Taxation on Real Estate Rental Income in China

Including city-specific details on Chengdu, Guangzhou and Shenzhen

Feb. 7 – Both Chinese nationals and a foreign individuals are subject to a combination of taxes on real estate rental income: including individual income tax (IIT), business tax (BT), property tax (PT), urban maintenance and construction tax (UMCT) and an education surcharge (ES).

If simply left to adding up all those rates according to each specific tax law, the taxation on individual rental income would end up pretty high. However, in a move to energize China’s housing supply market, the Chinese government began offering some tax incentives starting in 2008.

In the “Circular on Taxation Policies Concerning Low-rent Housing, Affordable Housing and Rental Housing (caishui [2008] No. 24),” the Ministry of Finance and State Administration of Taxation offered the following favorable tax treatment to individuals who rent out their houses:

- IIT on taxable rental income: Imposed at a reduced rate of 10 percent

- Stamp duty on rental contracts: Exempt

- BT on taxable income from rental services: Imposed at a rate of 3 percent and then reduced by half (for individuals and individual businesses, there is an amount of income from services that is BT free. The national BT-free threshold was raised to the range of RMB5,000 – RMB20,000 last year, and the actual thresholds in different regions are determined by local tax authorities)

- PT on rental income: Imposed at a rate of 4 percent

- Urban land use tax on the land occupied by the property: Exempt

Following Circular No. 24’s main principles and local governments’ recent announcements on increased BT exemption thresholds for individuals, several Chinese cities have released new standards for individual rental tax (IRT) collection. To simplify the tax imposition process, IRT is often collected at a combined rate, which varies along with the amount of rental income.

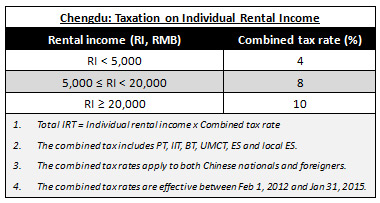

In Chengdu, the capital city of southwestern Sichuan Province, the combined IRT rates have been adjusted (according to Chengdu Tax Bureau Announcement [2012] No.1) as follows:

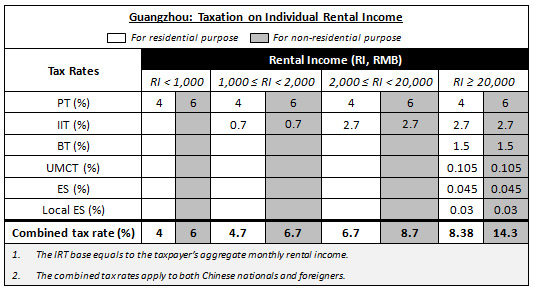

Guangzhou, the capital city of southern Guangdong Province, also begun implementing new combined IRT rates at the end of last year:

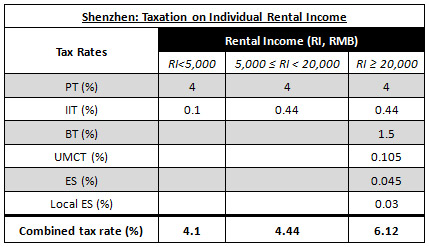

In Shenzhen, another key coastal city in Guangdong Province, the new combined IRT rates (starting on November 1, 2011) are as follows:

Dezan Shira & Associates is a boutique professional services firm providing foreign direct investment business advisory, tax, accounting, payroll and due diligence services for multinational clients in China. The firm specializes in assisting foreign enterprises with their tax obligations. For advice, please email china@dezshira.com, visit www.dezshira.com, or download the firm’s brochure here.

Related Reading

The China Tax Guide (Fifth Edition)

The China Tax Guide (Fifth Edition)

This popular book, fully updated with all recent tax changes and amendments, details all taxes in China affecting businesses and individuals, how to calculate the amounts due, tax registration and filing procedures, tax minimization techniques, and claiming VAT rebates. It also details good financial management techniques, handling negotiations with the tax bureau and annual audit and compliance procedures.

China Lifts Tax-free Thresholds for Business Tax and VAT Collection

- Previous Article Foreign Law Firms in China – 2012 Listings

- Next Article Liquidating a China Business