors establishing FIEs within the territory of the PRC or merging and acquiring domestic non-foreign-invested enterprises in China.

- Enterprises from foreign countries (regions) engaging in production and business activities in China, and enterprises from foreign countries (regions) establishing a permanent representative organization in China to engage in production and business activities etc.

- Investment companies and venture capital enterprises established by foreign investors and partnership enterprises primarily engaging in investment activities which are establishing enterprises in China.

When to submit the initial report?

Among others, foreign investors establishing a foreign investment enterprise in China shall submit an initial report at the time of completion of establishment registration for the foreign investment enterprise.

Foreign investors undertaking a merger and acquisition of a non-foreign investment enterprise in China shall submit an initial report at the time of processing the change of registration formalities of the target company.

2) Change report

If the information in the initial report of FIEs has changed, a report on the changes to the basic information of the enterprise, the investor, and its actual controller should be submitted through the online Enterprise Registration System.

Where the change is subject to enterprise change registration (filing), the relevant party shall submit a change report through the Enterprise Registration System at the time of completion of enterprise change registration (filing).

Where the change is not subject to enterprise change registration (filing), such as change of actual controlling party of a FIE, change in information pertaining to tax reduction and exemption information for imported equipment, no change in address but change in special economic zone, as well as change in basic information of a shareholder who is not a promoter of the foreign invested joint stock company, the relevant party shall submit a change report through the Enterprise Registration System within 20 working days from occurrence of the change matter. The date of occurrence of the change is decided in two situations:

- Where the enterprise passes a resolution on the change in accordance with the articles of association, the date on which the resolution is passed shall be deemed as the date of occurrence of the change matter.

- Where the laws and regulations stipulate otherwise on the conditions for the change to take effect, the date on which the corresponding conditions are satisfied shall be the date of occurrence of the change matter.

For foreign investments in listed companies and companies quoted on the National Equities Exchange and Quotations, the information on change in investors and their shareholdings may be reported only when the cumulative change in a foreign investor’s shareholding exceeds five percent or leads to a change to the foreign party’s controlling or relative controlling status.

3) Annual report

Relevant foreign investors and FIEs shall submit an annual report for the preceding year through the National Enterprise Credit Information Publicity System between January 1 and June 30 of each year. The contents of the report include basic corporate information, information about investors and their actual controllers, corporate operating information, assets, and liabilities, etc.

Foreign investment enterprises established in the current year shall commence submission of annual reports from the following year.

4) Deregistration report

Relevant information about the deregistration or conversion of FIEs to domestic-funded enterprises is forwarded by the market regulatory authorities to the competent commerce authorities.

To better illustrate, we put together the below table:

| Foreign Investment Information Reporting System in China | |||

| Type of report | Reporting circumstances | Reporting time | Reporting method |

| Initial Report |

|

During enterprise’s establishment registration procedure | Through the Enterprise Registration system operated by SAMR and its local branches |

| Change Report |

|

During enterprise’s amendment registration procedure; or within 20 working days if the amendment registration procedure is not required | |

| Annual Report |

(Refer to the entities listed in the table above, titled: “Foreign Investors or FIEs Subjecting to the Foreign Investment Information Reporting System”.) |

From January 1 to June 30 in each year | Through the National Enterprise Credit Information Publicity System operated by SAMR |

| De-registration Report |

|

The deregistration report shall be deemed submitted once the enterprise deregistration formalities or enterprise change registration formalities are completed | Deregistration information is forwarded by the market regulatory authorities to the competent commerce authorities; no separate reporting is needed. |

To be noted, for domestic enterprise invested by FIEs (including multi-tier investments), there is no need to submit a separate report—all information is shared by the market regulatory authorities to the competent commerce authorities.

Requirements on Investment Information Report

The foreign investors or FIEs who are obliged to make the investment information report shall make the report in a timely manner and ensure that the information to be reported shall be authentic, accurate, and integrated. No false or misleading information shall be reported, and no important information shall be omitted. The party who made the report is obliged to amend or correct the information where there are any mistakes or omits.

What are the legal consequences of violating foreign investment information reporting obligations?

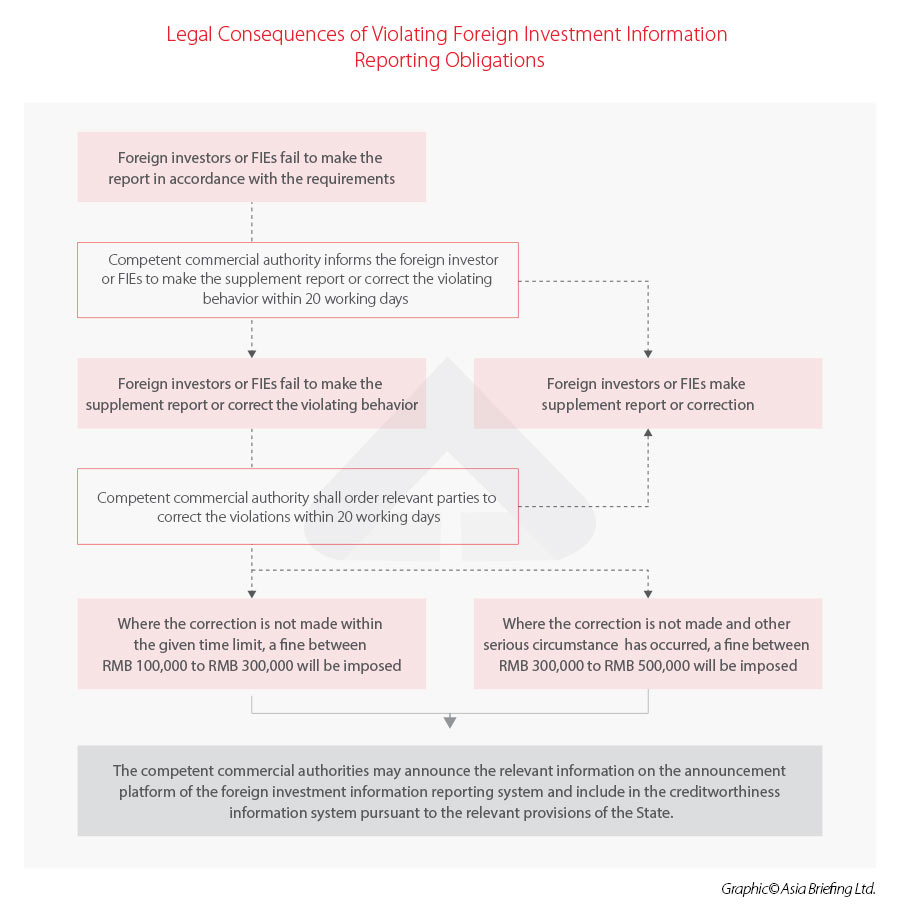

Where a foreign investor or a foreign investment enterprise fails to submit investment information in accordance with the requirements of relevant laws and regulations, the competent authority shall inform the foreign investor or FIE to make the supplement report or correct the violating behavior within 20 working days. If relevant parties fail to meet either / both these requirements within this given period, the competent commerce authorities shall order it to make the correction in the following 20 working days. If there are still no corrections made – as stipulated by the authorities – a fine ranging from RMB300,000 to RMB500,000 shall be imposed:

- Where correction is not made within the stipulated period, a fine ranging from RMB100,000 (approx. US$15,500) to RMB300,000 (approx. US$46,500) shall be imposed.

- Where correction is not made and where serious circumstances exist, a fine ranging from RMB300,000 (approx. US$46,500) to RMB500,000 (approx. US$77,500) shall be imposed.

Serious circumstances refer to below situations:

- Where the foreign investor or a FIE deliberately evades information reporting obligation, or conceals true information, or provides misleading or false information when making information reporting.

- Where the foreign investor or the FIE commits reporting error of significant information, such as the industry it is in, whether it is subject to foreign investment admission special administrative measures, the enterprise’s investors and their actual controlling party etc.

- Where the foreign investor or the FIE fails to submit investment information in accordance with the requirements of relevant laws and regulations and is subject to administrative punishment therefor and violates the relevant requirements again within two years.

- Where any other serious circumstances exist as determined by the competent commerce authorities.

In addition to the monetary fines, foreign investors or FIEs may also be subject to administrative punishment imposed by the competent commerce authorities for violation of information reporting obligations. The competent commerce authorities may announce the administrative punishment information on the announcement platform of the foreign investment information reporting system and include the information in the creditworthiness information system – pursuant to the relevant provisions of the State.

Nevertheless, if the foreign investor or the FIE has not violated information reporting obligation again within one year upon correcting the violation and fulfilling the relevant obligations, it may apply to the competent commerce authorities for removal of the relevant information and records on the announcement platform of the foreign investment information reporting system.

To better illustrate, we developed the below flowchart:

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article How to Sign an Electronic Labor Contract in China: Your Step-by-Step Guide

- Next Article China Trade Unions – Considerations for Employers Under New Amended Law