Setting Up in India Compared With China

An examination of the applicable China – India investment vehicles, taxes, labor costs and available investment incentives

Op-Ed Commentary: Chris Devonshire-Ellis

Feb.11 – As the cost of doing business in China increases, many international investors are looking at alternative locations to operate from, in addition to keeping an eye on new emerging markets. India is an attractive destination as, similar to China before it, it offers two advantages: cheap labor, and an increasingly affluent domestic market. In the former, India now offers a significant discount in operating costs compared to China, and in the latter, a market familiar with and able to afford high property prices, expensive consumer goods, and international standards of merchandise.

In this article, we examine the differences in legal structures for investing in the China and India markets, and compare the taxes, salary levels, and real estate costs.

Applicable Legal Structures

China Project Offices vs. India Project Offices

In-country project offices (POs) are useful as they permit foreign investment and project-specific participation, usually linked to a high value contract that may take two or three years to complete. POs negate the need for the foreign participant to establish a more permanent presence, as the PO is linked to the contract completion terms, yet provide flexibility of hiring labor, funding the project, and remitting profits overseas. As China developed and required specific skill sets to complete specific, usually construction-based projects, the China PO enjoyed a relatively successful period of popularity in the late 1990s and early 2000s. Recently POs have fallen out of favor, mainly as Chinese contractors are now able to take the lion’s share of construction work and do not need foreign short-term sub-contractors to assist and also because the Chinese themselves are restricting the use of POs. When discussing the matter with authorities in Beijing, it appeared no PO licenses have been granted for a number of years, and that applications would probably no longer be approved.

This policy is in sharp contrast to India, where the project office remains a viable vehicle for foreign investors to participate in infrastructure and construction-related projects tied for a limited period to a specific contract. Foreign investors planning to execute specific projects in India can set up a temporary project site office in India to handle the contract. The Reserve Bank of India (RBI) provides approval and grants general permission for foreign entities to establish project offices, subject to certain conditions. These dictate that the foreign investor has secured a contract from an Indian company to execute a project in India.

In addition, the project needs to adhere to one of the following conditions:

- The project is funded directly by inward remittance from abroad

- The project is funded by a bilateral or multilateral international financing agency

- The project has been cleared by an appropriate authority

- A company or entity in India awarding the contract has been granted term loan by a public financial institution or a bank in India for the project

If the above criteria are not met, the foreign entity has to approach RBI to obtain approval.

In terms of remittances, authorized Indian banks can permit intermittent remittances by the PO pending the completion of the project provided they are satisfied with the legitimacy of the transaction. Legitimacy is subject to the following:

- The PO submits an auditors or chartered accountants certificate to the effect that sufficient provisions have been made to meet other liabilities in India including income tax

- An undertaking from the PO that the remittance will not, in any way, affect the completion of the project in India and that any shortfall of funds for meeting any liability in India will be met by inward remittance from abroad

Any inter-project transfer of funds requires prior permission of the pertinent regional office of the RBI under whose jurisdiction the PO is situated.

In the financial circumstances described above, readers familiar with China-based transactions involving foreign currency should note the Reserve Bank of India in such circumstances fulfills much the same role as China’s State Administration of Foreign Exchange.

Under these circumstances, it is apparent that in order to take advantage of, and participate in, India’s massive reconstruction projects foreign investors may well find the Indian project office a suitable vehicle to use as it affords relatively easy market entry and exit upon project completion. This contrasts greatly with China, where the project office is now largely seen as having had its day.

China FICE vs. India Branch Offices

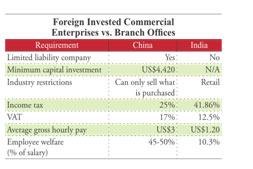

There are some fundamental legal structural differences between China’s foreign-invested commercial enterprises (FICEs) and India’s branch offices (BO), not least amongst them being that Indian BOs are not independent legal entities, whereas China FICEs are. However, in terms of use, both fulfill pretty much the same criteria for foreign investors: they can import and export goods, buy and sell goods, trade or offer consulting services, and remit profits back overseas. BOs differ in that they are still considered part of a foreign entity based overseas, and are not limited liability companies. Foreign-invested commercial enterprises are independent, limited liability companies. Accordingly, BOs do not require capitalization whereas FICEs do.

A downside of the India BO is the high level of income tax – 41.86 percent – which is high compared to India’s norm of 33.99 percent – and the standard income tax rate of 25 percent in China.

Other differences exist in FICEs and BOs engaged in the service industries. BOs do not attract turnover tax, which China levies on FICEs involved in the service industry at a monthly rate of 5 percent. Service industry BOs are subject to service tax against invoice value at a rate of 10.3 percent. For trading however, the applicable tax burden is VAT, which in China is 17 percent and in India is 12.5 percent. Though it may not be possible to reclaim all VAT upon export in China, whereas in India VAT can be reclaimed in full upon export. The advantage of the BO over the FICE is the ease of establishing and exiting it as an entity. For this reason it may make sense to set up a BO despite the initial higher income tax burden to test the Indian market without having to commit to major capitalization costs. For longer term trading and manufacturing, a private limited company incorporation would be more suitable.

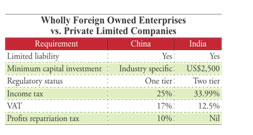

China WFOE vs. India Private Limited Companies

China’s wholly foreign-owned enterprise (WFOE) has become the investment vehicle of choice for the international investor wanting to manufacture, service or trade in China. In addition to the WFOE’s expansive business scope, its unrivaled popularity arises from multiple other factors, including 100 percent foreign ownership and control, security of technology and intellectual property rights, a self-developed internal structure, and the abilities to insert existing company culture, sell to China’s domestic market, and repatriate profits. In this regard, India’s private limited companies (IPLC) are the same animal, with the exception that whereas China has a specific set of regulatory considerations for Sino-foreign joint ventures, an IPLC can also be an Indo-foreign JV, and both 100 percent foreign-owned IPLCs and IPLC JVs are governed by the same regulations. For the purposes of this analysis, we shall concentrate on the 100 percent foreign-owned IPLC. Whether a company has 100 percent foreign ownership or whether it requires an Indian investor is dependent, in a similar fashion to China, upon the scope of the business’s intended activities. The intended scope of business activities in India needs to be studied first to assess the suitability of the business as being a 100 percent foreign-owned entity.

On the assumption that the scope of activities does not require Indian investment, then an IPLC may be established with 100 percent foreign ownership in India. This is known as the “automatic route” and does not require approval from the RBI. Accordingly, this has made IPLC the investment vehicle of choice of most foreign investors in India.

Unlike China, application procedures for 100 percent foreign ownership of IPLC may sometimes fall into a second category, which does require specific approval from India’s Foreign Investment Promotion Board (FIPB). These categories are identified by the Reserve Bank of India, and comprise two lists concerning approval required (List A), and limited eligibility (List B) that affect foreign investment in India. All items and activities that are not mentioned in List A and List B are eligible for foreign investment under the automatic route up to 100 percent. Items in List A require approval from the FIPB. List B prescribes the limits on the foreign investments for which automatic approval will be granted by RBI, subject to certain restrictions. The lists are quite specific and generally do not cover standard manufacturing or trading which are usually applicable under the automatic route. Most India investors entering the market to manufacture, trade and sell standard products will not fall into either List A or B restrictions.

Similar to the China WFOE, an IPLC requires a minimum of two directors, and has from two to 50 shareholders with limited liability related to the amount of paid up capital. Both directors and shareholders can be other legal entities. As is the case in China, the amount of paid up capital required should be a financial exercise to determine the business’s start up and cash flow needs.

Interestingly, when all taxes are considered, in terms of repatriating profits from India, the IPLC is more tax efficient than the China WFOE. Although Indian profits tax is higher, it does not levy a tax on profits repatriated overseas, which China does. The additional costs of labor welfare are also considerably more in China, making the IPLC more financially viable than its Chinese counterpart, something to mull over if considering one market over the other.

Applicable Tax Regimes

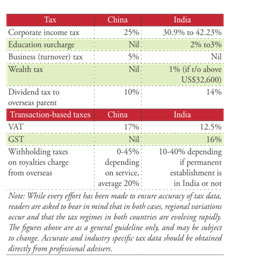

China vs. India Corporate Income Tax

Both China and India have fairly well-developed tax structures, both with the authority to levy taxes divided between the central and regional governments. Both countries are going through an extended period of tax reform at present, and India especially as the country seeks to pass legislation to update its tax base for the first time in 50 years. Top amongst these changes is likely to be the introduction of a goods and services tax (GST) at varying rates amongst internal purchase and sales, although 100 percent refund upon export is expected. The GST is expected to amount to 16 percent of invoice value. This system is expected to partially replace VAT in some states, although in others it will be a new introduction. VAT is not uniformly applied by all states in India. For certain “sin” goods, such as tobacco and petrol, VAT may be applied on top of GST. This system is expected to be rolled in mid-late 2011, however may be subject to further delay.

India however does score better in the application of VAT (and future GST) refunds against exports. China levies a tiered system of VAT refunds against exports, and in some sectors, such as garments, does not permit refunds at all. India however permits VAT refunds against all categories of goods and services upon export. It should be noted that China does not currently levy VAT on services, while India does.

In terms of corporate taxes, applicable rates are as follows:

Tax Incentives

With China unifying its tax base in 2008, it did away with preferential tax incentives largely available to foreign investors, and especially those in free trade zones and special economic zones. China now tends to levy or provide refunds against a variety of taxes depending upon industry. In doing so, the Chinese central government tries to manage balances between domestic sales of certain products and exports of certain products, and varies these from time to time or as circumstances dictate. China is still very much a centrally planned economy. Specific tax incentives therefore are usually applicable in certain industries only, occasionally regionally-based, and typically involve a manipulation of business tax, profits tax or VAT.

India on the other hand wishes to develop its special economic zones and free trade zones, and accordingly provides highly attractive tax incentives to do so. These can include 100 percent corporate income tax breaks for up to 10 years. These can be applicable to certain development projects to be carried out in India, mainly within infrastructure. Incentives also exist for businesses involved in 100 percent export of products manufactured in an Indian SEZ or FTZ. These are typically 100 percent for the first five years of profitability, and 50 percent for an additional five years, although there are regional and eligibility variations. Nevertheless, the boom in manufacturing that China enjoyed with the tax incentives it used to offer in its development zones are now being recreated in India, and this should spur foreign investors familiar with the China model to consider India as an alternative manufacturing base, as these incentives provide a clear impetus for doing so.

It should be noted that China engages a calendar year audit cycle, January 1st to December 31st. India uses the fiscal period from April 1 to March 31.

Summary

From the global manufacturing perspective, China and India now offer similar, yet also differing opportunities. China’s main development thrust is now creating equality of wealth within its borders, and to do this it needs to both improve upon the infrastructure, education and housing options and facilities its rural areas. China’s growth will come increasingly from the rural population – a total of some 600 million people – and it is this sector that the government wishes to develop into becoming a consumer class. Today’s opportunities for China are largely about being able to service this sector.

China is also moving up the value chain and wants to move away from its traditional low cost, export driven manufacturing base. In doing so, opportunities exist in adding value – research and development, innovation and design are all going to be developing services that China increasingly needs. China is becoming increasingly sophisticated in this respect, together with increasing opportunities in the sale of goods and services to its domestic market.

For India, this is also partially true. Indians are receptive to international brands and a wealthy middle class, with English widely spoken, has a huge and yet still untapped potential for global manufacturers looking for sales overseas. This is true of everything from auto components to fashion, and in this aspect the two countries share similarities in their major urban markets. India has also taken up the mantle, recently discarded by China, of offering cheap manufacturing. As China has wound down its free trade zones and special economic zones for the purposes of export manufacturing, India has ramped its up. China has become too dependent upon export manufacturing to the detriment of its overall economy, while India does not have enough manufacturing capability and is too dependent upon services. It is these realignments that are creating the opportunities. India’s tax breaks of 10 years are an opportunity for growth and profitability in overseas markets that should not be wasted.

Accordingly, India may now be considered as a viable and serious destination for export-driven manufacturing to markets abroad. While the world recovers from the global financial crisis and Western demand remains weak, that may seem somewhat optimistic. Businesses still need to achieve growth, and as Asia starts to post impressive results in earnings and transforming its population into consumers, so manufacturing in India to service these markets becomes more realistic.

In truth, the China vs. India debate is a no-brainer. Its neither one, nor the other, and although some cross over in capabilities will undoubtedly emerge, it is quite apparent to the author at least, that global strategy, in terms of getting growth onto balance sheets of parent companies elsewhere, must now embrace China and India as two unique, but complimentary destinations to achieve dynamism and profit capabilities for the next two decades.

India is now more competitive than China overall for labor-intensive industries and a reduction of income tax to 30 percent (China: 25 percent) during 2011 will trigger a spurt of foreign investment. Also of note is India’s average minimum salary level – US$857 per annum as against China’s US$1,500, and lower mandatory welfare payments to employees – an average of 10 percent against China’s 50 percent. These developments will further increase Indian competitiveness over China in attracting foreign direct investment in certain industries.

Chris Devonshire-Ellis is the founding partner of Dezan Shira & Associates, establishing the firm’s China practice in 1992 and its India practice in 2006. The firm now has ten China offices and five in India, advising foreign investors on market entry due diligence, legal establishment, tax implications, and on-going compliance and accounting matters in both markets. The practice also maintains two offices in Vietnam. For comparisons and advice over China and India corporate establishment, please contact the firm at chinaindia@dezshira.com or download the firm’s brochure here.

Related Reading

Our India legal, tax, regulatory and business platform. A complimentary subscription to our weekly update is available.

Current topic: The impact of FDI on India’s Manufacturing Sector

Our new, 156-page guide to foreign investment in India, establishment, legal and tax issues together with introductions to each state, demographics, and investment incentives

An Expatriate Managers Introduction To India

An Expatriate Managers Introduction To India

Our examination of the business and cultural environment that new-to-India executives will encounter

Our 25-page complimentary evaluation and comparison of both countries’ demographics and investment climates

India Second in Global Manufacturing Competitiveness

- Previous Article When China Mandatory is Negotiable

- Next Article Devonshire-Ellis Named as ‘China Leading Light’

Doing Business In India

Doing Business In India China-India 2011 Comparison

China-India 2011 Comparison