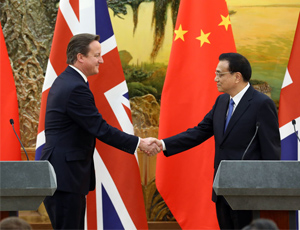

China and the UK Sign Trade Deals Worth US$24 Billion

UK Prime Minister David Cameron and Chinese Premier Li Keqiang have announced trade deals worth approximately US$24 billion as the two sides agree to cooperate to boost growth in their two countries.

UK Prime Minister David Cameron and Chinese Premier Li Keqiang have announced trade deals worth approximately US$24 billion as the two sides agree to cooperate to boost growth in their two countries.

26 agreements were signed on Tuesday, the second day of Li’s three-day visit to the UK. Li spent the beginning of his first full day at Windsor Castle for an audience with the Queen before later attending a ministerial summit with Cameron. The annual UK-China summit was attended by ministers from both countries, including Chancellor George Osborne, Foreign Secretary William Hague and Energy Secretary Ed Davey on the British side.

Approximately 200 Chinese business leaders are accompanying Li on his visit to the UK, representing a wide range of sectors including nuclear power, solar power, general environmental engineering, telecommunications and financial services.

Li has stated that he hopes his visit will help to “change misperceptions and misgivings” about China as well as advance business and cultural ties.

The two countries’ economic relationship is flourishing, with two-way trade reaching US$70 billion in 2013. Among EU nations, Britain is China’s third largest trading partner and second largest source of investment.Chinese investment into the UK is also booming, with more investment in the past 18 months than in the previous three decades. China invested approximately US$13.6 billion in the UK in the 2013-14 fiscal year.

Both sides adopted a pragmatic approach to the visit, putting aside controversial political topics in favor of discussing a range of possibilities for cooperation, including nuclear power, finance, high-speed railways and climate change. Along with signing trade deals worth approximately US$24 billion, the two sides also set a two-way trade target of US$100 billion by the end of next year.

Among the British companies which landed deals with China were BP and Royal Dutch Shell. BP signed a US$20 billion deal to supply China National Offshore Oil Corporation (CNOOC) with up to 1.5 million tons of liquefied natural gas (LNG) per year starting in 2019. BP, which already supplies CNOOC with LNG from Indonesia, expects to supply LNG from its global portfolio.

RELATED: China and Russia Sign Long-Awaited Natural Gas Deal

“It is a 20-year supply agreement on LNG. It is a fair price for them and a fair price for us. It is a good bridge between the UK and China in terms of trade,” said Bob Dudley, BP chief executive, at a conference in Moscow.

Royal Dutch Shell also announced their intention to work together with CNOOC on a global alliance, as well as signed a short-term LNG supply contract. These energy deals will help China to reduce its reliance on coal and will also boost its efforts to improve the quality of its oil.

A more controversial aspect of the announced deals is Chinese investment in major UK infrastructure projects, with the China Development Bank (CDB) planning to directly fund new power stations and a high-speed railway network.

The UK announced their intentions to allow Chinese companies to own stakes in the country’s nuclear power stations in October last year, yet new agreements this week go a step further by paving the way for Chinese firms to own and operate Chinese-designed nuclear power stations in the UK.

As a result of the talks, Rolls-Royce has signed a memorandum of understanding (MoU) with China’s State Nuclear Power Technology Corporation (SNPTC) to cooperate on civil nuclear power projects across the world. Chinese funds will also be invested into the UK’s new Hinkley Point power station, the UK’s first nuclear power station in a generation.

In addition to funding new nuclear power stations, CDB will also invest in the UK’s planned High Speed 2 (HS2) rail network, a US$85 billion project which will link London with Birmingham and northern English cities. The first 192-kilometer stage, which will link London and Birmingham at speeds of up to 400 kilometers per hour, is due to open in 2026.

China is home to an 11,208 kilometer-long high-speed rail network, the world’s largest.

In terms of other forms of bilateral infrastructure cooperation, the UK’s MAP Environmental has entered into a joint venture with China’s ZN Shine Solar in order to buy, develop and manage approximately US$680 million of UK solar panel assets.

The end of a Chinese ban on imports of British beef and lamb, which was imposed following the BSE outbreak in the 1980s and 1990s, is also set to be announced shortly, potentially giving a boost of up to US$200 million to the sector.

Another important result of Li’s visit to London has been agreements signed which will advance financial cooperation between the two sides. CDB has signed an MoU with TheCityUK which will boost trading in China’s currency, open up trade opportunities in China to British businesses and encourage CDB lending in the UK. London aspires to become the major renminbi trading center outside of Hong Kong at a time when the Chinese government is beginning to slowly loosen capital controls and this marks a significant step towards this goal.The China Construction Bank is expected to be designated the first Chinese clearing bank in London for the Chinese currency.

“London is the world’s most international financial market and a natural partner to China in its ambitious global development,” said Christopher Gibson-Smith, Chairman of the London Stock Exchange.

RELATED: RMB Internationalization and the Shanghai FTZ

In another move aimed at improving ties between the two countries, Britain has announced that it will streamline visa rules for all Chinese visitors to the UK, a long-standing request from the Chinese government which has complained about the difficulties of travelling to the UK compared with other European countries.

A new fast-track application service, which was piloted last year, is to be rolled out to all Chinese nationals.Under the new system, Chinese visitors to the European Union will not have to apply for a separate visa for the UK. In addition, there will be a new 24-hour visa service available from August and 12 visa application centers will be opened across China.

The new visa changes will be welcomed by UK businesses who have previously complained that the previous lengthy and bureaucratic visa process was discouraging high-spending Chinese visitors from spending their money in the UK.

Li’s trip marks the first UK visit by a Chinese premier since relations between the two countries took a nosedive in 2012 over Cameron’s meeting with the Dalai Lama, the exiled Tibetan spiritual leader who the Chinese government considers to be a violent separatist and traitor for advocating Tibetan self-rule.

After the leadership of the Chinese Communist Party changed in March 2013, relations thawed somewhat and Cameron, accompanied by a delegation of 100 business executives, visited China in December 2013. However, Cameron’s visit was overshadowed by a contemptuous editorial in China’s Global Times, which called the UK “just a European country” and “not a big power in the eyes of the Chinese.”

In spite of this, China-UK relations appear to have improved. “Cameron now looks to project the UK as China’s best friend in the West,” said Hugo Williamson, managing director of the Risk Resolution Group.

When announcing the deals, Cameron asserted Britain’s status as a “strong and good friend of China and supporter of China’s rise” and has said that the bilateral relationship is “gaining in strength, depth and understanding” as a result of this week’s talks.

After the conclusion of his commitments in London, Li will fly to Greece for a visit from June 19-21, where he is expected to focus on the opportunities that Greece’s privatization program can offer Chinese firms.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

- Previous Article China Corporate Bond Market Overtakes the U.S. as World’s Biggest

- Next Article Ten Provinces Release Guidelines on Wage Increases for 2014