Eco-Friendly Investment Opportunities in China: The Rise of Green Bonds

By Maurizio Mazzoni

China is embracing green bonds as part of its efforts to combat the country’s notorious pollution problems.

China Securities Regulatory Commission (CSRC), the main regulator of the securities industry in China, released a new set of guidelines to support the issuance of green bonds on March 2, 2017.

Promoting green bonds could be considered the latest in the government’s efforts aimed at promoting environmental protection and to reduce the effects of pollution as a result of its rapid industrial growth over the past decades.

China has the world’s largest green bond market, with more than RMB 200 billion (US$ 30.3 billion) worth of green bonds issued in 2016 alone – almost 40 percent of green bonds issued globally that year.

Policymakers are providing financial support and governmental incentives for green bonds issuers in order to attract foreign investors and encourage CSR related projects. The Climate Bonds Initiative (CBI) estimates that the annual issuance of green bonds rose from RMB 21 billion (US$3.2 billion) in 2012 to RMB 559 billion (US$84.5 billion) in 2016.

The policy support and market growth provides foreign investors and businesses operating in China with a wide range of opportunities: foreign investors can profit the support of a state-run program, while China-based businesses can fund eco-friendly projects with relative ease.

![]() RELATED: Investing in China’s Green Industries

RELATED: Investing in China’s Green Industries

The Importance of Green Bonds

Conventional sources of capital, such as banks and governments, struggle to meet investors’ expectations and satisfy the amount of capital required to set certain projects in motion. External funds, such as green bonds, can represent a powerful tool to make China more green.

The People’s Bank of China (PBOC) has made it clear that public investment alone is not enough to meet the funding requirements needed to drive green and environmentally-friendly solutions, and has set out to make green bonds a powerful financial alternative to attract foreign investors.

China’s environment paid a high price for the country’s rapid economic ascent, bringing air and water pollution to alarming levels over the span of just a few decades. Interestingly, this ongoing threat has yielded opportunities for eco-friendly companies not only to thrive financially, but also play a role in the efforts to combat environmental stress. Therefore, green bonds represent a useful means to combine the government’s efforts with private investment and assist and alleviate the cleanup operation.

Sustainable urban planning has been identified as one of the primary methods to accomplish this: rethinking how cities can conserve energy is becoming less of a solution, with developing eco-cities a more effective option for cutting carbon emissions. Regional governments benefit from green bonds as they can help to finance and develop local green infrastructure. As a result, the demand for companies able to provide cities with the latest green-related technology is increasing rapidly.

The benefits of supporting green bonds are manifold. Public authorities’ efforts to support sustainable initiatives will allow the country to gain international recognition for green investment and growth, while companies have the chance to implement CSR activities. Green bonds will help businesses empower R&D departments financially, potentially allowing the Chinese market to become one of the most eco-friendly in the world.

Regulation

China supports the development of green bonds at both a local and national level. Most green bond issuers are headquartered in 14 cities, and more than 80 percent of bonds were issued in Shanghai, Fuzhou, and Beijing for projects in green industries such as clean energy, clean transport, and resource recycling.

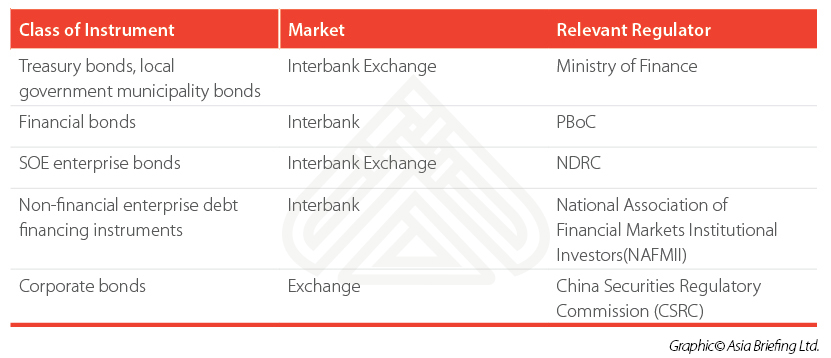

Depending on the type of issuer, regulation is supervised by the PBOC, which regulates green bonds issued by financial entities, and the National Development and Reform Commission (NDRC), which regulates bonds issued by other corporate entities that do not have listed equity.

The regulation requires companies to submit a ‘commitment letter’ to CSRC confirming the intention of using raised funds solely for green projects conforming to its guidelines. Companies in industries that have high emissions or energy usage, such as in the oil industry, will not be allowed to issue green bonds.

The CSRC’s new guidelines will apply to all green bonds. They state that there are regulators for each category of issuer, and recommend the use of third-party auditors and certifiers to speed up the process. Finally, the guidelines encourage rating agencies to evaluate companies’ performances in order to assess the issuer’s credit risk.

The process to become a green bond issuer are as follows:

- First, companies are required to disclose their projects and the details of its assets (the same process is undertaken by normal bonds issuers);

- A company can then chose independent review to secure its reputation or submit details of the project directly to the relevant regulator according to its nature (see the table below);

- After being approved, the company can start to issue green bonds.

Periodic reporting on the use of proceeds and undistributed proceeds is also required. The issuer should disclose the development status of green projects and their environmental benefits on an annual basis.

Though several provincial and municipal governments have stepped up their efforts to follow and support the central government’s green policies, many companies have limited knowledge of green bonds. Special task forces aimed at supporting companies on the green bond issuance process have been set up in first tier cities such as Shanghai and Beijing, but the lack of awareness of opportunities for eco-friendly projects is still too high.

Potential issuers may be unaware that green bonds can be a valid tool to re-finance existing eco-friendly projects or assets, or that green bonds are not only issued to green enterprises. As long as the project can be qualified as a green project, green bonds are available to any type of company. For example, a power producer based in Tianjin was allowed to issue “green bonds” worth RMB 1 billion (US$151 million) to finance a coal-fired power plant in June.

![]() Pre-Investment, Market Entry Strategy Advisory Services from Dezan Shira & Associates

Pre-Investment, Market Entry Strategy Advisory Services from Dezan Shira & Associates

Utilizing government incentives

The Chinese government has been making efforts to attract green investors and support green projects at a time when many companies are increasingly taking action to combat climate change. A deeper understanding and holistic approach is required to face this issue; a different approach that can bring tax incentives and government support, as well as added competitive advantage.

Chinese citizens are showing a strong interest in energy-saving and eco-friendly solutions. Companies that will address such interests will not just only be rewarded by the government and potential investors, but by a fast-growing green market.

Tax incentives, funding opportunities, government support, and the high demand for these kind of products and services create the right scenario for successful business. Although entering the Chinese market requires a detailed business plan, the range of incentives offered by the government for green projects and responsible companies make investments in China worthwhile.

|

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here. Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

|

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

This Dezan Shira & Associates 2017 China guide provides a comprehensive background and details of all aspects of setting up and operating an American business in China, including due diligence and compliance issues, IP protection, corporate establishment options, calculating tax liabilities, as well as discussing on-going operational issues such as managing bookkeeping, accounts, banking, HR, Payroll, annual license renewals, audit, FCPA compliance and consolidation with US standards and Head Office reporting.

In this issue of China Briefing magazine, we provide foreign investors with best practices for implementing internal controls in China. We explain what makes China’s internal control environment distinct, and why China-based operations need to prioritize internal control. We then outline how to execute an internal control review to gauge organizational resiliency and identify gaps in control points, and introduce practical internal controls for day-to-day operations. Finally, we explore why ERP systems are becoming increasingly integral to companies’ internal control regimes.

- Previous Article China-Russia Bilateral Trade is World’s Fastest Growing Opportunity Corridor

- Next Article Internal Control for Day-to-Day Operations in China