Belt And Road Weekly Investor Intelligence #9

Tuesday, December 29, 2020

Welcome to this week’s issue of China Briefing’s Belt & Road Initiative Weekly Investor Intelligence round up.

We explain why China is likely to remain a favored destination for foreign investment and trends in attracting Chinese ODI, discuss the just-released Negative List, why China invested US$300 million in a Sri Lankan tire factory, a round-up of what international media are saying about the BRI, and on Russia’s increasing diplomatic moves to Asia instead of Europe.

A New China for 2021: Foreign Investor Friendly Access, Overseas Direct Investment in Hi-Tech Projects and M&A, and More Belt & Road Initiative Opportunities

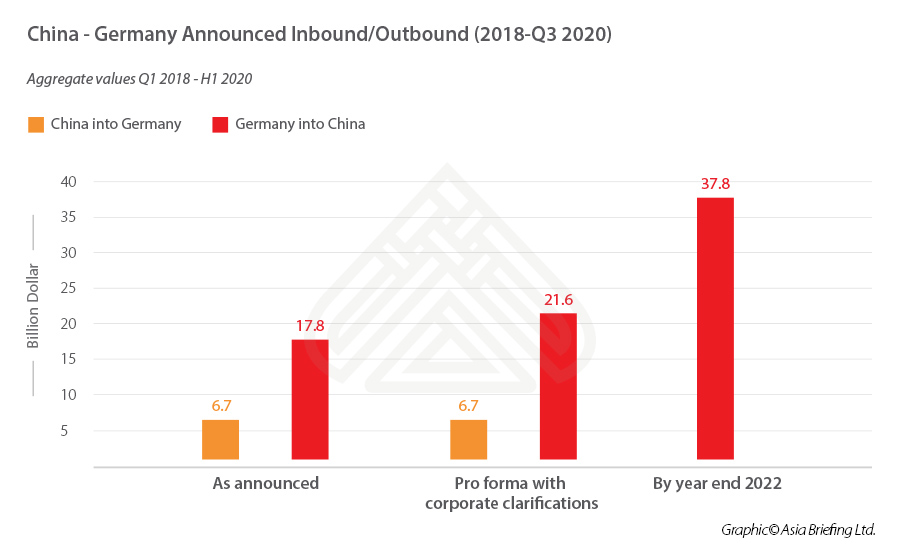

China has been making some significant changes to its economic direction and overall investment policy during the course of 2020, with profound implications for foreign investors in China and for overseas funds and investors looking for Chinese money.

China Releases 2020 Negative List For Market Access

A newly released list provides details of what industry sectors in China foreign investors can access.

About Us

Dezan Shira & Associates provide business intelligence, market research, legal, tax and compliance issues for foreign investors throughout Asia, and have 28 offices across the region. We are members of the Leading Edge Alliance, a network of related firms with offices throughout the world. For assistance with Belt & Road Initiative research, please contact us at silkroad@dezshira.com or visit us at www.dezshira.com. To subscribe to our Belt & Road Initiative portal, please click here.

- Previous Article A New China for 2021: Foreign Investor Friendly Access, Overseas Direct Investment in Hi-Tech Projects and M&A, and More Belt & Road Initiative Opportunities

- Next Article A Reinvented Hong Kong is Emerging to Become a US$3 Trillion Financial Services Wealth Management Hub