Optimizing Tax Benefits Through One-Off Deduction Policy for Fixed Assets Under RMB 5 Million

Qualified fixed assets that meet specific criteria are eligible for a one-off deduction before corporate income tax in China. This provision allows businesses to deduct the full cost of eligible equipment and instruments from their taxable income in a single year, providing a substantial tax benefit for many companies. In this document, we introduce this preferential policy and illustrate the compliance requirements through real-world case studies.

When calculating corporate income tax (CIT) taxable income, the reasonable depreciation of fixed assets is generally deductible, except for specific asset categories that tax laws exclude. Fixed assets refer to the non-currency assets held and used by the enterprises for over 12 months. These assets are typically depreciated annually using the straight-line method, ensuring that the cost is evenly spread over their useful life.

The straight-line method calculation for depreciation is as follows:

ANNUAL DEPRECIATION = (COST – SALVAGE VALUE) / MINIMUM USEFUL YEARS

| Minimum Useful Years for Fixed Asset Depreciation | |

| Fixed Assets | Minimum Useful Years |

| Premises and buildings | 20 |

| Planes, trains, ships, machinery, and other manufacturing equipment | 10 |

| Biological assets – forest | 10 |

| Instruments, tools, and furniture related to production and business operations | 5 |

| Means of transport other than planes, trains, and ships | 4 |

| Electronic equipment | 3 |

| Biological assets – livestock | 3 |

Under certain circumstances, enterprises can accelerate the depreciation of their fixed assets. Moreover, qualified fixed assets that meet certain criteria are eligible for a one-off CIT deduction. This allows businesses to deduct the full expense of eligible equipment and instruments from their CIT taxable income in a single year, offering a significant tax benefit for some businesses.

This article covers the effective policies regarding one-off deductions for fixed assets that do not exceed RMB 5 million (Approx.US$ 702,000). We also provide practical examples and case studies to illustrate how this policy can be applied, ensuring companies make the most of available tax benefits when declaring taxable income.

Current policies for one-off deduction policy for fixed assets

The one-off deduction policy for fixed assets was first established in the “Notice on Corporate Income Tax Policies for the Deduction of Equipment and Appliances (Cai Shui [2018] No. 54)” by the Ministry of Finance (MOF) and the State Taxation Administration (STA).

This policy allowed companies purchasing equipment and tools between January 1, 2018, and December 31, 2020, with a per-item value up to RMB 5 million (approximately US$702,000), to deduct the entire purchase cost from their taxable income in a single year, bypassing multi-year depreciation calculations. This approach streamlined tax reporting and provided an immediate reduction in taxable income.

Initially set to expire at the end of 2020, the policy was extended through December 31, 2023, under the “Announcement on Extending the Implementation Period of Some Preferential Tax Policies (MOF STA Announcement [2021] No. 6)“. Later, it was extended again until December 31, 2027, by the “Announcement on Corporate Income Tax Policies for the Deduction of Equipment and Appliances (MOF STA Announcement [2023] No. 37)“.

These extensions continue offering enterprises substantial tax benefits, fostering growth and investment flexibility.

Accordingly, companies purchasing equipment and tools between January 1, 2018, and December 31, 2027, with a per-item value of up to RMB 5 million (approximately US$702,000) are allowed to deduct the entire purchase cost from their taxable income in a single year, bypassing multi-year depreciation calculations.

Equipment and tools here refer to fixed assets other than houses and buildings. They include those purchased in monetary form or self-constructed.

Key points for declaring the one-off deduction policy for fixed assets

Optional policy

The one-off deduction for fixed assets is a choice, not a requirement. Enterprises can decide to implement or opt out of this policy based on their business needs and tax strategies.

Deduction timing

If a business opts for the one-off deduction, the full pre-tax deduction should be applied in the fiscal year following the month the asset is put into use.

This is because companies should begin to depreciate fixed assets starting from the month following their readiness for use, according to China’s accounting standard. This means that if a fixed asset is purchased and put into use in a particular month, its depreciation should be calculated from the following month, rather than starting in the month of purchase.

How to determine the time of purchase:

- Cash purchases: Fixed assets bought with cash (excluding installment or credit purchases) are recorded based on the invoice date.

- Installment/credit purchases: Assets purchased on credit or installments are recorded when the asset is delivered.

- Self-built assets: These are recorded upon completion and final settlement.

Filing requirements

No special filing or application is required. To claim the deduction, taxpayers should enter the relevant details on the designated lines of the quarterly Enterprise Income Tax Monthly (Quarterly) Prepayment Tax Return Form (Class A) (A200000) and the Asset Accelerated Depreciation, Amortization (Deduction) Preferential Statement (A201020) during the quarterly CIT filing, as well as on the Asset Depreciation, Amortization, and Tax Adjustment Statement (A105080) during the annual CIT reconciliation.

Documentation and record-keeping

When completing these tax forms, ensure the following information is included for accurate records and future reference:

- Purchase documentation: This includes invoices, asset arrival records for installment purchases, and settlement details for self-built assets.

- Accounting records: Maintain detailed accounting vouchers and any records showing discrepancies between tax and accounting treatments for assets.

Case studies on the one-off deduction policy for fixed assets

This section provides a detailed guide on the accounting and tax treatment for the one-off deduction of fixed assets using two case studies. Additionally, we illustrate how to correctly fill in the relevant lines on the tax declaration and settlement forms, ensuring compliance and clarity in reporting.

Case 1

Company H, a PRC resident enterprise and a value-added tax (VAT) general taxpayer, purchased a piece of production equipment (Equipment A) that did not require installation on October 1, 2022. On the same day, they obtained a special VAT invoice with a cost of RMB 3 million and an input tax of RMB 390,000.

For accounting purposes, the equipment is depreciated using the straight-line method over a 10-year useful life, with no residual value and without other adjustments.

For tax treatment, Company H chose to apply the one-off deduction policy for fixed assets in 2022, allowing them to expense the full cost of the equipment in the current tax period, providing an immediate pre-tax deduction.

Accounting treatment

In 2022, Equipment A was recorded as a fixed asset in accounting books at RMB 3 million.

The annual depreciation of fixed assets under the straight-line method is calculated following the below formula:

Annual depreciation of fixed assets = [tax basis / (minimum depreciation period stipulated by the tax law * 12 months)] x the number of months of depreciation in the current year.

As mentioned above, fixed assets do not need to be depreciated in the month they are purchased but are calculated from the month following when the fixed asset is put into use. Accordingly, the depreciation started from November 2022 and the number of months of depreciation in the current year is two.

The recorded depreciation in 2022 for Equipment A under straight-line method is calculated as follows:

RMB 3 million÷10 years÷12 months×2months = RMB 50,000.

This is the depreciation amount that is allowed to be recorded for 2022 under accounting principles.

For tax purposes, Equipment A qualifies for a one-off deduction. Thus, the full cost of RMB 3 million is deducted in 2022, with a tax basis (historical cost) of RMB 3 million and a pre-tax allowable deduction also at RMB 3 million.

Due to the difference between accounting depreciation and tax treatment, an adjustment is needed in the accounting books of 2022:

Tax adjustment amount = -RMB 3 million + RMB 50,000= -RMB 2.95 million.

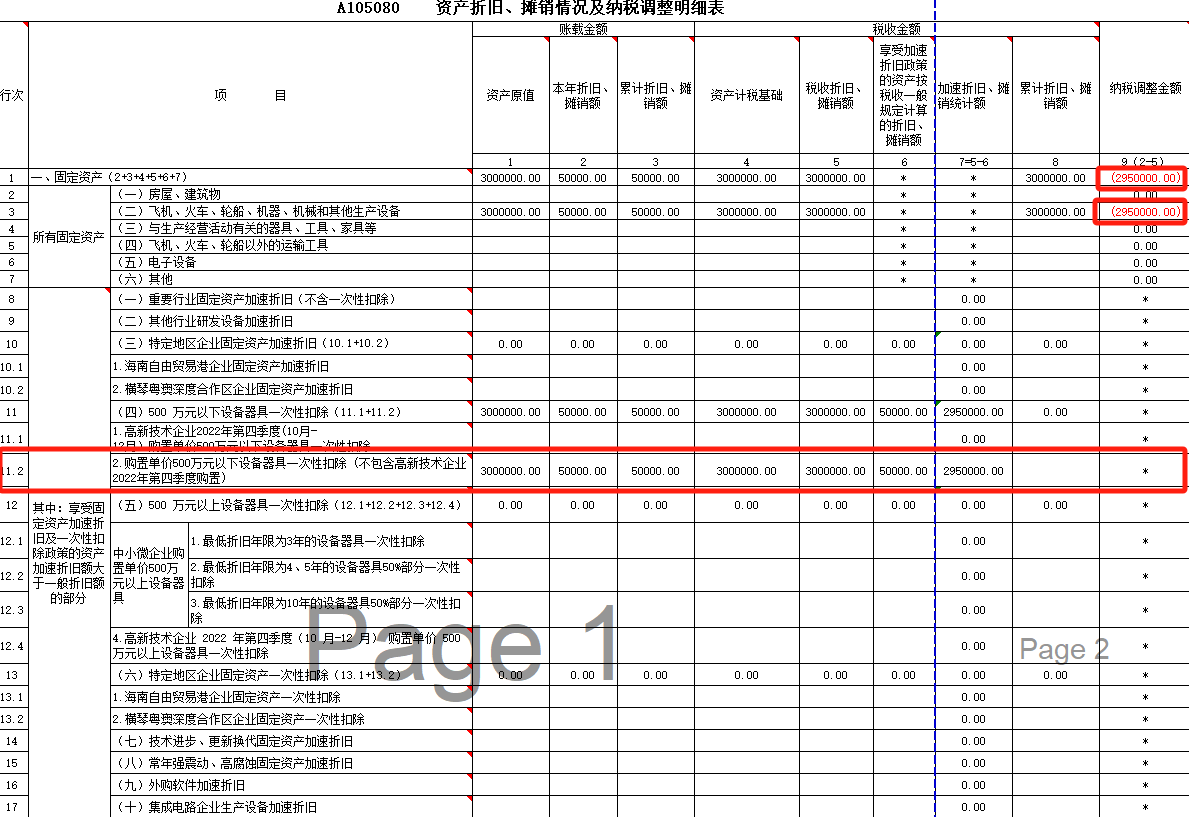

Complete the form A105080

Let’s take a look at the column 6 and column 9 to fill in form A105080:

For Column 6 “amount of depreciation and amortization of assets entitled to accelerated depreciation policy calculated according to the general provisions of taxation (享受加速折旧政策按税收一般规定计算的折旧、摊销额)”, only taxpayers enjoying the preferential policy of accelerated depreciation and amortization need to fill:

- The “amount of depreciation and amortization entitled to accelerated depreciation policy calculated in accordance with the general provisions of taxation” refers to the amount of depreciation and amortization of qualifying fixed assets calculated by the straight-line method in accordance with the minimum depreciation period without enjoying the preferential policy of accelerated depreciation and amortization.

- To be noted, the “amount of depreciation and amortization of assets entitled to accelerated depreciation policy calculated according to the general provisions of taxation ” is only reported in the months when it is less than the “(actual) tax depreciation and amortization”. And for the preferential policy of one-time deduction, the situation of “less than” can only occur in the first year of purchase and put into use. In the subsequent years, there is only accounting depreciation, with no tax deduction available.

In other words, taxpayers only need to complete line 11 in years when they acquire new qualifying fixed assets (under RMB 5 million) that are eligible for the one-off deduction. In subsequent years, this line should be left blank unless similar new purchases occur.

As such, to accurately complete form A105080 for the one-off deduction of Equipment A, Company H needs to include details in relevant lines as specified above:

- Line 11: Enter the cost (historical cost) of Equipment A, which is RMB 3 million, and the “amount of depreciation and amortization entitled to accelerated depreciation policy calculated in accordance with the general provisions of taxation”, which is RMB 50,000, to relevant cells.

- Line 3: Report the tax adjustment amount, which is -RMB 2.95 million. This reflects the difference between accounting depreciation and the one-off tax deduction.

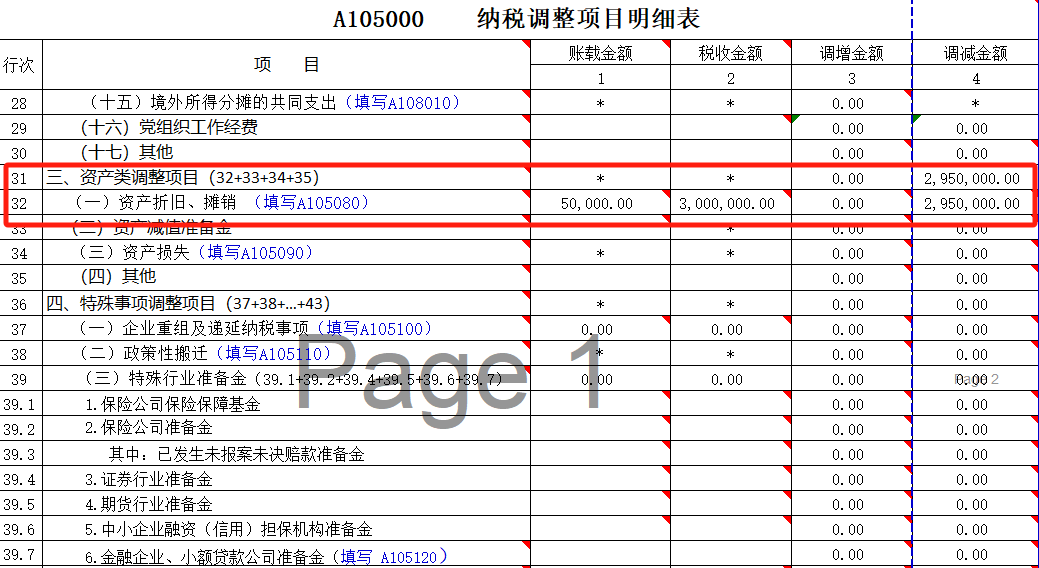

Form A10500

After completing the form A105080, a detailed list of tax adjustment items will be generated in form A10500

Case 2

Company A, a PRC resident enterprise and VAT general taxpayer, purchased a transportation vehicle on December 1, 2022, with a purchase price of RMB 2 million.

For accounting purposes, the vehicle’s depreciation was calculated using the straight-line method over a 5-year useful life, with no residual value.

For tax purposes, Company A opted for the one-off pre-tax deduction method, enabling the full expense of the vehicle to be deducted in the current period. As the vehicle was purchased in December 2022, the depreciation period starts from the month following, i.e., in January 2023. Correspondingly, the one-off deduction should also be enjoyed in 2023

Accounting treatment

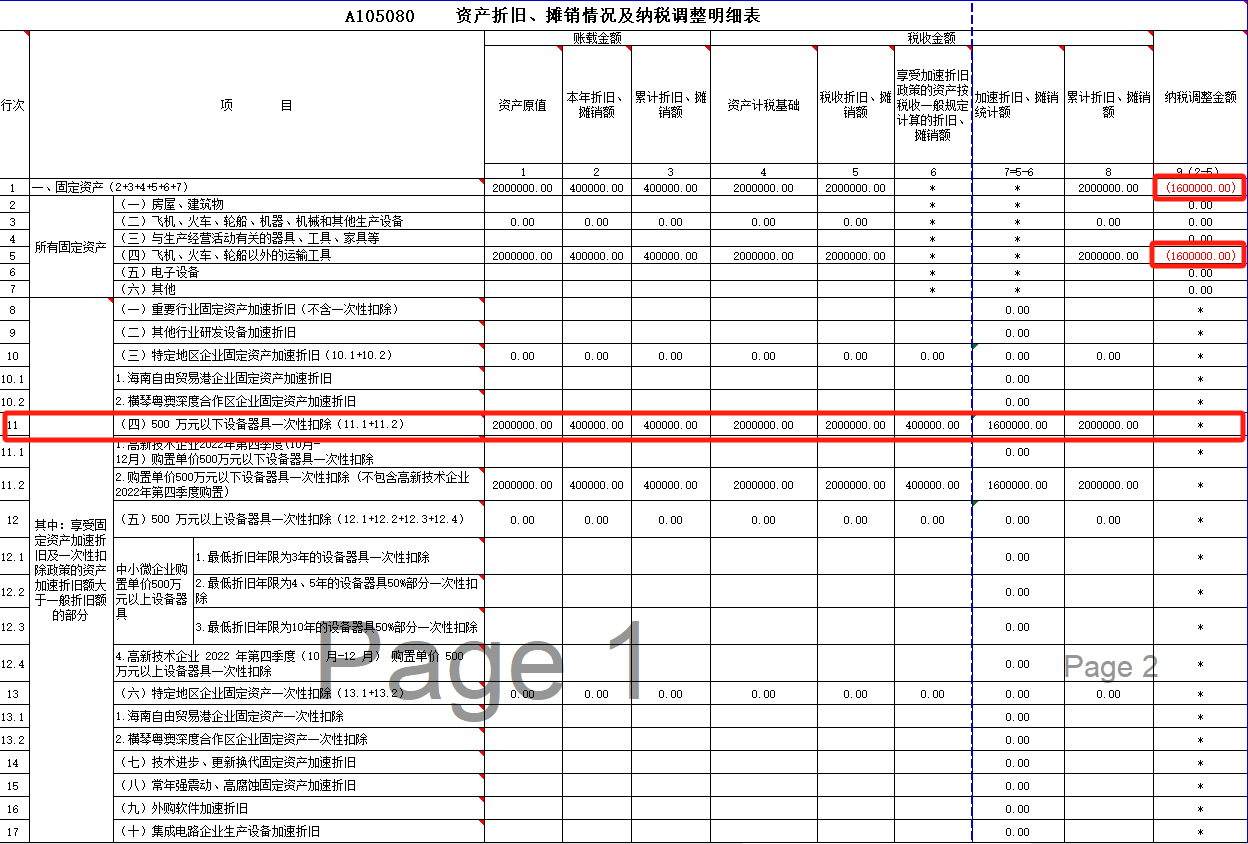

According to accounting standards, the vehicle’s depreciation for 2023 was recorded as follows:

RMB 2 million÷5 years÷12 months×12 month=RMB 400,000

For tax purposes, the vehicle qualifies for the one-off deduction, allowing the full purchase cost of RMB 2 million to be deducted in 2023 as a pre-tax allowable deduction.

Given the difference between accounting depreciation and tax treatment, an adjustment is required in the accounting books for 2023:

Tax adjustment amount: −RMB 2 million + RMB 400,000=−RMB 1,600,000

Fill in the form A105080

Friendly reminder on book-tax differences

When an enterprise applies the accelerated depreciation policy for fixed assets (including the one-time deduction policy for fixed assets valued under RMB 5 million), aligning tax and accounting treatments is optional. It’s possible that book-tax differences exist. However, taxpayers need to record relevant tax adjustments (reduction) for accounting purposes.

Meanwhile, although the full asset expense is deducted for tax purposes initially, depreciation will still be accrued in the accounting records over the asset’s useful life. In subsequent years, the enterprise must account for this difference by adjusting the tax treatment on the accounting books to reflect the ongoing depreciation. This approach ensures accurate alignment between tax deductions and accounting depreciation.

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article China and Italy New Double Taxation Agreement to be Effective in 2025

- Next Article China Public Holiday 2025 Schedule