Annual Confirmation for China IIT Special Additional Deductions Starts on December 1

From December 1, 2023, the annual confirmation for Individual Income Tax (IIT) special additional deductions begins. Individuals, including expatriates in China, should check their eligibility for these deductions.

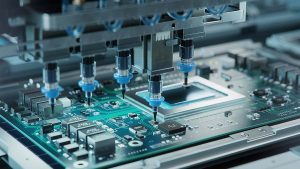

Understanding China’s New-Type Industrialization: An Explainer

We discuss why China’s new-type industrialization thrust is an opportune time for foreign businesses and investors looking to expand their presence in the Chinese market.

China’s Outdoor Sports Industry: Growth Potential, Trends, and Opportunities

We break down the factors driving growth in China’s outdoor sports industry, including local preferences and demographic-linked habits. Foreign brands face growing competition from China firms but can customers at the premium and entry-level segments.

China Monthly Tax Brief: September 2023

In this China Monthly Tax Brief, we discuss the roll-out or extension of 16 tax policies announced in September and support measures for FIE enterprises liberalizing cross-border capital flows and optimizing the foreign investment environment.

Shenzhen Extends Application Deadline for 2021/2022 IIT Subsidy to October 20

Shenzhen has extended the individual income tax (IIT) subsidy application deadline for foreign and in-demand talent to October 20, 2023, from September 30.

Challenges and Solutions for European Businesses in China: Insights From the EU Chamber’s Position Paper 2023/2024

The Position Paper makes several recommendations for policymakers to address the challenges identified and possible solutions. Regardless of the shifts in perspectives, European businesses remain invested in the China growth story and are keen to be able to play a role in the evolving market landscape.

China Announces New Additional VAT Deduction for Advanced Manufacturing Companies

China’s tax authorities have announced a new additional 5% VAT deduction for companies in the advanced manufacturing sector.

China Monthly Tax Brief: August 2023

In August 2023, over 30 tax policies and guidelines were released by China’s Ministry of Finance (MOF), State Taxation Administration (STA), and other departments.