China Eases FDI Rules Concerning the Administration of Foreign Exchange

Nov. 28 – China’s State Administration of Foreign Exchange (SAFE) recently promulgated the “Circular on Issues Concerning the Further Improvements and Adjustments of Administration Policies of Directly Invested Foreign Exchange (Huifa [2012] No.59, hereinafter referred to as the ‘Circular’),” which will come into force on December 17, 2012. The Circular aims to ease the rules for foreign direct investment (FDI) and enhances risk prevention. It also relaxes various requirements in relation to outbound investments by Chinese companies. This circular will have a profound effect on inbound and outbound investments, including greenfield/brownfield projects, and mergers and acquisitions.

The main contents of the Circular can be found below.

Removal of certain administration procedures for FDI, including:

- Examinations for opening and debiting FDI-related accounts, exchange settlements, and purchasing and paying through foreign exchanges

- Examinations for domestic transfers of foreign exchange through regular FDI activities

- Examinations for reinvestment made by foreign investors with legitimate incomes generated within China

- Verification of capital in the condition of capital deduction

- Foreign exchange registration and capital verification for reinvestment in China made by foreign investing companies

Simplification of the current administration system, including:

- Types of foreign exchange accounts related to FDI

- Administrative procedures regarding settlement of foreign currency capital

- Capital verification procedures of foreign invested enterprises (FIE)

- Foreign exchange registration procedures concerning acquisitions of shares by FIEs

- Examination procedure of documents

Relaxation of restrictions upon fund operations under FDI, including:

- Limitations on the number of foreign exchange accounts and limitations on opening accounts in multiple areas

- Restrictions on purchasing and paying for foreign exchange in multiple areas

- Restrictions on the source of foreign capital and statute of subject of the source

The Circular also allows foreign exchange loans offered by domestic subjects, or loans offered by FIEs, to their parent companies overseas.

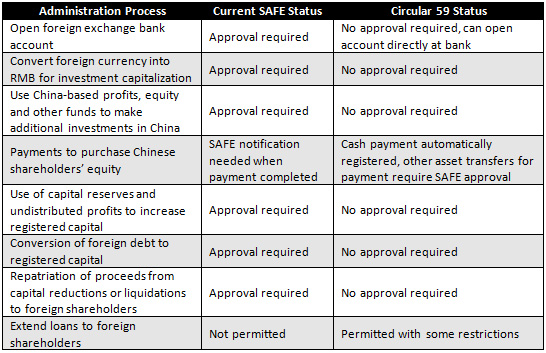

We can summarize the impact of Circular 59 as concerns foreign investors as follows:

By implementing the Circular, the administration procedures of foreign exchange under FDI will be considerably eased. Foreign investors will be able to open foreign exchange accounts and receive foreign capital, which shall be within the registered inflow limit, through banks before establishing an FIE as long as the information registration at SAFE is completed. During the stage of establishment, operation, and closure, FIEs will be able to open foreign exchange accounts, transfer funds, and purchase and pay for foreign exchanges through banks with competent SAFE registrations.

To summarize, Circular 59 further relaxes China’s foreign exchange controls. The simplified procedures are encouraging for foreign investors and FIEs in China, however the effective implementation of the revised SAFE regulations can be expected to take some time.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across China by subscribing to The China Advantage, our complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

China Profit Repatriation Techniques

Getting Paid from China – Procedural and Tax Implications

China Accelerates Approval of Investment Quotas for QFIIs and RQFIIs

Chinese Currency Controls and the Liberalization of the Renminbi

China Releases Measures for Strengthening Credibility Supervision in Securities and Futures Market

China Expands QFII Schemes to Allow Greater Foreign Investment

China Urges Financial Industries to Serve Real Economy

- Previous Article China’s Actual Use of Foreign Capital

- Next Article Intra-Asian Trade Flows to Help Global Economy Top US$100 Trillion by 2020