Belt and Road Weekly Investor Intelligence, #26

Tuesday, April 27, 2021

Welcome to this week’s issue of China Briefing’s Belt & Road Initiative Weekly Investor Intelligence round up.

China has been making changes to encourage more foreign participation in procurement, we look at what these are. Australia meanwhile is having a spectacular trade bust-up with China over the BRI – we look at what lies underneath the rhetoric. Meanwhile, alternative, non-China BRI funding is gaining traction for regional infrastructure builds, we look at some of these cases – and moves to offset a global digital currency move by reverting to gold. Finally, we examine cyber-security for your China business operations.

If you find this useful, please forward it to a friend. Subscriptions can be obtained at www.silkroadbriefing.com.

Improved Tax Assistance for China SMEs in Belt & Road Procurement

Although the circular is not specifically aimed at BRI projects, it has an impact on foreign investors in China interested in tendering for China infrastructure build overseas as part of the Belt and Road Initiative.

The Australia-China Belt & Road Fallout: What’s Been Cancelled?

Two Victoria MoU with Beijing’s NDRC withdrawn, with losses of over US$3 billion in China exports. Canberra needs to rebuild trust: The RCEP agreement is an opportunity.

Setting Up Your China Back Office: Cyber Security & Compliance Solutions

Solutions to achieve cybersecurity and compliance for foreign firms setting up back-office operations in China and ways to strengthen IT support on the ground.

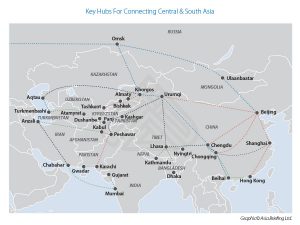

Uzbekistan Considers PPP Models to Raise Finance Instead of China’s BRI

The World Bank has approved a US$350,000 grant to fund a feasibility study for a toll road to link Tashkent with Andijan, a project that would transform connections between the densely populated Ferghana Valley and the rest of Uzbekistan.

Why Are Russia’s Surging Gold Exports Being Stockpiled in the United States and Not by China?

Unusual gold export patterns may indicate a change in US dollar debt as a global trade standard and a reversion to gold.

New China Plus Investment Guide: Identifying Opportunities Within the Belt & Road Initiative

This 142-page guide is a unique study into where investment opportunities are arriving within China’s Belt & Road Initiative. As infrastructure builds are completed, investment potential increases. This book discusses the complete free trade, tax, and legal aspects of the BRI as well as detailing potential pitfalls.

About Us

Dezan Shira & Associates provide business intelligence, market research, legal, tax and compliance issues for foreign investors throughout Asia, and have 28 offices across the region. We are members of the Leading Edge Alliance, a network of related firms with offices throughout the world. For assistance with Belt & Road Initiative research, please contact us at silkroad@dezshira.com or visit us at www.dezshira.com. To subscribe to our Belt & Road Initiative portal, please click here.

- Previous Article China’s Travel Restrictions due to COVID-19: An Explainer

- Next Article China Hints at Launching Shanghai-Zurich Stock Connect Program