Tax Considerations for Your Software Business Structures in China

By Dezan Shira & Associates

Editor: Jake Liddle

It is important for a company to plan its business structure carefully when taking advantage of China’s tax incentives, especially when selling software products. Companies that utilize an incorrect tax model are subject to hefty penalties. In this article, we present a case study and risk management techniques that companies can employ to enjoy China’s lucrative tax incentives for software businesses while ensuring tax compliance.

Tax Incentives for Selling Software in China

China’s State Administration of Taxation (SAT) offers an extremely attractive incentive to producers of software products in the country. According to the SAT, general taxpayers that sell personally developed software products with a tax burden surpassing three percent of VAT are eligible for a tax refund. This incentive applies to the following software products and conditions, subsequent to approval and examination of relevant tax authorities:

- Those with examination certification material issued by the software examination organization which has been approved by the provincial software industry regulatory department.

- Those with a software product registration certificate issued by the software industry regulatory department, or computer software copyright registration certificate issued by the copyright administrative department.

The SAT further states that taxpayers selling software products while receiving income from software installation, maintenance and training fees are subject to VAT according to the provisions of mixed sales. They can also enjoy the software product VAT rebate policy.

Meanwhile, income from maintenance, technical services or training fees for software products already purchased are classed as ‘software services’ under IT services, which are taxed at a lower tax rate of six percent, but are not eligible for the VAT refund after collection.

RELATED: Tax and Compliance Services

RELATED: Tax and Compliance Services

Case Study

The following is a typical example of how companies in China will attempt to enjoy the above tax incentives, but which can in fact result in a heftier tax bill.

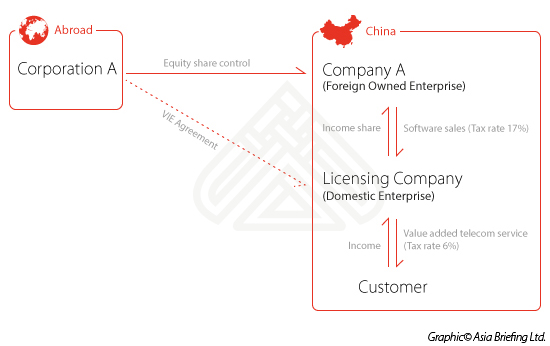

Company A provides software for civil use, online social media services, advertising services and online games. The company made profit by providing paid services to consumers via their free software. In China, such business is counted as a value added telecoms service (VATS) which refers to utilization of a public network infrastructure to provide additional telecommunications and information services.

However, as Company A is a foreign-owned enterprise, it is extremely difficult for it to obtain a VATS permit, which means it will be unable to directly access the Chinese market.

In order to work around this restriction, Corporation A entitled certain shareholders (Chinese nationals) to establish a domestic licensing company within China, which allowed Company A to control the licensing company’s operation and share in its gains. According to the contract signed by Company A and the licensing company, Company A carried out software development and marketing services (i.e., provide product for the licensing company’s VATS services), while the licensing company provided the VATS operating platform. Income earned via the licensing company was split according to an agreed proportion, with over 70 percent going to Company A.

While the licensing company issued invoices to the consumer under “providing VATS,” taxable by six percent, Company A issued a false invoice as ‘selling software’ to the licensing company, taxable by 17 percent , which later was deemed by the tax bureau as “providing a software service (taxable by six percent).” The benefit of issuing a 17 percent invoice means that both Company A and the licensing company can enjoy substantial tax deductions. While Company A can reduce their actual tax burden to three percent VAT rate due to the software tax incentive initiative, the licensing company was able to use their input tax of 17 percent to deduct their output tax of six percent, thereby cancelling out their tax burden and resulting in no payable tax. Tax authorities identified the false invoice claim issued by Company A and backlogged all payable tax.

Risk Management

In order to avoid such a penalty, it is necessary to issue correct invoices for relevant services. It is at the discretion of the tax authorities to determine the difference between ‘selling software’ and ‘providing software services’ when investigating incorrect tax practices. Therefore, there is significant risk for software companies when navigating tax structures.

James Zheng, Tax Specialist at Dezan Shira & Associates, comments: “When determining income from software services or software sales, there are a few points that should be taken heed of:

- Whether or not the sale shifts the reproduction rights and usage authorization of the software product to the consumer;

- Whether or not the income derived from sales is based on payment for obtaining the software product’s reproduction and usage rights.

Take the case study as an example: a free internet software download does not count as a software sale because the downloader makes no payment. Because the downloaders pay fees to the software providers in order to get better service in the future, this evidently falls under the category of software service.”

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

Tax, Accounting, and Audit in China 2015

Tax, Accounting, and Audit in China 2015

This edition of Tax, Accounting, and Audit in China, updated for 2015, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China operations.

Selling, Sourcing and E-Commerce in China 2016 (First Edition)

Selling, Sourcing and E-Commerce in China 2016 (First Edition)

This guide, produced in collaboration with the experts at Dezan Shira & Associates, provides a comprehensive analysis of all these aspects of commerce in China. It discusses how foreign companies can best go about sourcing products from China; how foreign retailers can set up operations on the ground to sell directly to the country’s massive consumer class; and finally details how foreign enterprises can access China’s lucrative yet ostensibly complex e-commerce market.

Internet Challenges & Solutions When Doing Business in China

Internet Challenges & Solutions When Doing Business in China

In this special edition of China Briefing magazine, we highlight how and why foreign companies will be negatively affected by China’s internet, and provide methods to help solve these problems. We discuss ISP selection, internet connection types, CDNs and VPNs, and internal control systems. Finally, we examine the importance of network security in China and how it can help augment a company’s internet connection.

- Previous Article Transfer Pricing in China – New Report from Dezan Shira & Associates

- Next Article Tax Practice: Applying for Tax Benefits under International Tax Treaties in China