Rising Demand, Supply Shortage to Cause Logistics Costs in China to Skyrocket

Rental rates of logistics properties across China expected to rise 20 percent this year

Mar. 24 – CB Richard Ellis, the world’s largest commercial real estate services firm, recently released a report describing how a more acute shortage of logistics land supply and a more rapid rate of appreciation of logistics rents will cause logistics costs in China to spike in the near future.

The report, “China’s Logistics: Rising Demand but a Shortage of Supply,” lists the major driving factors for logistics demand as:

- Manufacturing bases relocating to inland China

- Internal consumption hitting an all-time high

- Exports rebounding strongly after the Global Financial Crisis

- Vacancy rates for modern logistics facilities reaching historical lows

- Available land for logistics development becoming increasingly rare

“The confluence of the current supply-demand imbalance, the effects of rising fuel prices, increasing labor costs and escalating rental rates are likely to push logistics costs to record highs,” CBRE’s Executive Director of Industrial and Logistics Services Andrew Hatherley said. “The rental rates of logistics properties across China are expected to increase up to 20 percent this year.”

CBRE also explains in the report that since residential and commercial sites tend to command higher values than those fetched for industrial sites, local governments have a tendency to allocate residential and commercial zoning rather than industrial zoning when planning new development areas.

While offices, factories, and R&D facilities within industrial and high-tech parks are projects that will bring in revenue and boost employment, CBRE notes that the increase in business flow and employment directly resulting from the development of storage facilities is limited.

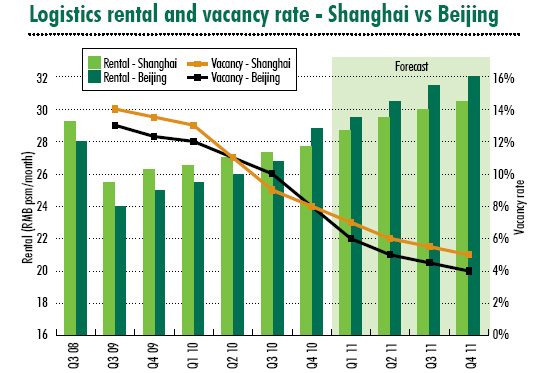

Consequently, Hatherley believes that demand for logistics space is expected to outstrip supply across the nation in the coming year, forcing rents to soar. He also says that the average logistics rents in Beijing are now higher than Shanghai.

“The appreciation of logistics rents and the shortage of land for logistics facilities poses a challenge for both the real estate sector and society as a whole, as logistics operators, retailers, and manufacturers will factor in higher storage costs in the pricing of goods,” Hatherley added.

The increase in storage costs, which accounts for roughly one-third of overall logistics costs, or 5.9 percent of the country’s GDP, will add further pressure to the already high rate of inflation in China.

Related Reading

Operational Costs of Business in China’s Inland Cities

Operational Costs of Business in China’s Inland Cities

It is widely held that land and labor costs in inland provinces offer quite significant cost savings over major east coast and southern cities. In this issue, we take a quick look at the numbers behind these beliefs.

Coastal China, Inland China, India or Vietnam for Your Sourcing Business?

- Previous Article IIT Due Date Fast Approaching for Expatriates Working in China

- Next Article The China Alternative – Thailand