Shenyang EU Economic / Techinical Development Zone

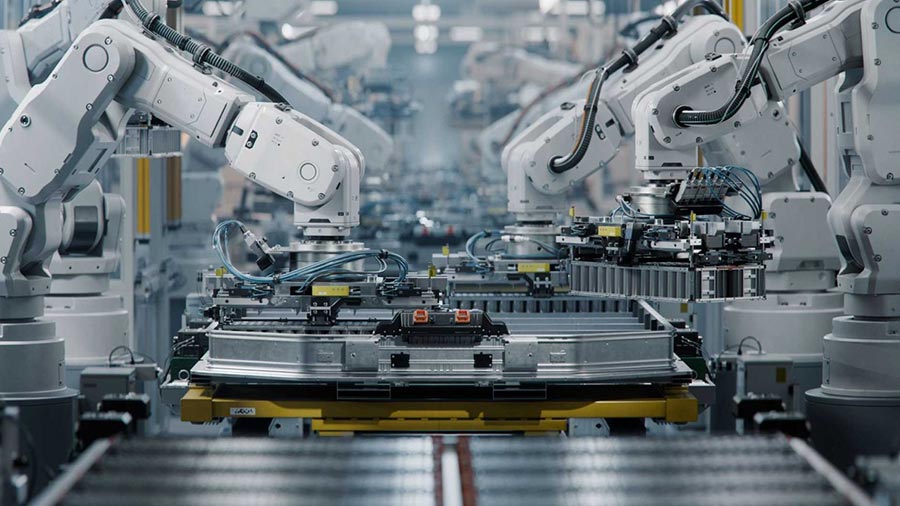

The Shenyang EU Economic Development Zone is a new project conceived by the Shenyang Municipal Government and located in the northeast part of Shenyang, 15 kilometers from the central business district. It covers an area of 12 sq. km, 5 sq. km of which is expected to be completed by the end of this year. This is the first development zone to focus on providing facilities for companies investing from the European Union. Capitalizing on the existing presence of large European manufacturers like Michelin and BMW, the park aims to build the best automobile electronic parts and advanced equipment manufacturing base in the north of China. It is expected that the manufacturing of vehicle parts will take up 8 to 10 sq. km of the space in the development zone.

The Shenyang EU Economic Development Zone is a new project conceived by the Shenyang Municipal Government and located in the northeast part of Shenyang, 15 kilometers from the central business district. It covers an area of 12 sq. km, 5 sq. km of which is expected to be completed by the end of this year. This is the first development zone to focus on providing facilities for companies investing from the European Union. Capitalizing on the existing presence of large European manufacturers like Michelin and BMW, the park aims to build the best automobile electronic parts and advanced equipment manufacturing base in the north of China. It is expected that the manufacturing of vehicle parts will take up 8 to 10 sq. km of the space in the development zone.

As the capital city of Liaoning Province and largest city in the whole region, Shenyang is developing into the economic, cultural and trading center of northeast China. At present Shenyang has opened up more than 20 international airline routes to several countries and regions including South Korea, Hong Kong and Japan. Most produce for export goes through the port of Dalian, which remains the largest port in the region. However Yingkou Port, the nearest port to Shenyang, is also developing fast and exports products to more than 20 countries including Japan, South Korea, Singapore, Malaysia, the Philippines, Australia, the United States, Canada, Italy and Hong Kong.

In addition to national tax incentive policies – soon to be drastically revised – there are also various tax incentives available to companies investing in the region. These fall into three categories:

1. Preferential tax policies granted to the northeast industrial region by the State

- For VAT taxpayers who mainly operate in equipment manufacturing, petrochemicals, metallurgy, shipping, automobile manufacturing, and agricultural products processing, input tax incurred from purchase of fixed assets, purchase of cargos for manufacturing self-use fixed assets, or transportation fees paid relating to fixed assets is allowed to be deducted from VAT payable for the year. If there is no new VAT incurred or the amount is not enough to offset the input VAT, the balance can be brought forward to offset in future years.

- For manufacturing enterprises, fixed assets (excluding houses and buildings) can be depreciated using a life of no less than 60 percent of the current stipulated depreciated life. Intangible assets can be amortized at a life of no less than 60 percent of the current stipulated amortization life.

2. Preferential tax policies granted to Shenyang

- A multinational company which establishes its regional headquarters in Shenyang is eligible for a subsidy of RMB0.5 million to cover part of its launching expenses; a multinational company which establishes its national headquarters in Shenyang is eligible for a subsidy of RMB1 million to cover part of its launching expenses.

- A foreign enterprise which establishes a branch or office in Shenyang is eligible for a subsidy of RMB0.1 million to cover part of its launching expenses. A foreign enterprise with a newly-established headquarters qualifies for a rebate of 15 percent of its contribution to the regional finances for the year; 30 percent of the contribution increase for the following year may also be rebated.

3. Preferential tax policies granted to the Shenyang European Union Economic/Technical Development Zone

- For investments with a large-scale of investment and contributing significantly to the local economy, a competitive low price may be granted for the land transfer.

- For investors who want to lease a factory, rent can be exempted for the first year and reduced by 50 percent for the second year.

Dezan Shira & Associates maintain an office in the Northeast Chinese city of Dalian, advising investors on legal administration, corporate establishment, due diligence and tax policy. Please contact Adam Livermore or visit the Dalian office website for more information.

- Previous Article New developments for foreign trade companies inside the Yantian and Futian FTZs

- Next Article Compensation payments for deceased employees in Dalian