The China Alternative – Bangladesh

The China Alternative is our series on other manufacturing destinations in Asia that are now starting to compete with China in terms of labor costs, infrastructure and operational capacity. In this issue we look at Bangladesh.

The China Alternative is our series on other manufacturing destinations in Asia that are now starting to compete with China in terms of labor costs, infrastructure and operational capacity. In this issue we look at Bangladesh.

By Teja Yenamandra

Mar. 18 – The tradeoff between risk and reward is one that every businessman faces. This is true everywhere – in OECD states, in China, in India, and is especially the case in Bangladesh.

Bangladesh’s government has one of the highest failure rates of any country, switching between civilian government and military rule. Corruption is endemic—Bangladesh’s ranking on Transparency International’s Corruption Index has remained approximately the same as Pakistan’s – notorious for its high levels of graft – for a number of years. As a result, civil strife and the threat of terrorism remains a concern.

Bangladesh is also highly susceptible to natural disasters – i.e. cyclones and major floods – with reports suggesting that 17 percent of Bangladesh will be underwater by 2050 due to rising sea levels. This has taken a toll on its already poor infrastructure. Railway and roads are not a reliable means to transport goods, leaving only air transport, however costly.

Surprisingly, though, Bangladesh, as nation, has consistently encouraged foreign investment roughly since its inception. The state declared its independence from Pakistan in 1972, and The Foreign Investment (Promotion and Protection) Act was passed in 1980. Since then, The Civil Procedure Code Act of 2002, which facilitated arbitration procedures for foreign firms, was passed. One goal that’s remained consistent throughout Bangladesh’s various political regimes, whether civilian or otherwise, has been their continued support for foreign investment, particularly in the form of foreign-direct investment, or FDI.

The World Bank Doing Business Index places Bangladesh 28 countries behind its regional neighbor China in the ease of conducting business, meaning bureaucratic procedures involved in setting up a company and paying taxes are not significantly more cumbersome. Moreover, given Bangladesh’s relatively low level of development, operating costs in monetary sense are comparably inexpensive. In Bangladesh, mean wages were US$0.58 per man-hour in 2009, compared to US$19 in Shanghai, China according to estimates made by the International Monetary Fund. And, given China’s continued development, such wage growth has shown zero signs of abating.

Bangladesh’s huge supply of unskilled labor places it squarely on the low-end of the value chain, with textiles making up more than three-fourths of the nation’s export revenue. In 2009, Bangladesh overtook India in apparel exports in 2009, with its exports at US$2.66 billion, ahead of India’s US$2.27 billion. The World Trade Organization ranked it as the fourth-largest clothing exporter worldwide. On the other hand, two-thirds of Bangladeshis are farmers, and the country is a significant producer of rice (4th largest producer), mango (9th), onion (16th), banana (17th), and potato (11th).

The textile sector is mainly centered in export processing zones in Dhaka and Chittagong. These zones, administered by the Bangladesh Export Processing Zone Authority, offer preferential investment policies.

Such policies include:

- 10 year tax holidays

- Duty free import of capital goods, raw materials and building materials

- Exemptions on income tax on salaries paid to foreign nationals for three years

- Dividend tax exemptions for the period of the tax holiday

For more specific information, visit the Bangladesh Export Promotion Bureau web site. Other EPZs include: Adamjee, Chittagong, Comilla, Dhaka, Ishwardi, Karnaphuli, Mongla, and Uttara.

All goods produced in these EPZs are exported duty free. Bangladesh imposes no investment ceiling within the EPZs and allows profits to be fully repatriated as well. The formation of labor unions and strikes are also prohibited.

Moreover, Bangladesh can serve as a launching point into the rest of South Asia. In 1993, the South Asian Association for Cooperation signed an agreement to gradually lower tariffs within the region. Eleven years later, at the association’s summit in Islamabad, countries devised the South East Asia Free Trade Agreement, which created a framework for the establishment of a free trade area covering 1.4 billion people. This agreement went into force on January 1, 2006. By the end of 2016, the creation of a duty-free trade zone will be complete.

The road and highway network in Bangladesh provides the most significant hindrance to the development of the country. While the country has 239,226 kilometers of roads, less than 10 percent of them are paved. Dhaka, the capital and most populous city, is considered one of the world’s most congested urban centers in the world.

Over the past few years, the reliability and standards of Bangladesh’s railway system (a state-owned monopoly) have deteriorated as well. While Bangladesh Railways has over 2,855 kilometers of track and employs over 34,168 people, the volume of both freight and passengers utilizing the rail is growing beyond the company’s capacity. Half of the railway is single-track lanes, a hindrance which increases the likelihood of delays and rail accidents. On the upshot, the government has put into place a seven-year US$924.5 million plan to modernize the rail system.

On the positive side, Bangladesh has one the largest inland waterway networks in the world. The network transports over 40 percent of the country’s foreign trade and acts as a link to the more rural parts of the country.

The international air links to Dhaka have received improvement in the last few years as well, making domestic flights one of the more reliable ways to travel. There are over 17 operational airports, 15 of which have paved runways with modern facilities. Additionally, the country has three international airports with over 20 international airlines. There are direct flights from Guangzhou to Dhaka, and there is a growing trend of especially garment manufacturers and related parts of the textiles industry relocating to Bangladesh from South China.

Nevertheless, a number of large and profitable local businesses and multinationals such as Beximco, Square, Akij Group, Ispahani, Navana Group, Transcom Group, Unocal Corporation and Chevron have made major investments, with the natural gas sector and other aspects of infrastructure being a top priority for public-private partnerships.

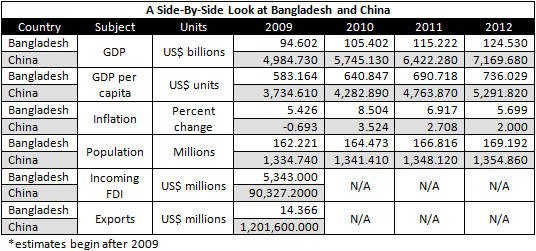

In a straight comparison between China and Bangladesh, Bangladesh’s GDP is equivalent to approximately that of Shanghai. But as the chart demonstrates, that development came at a price, and a hefty one at that, for manufacturers seeking low-cost alternatives for production.

Teja Yenamandra is a research analyst with Dezan Shira & Associates. The practice has a partner firm in Dhaka. Businesses interested in Bangladesh may contact info@dezshira.com for assistance.

Related Reading

The China Alternative

The China Alternative

Our complete series on other manufacturing destinations in Asia that are now starting to compete with China in terms of labor costs, infrastructure and operational capacity.

China’s Neighbors

China’s Neighbors

This unique book is an introductory study of all 14 of China’s neighbor countries: Afghanistan, Bhutan, India, Kazakhstan, Kyrgyzstan, Laos, Myanmar, Mongolia, Nepal, North Korea, Pakistan, Russia, Tajikistan and Vietnam.

Operational Costs of Business in China’s Inland Cities

Operational Costs of Business in China’s Inland Cities

It is widely held that land and labor costs in inland provinces offer quite significant cost savings over major east coast and southern cities. In this issue, we take a quick look at the numbers behind these beliefs.

Coastal China, Inland China, India or Vietnam for Your Sourcing Business?

- Previous Article New German-Language China/Asia Book Released

- Next Article China Industry Report: March 21