Will Virtual Banks Benefit Foreign SMEs in Hong Kong?

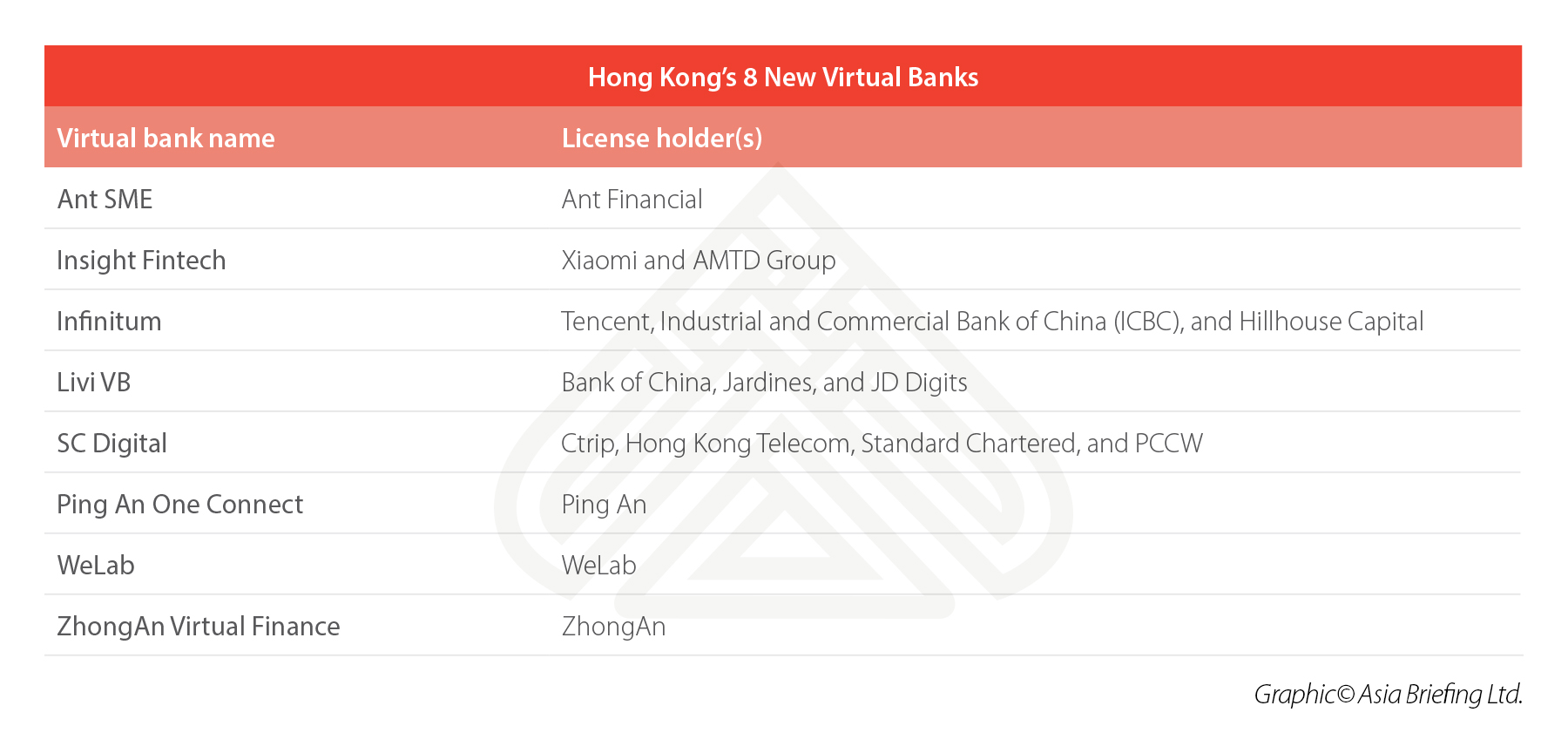

The Hong Kong Monetary Authority recently announced that it had granted four new virtual banking licenses, bringing the total number of licenses to eight. In comparison to traditional retail banks, new virtual banks will operate almost exclusively online.

Whereas traditional banks provide face-to-face assistance at bank branches, virtual banks have no physical branches and provide almost no physical services.

Virtual banking licences can also be held by bodies other than regulated financial institutions. This means e-commerce and technology companies – such as the Chinese company Xiaomi – will be allowed to provide banking services so long as they hold a license.

Exactly how each of the eight virtual banks will operate their services in Hong Kong will be unclear until they launch later this year.

Still, as these banks will likely focus on banking for small and medium sized enterprises (SMEs), it is worth exploring some of the advantages and disadvantages of the new banks and how they could benefit foreign SMEs.

Advantages of virtual banking

- Better rates and fewer fees

The absence of physical branches and the costs associated with maintaining them means that virtual banks are expected to offer better deposit interest rates and fewer fees, such as low-balance fees.

- Set up convenience

Many traditional banks require that one be physically present to open a bank account. The virtual banking model, by contrast, should allow individuals to open Hong Kong bank accounts online even from overseas locations. This does not mean, however, that due diligence will be taken any less seriously.

- Integration with enterprise software

Digitizing the entire process means there is ample opportunity to allow for information to be automatically transferred to other enterprise software. For example, digital information could be shared with accounting software, automating some of the process, and cutting some of the costs.

- SME focus

While the exact details of the services that virtual banks offer will be unknown until they are launched, the expectation is that they will be heavily focussed on SMEs. Ant SME is one virtual bank that is expected to focus more on credit options for SMEs. Pingan One Connect and Infinium are also expected to have a heavy focus on the SME market.

Disadvantages of virtual banking

- Less relationship development

The absence of physical branches and the staff that occupy them mean that account holders will no longer be able to form relationships though face-to-face interaction with bankers. For those who value the human aspect of their banking experience, virtual banks will be less attractive.

- ATM network

Virtual banks new to the industry will lack their own established ATM network. To address this, some virtual banks in other locations have partnered with a traditional bank that owns an ATM network. Because the network is often used by the virtual bank at a cost, customers should be aware of what costs are passed on to them.

- Deposit inflexibility

Depending on the virtual bank, depositing cash can be a cumbersome process. Traditional banks offer both ATM and face-to-face services for doing so. If a virtual bank does not have access to an ATM network with cash depositing services, cash may have to be deposited into an account with a different bank and transferred across.

- Other services unavailable

Services offered by traditional banks, such as notarization and signature guarantee are not likely to be offered by virtual banks. These services require a notary to witness the signatory physically signing the document, which cannot be done virtually.

Foreign SMEs in Hong Kong

For foreign SMEs operating in Hong Kong, virtual banks could offer a more convenient and cheaper service. This is particularly true for business owners who operate subsidiaries in Hong Kong that primarily function as holding companies.

For owners who are not based in Hong Kong, opening a bank account without having to travel to Hong Kong could be more convenient.

As the additional services offered by traditional banks are often not required by business owners operating Hong Kong-based holding companies, the lower fees and better rates offered by virtual banking could be advantageous.

However, what concrete savings these virtual banks will be able to offer is not yet fully known. Hong Kong’s three big traditional banks – HSBC, Standard Chartered, and the Bank of China – have recently all cut minimum-balance fees anticipating future competition.

More will be known about how virtual banks can help foreign SMEs once the banks officially launch and there is more clarity regarding their delivery models.

Nevertheless, whatever the role virtual banks carve out for themselves, a diversity of options in the banking industry is a positive development.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write to china@dezshira.com for more support on doing business in China.

- Previous Article Hainan Free Trade Zone: Tracking its Progress

- Next Article China’s 2019 Negative Lists and Encouraged Catalogue for Foreign Investment