Selected Tax Incentives in China’s Renewable Energy Sector

Jun. 15 – With China’s new Foreign Investment Catalog pushing several additional green industries into the “encouraged” category and the 12th Five Year Plan declared the “greenest in history,” China is abuzz with talk about the green sector.

Jun. 15 – With China’s new Foreign Investment Catalog pushing several additional green industries into the “encouraged” category and the 12th Five Year Plan declared the “greenest in history,” China is abuzz with talk about the green sector.

Almost every article addressing China’s renewable energy sector mentions tax incentives as one of the key government methods to push forward sector development. While new tax incentives applicable to the green sector are continuously emerging and many types of incentives can apply, three major groupings of note are those specifically mentioned in the Corporate Income Tax Law and its implementing regulations, those directly targeted at high and new tech enterprises (which can include those in the green sector), and the value-added tax and business tax incentives for energy-saving service companies effective January of this year.

CIT three-year exemption + three-year half reduction

Revenues earned by energy conservation and water saving conservation projects, environmental protection and clean development mechanism projects are eligible for a three-year exemption and three-year 50 percent reduction in corporate income taxes.

Such projects could include technological renovation with respect to energy conservation and emission reduction, comprehensive exploitation and utilization of methane, as well as public sewage treatment, public garbage treatment and sea water desalination. Also eligible for this tax incentive is investment in and operation of infrastructure projects which have the major support of the State, including electric power and water conservancy projects.

The Corporate Income Tax Law and its implementing regulations provide other tax incentives to a number of areas in the green sector, including:

Purchases of environmental protection, conservation equipment

Where an enterprise purchases and actually utilizes any of the special-purpose equipment related to environmental protection, energy and water conservation and work safety, 10 percent of the investment in the special-purpose equipment may be offset against its tax payable for the current year. Where the tax payable is insufficient for the credit, the excess may be carried forward for credit in the following five taxable years.

Comprehensive use of resources

Where an enterprise uses any of the materials listed in the Catalogue of Income Tax Concessions for Enterprises Engaged in Comprehensive Resource Utilization as its major raw materials, the income it obtains shall be included in the total income at the reduced rate of 90 percent.

High and new tech enterprises

Many enterprises engaging in activities in the green sector are considered high and new technology enterprises, which can be granted a reduction in CIT tax liability.

In addition, high and new technology enterprises in special economic zones (Shenzhen, Zhuhai, Shantou, Xiamen and Hainan) or in Shanghai Pudong New District and founded after January 1, 2008, are eligible for tax holidays (first two years tax-free, subsequent three years taxed at 12.5 percent).

Among the requirements for being considered a high and new technology enterprise are:

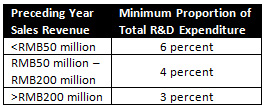

- Having a proportion of total research and development expenditure and its total sales revenue that accounts for at least 60 percent of the total revenue of the enterprise during the current year and a proportion from the immediately preceding three accounting years of (depending on sales revenue).

- Possessing independent intellectual property rights of the core technologies in its major products (services) by way of independent research and development, acceptance of transfer, donation or merger during the immediately preceding three years or through exclusive licensing for a minimum period of five years

- Conducting continuous research and development activities for purposes of making pioneering discoveries in science or technology (excluding humanities and social sciences), making creative use of new scientific and technological knowledge, or substantially improving technologies or products (services)

VAT exemptions/reductions

Products or services making a “comprehensive utilization of resources” through utilization of wastes as production inputs or energy-efficient processing have been eligible for VAT exclusion since 2008. This includes resources such as green building materials, combined heat and power pollutions, reclaimed waste-water.

Under the green building sector, VAT exemptions are given for selling self-manufactured products no less than 30 percent of waste residues in raw materials; an immediate rebate selling of self-manufactured recycled asphalt concrete produced from waste asphalt concrete; and immediate rebate (50 percent) on selling of self-manufactured environmentally-friendly new walling materials.

Wind turbine component importers and wind power equipment manufacturers also receive VAT benefits. Among the government tax incentives specifically targeted at this sector is an immediate VAT rebate (50 percent) applied to selling self-manufactured electric power generated from wind power.

Energy-saving services

Effective January 1, 2011, income earned by qualified energy-saving service companies engaging in energy management contracting projects is temporarily exempted from business tax. When an energy-saving service company transfers its taxable goods from qualified energy management contracting projects to energy-consuming enterprises, the value-added tax arising therefrom shall be temporarily exempted. Such companies are also eligible for the CIT three-year exemption + three-year half reduction.

Portions of this article were taken from the June 2011 issue of China Briefing magazine titled, “Foreign Investment in China’s Green Sector.” This issue is essential reading for anyone looking at China’s green tech market. To purchase the full version, priced at US$10 for immediate PDF download, please access the Asia Briefing Bookstore here.

Portions of this article were taken from the June 2011 issue of China Briefing magazine titled, “Foreign Investment in China’s Green Sector.” This issue is essential reading for anyone looking at China’s green tech market. To purchase the full version, priced at US$10 for immediate PDF download, please access the Asia Briefing Bookstore here.

Dezan Shira & Associates is a boutique professional services firm providing foreign direct investment business advisory, tax, accounting, payroll and due diligence services for multinational clients in China. The firm assists foreign enterprises take advantage of special tax incentives in the country. For advice, please email tax@dezshira.com, visit www.dezshira.com, or download the firm’s brochure here.

Related Reading

Doing Business in China

Doing Business in China

Our 156-page definitive guide to the fastest growing economy in the world, providing a thorough and in-depth analysis of China, its history, key demographics and overviews of the major cities, provinces and autonomous regions highlighting business opportunities and infrastructure in place in each region. A comprehensive guide to investing in China is also included with information on FDI trends, business establishment procedures, economic zone information, and labor and tax considerations.

The China Tax Guide (Fifth Edition)

The China Tax Guide (Fifth Edition)

This popular book, fully updated with all recent tax changes and amendments, details all taxes in China affecting businesses and individuals, how to calculate the amounts due, tax registration and filing procedures, tax minimization techniques, and claiming VAT rebates. It also details good financial management techniques, handling negotiations with the tax bureau and annual audit and compliance procedures.

- Previous Article China’s MOFCOM Clarifies Security Reviews for M&A Transactions

- Next Article An Overview of China’s Renewable Energy Market