Unlocking China’s Elderly Market: Tapping into the Power of the ‘Silver Economy’

China’s ‘silver economy’ is booming as its elderly population constitutes nearly 18.7 percent of the country’s total population. This transformative market offers significant growth opportunities and investment potential for foreign companies, making it a compelling focus for business products and services. We discuss key market segments tailored for the older consumer base in China from senior homes and healthcare to lifestyle management, culture, and entertainment.

UPDATE (January 23, 2024): China has released a new set of Opinions on Developing a Silver Economy to Improve the Well-being of the Elderly, which proposes a variety of measures to improve elder care services and leverage new opportunities presented by China’s aging population. They include improving social support systems and infrastructure for the elderly population and cultivating various industry segments to leverage new market opportunities. See our article on Developing the Silver Economy – New Proposals to Cultivate China’s Elder Care Industry to learn more.

China’s silver economy, characterized by the economic activities and market opportunities surrounding its rapidly growing elderly population, has emerged as a dynamic and transformative force. With an aging population that surpasses 260 million people aged 60 and above, accounting for nearly 18.7 percent of the total population, China’s silver economy is witnessing remarkable growth.

In this article, we discuss the distinct characteristics of this market, along with its projected growth and investment potential for foreign companies.

China’s silver economy

The term ‘silver economy’ encompasses the economic activities related to the aging population and addresses their specific needs and preferences. It recognizes the growing consumer demand from older individuals and focuses on sectors that cater to their requirements, promoting their well-being and quality of life.

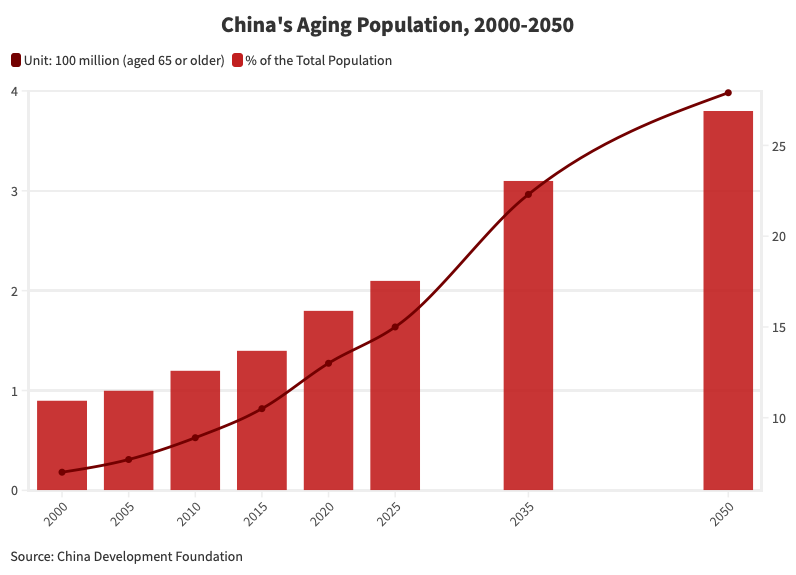

As a result of increasing life expectancy, China is experiencing a shifting population pyramid. United Nations data reveals that in 2022, the proportion of people aged over 60 in China reached 280.04 million, up from 267.36 million people (or 18.9 percent of the total population) from the previous year. The average annual growth rate of the population aged 65 and above is 2.37 percent, increasing from 3.7 percent in 1960 to 11.97 percent in 2020.

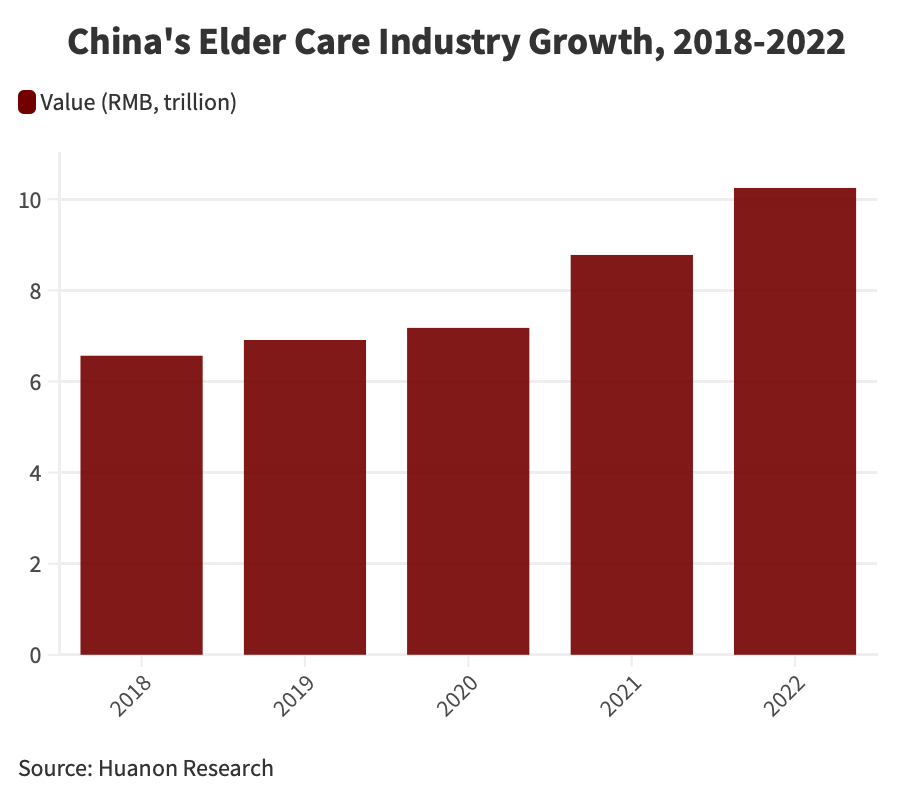

Over the past few decades, China’s population structure has experienced significant transformation: as the country grew at a notable pace, the cumulative impact of worker migration, rapid urbanization, and the previous implementation of the One Child policy, have been numerous elderly individuals who now face the challenges of aging without the support of family or caregivers. Because of these factors and trends, the market size of China’s silver economy has consistently grown between 2016 and 2020. In 2020, it reached RMB 5.4 trillion (US$744 billion) and is projected to grow to RMB 12 trillion (US$1.6 trillion) by the end of 2023.

The “new” elderly: Changes in attitude

China’s older generation has undergone a noticeable transformation in recent years, displaying a departure from their traditional reputation for frugality and home-centered lifestyles focused on grandchild care. Instead, the “new” older generation now possesses both financial resources and leisure time, demonstrating a more adventurous and resourceful approach to enjoying their golden years.

This shift can be attributed to a heightened emphasis on health consciousness and a desire to maintain a youthful appearance. Older individuals are actively investing in healthy foods and supplements, with health supplements ranking high on the wish lists of Chinese tourists and being popular gifts among older people in China.

Additionally, both men and women in this generation seek to appear younger by dyeing their hair and availing themselves of beauty treatments. In addition to these aesthetic procedures, this cohort is also purchasing more cosmetics and jewelry, benefiting both domestic and foreign luxury brands. Further, the increased wealth of the older generation has stimulated growth in wealth management, financial planning, and insurance sectors. With greater savings and disposable income, this generation has a greater demand for services that safeguard their financial well-being in retirement and facilitate the transfer of wealth to future generations.

Elderly individuals’ preferences regarding retirement have undergone noticeable changes, as more of them are now choosing to spend their later years in senior homes instead of relying on their children for care. This shift is primarily driven by the desire for a comfortable and hassle-free lifestyle. These homes cater to their needs and provide a high standard of living. They are often constructed by real estate companies, specifically designed for older consumers, and offer a range of amenities and services tailored to their preferences.

Additionally, to meet the demand for upscale senior facilities, some former upscale hotels in suburban areas have been transformed into luxury senior homes, providing a sophisticated and elegant environment for retirees to enjoy their golden years.

Consumption patterns of China’s elderly population

The main consumption patterns of China’s elderly population can be grouped into two categories: daily consumption (39.1 percent) and health-related consumption (40.9 percent). The senior population faces more health issues, and as a result, health consumption has become their primary focus. When it comes to health consumption, the silver-haired population is not only concerned about healthcare but also increasingly emphasizes disease prevention. Especially due to the influence of the COVID-19 pandemic, health awareness has become increasingly popular among people at large.

In relation to this, preventive health services, such as physical examinations, will have significant room for growth. Industry data reveals that over 80 percent of China’s elderly population with a monthly disposable income exceeding RMB 15,000 (US$2,067), are more likely to have regular health checkups for longer periods of time (over five years), and likewise, 40 percent of those living in top-tiers cities exhibit the same patterns. It is evident that regular physical examinations require a certain amount of time, economic costs, and medical support. Therefore, the high-income population in first- and second-tier cities can sustain regular physical examinations for a longer period of time due to their subjective willingness and objective conditions.

Key sectors and opportunities within China’s silver economy

Eldercare and senior home facilities

China’s silver economy places significant importance on eldercare services and facilities, which are essential for supporting and caring for the elderly population. This encompasses a wide range of services, including nursing homes, assisted living facilities, home care services, and rehabilitation centers. As the aging population continues to expand, there is a rapid increase in the demand for high-quality eldercare services. Indeed, China’s eldercare market is predicted to reach US$800 billion by 2025 and to exceed US$3 trillion by 2030.  Evergrande Health (formerly known as China Evergrande Group) is one of the major players in China’s eldercare industry. They have invested heavily in developing senior living communities and have plans to construct over 1,300 eldercare projects across the country. Country Garden Holdings, a prominent real estate developer, has also entered the eldercare sector by constructing senior care facilities, assisted living apartments, and medical centers. Other notable domestic players in the industry include Poly Group Corporation, China Resources (Holdings) Co., Ltd., and Sino-Ocean Group Holding Limited, among others.

Evergrande Health (formerly known as China Evergrande Group) is one of the major players in China’s eldercare industry. They have invested heavily in developing senior living communities and have plans to construct over 1,300 eldercare projects across the country. Country Garden Holdings, a prominent real estate developer, has also entered the eldercare sector by constructing senior care facilities, assisted living apartments, and medical centers. Other notable domestic players in the industry include Poly Group Corporation, China Resources (Holdings) Co., Ltd., and Sino-Ocean Group Holding Limited, among others.

There are also significant examples from foreign players. Brookdale Senior Living has expanded its operations to China, partnering with local developers to establish senior living communities and provide professional eldercare services. Orpea Group, a European company specializing in elderly care, operates a network of nursing homes and assisted living facilities in China, offering a range of services and specialized care for the elderly.

Elder medical devices and technology

Another key sector of China’s silver economy is represented by the development and application of medical devices and technology tailored for the elderly. These advancements in elder medical devices and technologies are designed to enhance the health, well-being, and independence of older individuals. In particular, against the backdrop of an aging population, the industry expects the market for household medical devices to expand, with the domestic market size exceeding RMB 380 billion (US$52.64 billion) by 2025.

To exemplify the progress in this sector, one notable area of development is the adoption of remote monitoring systems. These systems utilize cutting-edge technology to enable healthcare professionals to remotely monitor the vital signs and health status of elderly individuals, providing real-time feedback and intervention when necessary.

This not only ensures prompt medical attention but also allows older adults to maintain their independence and age comfortably in their own homes. Reputed brands include Xiaomi, which has developed a wide range of such products. Also, Philips offers a range of remote monitoring devices and systems that enable healthcare professionals to remotely track and assess the health status of senior individuals.

Elder products and lifestyle needs

Elder products and lifestyle needs are important components of Chinese seniors’ spending habits. This thriving market includes various offerings, such as home modifications for accessibility, assistive technologies, specialized clothing, personal care products, and nutritional supplements.

The demand for home modifications that ensure accessibility and safety for the elderly is on the rise. These modifications encompass the installation of features like handrails, ramps, and grab bars, as well as the adaptation of bathrooms and kitchens to accommodate mobility challenges. By creating age-friendly living spaces, older individuals can enjoy enhanced independence and navigate their homes comfortably.

Assistive technologies play a vital role in the silver economy, providing practical solutions to support the elderly in their daily lives. This includes devices like mobility aids, hearing amplifiers, vision enhancement tools, and smart home automation systems. These technologies assist in improving mobility, communication, and overall well-being, enabling older adults to maintain an active and fulfilling lifestyle. Recognizing the immense potential of the silver economy, businesses in China are actively developing products that cater to the unique requirements of older individuals.

Key players in this market include domestic companies, such as Songzi Innovation, which specializes in smart home solutions for the elderly, and Suncare Group, a leading provider of healthcare and personal care products for seniors. International brands like Philips, with its range of medical devices and healthcare solutions, and Kimberly-Clark, offering a diverse portfolio of personal care products, are also making significant contributions to the market.

Culture and entertainment for the elderly

Acknowledging the significance of social engagement, mental stimulation, and cultural experiences in enhancing the well-being of the elderly, the culture and entertainment sector has also emerged as a key component of China’s silver economy.

This sector is dedicated to offering a diverse array of activities, events, and entertainment options tailored to the unique preferences and needs of older individuals. Organized tours are a popular feature of the culture and entertainment sector, allowing seniors to explore various destinations and engage in enriching experiences. These tours encompass visits to historical sites, scenic spots, and cultural landmarks, providing opportunities for older adults to broaden their horizons and deepen their understanding of China’s rich heritage.

Social clubs specifically designed for the elderly play a vital role in fostering social interaction and a sense of community. These clubs offer a platform for older individuals to connect, share experiences, and engage in meaningful conversations. They often organize social gatherings, group activities, and educational sessions, creating a supportive environment where seniors can form new friendships and maintain an active social life.

Arts and crafts workshops provide older adults with creative outlets and opportunities for self-expression. These workshops cover a wide range of artistic disciplines, including painting, calligraphy, pottery, and handicrafts. By participating in these activities, older individuals can tap into their artistic talents, stimulate their cognitive abilities, and experience a sense of accomplishment.

Music and dance performances tailored for the elderly are also a significant component of the culture and entertainment sector. These events showcase a variety of genres and styles, ranging from traditional Chinese music to contemporary performances. By attending these concerts and performances, older adults can immerse themselves in the beauty of music, dance, and artistic expression, uplifting their spirits and promoting emotional well-being.

Policy trends and supportive measures for foreign investors

The Chinese government is well aware of the demographic challenges and has been implementing a range of policies and supportive measures to foster the growth of the silver economy while addressing the challenges faced by the elderly.

A key example is the facilitation of foreign investment in the eldercare sector, where the Chinese government has implemented favorable policies and incentives. The 2014 Eldercare Foreign Investment Circular stipulates that eldercare institutions with foreign investments enjoy the same preferential tax policies as domestic ones. In addition, policies such as the 2015 Implementing Opinions on Private Participation in Eldercare provide benefits like tax exemptions, administration levy reductions, and increased allocation of state lottery welfare funds.

The government has also focused on promoting job opportunities and educational programs to enhance the quantity and quality of workers in the industry.

In 2016, the Chinese government announced its intention to fully open the elderly care market to foreign investment by the end of 2020. Later in mid-2018, eldercare institutions were removed from the Special Administrative Measures (Negative List) for Foreign Investment Access (Edition 2018), which means that foreign investors had been allowed to establish wholly foreign-owned eldercare institutions since then. Additionally, in October 2021, the Chinese government released its Development Action Plan for the Smart Elder Care Industry (2021-2025), outlining the specific smart products and services required for elderly care. These include:

- Wearable devices and self-service health testing equipment for monitoring vital signs;

- Rehab training equipment such as exoskeleton robots;

- Smart care products like handling robots and smart nursing beds;

- Telemedicine solutions; and

- Comprehensive health management solutions.

More recently, the Ministry of Commerce issued the 2022 Catalogue of Encouraged Industries for Foreign Investment, which encourages foreign capital to invest in various sectors of the elderly care industry. This includes manufacturing intelligent health and elderly products, providing elderly services, and offering professional education related to senior care services.

These legislative reforms have created a favorable environment for foreign companies to enter the Chinese market. For instance, Columbia Pacific Management, an American-based company, partnered with Temasek, a Singaporean investment fund, to establish a joint venture named Columbia China. This joint venture operates senior living facilities and hospitals in China, with a portfolio that includes a hospital, two clinics, and three senior living facilities. They have further expansion projects underway, demonstrating the opportunities available for foreign investors in the growing Chinese eldercare industry.

Key takeaways

All in all, China’s silver economy presents a wealth of opportunities for domestic and foreign companies alike. The country’s rapidly growing elderly population, coupled with changing attitudes and consumption patterns of the older generation, has created a dynamic market with significant potential for various industries.

Key sectors within China’s silver economy include eldercare services and facilities, elder medical devices and technology, elder products and lifestyle needs, and culture and entertainment for the elderly. These markets are experiencing robust growth and offer avenues for investment and innovation.

Moreover, collaboration between foreign and Chinese entities is becoming more common in core innovation in areas such as materials, pharmaceuticals, and healthcare. This collaboration allows companies to gain a competitive edge and access jointly developed intellectual property.

About Us China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Trademark Registration in Hong Kong: A Primer

- Next Article China and Honduras Establish Diplomatic Relations (updated)