Setting Up a Wholly Foreign-Owned Enterprise (WFOE) in China

By Eunice Ku

Sept. 11 – A wholly foreign-owned enterprise (WFOE) is a company established in China according to Chinese laws and wholly owned by one or more foreign investors. A WFOE is a limited liability company, meaning that the liability of the shareholders is limited to the assets they brought to the business. Unlike the simpler representative office setup which is subject to a number of limitations, a WFOE can make profits and issue local invoices in RMB to its customers, which is crucial as invoices are the basis for obtaining tax deductions in China. Compared to a joint venture, a WFOE has greater freedom and independence, and can better protect its intellectual properties. It can also employ local staff directly, without obligation to employ services from employment agencies. Although there is no legal restriction on the number of foreigners a WFOE can employ, in practice the number of foreign employees does depend on the amount of registered capital (discussed below) that the respective company injects.

Sept. 11 – A wholly foreign-owned enterprise (WFOE) is a company established in China according to Chinese laws and wholly owned by one or more foreign investors. A WFOE is a limited liability company, meaning that the liability of the shareholders is limited to the assets they brought to the business. Unlike the simpler representative office setup which is subject to a number of limitations, a WFOE can make profits and issue local invoices in RMB to its customers, which is crucial as invoices are the basis for obtaining tax deductions in China. Compared to a joint venture, a WFOE has greater freedom and independence, and can better protect its intellectual properties. It can also employ local staff directly, without obligation to employ services from employment agencies. Although there is no legal restriction on the number of foreigners a WFOE can employ, in practice the number of foreign employees does depend on the amount of registered capital (discussed below) that the respective company injects.

The Chinese government’s initial aim in permitting the establishment of WFOEs in 1986 was to introduce advanced technology into China and to encourage export-oriented manufacturing activities. Since then, the scope of business allowed to WFOEs has steadily increased.

After joining the World Trade Organization in 2001, WFOEs were allowed in consulting and management services, software, development and trading. Further sectors have been progressively opened up in the course of the past few years.

The fundamental legal bases for WFOEs are:

- Law on Foreign-invested Enterprises (“WFOE Law”), effective April 12, 1986 and subsequently revised on October 31, 2000;

- Implementing Rules of the WFOE Law, effective December 12, 1990 and subsequently revised on April 12, 2001; and

- Company Law, effective January 1, 2006.

WFOE Structures

There are three distinct WFOE structures:

- Service (or Consulting) WFOE;

- Trading WFOE (or Foreign-invested Commercial Enterprise, “FICE”); and

- Manufacturing WFOE.

While all three structures share the same legal identity, they differ significantly in terms of setup procedures, costs and the range of commercial activities in which they are allowed to engage. Trading WFOEs and Manufacturing WFOEs must derive the majority of their revenue from that main business, but can also provide associated services. Meanwhile, some Service WFOEs can also conduct trading activities related to their services.

When applying to set up a WFOE, the business scope must be specified in the application. The business scope is a one sentence description of the business activities in which a business will engage, and will appear on the business license. Note that the WFOE can only conduct business activities within its business scope and any amendments to the business scope require further application and approval, and can be quite time consuming. We include examples of the business scope for each WFOE setup below.

Service WFOE

A Service WFOE is a company that has as its core activity the provision of services to third parties. It is the easiest type of limited liability company to set up as it requires a shorter establishment time frame and a lower capital requirement compared to a Trading WFOE or Manufacturing WFOE. Below is an example of the business scope for a Service WFOE that provides technical services:

“To provide XXX technical services and consulting services for XXX technologies; technology transfer, technology consulting and technology development; and wholesale, import and export of related products associated with the provision of said technical consulting services and commission agency services (excluding auction) and other related services.”

Trading WFOE

To engage in import and export activities as well as domestic distribution (i.e., retail, wholesale and franchising trade activities) in China, a trading company – also known as a FICE – can be established. Trading WFOEs can combine different business activities, e.g., assembling and providing services. Below is an example of a business scope for a FICE:

“Wholesale, commission agency (excluding auction), import and export of XXX products; after-sales services; technology transfer; technology consulting; technology development and other business consulting services.”

Manufacturing WFOE

Manufacturing WFOEs refer to companies engaged in industries such as machine manufacturing and electronics; energy; building materials and construction; medical equipment; transportation; and animal and plant raising and breeding. A Manufacturing WFOE is required to rent a factory space as its registered address. The local Administration of Industry and Commerce (AIC) will physically check the factory space before registering the WFOE. In addition, Manufacturing WFOEs are required to obtain approval from the Environmental Protection Bureau. In some cases, a full report on the estimated environmental impact of the factory issued by an appointed agent is required, which is intended to ensure that manufacturing production processes comply with specified environmental norms. The Bureau will require information about the raw materials used, the machinery and equipment, consumption and safe disposal of toxic products. An example of the business scope of a Manufacturing WFOE is:

“Design, develop and manufacture XXX products and related parts and components, sale of self-manufactured products; wholesale, import and export of similar products and commission agency (excluding auction); provision of after-sale services and other associated services to the products; technical consulting, technical development and technology transfer.”

Registered capital

Registered capital is the initial investment into a company that is required to fund its business operations until it is in a position to fund itself. The absolute minimum capital requirements under Chinese law are RMB30,000 for multiple shareholder companies and RMB100,000 for single shareholder companies. In practice, however, the official requirements for registered capital vary by industry and region. With Manufacturing WFOEs, for example, the minimum registered capital is RMB1 million, subject to considerations such as factory size and equipment costs. Meanwhile, Service WFOEs generally require above RMB100,000 and FICE require above RMB500,000 for value-added tax purposes.

Generally, locally-obtained RMB cannot be injected as registered capital – it must be offshore RMB or RMB converted from foreign currency sent in from the overseas investor. Subject to approval from the relevant authority, a foreign investor can make capital contributions with RMB gained by other foreign-invested enterprises they have established in China.

RMB is not a freely convertible currency, so under China’s pre-existing foreign exchange administration regime, foreign investors have only been able to establish and capitalize an FIE using foreign currency, which would then be converted into RMB after the capital injection is finalized. However, as offshore RMB holdings have continued to grow, this old rule has come under pressure. Beginning in 2011, foreign investors were allowed for the first time to use offshore RMB holdings to capitalize or acquire a Chinese FIE, and to fund its operations by means of a cross-border RMB loan. Using offshore RMB to establish an FIE offers a number of advantages over the use of traditional foreign currency. For example, currently-held offshore RMB may be used without the expense of conversion, and exposure to volatility in foreign currency exchange rates may also be lessened. For companies heavily involved in cross-border trade and investment with China, these reasons alone may be enough.

Registered capital contributions can also be made in-kind (e.g., machinery and equipment, industrial property rights, know how). Any machinery and equipment contributed must be necessary to the production of the WFOE concerned and valuated at normal market price. A detailed list of valuated and priced items should be submitted as part of the application. When the machinery and equipment contributed arrive at a port in China, the WFOE should report to the commodity inspection authority in China and apply for an inspection, and an inspection report should be issued. In should be noted, however, that any industrial property rights or know-how contributed should not exceed 20 percent of the registered capital. It must also be owned by that foreign investor and valuated in accordance with general international principles.

The payment schedule of the registered capital should be specified in the WFOE application for establishment and its articles of association. The foreign investor can pay the capital contribution by installments, but the final installment should be paid up within three years following the issuance of the business license. The first installment should be no less than 15 percent of the capital contribution subscribed by the foreign investor, and paid up within 90 days of the issuance of the WFOE’s business license. After payment of each installment of capital contribution, the WFOE should engage a certified public accountant in China to verify and issue a capital verification report.

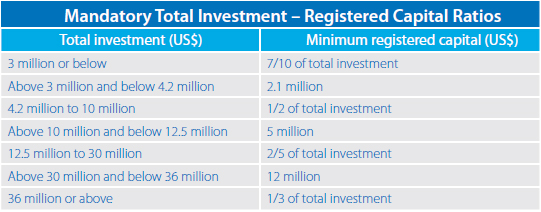

After the registered capital has been contributed, this amount cannot be wired out again freely. If a company wishes to expand its scope of business later on, there may be a requirement to increase the registered capital. In addition to the registered capital, a total investment figure also needs to be specified in the company’s articles of association. The total investment quota is the total amount of funds planned to be contributed to the project over its lifespan. The difference between registered capital and total investment represents the debt of the investment and can be made up by loans from the investor or foreign banks. The chart below shows the minimum registered capital amounts corresponding to the relevant total investment amounts.

China is currently implementing a “zero registered capital rule” for domestic companies in the cities of Shenzhen, Zhuhai, Dongguan and Shunde. Under the pilot rule, the AIC will not verify a company’s capital injection at the time of registration. This allows companies to complete the business registration process without the need to actually inject any capital. However, the method of capital injection, amount and schedule still need to be specified in the company’s articles of association. Although this policy currently applies only to Chinese enterprises, it could be expanded to cover foreign-invested enterprises in the future.

Registration process

The application process to create a company in China generally takes three to six months. The establishment process varies based on the WFOE form and the planned business scope. For example, a Manufacturing WFOE will require an environmental evaluation report, and Trading WFOEs will need to undergo customs/commodity inspection registration. The application process can be divided into two parts:

- Pre-registration – what happens before the company formally exists

- Post-registration – what happens after the company formally exists

Pre-registration

1. Name registration

The company name can be translated from English by meaning and/or phonetically. Verification of feasibility of the proposed name by the AIC will take a few working days. Only the Chinese name will be legally binding – the English name is not legally relevant for Chinese authorities. Note that the words “China” and “International” cannot be freely included in the Chinese name, and are subject to further requirements.

2. Issuance of approval certificate and temporary business license

The authorities will issue the approval certificate and temporary business license after assessing the following documentation:

From the investor:

- Business license (certificate of incorporation – depending upon locations, this may need to be notarized in the investor country of origin, and then translated into Chinese);

- Bank statement to demonstrate credit worthiness (from relevant bank in country of origin and translated into Chinese); and

- Photocopy of passport of the legal representative of the investor company.

From the new company:

- About the new business – Name of the company, business scope, registered capital, business term, lease contract;

- About the legal representative – Photocopy of passport and passport-size photos;

- About the directors – CVs, photocopies of passports, and passport-size photos;

- Feasibility study report – Outlining the estimated cash flow for the next three years;

- Articles of association; and

- Environmental protection evaluation report (if applicable).

The approval certificate will be issued by the local office of the MOFCOM. Upon issuance, there is a 30-day limit for registering the company with the AIC, which then issues the temporary business license.

Post-registration

Following the issuance of the temporary business license, the WFOE would need to perform a number of formal registrations at various Chinese government entities, including applying for carving various seals (or chops) in order to authorize documents on behalf of the company, as well as opening an RMB account for managing daily operating expenses and a foreign capital account for receiving foreign currency.

Portions of this article came from the September 2013 issue of China Briefing Magazine titled, “Using China WFOEs in the Service and Manufacturing Industries,” which is currently available as a complimentary PDF download on the Asia Briefing Bookstore until the end of this month. In this issue of China Briefing Magazine, we provide a detailed overview of the WFOE establishment procedures as well as outline the typical costs associated with running these entities in China. We hope that this information will give foreign investors contemplating entry into the Chinese market a better understanding of the time and costs involved.

Portions of this article came from the September 2013 issue of China Briefing Magazine titled, “Using China WFOEs in the Service and Manufacturing Industries,” which is currently available as a complimentary PDF download on the Asia Briefing Bookstore until the end of this month. In this issue of China Briefing Magazine, we provide a detailed overview of the WFOE establishment procedures as well as outline the typical costs associated with running these entities in China. We hope that this information will give foreign investors contemplating entry into the Chinese market a better understanding of the time and costs involved.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

This edition of the China Tax Guide, updated for 2013, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China operations.

Setting Up Wholly Foreign Owned Enterprises in China (Third Edition)

Setting Up Wholly Foreign Owned Enterprises in China (Third Edition)

This guide provides a practical overview for any business-minded individual to understand the rules, regulations and management issues regarding establishing and running a WFOE in China.

Establishing a Trading Company in China

- Previous Article China Adopts New Trademark Law

- Next Article China Releases 2012 Advance Pricing Arrangements Report