Understanding How China’s VAT Reform Has Affected the Real Estate and Construction Sectors

By Dezan Shira & Associates

Editor: Jake Liddle

Effective as of May 1, China completed the last step in its extensive business tax to VAT reform by extending the previous pilot programs to cover the remaining sectors of finance, life services, property and construction. The reform was initiated with the aim to reduce the tax burden of businesses, with an estimated 97 percent of tax payers to pay less tax with savings of over RMB 300 billion.

Previously, the real estate and construction industries were subject to three and five percent business tax (BT) respectively, but both are now subject to 11 percent VAT. There is no value in making a direct comparison between the two, however, as VAT is assessed on a net basis, and BT on a gross basis.

Preferential Policies

Under the BT system, real estate and construction were the biggest sources of China’s tax income and the most economically sensitive to the reform, primarily because of the proportionately greater change in rates between BT and VAT. In order to ensure the smooth transition to the VAT system, the government has introduced a number of policies, which we highlight below.

Transitional policies

Entities who fall into any of the following criteria may enjoy the simple taxation method of five percent:

- General taxpayers developing a real estate enterprise.

- Selling self-developed construction projects with a starting date before April 30, 2016.

- General taxpayers renting real estate acquired before April 30, 2016.

This policy, which prevents a sudden jump to the 11 percent VAT, allows older projects to continue to enjoy the same rate as the previous BT. New properties (those sold after May 1) are subject to 11 percent VAT. However, this policy does not apply to the sale of private properties.

RELATED: Tax and Compliance Services from Dezan Shira & Associates

RELATED: Tax and Compliance Services from Dezan Shira & Associates

VAT input credit for land use rights purchase

Developers looking to sell real estate are able to deduct proceeds of land use rights purchased from the local government from their VAT liability. This policy only applies to entities which pay the 11 percent VAT rate, and not those who have enjoyed the above simplified taxation method. It ensures that the tax is only levied on the value added by the developer.

VAT exemption for sales of occupied or residential investment properties owned for less than two years

Sales of residential properties owned by an individual are subject to the five percent simple VAT taxation method if sold within two years of purchase. If sold after two years of purchase, they are VAT exempt. (Note – this does not apply to high end properties located in Beijing, Shanghai, Guangzhou or Shenzhen, where the five percent simplified VAT taxation method applies to the net gain after two years). This policy offers the same rate as under the BT scheme, encouraging longer term holdings of real estate.

Staged input VAT credit for property purchases levied at 11 percent

VAT credit may normally be claimed by a general taxpayer in a VAT return on real estate purchased after May 1, 2016 and is subject to 11 percent VAT. However, a special policy exists which allows the input VAT credit to be spread over the two-year period after the purchase. 60 percent of the input VAT credit is claimable within the first year, with the remaining 40 percent claimable in the second year.

VAT paid under simplified tax method creditable where recipient is a general VAT taxpayer

China’s VAT reform law indicates that suppliers who are already general VAT taxpayers might be able to issue special VAT invoices by themselves, or must obtain authorization of a tax authority to issue a special VAT invoice on their behalf. However, it is not clear as to whether it will only apply to sales of real estate, or also to leases.

Real Estate Leasing

As mentioned above, leasing of real estate may be subject to a reduced VAT rate depending on category of taxpayer, explained in further detail below:

General taxpayer:

- For real estate obtained before April 30, a general taxpayer can choose the simple VAT rate of five percent.

- For real estate obtained after May 1, the VAT rate is 11 percent.

Small-scale taxpayer:

- For non-residential accommodation rented out by a small-scale taxpayer or individual business taxpayer, the VAT rate is five percent.

- For residential accommodation rented by an individually owned business taxpayer, the VAT calculation method is gross rental income ÷ (1+5%) × 1.5%

Natural person taxpayer:

- For non-residential accommodation rented out by a natural person, the VAT rate is five percent.

- For residential accommodation rented out by a natural person, the VAT calculation method is gross rental income ÷ (1+5%) × 1.5%

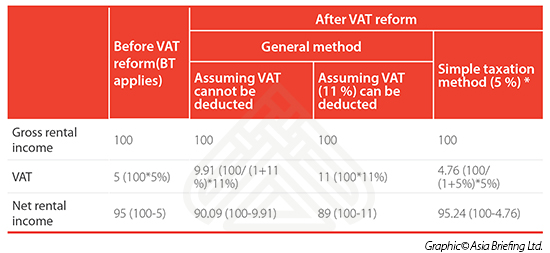

The below table analyzes the net income according to the varying tax rates before and after the VAT reform:

* The simplified VAT method is optional, but not a requirement. Once a choice is made, it cannot be retracted by the taxpayer for the period of three years. Input VAT cannot be deducting from output VAT.

For further information on how the new VAT reform will impact your business in China, please contact one of our experts here.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Tax, Accounting, and Audit in China 2016

Tax, Accounting, and Audit in China 2016

This edition of Tax, Accounting, and Audit in China, updated for 2016, offers a comprehensive overview of the major taxes that foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China-based operations.

Annual Audit and Compliance in China 2016

Annual Audit and Compliance in China 2016

In this issue of China Briefing, we provide a comprehensive analysis of the various annual compliance procedures that foreign invested enterprises in China will have to follow, including wholly-foreign owned enterprises, joint ventures, foreign-invested commercial enterprises, and representative offices. We include a step-by-step guide to these procedures, list out the annual compliance timeline, detail the latest changes to China’s standards, and finally explain why China’s audit should be started as early as possible.

China Investment Roadmap: the Commercial Real Estate Sector

China Investment Roadmap: the Commercial Real Estate Sector

In this issue of China Briefing, we explore the latest trends in commercial real estate in China, and discuss how foreign companies can benefit from China’s massive construction boom. We provide a guide to how firms can sell construction materials in China, and finally detail how foreign architects can most effectively enter and take advantage of China’s rapid urbanization.

- Previous Article Changing Registered Company Address in China: Effects of the New Integrated Business License

- Next Article Shifting Gears: Investing in China’s Electric Vehicles Market