Shenzhen Adopts New Population and Family Planning Regulation

Jan. 11 – The Standing Committee of the Fifth People’s Congress of Shenzhen Municipality passed the “Shenzhen Special Economic Zone Population and Family Planning Regulations (hereinafter referred to as ‘Regulation’)” on October 30, 2012, which came into effect on January 1, 2013. The Regulation is the first local law in China that clarifies the issue of violating the State one-child policy by giving birth outside of Mainland China.

Specifically, the Regulation for the first time explicitly states that couples giving birth outside Mainland China in violation of the one-child policy will be fined. It stipulates that for every child born against the one-child policy, the couple together needs to pay a “social maintenance fee” six times the city’s disposable income per capita in the year before the birth.

In 2011, the disposable income per capita in Shenzhen was RMB36,505, meaning that for each child born in violation of China’s one-child policy, the fine will be up to RMB219,030.

Furthermore, for couples giving birth for the first time, but who have not yet been officially registered as married within 60 days of the birth of their child, together they will be fined twice the disposable income per capita of Shenzhen in the year before the birth.

The Regulation also forbids parents from having triplets or more births with assisted reproductive technology.

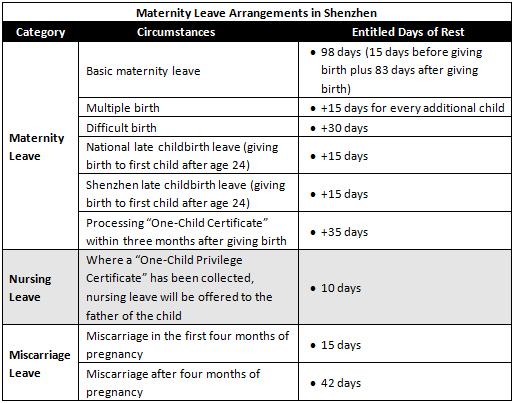

A complete chart outlining Shenzhen’s maternity leave arrangements have been provided as follows:

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across China by subscribing to The China Advantage, our complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Human Resources and Payroll in China (Third Edition)

Human Resources and Payroll in China (Third Edition)

A firm understanding of China’s laws and regulations related to human resources and payroll management is essential for foreign investors who want to establish or are already running foreign-invested entities in China. This guide aims to satisfy that information demand, while also serving as a valuable tool for local managers and HR professionals who may need to explain complex points of China’s labor policies in English.

Social Insurance and Payroll

Social Insurance and Payroll

In this issue, we take a “back to basics” approach to China’s mandatory benefits. Where, exactly, is that extra 35-40 percent on top of an employee’s salary going? What are social insurance contribution rates, base amounts, and tax exemptions? How does all of this figure into the payroll process? We next look at mandatory benefits as a piece of the larger payroll puzzle, with highlights on two very China-specific pieces: FESCOs and hukou, China’s “domestic passport.”

Mandatory Social Welfare Benefits for Chinese Staff

China Labor Force Issues: Hepatitis B Virus and Infectious Diseases

Update: Foreigner Participation in China’s Social Insurance Scheme

A FESCO as a Tool for Labor Dispatch in China

- Previous Article China Clarifies Status of VAT Amounts Carried Over During Asset Reorganization

- Next Article China Releases Interpretations on Foreign-Related Civil Relations