Second Cup? China’s Coffee Industry Revisited

By Rainy Yao and Benedict Lynn

Coffee reportedly made its initial appearance in China when a French missionary planted beans throughout Yunnan Province in the 1890s. Over the next hundred years, the drink would go largely unnoticed, but as with many things in China, the market has undergone rapid change over the last 20 years.

This week China Briefing revisits our three-part series from 2013 detailing various facets of China’s coffee industry. Part one, introducing China’s coffee industry, can be found here; part two, dealing with the coffee trade in China, here; and part three, dealing with domestic production, here.

Coffee Market Still Growing Fast

China is now the world’s fastest growing coffee market with a growth rate of approximately 15 percent annually – about seven times the average global rate of just two percent in the last decade. In first-tier cities like Beijing, the rate is even higher at 18 percent.

Although the average Chinese person consumes just five cups of coffee annually, this can vary drastically by location. In a small town in Hainan Province, for example, jittery residents each drink as many as 200 cups a year. In 2012, Chinese consumers drank a total of 130,000 tons of beans worth of coffee. Research shows that there were 28,000 coffee shops in China by the end of 2013, of which 8400 were chain outlets.

Riding the Korean Wave

The arrival of Swiss company Nestlé in 1990 introduced the Middle Kingdom to a wide array of coffees from around the world. This was followed to great success by Western coffee pioneers Starbucks (in 1999) and Costa Coffee (2006), but these are no longer the only key players in China’s coffee market.

Recently, a slew of Korean coffee chains have been springing up in metropolitan areas like Beijing and Shanghai, positioning themselves firmly at the forefront of the ongoing coffee revolution. According to Korean newspaper AJU Business Daily, to date, over 700 Korean coffee shops have been established in China with some 300 more expected by the end of 2014. Caffe Bene, which arrived in China in 2012, has already opened more than 400 chain outlets in just two years, a feat that took Starbucks the better part of 13 years.

These Korean brands have skilfully exploited the marketability of Korean popular culture, now very much in vogue in China. Mango six, for example, a new Korea-based coffee & dessert café that first appeared in a popular television drama, expanded into China in 2014. Targeting upper-middle class teenage girls, its huge success is owing to Chinese consumers’ greater emphasis on the experience and environment of a café rather than the quality of its coffee. Zoo coffee, one of Starbucks’ biggest competitors, with its giant stuffed animals and zebra-pattered chairs is immensely popular amongst Chinese students and young children.

Having recognized that it is comparatively difficult to compete with their more established Western counterparts in China’s first-tier cities, the majority of these newly-introduced Korean coffee shops have instead opted to target second-tier cities.

Indie Culture: The Next Mainstream?

An ever increasing number of independent coffee shops and cafés have been emerging across the country. Many have their own unique theme, be it cats, old movies or French maids. As young Chinese start to develop their own distinct coffee culture, these indie cafés are growing in popularity. Type the word “unique” into Baidu (China’s biggest search engine), and “most unique cafés” pops up as the fourth most popular search item, out of over 2,730,000 relevant search results.

Indonesian Instant: A Dark Horse

China’s instant coffee market has traditionally been dominated almost entirely by Western brands such as Nestlé and Maxwell House. But recently the industry has been shaken by the rapid and surprising success of Indonesian brand Kopiko. Arriving in China in 2012, the dark horse of the Chinese instant coffee market has in just two years become one of the country’s top three sellers of the powdered beverage. Chinese consumers, many not yet accustomed to the bitter flavor of brewed coffee, are attracted by Kopiko’s sachets that include powdered chocolate as well as the more usual powdered milk and sugar. In fact, as shown below, Indonesia is fast becoming a major exporter of coffee to China.

Imports

Chinese imports of coffee have been growing steadily since our last report. Vietnam remains the largest exporter of coffee to China, but the trend is changing. Over the first five months of 2013, China’s coffee imports from Vietnam dropped by 13.7 percent to US$23.2 million. Conversely, imports from Indonesia reached US$7.2 million at an incredible growth rate of 553.5 percent.

In 2013, imports from Korea stood at almost US$10 million, and have increased by 80 percent during the first half of this year. Meanwhile, Laos, Thailand and Malaysia stand out as emerging coffee import markets for China.

![]()

Vietnam Could Become World’s Largest Coffee Producer and Exporter

Exports

Exports

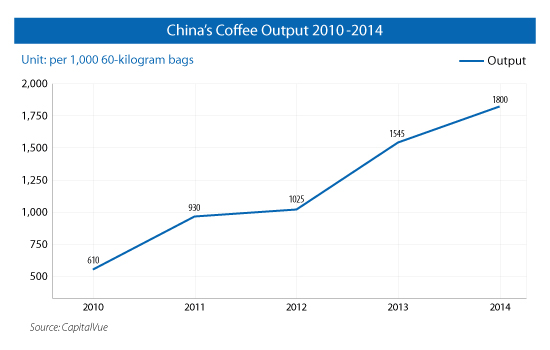

China is also becoming more and more self-sufficient in terms of coffee beans. By the time of writing, the Asian Superpower’s 2014 coffee output had already reached 108,000 tons, up from 36, 600 tons in 2010.

Yunnan province accounts for over 90 percent of China’s total coffee production. Of the province’s total coffee harvest, more than half of the output is exported in its crude form. Between 2012 and 2013, Yunnan’s total coffee harvest stood at about 82,000 tons. Of this, over 50,000 tons were exported to other countries.

Conclusion

China’s coffee market is still growing and still changing. From Paris to Tokyo, people the world over enjoy their own distinct coffee cultures, and excitingly this is now starting to happen in China, as the country’s youth spur on a growing number of independent cafés. The Asian superpower is also emerging as both a major coffee exporter and importer in its own right. Beans from Yunnan are now sold in Starbucks stores in New York, while Chinese imports of coffee from ASEAN member states are working to strengthen economic ties in the region. The Chinese coffee industry is hotter than ever, and it has only just started percolating.

CapitalVue is a Greater China-centric data and information provider servicing global institutional investors, investment banks, government organizations, and corporations, with critical real-time capital market (Equities, Funds, Fixed Income, Index), fundamental, and time-series statistical databases, with the speed, depth and breadth institutions require

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

![]()

China Retail Industry Report 2014

China Retail Industry Report 2014

In this special edition of China Briefing, we provide an overview of the retail industry in China and the procedures for setting up a retail shop, focusing specifically on brick-and-mortar physical retail stores. Further, we have invited our partner Direct HR to offer some insights on the talent landscape in the retail industry, as well as tips for recruiting retail personnel in China.

Adapting Your China WFOE to Service China’s Consumers

Adapting Your China WFOE to Service China’s Consumers

In this issue of China Briefing Magazine, we look at the challenges posed to manufacturers amidst China’s rising labor costs and stricter environmental regulations. Manufacturing WFOEs in China should adapt by expanding their business scope to include distribution and determine suitable supply chain solutions. In this regard, we will take a look at the opportunities in China’s domestic consumer market and forecast the sectors that are set to boom in the coming years.

Industry Specific Licenses and Certifications in China

Industry Specific Licenses and Certifications in China

In this issue of China Briefing, we provide an overview of the licensing schemes for industrial products; food production, distribution and catering services; and advertising. We also introduce two important types of certification in China: the CCC and the China Energy Label (CEL). This issue will provide you with an understanding of the requirements for selling your products or services in China.

- Previous Article Double Taxation Avoidance in China: A Business Intelligence Primer – New Issue of China Briefing Magazine

- Next Article End of the Line: Terminating an Employee in China (Part 1)