A FESCO as a Tool for Labor Dispatch in China

Oct. 12 – Many foreign-invested companies and representative offices in China have a contract in place with a FESCO (Foreign Enterprise Service Company) for labor dispatch, payroll and/or additional services for Chinese employees.

Oct. 12 – Many foreign-invested companies and representative offices in China have a contract in place with a FESCO (Foreign Enterprise Service Company) for labor dispatch, payroll and/or additional services for Chinese employees.

Many foreign investors assume that FESCO is a single organization, but in fact it is a generic term used by dozens of local HR companies around the country. There are often multiple competing “FESCO” organizations in each city, some subsidiaries or affiliates of companies in another part of the country, some partially state-owned and some 100 percent privately-owned.

The English term “FESCO” is a generic one, indicating nothing more than the type of service provided by the company. Because of the widely-held misconception that FESCO is one company, the “brand” is a powerful marketing tool, and the term is often casually used to refer to companies providing similar services.

“It is important that foreign investors realize that FESCO is not a single organization. Many general managers operate under the misconception that their organization (especially if it is a representative office) has no negotiating power with FESCOs, and simply accept the quoted price without question,” says Adam Livermore, Regional Manager, Dezan Shira & Associates, Dalian Office.

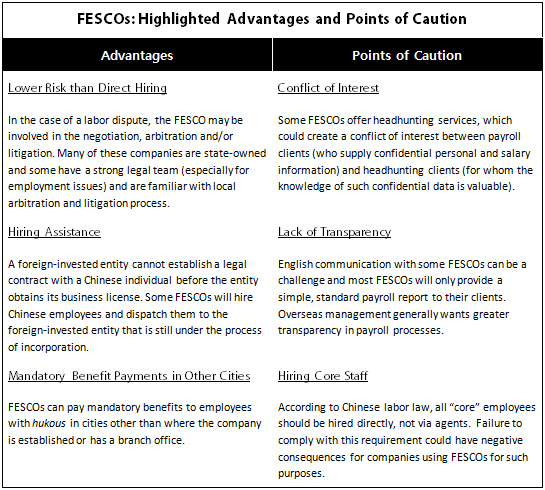

Some FESCOs also carry out services such as executive search work (headhunting) on behalf of their clients, which could create a conflict of interest between payroll clients (who supply confidential personal and salary information) and headhunting clients (for whom the knowledge of such confidential data is valuable).

Labor dispatch and decreasing hiring risk in labor disputes

“A FESCO is a kind of tool,” explains Victor Zheng, Business Advisory Services, Dezan Shira & Associates, Shanghai Office. “Representative offices must recruit their Chinese employees through an agent (many of which use the catch-all term FESCO as their company name), and such agents can also be quite useful for other foreign-invested entities on occasion.

FESCOs generally have their own standard labor contracts, with little room for negotiation. These contracts aren’t always the most well-written, and it’s usually a “take it or leave it” situation, but hiring employees through a FESCO can sometimes be less risky than hiring them directly.

While a FESCO will not take liability for financial compensation – this will be quite clear in the initial agreement – in the case of a labor dispute (on issues such as performance, termination of the labor contract, salary payments, social insurance payments, training, labor protection), the FESCO can get involved in the negotiation, arbitration and/or litigation.

Many of these companies are state-owned and some of them have a strong legal team (especially for employment issues) and are familiar with local arbitration and litigation process. FESCO’s involvement in labor disputes can sometimes help to achieve a resolution.

In addition, FESCOs can also be useful for foreign-invested entities during the pre-incorporation period, during which preparation work often requires the assistance of Chinese employees. A foreign-invested entity cannot establish a legal contract (no matter labor contract or service contract) with a Chinese individual before the entity obtains its business license. Some FESCOs (not all) will agree to hire the Chinese employee and dispatch them to the foreign-invested entity that is still under the process of incorporation, generally on the condition of a 3-4 month cash deposit of all salary and social insurance payments.”

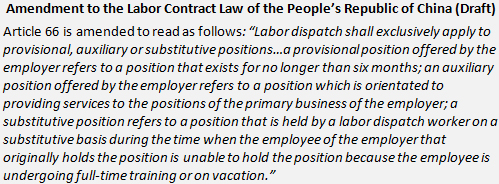

Labor Contract Law stipulates that workers dispatched from a FESCO should generally assume temporary, substitute or auxiliary positions. In the past, this directive has often been ignored and FESCOs have been used to hire a wide variety of Chinese workers upon the client’s request. However recent draft legislation regarding the obligation of employers to directly employ core staff has brought extra risk to companies employing a large portion of their employees through agencies, and many companies are now re-considering their approach to hiring in the light of this new regulation.

One thing to keep in mind about FESCOs is that, according to Labor Contract Law, they can only offer fixed-term contracts for at least two years. An employer may still terminate the employment relationship with the Chinese employees, following the stipulations of Labor Contract Law and the agreement signed with FESCO.

According to legislation available as of July 2012, it is unclear whether an employee that is working under an agency contract will have the opportunity to achieve an open-term contract with the company after expiration of two fixed-term contracts. Options beyond a fixed-term contract include a service agreement or part-time arrangement based on relevant Chinese laws and regulations, which can be terminated more easily.

Portions of this article came from the October 2012 issue of China Briefing Magazine titled, “Social Insurance and Payroll.” In this issue, we take a “back to basics” approach to China’s mandatory benefits. Where, exactly, is that extra 35-40 percent on top of an employee’s salary going? What are social insurance contribution rates, base amounts, and tax exemptions? How does all of this figure into the payroll process? We next look at mandatory benefits as a piece of the larger payroll puzzle, with highlights on two very China-specific pieces: FESCOs and hukou, China’s “domestic passport.”

Portions of this article came from the October 2012 issue of China Briefing Magazine titled, “Social Insurance and Payroll.” In this issue, we take a “back to basics” approach to China’s mandatory benefits. Where, exactly, is that extra 35-40 percent on top of an employee’s salary going? What are social insurance contribution rates, base amounts, and tax exemptions? How does all of this figure into the payroll process? We next look at mandatory benefits as a piece of the larger payroll puzzle, with highlights on two very China-specific pieces: FESCOs and hukou, China’s “domestic passport.”

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across China by subscribing to The China Advantage, our complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

An Introduction to Doing Business in China

An Introduction to Doing Business in China

Asia Briefing, in cooperation with its parent firm Dezan Shira & Associates, has just released this 40-page report introducing everything that a foreign investor should be familiar with when establishing and operating a business in China.

The Best of Asia Briefing – August/September 2012

Limiting Tax Exposure for American Expatriates in China

China Releases 2011 Statistics for HR and Social Security Development

Shenzhen Adjusts Housing Fund Base and Work-Related Injury Insurance Rates

- Previous Article China’s Lenovo Surpasses HP as Largest Global PC Maker

- Next Article China Releases Circular on Reporting VAT Collection Data