Preparing for Annual Tax Reconciliation in China in 2021: FAQs

By Daisy Huang and Karen Liu, Corporate Accounting Services, Dezan Shira & Associates’ Guangzhou office

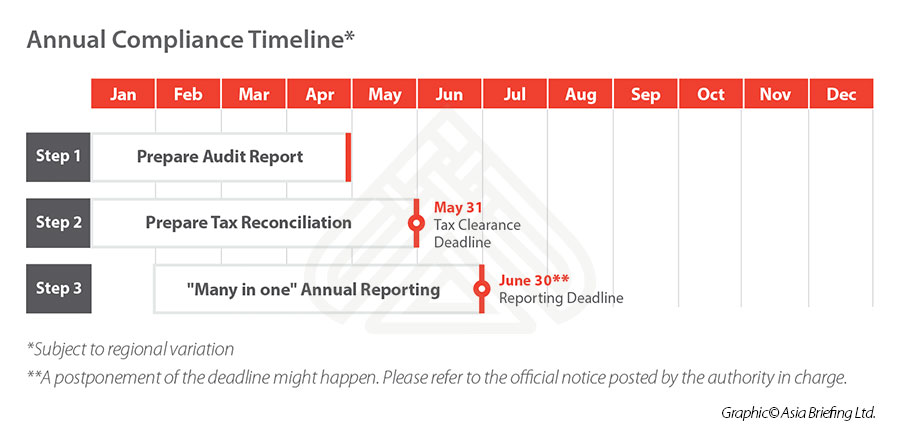

Annual tax reconciliation is an important compulsory annual reporting requirement in China, which requires the company registered in China to submit its annual reconciliation report to the tax authority in charge to analyze and settle its annual income tax obligations before May 31 every year.

To manage the tax costs and avoid potential tax risks, it is vital for companies to have a clear understanding of the calculation of annual taxable income, make the full use of relevant preferential tax policies, and properly reconcile the information with the tax authority.

In this article, we list out some frequently asked questions received by our tax experts at Dezan Shira & Associates when preparing the annual tax reconciliation for our clients in 2021. Below, we share our insights and best practices on how to handle each query.

Q1: Our company suffered a significant loss due to the COVID-19 pandemic. Can the losses be carried forward to future years and offset with future profits?

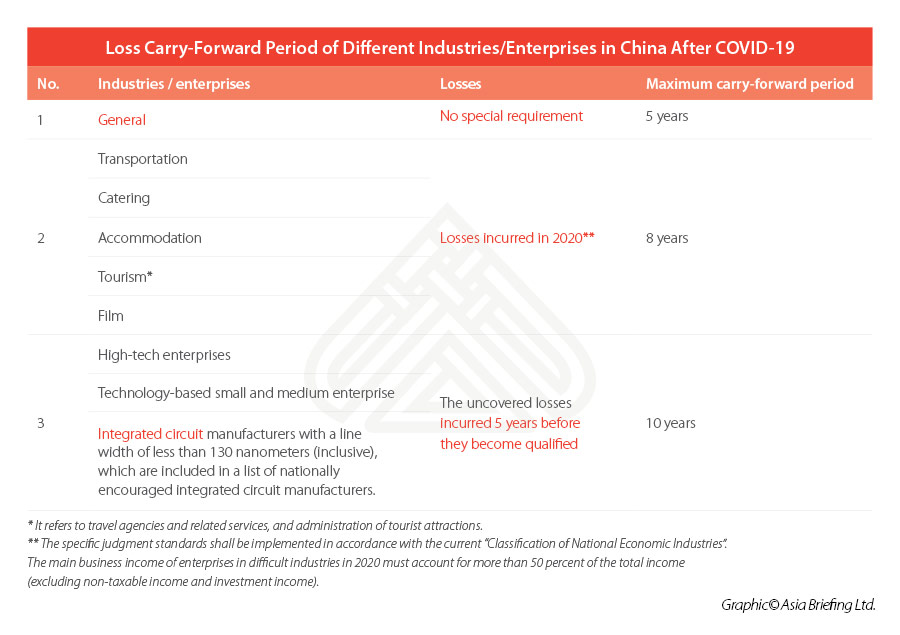

A1: Yes. In general, the losses can be carried forward to the subsequent five years to be set off if the current year profit is not enough to make up the losses. For those industries that suffered significant losses in the pandemic or have been specially encouraged by the government, the carry-forward period is even longer, ranging from eight years to 10 years. Below, we summarize the conditions and treatment of losses suffered by different industries/enterprises.

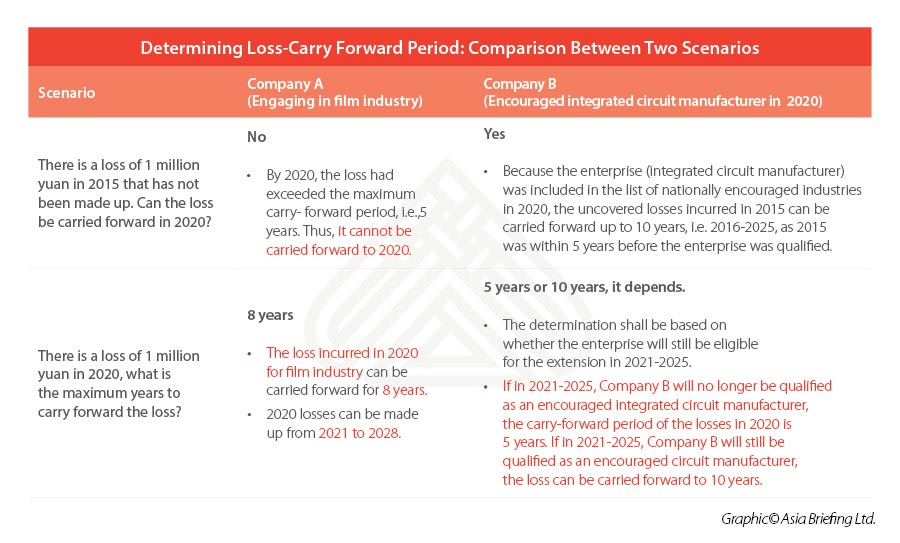

For better understanding / more clarity, we have prepared two examples in the following table:

Q2: Our company faces bad debt issues on receivables due to the COVID-19 outbreak. How can we report and claim the bad debt losses in annual tax reconciliation?

A2: The company needs to fill in the annual corporate income tax filling sheet named “Detailed List of Asset Loss Pre-tax Deduction and Tax Adjustment” and retain relevant supporting documents for future checking by the tax bureau.

Generally, the supporting documents includes contract, agreement, and the detailed description of related matters.

Besides, some specific materials are required under different circumstances.

- In the case of bankruptcy/liquidation of the debtor, there shall be a bankruptcy and liquidation announcement by the court.

- If it is a litigation case, a judgment issued by the court, an arbitration statement issued by an arbitration institution shall be required, or a legal document ruling the termination (suspension) of execution issue by the court, shall be required.

- If the debtor has ceased business, the business license shall be cancelled or revoked by the industrial and commercial department, and there shall be a receipt from the administration for market regulation in charge.

- If the debtor has died or disappeared, the public security organ and other relevant departments shall have the personal death or disappearance certificate of the debtor.

- In the case of debt restructuring, there should be a debt restructuring agreement and a description of the taxation status of the debtor’s restructuring proceeds.

- If it is a natural disaster, war, or other force majeure event that cannot be recovered, there should be an explanation of the debtor’s situation and a statement of waiver of the creditor’s rights.

Q3: Are there any tax preferential policies on donation during the COVID-19 pandemic period?

We are a general taxpayer engaging in the wholesale business of medical supplies. We purchased a batch of masks at a price of RMB 100,000 (excluding tax) with an input tax of RMB 13,000. If we sell it externally, the price excluding tax is RMB 120,000 (VAT rate 13 percent). In response to the epidemic outbreak, we decided to donate the masks to designated hospitals, and obtained a donation acceptance letter issued by the designated hospital.

A3: We explain below:

- Value-added tax (VAT): Exempted

Before: VAT=(RMB 120,000-RMB 100,000) ×13%=RMB 2,600

After: VAT=0

Note: Input VAT (RMB 13,000) cannot be deducted. Rather, it should be transferred out.

- Surcharges: Exempted

Before: Surcharges= RMB 2,600×12%=RMB 312

After: Surcharges=0

Note: Foreign-invested enterprises, foreign enterprises, and foreign individuals who are subject to VAT or CT are also subject to urban construction and maintenance taxes (UCMT), education surcharge (ES), and local education surcharge (LES). The total surtaxes amount to 12 percent of the total turnover tax liability (that is, VAT and CT) in urban areas, meaning that these taxes are levied on the amount of the turnover tax but not the total value of the transaction.

- Corporate income tax (CIT): Donations are 100 percent deductible before tax

Before: Only the part within 12 percent of the total annual profit is allowed to be deducted before tax.

After: 100 percent deductible before tax.

Besides goods, cash donated through public welfare social organizations or people’s governments at or above the county level and their departments, is also allowed to be deducted in full when calculating taxable income.

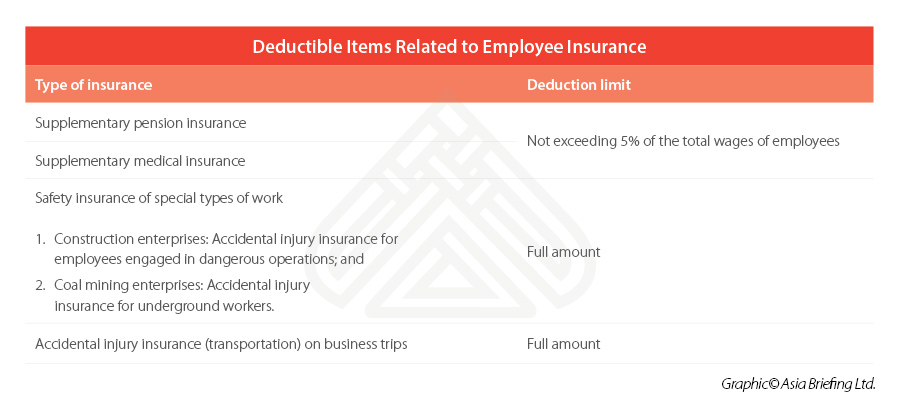

Q4: Besides basic social insurance, what other employee-related insurance can be deducted before tax?

A4: We have summarized the deductible items related to employee insurance as below:

Q5: At year end, how to deal with cross-year invoice?

A5. We discuss it case-wise below.

Case A

The employee took a business trip in December 2020 and occurred RMB 5,000 hotel fees. He returned to the company to reimburse his travel expenses in January 2021.

Question 1: How should the company deal with the reimbursement?

Answer 1:

- Accounting treatment: The business trip was taken in 2020, thus the hotel fees should be booked in 2020.

- Tax treatment: If the invoice is obtained before the annual tax reconciliation, there is no need to make tax adjustments. If invoices have not been obtained by the time of annual tax reconciliation, then the company will need to do tax adjustment.

Question 2: Due to various reasons, the hotel fees were not recorded in 2020, how to deal with this case in 2021?

Answer 2:

- Accounting treatment: The expenses should be booked through “previous year profit and loss” accounts.

- Tax treatment: For the expenditures incurred in previous years but not deducted yet, the company can make up for the deduction in the following years with invoice and other tax documents, but the compensation period shall not exceed five years.

Case B

Question 1: If the tax authority finds that our company has not obtained invoices for the expenses deducted, what should we do?

Answer 1:

The enterprise shall submit the invoice within 60 days from the date of notification. If the invoices cannot be provided due to special reasons, the enterprise shall provide other supporting documents that can verify the authenticity of the expenditure within 60 days instead.

To properly deal with cross-year invoices, DSA experts provides the below suggestions:

- Finance team should remind the employees to reimburse in time without delay before the year-end. If the expenses will be reimbursed in the next year, the employee can provide an estimated amount of expenses so the accountant can make an accrual first.

- For operating costs and materials costs, the company should regularly check out invoices that are not in place and timely follow up with purchase team or other relevant departments for invoice collection.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Why it is Essential for Technology to Power Your Company’s Accounting

- Next Article China’s Two Sessions 2021: GDP Target, Tax Incentives, and 14th Five Year Plan