China-Switzerland Economic Ties: Trade and Investment Highlights

- China is Switzerland’s largest trading partner in Asia and the third largest globally. In 2023, bilateral trade reached approximately RMB 416.93 billion (US$57.34 billion), with China accounting for significant Swiss exports, particularly in pharmaceuticals and machinery.

- The Sino-Swiss Free Trade Agreement, in effect since 2014, has significantly enhanced trade by eliminating tariffs on 99.7 percent of Chinese exports to Switzerland and 84.2 percent of Swiss exports to China. Currently under review, discussions are ongoing as of 2024 to update the agreement to better reflect evolving trade dynamics.

- Swiss companies such as Nestlé, Novartis, and UBS have made substantial investments in China, contributing to a diverse range of industries. Simultaneously, the influx of Chinese investments in Switzerland has increased, highlighting the growing interdependence and mutual interests of both nations.

- Despite differences in market sizes and economic structures, Switzerland and China have cultivated a strong economic partnership characterized by stable political relations and ongoing dialogues.

Since establishing diplomatic ties in 1950, China and Switzerland have built a strong, multifaceted relationship encompassing trade, finance, environmental protection, and human rights. Switzerland was among the first Western nations to recognize the People’s Republic of China, and today, both countries engage in regular dialogues on various issues, including migration, education, science, and sustainable development, enhancing collaboration at federal, cantonal, and civil society levels.

Economically, China is Switzerland’s largest trading partner in Asia and the third largest globally, following the EU and the United States. The Sino-Swiss Free Trade Agreement (FTA), effective since 2014, has strengthened economic ties by facilitating trade in goods and services, intellectual property protection, and sustainable development. As of 2024, the two nations are in discussions to update the FTA, aiming to enhance trade facilitation and cooperation in green development and finance amid ongoing global economic challenges.

Additionally, the two countries engage in dialogues on intellectual property, financial matters, and third-party market cooperation under China’s Belt and Road Initiative (BRI). Switzerland’s China Strategy 2021-24 emphasizes the partnership’s significance, focusing on peace, prosperity, sustainability, and digitalization.

In this article, we explore the evolving economic and diplomatic relations between China and Switzerland and the potential for future collaboration across various sectors.

Opportunities for Swiss companies in China

China’s evolving economy presents a wealth of opportunities for Swiss companies, particularly in sectors where quality, innovation, and specialized technologies are in high demand. These include:

- Mechanical, electrical, and metal industry: The increasing sophistication of China’s economy has led to a rising demand for Swiss-engineered machines and technologies tailored for niche applications in industries such as aerospace, new energy, and medical technology. As Chinese customers elevate their quality standards in line with the objectives of the 14th Five-Year Plan—focusing on innovation, intelligent manufacturing, and green production—Swiss companies are well-positioned to contribute significantly, especially in the rapidly growing automotive sector and the development of electric vehicles.

- Healthcare sector: With an ageing population and a rising demand for advanced medical treatments, the pharmaceutical and medtech markets in China are expanding. Swiss companies offering innovative medical technologies in areas where local expertise is limited can find substantial market potential. However, navigating the pre-market approval process for Class II and III medical products can be lengthy and costly. Initiatives like the Hainan Boao Lecheng International Medical Tourism Pilot Zone offer streamlined approval processes for urgently needed medical devices and drugs, presenting a valuable entry point for Swiss firms.

- Cleantech: As China aims to decarbonize and lead in green technology, opportunities abound for Swiss companies specializing in cleantech solutions. The Chinese government has identified hydrogen power as a key future industry, and there is significant potential for collaboration with local firms to enhance market access.

- Low-altitude economy: The emergence of the “low-altitude economy,” which encompasses airspace from 1,000 to 4,000 meters for both manned and unmanned aircraft, opens new avenues for Swiss drone technology companies. As pilot zones in China explore applications such as food delivery by drone and helicopter taxi services, Swiss expertise in drone technology positions these companies favorably in this strategic market.

- Consumer goods sector: Despite the Chinese government’s ambition to make consumption a primary economic driver, recent trends indicate that consumers have become more price-sensitive, with domestic brands gaining popularity. Swiss products, known for their high quality, continue to appeal to consumers, yet companies must navigate the pre-market approval processes for food, cosmetics, and nutritional supplements. Cross-border e-commerce offers alternative pathways for market entry, allowing Swiss firms to reach Chinese consumers without the need for local registration.

China-Switzerland bilateral trade

Trade in goods

In 2023, trade between China and Switzerland reached RMB 416.93 billion (US$57.34 billion), marking a 9 percent year-on-year increase. China remains Switzerland’s largest trading partner in Asia, with key Chinese exports including mechanical and electrical products, while Switzerland’s leading exports to China comprise jewelry, precious metals, and related items.

The robust trade relationship has been bolstered by the Sino-Swiss FTA, which has enabled 99.7 percent of Chinese exports to Switzerland and 84.2 percent of Swiss exports to China to enjoy zero tariffs since 2014.

According to the United Nations COMTRADE database, in 2023, Switzerland’s main exports to China were led by pearls, precious stones, and metals (valued at a staggering US$29.38 billion). This was followed by pharmaceutical products (US$5.23 billion), clocks and watches (US$3.08 billion), machinery and nuclear reactors (US$2.55 billion), and optical, photo, technical, and medical apparatus (US$1.66 billion).

| Main Products Exported from Switzerland to China, 2023 | |

| Product category | Value (US$) billion |

| Pearls, precious stones, metals, coins | 29.38 |

| Pharmaceutical products | 5.23 |

| Clocks and watches | 3.08 |

| Machinery, nuclear reactors, boilers | 2.55 |

| Optical, photo, technical, medical apparatus | 1.66 |

| Miscellaneous manufactured articles | 0.75 |

| Source: COMTRADE, 2024 | |

On the import side, Switzerland’s imports from China in 2023 were led by electrical and electronic equipment, valued at US$5.06 billion, followed by US$3.12 billion in machinery and nuclear reactors. Organic chemicals contributed US$1.76 billion, while apparel imports totaled US$1.31 billion. Additionally, pearls, precious stones, and metals accounted for US$0.95 billion, reflecting Switzerland’s diverse import portfolio from China.

| Main Products Imported from China to Switzerland, 2023 | |

| Product category | Value (US$) billion |

| Electrical, electronic equipment | 5.06 |

| Machinery, nuclear reactors, boilers | 3.12 |

| Organic chemicals | 1.76 |

| Articles of apparel | 1.31 |

| Pearls, precious stones, metals, coins | 0.95 |

| Miscellaneous manufactured articles | 0.75 |

| Source: COMTRADE, 2024 | |

Trade in services

As of 2023, China ranks as Switzerland’s seventh-largest partner in global trade in services, with total bilateral trade amounting to US$10.76 billion, reflecting a year-over-year increase of 2.8 percent. This trade consists of Swiss service exports to China totaling US$5.9 billion, despite a decline of 8.5 percent compared to the previous year, and Chinese service imports by Switzerland reaching US$4.84 billion, marking a 13.7 percent increase. Transport services represent the largest segment of Swiss service exports to China, followed by royalties, telecommunications and IT services, and tourism. This diverse range of services highlights the interconnected nature of the two economies.

In a significant development for travelers, starting March 14, 2024, China will allow visa-free entry for Swiss citizens, along with citizens from several other European countries. This policy enables Swiss nationals to travel to China for up to 15 days without the need for a visa, facilitating easier access for tourism, business, family visits, and transit to third countries.

China-Switzerland bilateral investment

In 2023, bilateral investment between China and Switzerland showed notable developments, reflecting a cautious yet optimistic trend among Swiss firms operating in China. According to the Swiss National Bank, the stock of Swiss foreign direct investment (FDI) in mainland China reached CHF 27.9 billion (US$32.9 billion), with FDI flows recorded at CHF 2.4 billion (US$38.8 billion) in 2022. Conversely, statistics from Chinese sources indicate a 21.4 percent increase in FDI originating from Switzerland in 2023.

On the Chinese side, new investments in Switzerland surged to US$196 million in 2023, positioning Switzerland as the third most attractive destination in Europe for Chinese investors, following the Netherlands and Germany.

This trend indicates a strengthening of economic ties, fueled by China’s ongoing reforms, including plans to shorten the Negative List for foreign investment and enhance market access in the manufacturing sector. As both countries navigate their investment landscapes, the potential for deeper collaboration remains significant.

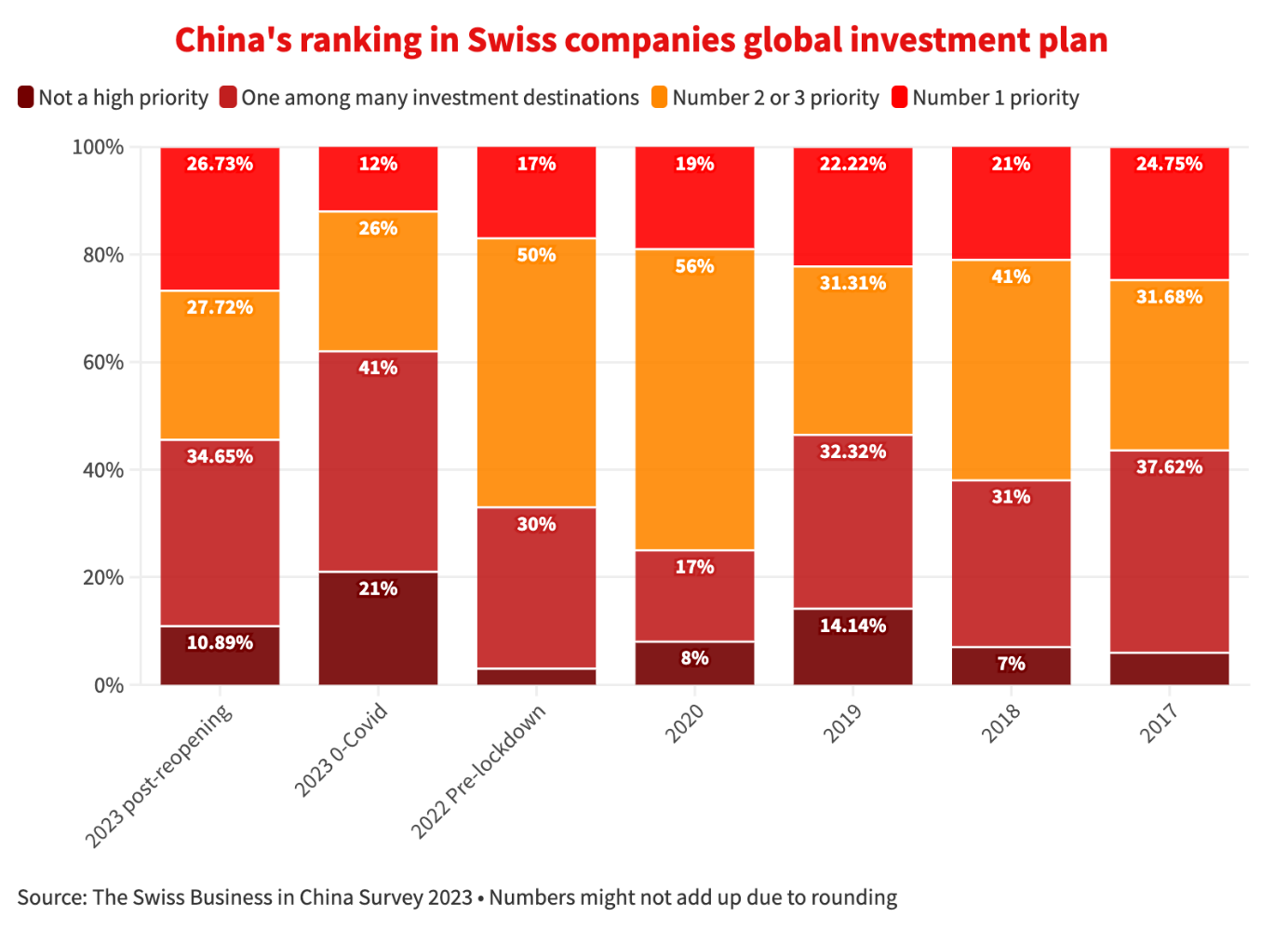

Moreover, the Swiss Business in China Survey 2023, published by Seismo Press AG in collaboration with the Swiss Chamber and other partners, provides valuable insights into the evolving landscape for Swiss firms operating in China. Following the Chinese government’s decision to lift zero-COVID lockdown restrictions in January 2023, Swiss businesses exhibited a notable rebound in confidence. However, this renewed optimism is tempered by a more cautious approach to investment, reflecting a shifting competitive environment and global uncertainties.

Trade and investment treaties

China-Switzerland FTA

In 2013, China and Switzerland signed a comprehensive FTA, marking a significant milestone in their economic relations. The agreement was aimed at enhancing market access for goods and services, improving intellectual property protection, and fostering economic cooperation. Key provisions of the China-Switzerland FTA include:

- Tariff reduction: The FTA dismantles tariffs fully or partially on the vast majority of bilateral trade. Tariff elimination is immediate for some products, while others undergo phased reductions over transition periods of 5, 10, 12, or even 15 years.

- Non-tariff barriers: The agreement addresses technical barriers to trade, sanitary, and phytosanitary measures. Sector-specific cooperation agreements are in place to reduce non-tariff barriers, facilitating smoother trade flows.

- Intellectual property protection: The FTA improves legal security for the protection of intellectual property rights, offering standards that surpass those established under the WTO’s Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS), particularly in enforcement.

- Trade in services: The FTA includes enhanced rules compared to the General Agreement on Trade in Services (GATS) under the WTO, ensuring more clearly defined approval processes and improved market access for various service sectors.

- Investment protection and trade facilitation: The FTA introduces measures for customs procedures, trade facilitation, and investment protection. It also includes provisions for transparency in government procurement and safeguards for environmental and labor standards related to trade.

The agreement also established a Joint Committee, which oversees the implementation, development, and resolution of issues within the FTA. Through this cooperation framework, China and Switzerland have continued to strengthen their economic ties, promoting trade liberalization and sustainable growth.

In September 2024, China and Switzerland officially began negotiations to upgrade their existing FTA. This upgrade is intended to enhance the trade and investment relationship between the two countries, building on a decade of successful bilateral cooperation. The talks were announced by Chinese Minister of Commerce Wang Wentao and Swiss Federal Councilor Guy Parmelin through a livestream event, with both leaders expressing the importance of intensifying consultations to achieve a high-level agreement based on mutual benefits.

China-Switzerland bilateral investment agreement

In 2009, China and Switzerland signed a bilateral investment treaty (BIT) to promote and protect mutual investments between the two nations. The agreement aims to foster economic cooperation by creating favorable conditions for investors, ensuring a stable and transparent investment environment.

Key provisions of the China-Switzerland BIT include:

- Investment protection: The BIT guarantees protection against expropriation, nationalization, and discriminatory practices, ensuring that investments are treated fairly. Compensation for expropriation is based on the fair market value of the investment at the time of the expropriation.

- Fair and equitable treatment: Investors from both China and Switzerland are guaranteed treatment that is no less favorable than that accorded to domestic investors or investors from third countries. This ensures fair treatment in the management, maintenance, and enjoyment of investments.

- Dispute resolution mechanisms: The BIT provides mechanisms for resolving investment-related disputes, including negotiation, mediation, and international arbitration. An investor-state dispute settlement (ISDS) clause allows investors to submit disputes to bodies such as ICSID or ad hoc tribunals under UNCITRAL rules.

The agreement also facilitates the free transfer of investment-related funds, including returns, capital gains, and compensation, in a freely convertible currency without delay.

China-Switzerland double taxation avoidance agreement

On September 25, 2013, China and Switzerland signed a new double taxation agreement (DTA), replacing the 1990 treaty. Taking effect on January 1, 2014, the agreement aligns with China’s recent efforts to revise DTAs with European nations such as Belgium and the Netherlands. The agreement is designed to avoid double taxation on income and capital between the two countries, streamlining tax policies for cross-border investments.

The DTA pertains to income and capital taxes imposed by both China and Switzerland. In China, it covers:

- The Chinese individual income tax (IIT); and

- The Chinese corporate income tax (CIT).

In Switzerland, the agreement applies to:

- Federal, cantonal, and municipal taxes on income and capital.

The revised DTA also introduces beneficial withholding tax (WHT) rates on passive income. Specifically:

- Dividends: Reduced from 10 percent to 5 percent when the beneficial owner is a company that holds at least 25 percent of the capital of the paying company. A full exemption is granted for institutions like China Investment Corporation (CIC) and the National Council for Social Security Fund.

- Interest: Maintained at 10 percent with exemptions for government-related entities.

- Royalties: Reduced from 10 percent to 9 percent.

The revised DTA also modifies capital gains taxation. Under the prior agreement, Swiss investors could dispose of shares in Chinese tax resident enterprises (TRE) without paying taxes in China, except for land-rich companies. However, under the revised DTA, China may impose a 10 percent tax on gains derived from the sale of shares if the Swiss investor holds 25 percent or more of the company’s capital during the 12 months prior to the sale.

The agreement further strengthens anti-avoidance measures through the inclusion of a ‘limitation of benefit’ clause, preventing misuse of reduced tax rates, and enhancing the exchange of information between the two countries.

Additionally, the definition of “permanent establishment” (PE) has been revised:

- Construction PE: The threshold has been extended from 6 months to 12 months.

- Service PE: Revised to 183 days, aligning with China’s recent DTA revisions with other European countries.

With these updates, the DTA aims to facilitate smoother economic relations between China and Switzerland, offering more clarity on tax obligations for cross-border investors.

Multilateral treaties

China and Switzerland, both members of the WTO, are signatories to various multilateral treaties concerning trade and investment. These include:

- TRIPS, which mandates WTO members to extend intellectual property rights to owners in any member state. It incorporates a most-favored-nation (MFN) clause, ensuring equal treatment for IP rights protection across all member countries. Additionally, it provides mechanisms for dispute resolution and compensation.

- The Agreement on Trade-Related Investment Measures (TRIMs), which prohibits the implementation of investment measures that restrict trade between members. This includes measures like local content requirements, which mandate the use of locally-produced goods or services by companies operating in a market.

- GATS, which grants most-favored-nation status to service providers of any WTO member, excluding governmental services such as social security, public health, education, and certain services related to air transport.

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article China-Thailand Economic Ties: Trade and Investment Opportunities

- Next Article 2024 China National Day Holiday Guide: Rest Days, Work Schedule, and Overtime Pay