Annual Confirmation for China IIT Special Additional Deductions 2025 Ending Soon

From December 1, 2024, the annual confirmation for individual income tax (IIT) special additional deductions begins. Individuals, including expatriates in China, should check their eligibility for these deductions. If they don’t submit their annual confirmation in time, taxpayers will have to wait for nearly a year to enjoy their special additional deductions compared to normal situations. This article also covers the procedure for confirmation.

Starting on December 1, 2024, the confirmation process for annual individual income tax (IIT) special additional deductions begins. All individuals, including expatriates working in China, are advised to determine their eligibility for relevant special additional deductions. If eligible, individuals should promptly confirm the special additional deduction information through designated channels before the end of the month. Failing to confirm the IIT special additional deduction information may result in unnecessary difficulties in tax savings for the following year.

What are IIT special additional deductions?

In 2019, China introduced special additional deductions for specific expenditures. According to the amended IIT Law, the taxable income amount of a resident individual in China shall be the balance after deducting the standard deduction (RMB 60,000 per year), as well as special deductions (social insurance and housing fund contributions), special additional deductions, and other deductions determined pursuant to the law, from the income amount of each tax year.

The special additional deductions cover seven types of expenses:

- Nursing expenses for children under three years old;

- Children’s education expenses;

- Continuing education expenses;

- Healthcare costs for serious illness;

- Housing loan interest;

- Expenses for supporting the elderly; and

- Housing rent.

Unlike the tax-exempt allowances/fringe benefits provided to foreigners in China, which can be reimbursed based on the actual cost of each expenditure, most special additional deductions (except for healthcare costs, which are deducted based on actual expense with a cap at RMB 80,000 a year) are deducted based on a standard basis—namely, on a fixed amount.

For more information about the applicable scope, deduction amount, and method to claim IIT special additional deductions, please read: China’s IIT Special Additional Deductions: An Explainer.

Why do China IIT taxpayers have to confirm their IIT special additional deduction information?

According to the Article 9 of the Operating Measures on Special Additional Deduction(s) for Individual Income Tax Purpose (for Trial Implementation):

“Where a taxpayer needs the withholding agent to continue to handle the special additional deduction(s) in the next year, he/she shall confirm the contents of special additional deduction(s) for the next year in December every year and submit the information to the withholding agent. If the taxpayer fails to confirm in time, the withholding agent shall suspend deduction from January of the following year and then handle the special additional deduction(s) upon confirmation by the taxpayer.”

So, if an employee (IIT taxpayer) requires their employer (withholding agent) to manage special additional deductions for them in the upcoming year, they must confirm the relevant information in December each year.

In cases where individuals fail to do so, the employer will cease deducting special additional deductions from January of the following year when calculating their payroll. These individuals will need to claim special additional deductions on their own during the annual IIT settlement, which takes place from March to June of the subsequent year. This implies that these taxpayers will have to wait for nearly a year to enjoy their special additional deductions compared to normal situations.

What are the starting and ending dates for confirming special additional deduction information for 2025?

The confirmation of special additional deduction information starts on December 1, 2024, and ends on December 31, 2024.

How can taxpayers confirm their special additional deductions?

Individual taxpayers, including foreigners, can make IIT reconciliation via the IIT app (个人所得税app) or the e-tax system website (自然人电子税务局, Online Tax Bureau for Natural Persons ) by themselves.

To be able to confirm the IIT special additional deduction information through the digital channels, the first and essential step is to register with the IIT app or the e-tax system. While Chinese citizens and those with Chinese permanent residence certificates can complete the registration for the IIT app and the e-tax system through face recognition and verification, other foreigners need to obtain a registration code from the local tax bureau in charge of the registration.

Normally, foreigners can obtain the registration code for the IIT app or the e-tax system by physically visiting the local tax bureau and submitting the required documents for real-name authentication.

If the foreigners are currently not in China, they can entrust their employer to obtain the registration code for the IIT app or the e-tax system.

According to official guidance released by some local tax bureaus, the entrusting party (individuals) and the entrusted party (the employer) are required to sign a power of attorney, specifying the specific matters being entrusted. The entrusted party will also need to submit a photocopy of the entrusting party’s identification document and the original copy of the entrusted party’s identification document.

It should be noted that different local tax bureaus may have different rules. Foreigners who want to obtain the registration code in this way are well advised to double-check with their tax bureau in charge of the local practices.

After successful registration, the individual taxpayer can make annual IIT reconciliation easily by following the step-by-step guidance provided by the IIT app or the e-tax system.

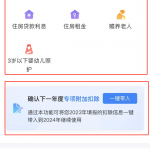

Example: Confirmation through the IIT app

Do expatriates in China also need to confirm their IIT special additional deduction information?

The special additional deductions are available for both domestic and expatriate employees, provided the expatriates have reached resident taxpayer standards. However, for foreign employees, the special additional deductions cannot be enjoyed together with the tax-exempt fringe benefits. They must choose to avail of either tax-exempted fringe benefits or special additional deductions. Once decided, the method cannot be changed during one calendar year.

Thus, expatriate employees who are expected to stay in China for over 183 days in 2024 and choose to enjoy special additional deduction policies, need to confirm their special additional deduction information in December 2023, similar to their Chinese coworkers.

Dezan Shira & Associates professionals possess extensive on-the-ground experience in payroll processing and Individual Income Tax compliance. If you have more questions on IIT special additional deductions or seek other professional tax services, please contact china@dezshira.com.

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Key Considerations for Entering China’s Healthcare Market

- Next Article China Expands Access for Wholly Foreign-Owned Hospitals: 9 Cities Open for Investment