Operational Costs of Business in China’s Inland Cities

By Samantha Jones

Mar. 7 – Five years ago, China’s Ministry of Commerce created an impetus to direct foreign investment into central China dubbed the “Go Inland” campaign.

Mar. 7 – Five years ago, China’s Ministry of Commerce created an impetus to direct foreign investment into central China dubbed the “Go Inland” campaign.

Connected to, but not to be confused with the “Go West” campaign launched in 2000 to stimulate development in the far western provinces, the “Go Inland” campaign focuses on six central provinces: Shanxi, Anhui, Jiangxi, Henan, Hubei and Hunan. In total, these provinces cover an area of 1.027 million square kilometers (11 percent of total land area), and account for roughly 28 percent of the population and approximately 20 percent of GDP.

The “Go Inland” campaign focuses on promoting foreign investment, as described in the 2009 “Foreign Investment Promotion Plan for Central China.” Priority zones include the economic belts along the Yangtze River and Beijing-Guangzhou Railway, city circles identified by each of the six provinces, as well as areas closely linked with the Yangtze River Delta, Pearl River Delta and the Bohai Bay Rim. At the time of official campaign launch in 2009, the central region’s combined exports accounted for only 4.3 percent of the national total, and manufacturing, energy and raw materials industries dominated.

Land and labor costs, which typically eat up about 70 percent of total operating costs, have been rising at break-neck rates, particularly in 1st tier east coast and southern cities, such as Beijing, Shanghai and Guangzhou. While prices in inland cities are rising as well, these cities remain lower than those along the east coast.

For manufacturers with tight budgets for overhead costs, promises of lower land and labor costs in central provinces are quite alluring. Many big name manufacturers are already located or relocated in the region; Hewlett-Packard and Cisco have bases in Chongqing, while Intel’s assembly and testing facility and Motorola’s research and development center are located in Chengdu.

Immediately following the introduction of the “Go Inland” campaign, China Briefing magazine took a look into the economics and opportunities of China’s inland provinces for export-based SMEs (China Briefing Magazine, Volume VII – Number IX). In his November 2006 commentary, Chris Devonshire-Ellis came to a general conclusion that, for export-based SMEs, the greater transportation costs of operations in inland China outweighed the other costs savings (including labor and land costs) of operations in the region. Greater competition and better transportation infrastructure were necessary in order to make operations in the region a palatable choice.

Half-way through the term of the “Go Inland” campaign’s development plan (2009 to 2014), we are once again returning to the campaign to ask a simple question on behalf of export-based SMEs: does it make economic sense to “Go Inland” today?

For a more comprehensive look at the inland regions, China Briefing expands slightly beyond the six provinces officially targeted in the “Go Inland” campaign – Shanxi, Anhui, Jiangxi, Henan, Hubei and Hunan – slightly west to include Chongqing municipality and Sichuan’s eastern-leaning capital, Chengdu. For each of these inland provinces, we look at the costs of locating in the provincial capital.

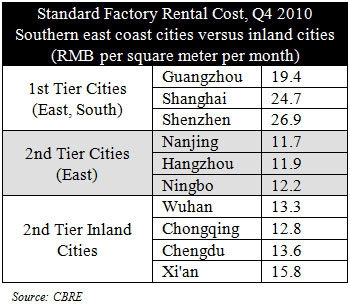

Land: factory rental

The first motivator cited by companies locating inland is quite often land cost. Prices for all types of land and facilities – residential, retail, logistics, and factory – are rising quickly in cities in all parts of the country. Costs in 2nd tier inland cities are undoubtedly cheaper and availability is greater – the inland region is estimated to have 1.4 times the amount of industrial-use land in the eastern region.

Of primary concern to the small or medium-sized, export-focused investor is factory rental cost, which varies greatly based on project size, development zone, and individual negotiations. Many local governments, particularly those in central provinces, are focused on long-term tax revenue gains and thus are eager to attract industrial enterprises by providing factory rentals at often severely discounted rates. These government incentives can take the form of corporate income tax rebates from the local government, incremental rebates to offset land cost, or assistance in lowering land rental costs (even if land rights are privately held). Generous free rental periods are also common.

In fact, factory rentals can vary up to 20 percent between zones in a single city. A factory in a state-level zone in Xi’an would likely rent for RMB14 per square meter per month, while a district level zone may rent for RMB10 to RMB11 per square meter per month. Factory rentals also vary largely based on popularity of any single zone. Suzhou Industrial Park, for example, has standard factory rental rates similar to those in Shanghai, whereas a factory in nearby Wuzhong Development Zone rents for approximately RMB12 per square meter per month (source: Roland Burton, NAI Asia Pacific Properties).

The dramatic increases in real estate prices that have been hitting media front pages in recent years are more severe in other real estate subdivisions (such as residential properties) than for factory rentals. Beijing saw an average annual rental growth around 3 percent in the past five years, while standard factory rental prices in southern and eastern 1st tier cities – including Guangzhou and Shanghai – have decreased since the Global Financial Crisis. Inland standard factory prices are rising between 0.5 percent and 2 percent annually over the past five years (source: CBRE).

For small and medium-sized export-based businesses choosing between a base in southern and eastern China or a base in an inland province, standard factory rental costs are similar enough between cities of common tier and geographic region to estimate the cost savings of moving inland.

In the north, Beijing’s standard factory rental prices are an astronomical RMB41.3 per square meter per month, while northern 2nd tier east coast cities show a great variance in standard factory price: Tianjin, at RMB23.1 per square meter per month, is priced similarly to most eastern and southern 1st tier cities, while Dalian is also on the higher end price-wise at RMB18 per square meter per month, and Qingdao boasts the incredibly low standard factory rental price of RMB10.1 per square meter per month (source: CBRE).

In the north, Beijing’s standard factory rental prices are an astronomical RMB41.3 per square meter per month, while northern 2nd tier east coast cities show a great variance in standard factory price: Tianjin, at RMB23.1 per square meter per month, is priced similarly to most eastern and southern 1st tier cities, while Dalian is also on the higher end price-wise at RMB18 per square meter per month, and Qingdao boasts the incredibly low standard factory rental price of RMB10.1 per square meter per month (source: CBRE).

Based on the prices described in the table above, the widespread understanding that factory costs are significantly lower inland is shaky when comparing east coast 2nd tier cities to their inland counterparts (perhaps a 15 percent savings), but with strong basis when comparing 1st tier east coast cities to 2nd tier inland cities, in which standard factory rental costs are about 40 percent lower.

In terms of standard factory rental prices, the price advantage that 2nd tier inland cities hold over eastern 1st tier cities is still significant, just as it was five years ago and, based on current growth rates, will remain significant for years to come.

- Standard factory rental costs average 40 percent lower in 2nd tier inland cities than in 1st tier east coast and southern cities.

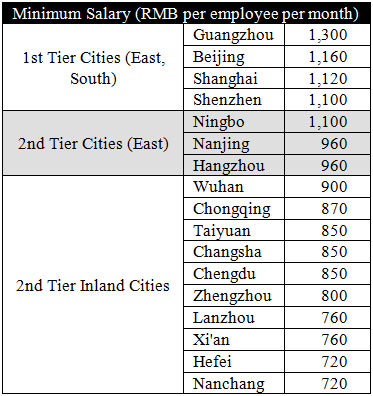

Labor: salary costs

Minimum wage

Minimum wages have increased dramatically across the country over the past year. Thirty provinces in China raised minimum wage in 2010, with increases averaging 22.8 percent nationwide. In the first month of 2011, Shanghai, Beijing and Tianjin announced increases to the minimum wage of 10 percent, 18.6 percent, and 16 percent respectively. No clear central vs. eastern regional trend has emerged in terms of the amounts of these increases – in fact, the largest increase in 2010 was 37 percent in the island province of Hainan. Nonetheless, labor costs seem to be on an increasing slope, making action to keep these costs down a priority for many businesses.

While many international investors pay salaries well above minimum wage and minimum wage cannot cater to managers and more senior personnel, this standard (taking overtime and mandatory social welfare contributions into account) is nonetheless the go-to figure when comparing labor costs for SMEs. Comparing the current legally permissible minimum salaries between cities gives a rough estimate of the potential labor savings of operations in inland cities.

Overtime

Overtime

Many factories will employ staff on an overtime basis in shifts, as it makes economic sense to do so. China’s labor laws indicate a premium of 150 percent for normal overtime. For comparison’s sake, we will assume for the remainder of this article that double shifts take place and thus worker salaries average 125 percent the legal minimums specified above.

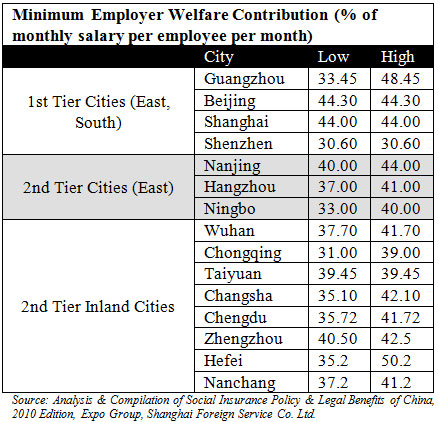

Mandatory welfare

Mandatory welfare payments to Chinese employees (including pension, unemployment, medical insurance and housing) will typically be an extra 30 percent to 50 percent on top of salary and vary by city.

There are also variances in minimum employer welfare contributions based on the employee’s residence registration, or hukou, as well as based on how much the employee chooses to personally contribute to the housing fund (distinguished in the table below as low and high contributions).

The Ministry of Commerce estimates that labor force costs are 60 percent less in central regions than in the eastern region. Taking into account overtime and mandatory welfare payments in our calculations here and comparing the extreme high and low numbers, locating in a 2nd tier inland city could, in theory, save up to 50 percent on labor costs in comparison to in a 1st tier east coast city.

The Ministry of Commerce estimates that labor force costs are 60 percent less in central regions than in the eastern region. Taking into account overtime and mandatory welfare payments in our calculations here and comparing the extreme high and low numbers, locating in a 2nd tier inland city could, in theory, save up to 50 percent on labor costs in comparison to in a 1st tier east coast city.

- 2nd tier inland cities could in theory save up to 50 percent on labor costs in comparison to 1st tier east coast cities.

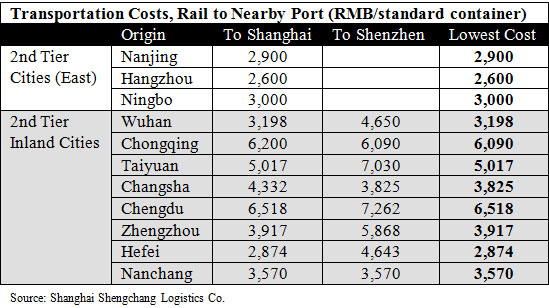

Transportation

While inland China is the country’s “transportation hub,” for an export-focused business getting product out of central China to a port must be balanced against inland labor and land cost savings.

To estimate the influence of such export transportation costs, we have obtained quotes for transporting a standard container from each of these inland cities to the nearest and most commonly used coastal ports: Shanghai and Shenzhen. Locating in a 1st tier east coast city, transportation costs to such major ports exist, but for estimation purposes, we’ll assume they are quite low.

Transportation of a standard container varies greatly depending on location, from under RMB3,000 in the more eastern Anhui Province, RMB3,000 to RMB4,000 in Hubei, Jiangxi, Hunan, and Henan provinces, RMB5,000 in northern Shanxi, to over RMB6,000 in Chongqing and western Sichuan.

Transportation of a standard container varies greatly depending on location, from under RMB3,000 in the more eastern Anhui Province, RMB3,000 to RMB4,000 in Hubei, Jiangxi, Hunan, and Henan provinces, RMB5,000 in northern Shanxi, to over RMB6,000 in Chongqing and western Sichuan.

These costs will of course decrease with negotiations and vary based on bulk, but the stark fact remains that for SMEs, transportation costs into inland provinces are not pocket change.

Portions of this article were extracted from China Briefing’s March 2011 issue titled “Operational Costs of Business in China’s Inland Cities.” To purchase the full version, priced at US$10 for immediate PDF download, please click here.

Related Reading

China Briefing has published a number of business investment guides to China, collectively covering the entire country. Each guide details local demographics, economies, complete business costings, investment zones, infrastructure, and available incentives to the foreign investor. All are priced at US$40 for the immediate PDF download.

Business Guide to Shanghai and the Yangtze River Delta (third edition)

Business Guide to Shanghai and the Yangtze River Delta (third edition)

188 pages. A complete overview of Shanghai and the Yangtze River Delta, including the provinces of Anhui, Jiangsu, Shanghai and Zhejiang, and with detailed introductions to the cities of Changshu, Changzhou, Hangzhou, Hefei, Huzhou, Jiangyin, Jiangxi, Kunshan, Nanjing, Nantong, Ningbo, Shanghai, Shaoxing, Suzhou, Taicang, Taizhou, Wenzhou, Wuxi, Yangzhou, Yiwu, Zhangjiagang, Zhenjiang and Zhoushan.

Business Guide to South China and the Pearl River Delta (second edition)

Business Guide to South China and the Pearl River Delta (second edition)

196 pages. A full description of South China, including Hong Kong, Macau, and the provinces of Guangdong, Fujian, Guangxi and Hainan, in addition to detailed introductions to the cities of Dongguan, Foshan, Fuzhou, Guangzhou, Haikou, Huizhou, Nanning, Shantou, Shenzhen, Xiamen, Zanjiang, Zhaoqing, Zhongshan and Zhuhai.

Business Guide to Beijing and Northeast China (second edition)

Business Guide to Beijing and Northeast China (second edition)

184 pages. Detailing Beijing and Northeast China, including the provinces of Hebei, Heilongjiang, Jilin, Liaoning and Shandong, and with expansive introductions to the cities of Anshan, Beijing, Changchun, Dalian, Dandong, Harbin, Jinlin, Jinan, Shenyang, Shijiazhuang, Qingdao, Qinhuangdao, Tianjin, Weihai, Yantai and Zibo.

Business Guide to Central China

Business Guide to Central China

120 pages. A comprehensive introduction to Central China, including the provinces of Hebei, Henan, Hubei, Inner Mongolia, Jiangxi and Shanxi, and includes detailed introductions to the key cities of Baotou, Chengde, Changsha, Datong, Hohhot, Kaifeng, Luoyang, Manzhouli, Nanchang, Taiyuan, Wuhan, Yichang and Zhengzhou.

Business Guide to West China

Business Guide to West China

172 pages. This book is a detailed overview of West China, including the provinces of Gansu, Guizhou, Ningxia, Shaanxi, Sichuan, Tibet, Xinjiang and Yunnan, and includes detailed introductions to the key cities of Chengu, Chongqing, Kashgar, Kunming, Lanzhou, Lhasa, Guiyang, Urumqi, Xining and Yinchuan.

Business Guide to China’s Second and Third Tier Cities

Business Guide to China’s Second and Third Tier Cities

217 pages. The guide book is the definitive guide to China’s second and third-tier cities. It provides a thorough and in-depth analysis, regional intelligence and overviews of fifty of China’s emerging cities, featuring economic data, infrastructure and investment climate reviews, and a directory to development zones, business associations, media and major hotels in all locations.

- Previous Article China Industry: March 7

- Next Article Mongolia Watch: A Nation of Millionaires Emerges