China’s Belt and Road Forum: Good News for SMEs Selling Products and Services to China

Op/Ed by Chris Devonshire-Ellis

The second Belt and Road Forum has just finished in Beijing, with Chinese President Xi Jinping taking center stage outlining both China’s vision for the Belt and Road Initiative (BRI) and making comments about opening up the country’s market. It is important to understand what he means by this, as there are two differing business sectors within this: opportunities for global MNCs and opportunities for global SMEs.

Much of the West’s media attention about the BRI has been on the subject of market access, with the focus on the ability of larger businesses – MNCs – to participate in infrastructure projects.

The fear that Western contractors would be shut out from Belt and Road projects has been a common theme – and criticism – of the initiative ever since it was announced as an infrastructure investment project a few years ago.

Western governments, in particular, have been critical of China, in that it has been Chinese state-owned enterprises that have picked up most of the infrastructure contracts for building everything from roads, ports, airports, railway lines, power plants, and all related infrastructure.

There are reasons for this, and it is logical that a Chinese initiative would include Chinese contractors. However, there are other reasons too, such as Chinese firms’ genuine competitiveness, local knowledge, and expertise (how many EU contractors, for example, have Central Asian business sensitivities?), and cultural divides for Western firms doing business in Asia.

Yet there is one other reason that larger Western businesses have failed to win BRI projects. It is because such projects are cross-border by definition, typically bilaterally agreed and financed, and China alone does not hold the keys to this.

It is pointless lobbying China for Belt and Road project access when there is another sovereign state involved – access is just not China’s alone to give. The large Western contractors seeking Belt and Road projects need to lobby not just the Chinese government, but the Chinese SOEs themselves and the other partnering governments involved. It is this business sector that has been creating the headlines over problems with China market access.

Consequently, all this noise about China market access has created a significant negative bias in news coverage of the BRI. Politicians are more interested in dealing with the billion-dollar opportunities than the million-dollar opportunities, and the SME sector tends to gets shut out of the discussion.

In fact, at the Belt and Road Forum, Xi actively stated that China wanted to buy foreign products and services. Initially, he quoted a Chinese proverb to make the point: “The ceaseless inflow of rivers makes the ocean deep. However, were such inflow to be cut, the ocean, however big, would eventually dry up.”

To ram the point home still further, Xi said: “We will increase the import of goods and services on an even larger scale. China is both a global factory and a global market. China does not seek trade surplus. We want to import more competitive, quality agricultural products, manufactured goods and services.”

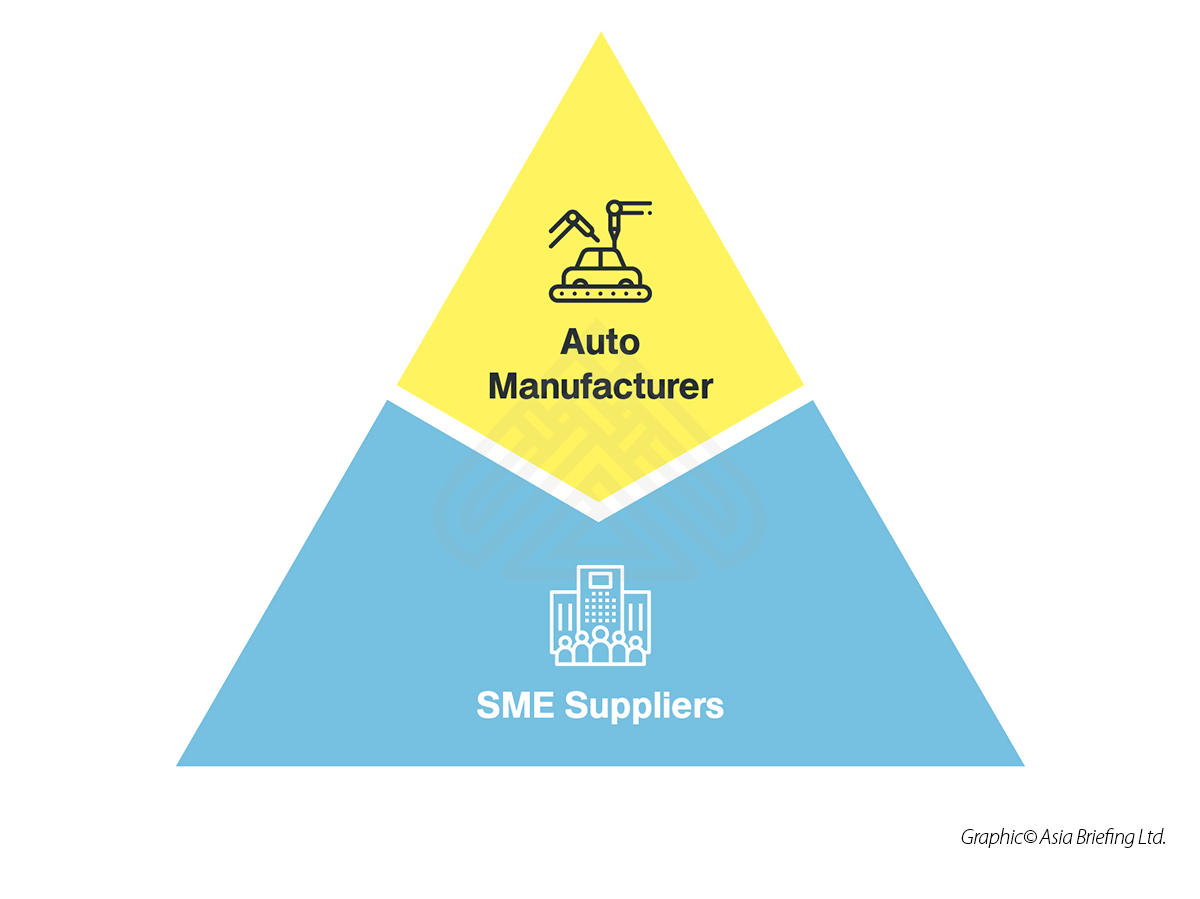

This is good news for global SMEs. Why SMEs? Because they are the largest single grouping of businesses servicing the Chinese consumer, and because they provide a far wider scope of products and services than MNCs tend to. Take a look at Volkswagen, for example. They manufacture and sell cars and trucks. But then look at all the smaller companies that service Volkswagen.

That group of companies, while individually smaller than Volkswagen, are collectively much larger, as many of them service not just Volkswagen but other auto manufacturers as well. This same dynamic – a pyramid shaped equation with Volkswagen at the top, and the smaller companies taking up positions below but larger as a whole – is the exact market sector that Xi is essentially saying that China needs to buy from and is open too.

This is because the SME sector is by nature far more diverse, often more innovative, and has a larger range of consumer products and services across the board that it can produce and sell. Not everyone in China can buy a Volkswagen or an Airbus. But what they can buy is smaller, more focused, less costly consumer products and services. And that is what Xi means when saying China is a global market and it wants to buy.

In fact, China has already taken significant steps to motivate foreign SMEs to sell to it. There are three main parts to this:

1) It’s an existing trend

Selling to China is nothing new. What is exciting for global SMEs is that it is very much an existing trend and expected to continue for some time. The Chinese consumer market continues to grow, meaning that there are opportunities to both sell to China today, and sell more to China in future.

2) Liberalizing China market access

At the Belt and Road Forum, President Xi specifically stated, “We will expand market access for foreign investment in more areas, and we will continue to slash the negative list.” The “Negative List” is a continuously revised list of industrial and service sectors that outlines exactly what areas are either fully open to foreign investment, partially restricted, or barred.

The fact that the Chinese president himself has stated this will be further relaxed and opened to foreign businesses is a hugely positive sign. To ascertain whether or not your SME is in an “approved sector”, all one has to do is examine this list. We have recently discussed the current list here.

3) Reducing duties on imported products

Over the past year, China has been expediting its policy of allowing more competitive foreign products to enter the Chinese market. This typically takes the form of reducing tariffs on imported goods. A significant and wide-reaching reduction in tariffs took place last May, covering thousands of products. We discussed that here.

SMEs, as long as they know the HS code for their products, can easily find out what tariffs apply as these will impact upon the cost of sale in China, which obviously affects local competitiveness. If you need assistance with working out your relevant HS code and the applicable China tariffs, email us here.

The reality in today’s China is that given a small amount of research, global SMEs can easily establish whether or not there is a viable market for their products. When the president of China himself states that China wants to buy, it is a good time to be listening. China is now a market for global SMEs.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout China and Asia and has done so since 1992. Please contact one of our China offices here, email us at china@dezshira.com, or visit us at www.dezshira.com.

- Previous Article China Reinforces IP Laws to Protect Trademarks, Trade Secrets

- Next Article China’s FDI into the UK After the Brexit Vote