Luxury Brands, Westward Expansion Fuel Chinese Automotive Industry

BEIJING – As the 2014 Beijing Auto Show wraps up on Tuesday this week, growth in China’s luxury car market and automakers’ westward expansion are two major trends that have come into focus for the Chinese automotive industry. Top executives of foreign manufacturers were out in full force at the Auto Show, the nation’s largest car exhibition, eager to drum up the attention of an estimated 120,000 daily visitors for their China-based operations.

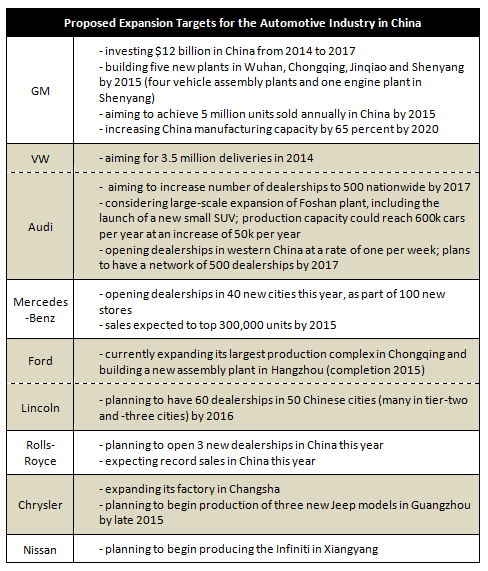

Based on a McKinsey report, China could surpass the U.S. as the largest luxury car market as early as 2016. While 70 percent of this market remains dominated by German manufacturers BMW, Audi and Daimler, a host of luxury brands such as Mercedes-Benz, Rolls-Royce, Lincoln and Inifiniti have all set ambitious expansion targets for the coming years (see table below).

This push comes against the backdrop of slowing sales growth in the megacities of China’s eastern seaboard, variously attributed to market maturation and government measures to limit the number of cars on the road to meet clean air targets.

RELATED: China Vehicle Sales Reach 22 million Units in 2013

In response, automakers have begun looking to tier-two and tier-three cities to pick up the slack, where the average number of cars per 1,000 people is typically still one-fifth that of Shanghai or Guangzhou.

Chengdu, the capital of Sichuan, is making a bid to become China’s automotive hub by concentrating on sales to the western provinces of Shaanxi, Qinghai, Gansu, Tibet and Xinjiang – against competition from Shenyang, Changchun, Wuhan and Shanghai. Its efforts are bolstered by the Chengdu Economic and Technological Development Zone (CEDZ), established in 2009 and currently hosting 17 vehicle manufacturers and 290 related companies.

In terms of foreign manufacturers, General Motors and Volkswagen have adopted the most aggressive measures to keep pace with the Chinese market. GM recently announced that it will invest US$12 billion into its China operations from 2014 to 2017 and is in the process of building five new plants.

Currently, the company operates in China through 10 JVs with domestic companies, including Shanghai GM and SAIC-GM-Wuling (producer of the low-cost brand Baojun). With 2.5 million units sold in 2011, the company’s China sales are the largest proportion of its overall global sales.

Meanwhile, Volkswagen continues to benefit from its early entrance into the Chinese market, last year overtaking GM as the top-selling foreign brand in China. The company, which opened factories last year in the western cities of Chengdu and Urumqi, made some 3.27 million deliveries in China in 2013 and has announced plans to spend 18.2 billion euros through 2018 via its joint ventures with First Automotive Works and Shanghai Volkswagen.

Production is booming at the FAW-Volkswagen joint venture plant in Chengdu, which at full capacity is now putting out 600,000 vehicles per year.

Combining the two trends, VW’s luxury division Audi is opening dealerships in western China at a staggering rate of one every week and sold close to 500,000 cars last year nationwide. This year the brand is on track to achieve double-digit sales growth with more than 540,000 sold cars in China.

As the tide of China’s booming automotive sector moves outward it is also raising up associated industries. Freight companies in particular are benefiting, as growing demand for cars in western China fuels the cross-country transportation of cars and components. The biggest players in the industry, Anji Automotive and Nippon Yusen, move some 2 million and 1.36 million vehicles annually, respectively.

It is estimated that some 21.98 million vehicles were sold in China last year – compare with 15.6 million sold in the U.S., up 13.9 percent from the year previous. In the years to come, the market is forecast to grow to 24 million cars sold in 2014, and 30 million by 2020.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Selling to China

Selling to China

In this issue of China Briefing Magazine, we demystify some complexities of conducting business in China by introducing the main certification requirements for importing goods into the country; the basics of setting up a representative office; as well as the structure and culture of State-owned enterprises in China. Finally, we also summarize some of the export incentives available in several key Western countries.

Doing Business in China

Doing Business in China

The China Briefing Business Guide to Doing Business in China is the definitive guide to one of the fastest growing economies in the world, providing a thorough and in-depth analysis of China, its history, key demographics and overviews of the major cities, provinces and autonomous regions highlighting business opportunities and infrastructure in place in each region. A comprehensive guide to investing in China is also included with information on FDI trends, business establishment procedures, economic zone information and labor and tax considerations.

China Vehicle Sales Reach 22 million Units in 2013

- Previous Article China Regional Focus: Dalian, Liaoning Province

- Next Article Investing in China’s Future: The New Silk Road Economy