Wage Growth in China in 2020: How to Read the Latest Data

Wages in China continue to increase, but at a slightly slower rate than before, according to newly released data.

On May 19, 2021, the National Bureau of Statistics released wage data for 2020, showing that wages in China increased despite the COVID-19 pandemic and its associated economic impacts.

Wages in some industries, such as information technology and finance, grew at a rapid pace, while those in other industries hit hard by the pandemic, like tourism and hospitality, stagnated or declined.

Overall, China’s latest wage data reflects both the short-term disruptions of the pandemic as well as the continuation of long-term economic and labor trends, as the country’s increasingly skilled workforce contributes to the growth of high-value industries.

What wage statistics are measuring

Official Chinese wage statistics are largely divided between urban non-private sector and urban private sector units, and do not measure the wages of all workers in the country.

The urban non-private sector is a somewhat unclear statistical category that includes a number of different types of employers.

They include state-owned enterprises (SOEs), collectives, limited liability corporations (LLCs), and foreign-invested enterprises (FIEs), among other types. Accordingly, many private companies are included in the urban non-private sector category for statistics purposes.

Urban private sector units refer to privately owned businesses registered or controlled by individuals. Most – but not all – of these are small and medium-sized enterprises (SMEs).

To be noted, Chinese wage statistics exclude rural, informal, and self-employed workers, who together make up the majority of all workers in the country.

As such, while official wage statistics offer insights about certain sectors of the economy, they are not representative of the entire country or workforce.

Average annual wage growth by ownership status

The average annual wage of workers in the urban non-private sector in 2020 was RMB 97,379 (US$15,188), an increase of 7.6 percent, or RMB 6,878 (US$1,073), compared to the previous year. This was the third consecutive year of slowing wage growth in the sector, as wages grew by 9.8 percent in 2019 and 10.9 percent in 2018.

Workers in the urban private sector had an average wage of RMB 57,727 (US$9,004), representing a similar increase of 7.7 percent, or RMB 4,123 (US$643), year-on-year. Like the urban non-private sector, it was the third consecutive year of declining wage growth. In 2019, wages in the urban private sector increased by 8.1 percent, and in 2018, they increased by 8.3 percent.

Wages at SOEs grew at an above average rate in 2020, increasing by 9.3 percent to reach an average of RMB 108,132 (US$16,865). Collective enterprises also grew quickly, at 9.5 percent, to reach RMB 68,590 (US$10,698).

In contrast, wages at FIEs grew at a below average rate of 5.1 percent, but still maintained a higher overall average wage of RMB 112,089 (US$17,482). LLCs grew by 6.2 percent to reach RMB 84,439 (US$12,170) and share-holding corporations grew by 5.3 percent for an average of RMB 108,583 (US$16,936).

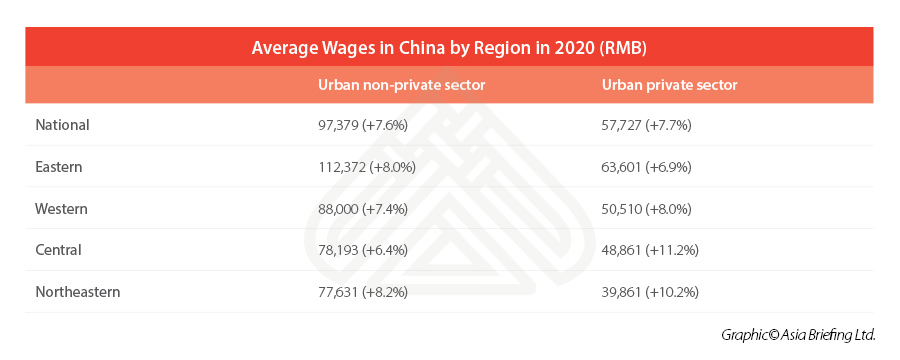

Wages by region

Regional wage growth trends varied to an extent between the urban non-private sector and the urban private sector.

In both cases, the Eastern region was home to the highest wages, with the urban non-private sector having an average of RMB 112,372 per year (US$17,527) (8.0 percent growth) and the urban private sector having an average of RMB 63,601 (US$9,920) (6.9 percent growth). Despite coming from a significantly higher base, the growth rate in the former was still 1.1 percentage points higher than in the latter.

The Western region had the second highest wages, with an average of RMB 88,000 (US$13,725) (7.4 percent growth) in the urban non-private sector and RMB 50,510 (US$7,878) (8.0 percent growth) in the urban private sector.

Next, the Central region had an average wage of RMB 78,193 (US$12,196) (6.4 percent growth) in the urban non-private sector, and RMB 48,861 (US$7,621) (11.2 percent growth) in the urban private sector. Thus, in the Central region, the wage gap between the two categories is smaller than in the other regions, and growing tighter.

Finally, the Northeastern region had the lowest wages in China, with an average of RMB 77,631 (US$12,108) (8.2 percent growth) in the urban non-private sector, and RMB 43,928 (US$6,851) (10.2 percent growth) in the urban private sector.

Industry wage trends

Among listed industry categories, information transmission, software, and information technology services had the highest average wage in China, at RMB 177,544 (US$27,691) in the urban non-private sector and RMB 101,281 (US$15,797) in the urban private sector. Not only was this industry the most lucrative on average, but it was also the third fastest growing (10.0 percent growth) in the urban non-private sector, and the fastest growing in the urban private sector (18.7 percent growth).

The second highest paid industry was scientific research and technical services, with an average wage of RMB 177,544 (US$27,691) (4.8 percent growth) in the urban non-private sector, though it was the third highest in the urban private sector, at RMB 72,233 (US$11,266) (6.8 percent growth). In the urban private sector, finance was the second highest paid industry, at RMB 82,930 (US$12,935) (9.0 percent growth), but finance wages were still higher in the urban non-private sector, at RMB 133,390 (US$20,805) (1.5 percent growth).

Wages in the manufacturing industry had steady growth in 2020. In the urban non-private sector, the average wage was RMB 82,783 (US$12,912) (5.9 percent growth), while in the urban private sector it was RMB 57,910 (US$9,032) (9.6 percent growth).

Among companies above designated size, the average wage for manufacturing and related personnel was RMB 62,610 (US$9,765). Despite gaps in development and economic growth, manufacturing wages were relatively similar across the country, with the Eastern region at the highest (RMB 65,241) (US$10,176) and the Central region at the lowest (RMB 56,302) (US$8,781).

The accommodation and restaurants industry was among the most hard-hit industries in 2020. Already the lowest paid industry in the urban non-private sector, the average wage decreased by 3.0 percent to RMB 48,833 (US$7,616), compared to a 4.2 percent increase in 2019. In the urban private sector, wages contracted by 0.4 percent to RMB 42,258 (US$6,591).

Similarly, wages in the culture, sports, and entertainment industry in urban non-private units increased by just 4.1 percent, which was a 5.1 percentage point drop from the year before. In the urban private sector, wages in education and management of water conservancy, environment, and public facilities also declined, by -4.6 percent and -2.6 percent, respectively.

How to read the data: Separate long-term trends from short-term deviations

China’s latest wage data reflect both the short-term impacts of the COVID-19 pandemic as well as ongoing economic and labor trends that will be longer lasting.

As expected, industries relating to food and beverage, travel, and hospitality were among those that suffered the most from the pandemic due to closures and travel restrictions, particularly during the first half of 2020. Travel and hospitality industries will continue to face challenges in the near future because of restrictions on international travel, but China’s immense domestic tourism market will likely soften these impacts to an extent.

On the other hand, rapid wage growth in information technology industries reflects the success and dynamism of businesses in this area, particularly within the context of national efforts to develop these industries. Strong wage growth in information technology and other technical professions is indicative of increased demand for skilled workers as China moves up the value chain and invests in its services sectors.

Due to shortages of skilled workers in some specialized positions, such workers may become increasingly concentrated in the more developed Eastern region, where wages and quality of life tend to be the highest. Employers located in other regions may therefore have to pay a premium to attract talent.

Some businesses in China in low-margin industries may struggle with growing wages, and consider relocation to lower-cost alternative destinations, such as Vietnam, Indonesia, and India. However, China’s solid rate of wage growth is proof of both the country’s ability to bounce back from the COVID-19 pandemic and the vitality of the emerging high-value industries that represent its economic future.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Belt and Road Weekly Investor Intelligence, #31

- Next Article This Week’s China Plus – Wednesday, June 2