Letters from America: U.S. Exports to Asia and American Job Creation

The re-shoring of jobs to America and increasing exports to Asia will result in a more buoyant American labor market

This is Part VI of our ongoing Letters from America to Asia Series, featuring opinions and observations on America’s trade relations with China and emerging Asia from Chris Devonshire-Ellis.

Nov. 5 – One of the key areas our practice, Dezan Shira & Associates, will be concentrating on and developing over the next few years is the expansion of our traditional American client base. Although our firm is based in Asia with offices in China, Vietnam, India, Hong Kong and Singapore, about 50 percent of our clients over the past 20 years of operations have originated from the United States. It is our belief, based on solid demographic evidence, that American companies will continue to develop and reach out in significant numbers to Asian consumers. I discussed the historical, decade-long rise of American exports to China in some detail in my earlier piece here.

To summarize, what has been happening in China – and is likely to be followed by the emergence of other Asian markets – is the increasing development of a substantial middle class consumer base. Today, China has some 250 million middle class consumers, with that figure expected to rise to 600 million by 2020. Once other Asian countries such as India are factored in (another 250 million middle class consumers today), and ASEAN in addition to this (at 100 million middle class today), then the true Asian picture begins to emerge. Right now, Asia is host to a massive middle class that is able to purchase imported products with the total number of consumers at roughly 600 million right now, growing to well over 1 billion by 2020.

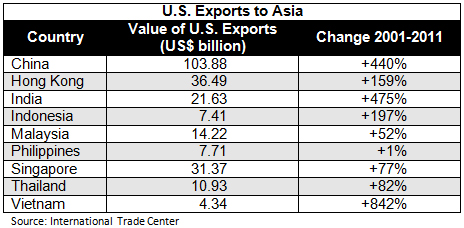

It is no wonder, then, that American businesses are starting to look overseas in increasing numbers at these potential markets. It is also beginning to have an effect on American job creation. China has especially been criticized for taking American jobs away by falsely subsidizing its manufacturing businesses. That is an issue for the politicians and World Trade Organization to debate and deal with, but it should also be noted that while much of China’s rise has been linked to its WTO accession back in 2001, those same 11 years have seen U.S. exports to China rise by 440 percent according to the International Trade Center.

In terms of the impact on American job creation, it appears there are two main drivers behind this that are directly related to the demographic changes Asia and Europe are going through, although these are not driven by increasing labor costs in China per se. According to a recent report from the Boston Consulting Group, the United States will have an export cost advantage of 5 percent to 25 percent over Germany, Italy, France, the United Kingdom and Japan in a range of industries. Among the biggest drivers of this advantage will be the costs of labor, natural gas, and electricity. As a result, America could capture 2 percent to 4 percent of exports from the four European countries and 3 percent to 7 percent from Japan by the end of the current decade. This phenomenon, known as “re-shoring,” will see jobs that have largely been based in Europe and Japan start to come back to America.

However, jobs that have been lost to China and other lower-cost destinations in Asia will not be coming back as the cost differential is too high. But it does mean better news and more competitive advantages for American workers when compared to their Japanese and European counterparts.

The China dividend for American job creation comes instead from the increased number of exports to the country, a situation that also extends across India and the major ASEAN economies over the past decade as we can see in the table below (Note that different organizations may quote slightly different figures based on variations in criteria, however, the overall trends reflected remain consistent):

Boston Consulting also forecasts that the biggest U.S. export gains will be in machinery, transportation equipment, electrical equipment and appliances, and chemicals. That is, in fact, borne out by our own live U.S. client portfolio across Asia, which encompasses American businesses from every one of these sectors. Infrastructure, especially in countries such as India, remains the opportunity, while higher and more reliable electronic technologies are increasingly being sold onto the China market where local productions have not been able to adequately marry low cost with high quality. An increasingly affluent Chinese middle class is now rejecting, in part, the previous domestic shoddiness in favor of trustworthiness, and as I pointed out recently, consumers across China now familiar with the thousands of McDonald’s, KFC and Starbucks outlets have come to regard American products across all consumer areas as representing good value and reliability. With these same consumers being able to trade up to higher standards, even though a price premium may apply, that new level of available and sustained income in China and throughout Asia is now eroding the gap between cheap shoddiness at the low end and limited choice at the high end.

With more American manufactured products making their way onto the shelves of Asian markets, the actual impact on jobs and trade this has had upon the United States can be seen by some of the statistics provided by the East-West Center’s Asia Matters for America site. According to the organization, 32 percent of U.S. jobs from exports depend on exports to Asia. Furthermore, exports to Asia supported 1.1 million jobs in 2011 (39 percent more than in 2002) and 33 states send at least a quarter of their exports to Asia.

Clearly, as America moves to an increasingly robust export model, with the emerging middle class of Asia as just one target, an evolution is underway being positive news for domestic employment in the United States. As has been noted by U.S. Department of Commerce’s International Trade Division, the percentage of GDP represented by exports is the highest in nearly a century and is indicative of how important exports will continue to be in any effort to encourage economic growth and the creation of new jobs in the country.

The new opportunities for American businesses lie within a strong export economy. Support in this regard from the demographics of Asia, let alone traditional export markets such as Canada and Mexico (with Brazil and the rest of Latin America also on the doorstep), the path forward is very clear for America’s manufacturing entrepreneurs. The demographic emergence of new consumer markets for the United States to reach out to is real and it is there. As long as government policies continue to echo these truths and promote American business interests abroad, and in particular the new economic driver of American exports, the United States will enter into a new era of internalization and prosperity. Our practice remains committed to American clients throughout Asia, and the U.S. domestic benefits that the expansion of American businesses in China, India, Asia and beyond will bring.

Chris Devonshire-Ellis is the founding partner of Dezan Shira & Associates. The firm has 17 offices throughout China and Asia, and assists foreign companies with their legal, financial and tax questions concerning exports into these markets. Additionally, Dezan Shira assists businesses establish permanent presences in these countries and the legal, tax, financial and accounting issues that these developments bring. The firm also works extensively with U.S.-based law and tax firms in assisting with the on-the-ground needs of their clients in Asia. For more information, please email usa@dezshira.com, download the firm’s brochure, or visit www.dezshira.com. The firm also maintains a U.S. liaison office in Charlotte, NC, please email Jessica Tou at jessica.tou@dezshira.com or call (704)-808-5287 for assistance across the United States.

Related Reading

An Introduction to Doing Business in China

An Introduction to Doing Business in China

Asia Briefing, in cooperation with its parent firm Dezan Shira & Associates, has just released this 40-page report introducing everything that a foreign investor should be familiar with when establishing and operating a business in China.

The Complete ‘Letters from America to Asia’ Series

A complete list of articles from our ongoing ‘Letters from America to Asia Series’ featuring opinions and observations on America’s trade relations with China and emerging Asia.

Delaware and Nevada Holding Companies for Chinese Foreign-Invested Enterprises

Co-Investing in China with Chinese Partners

Double Taxation Agreements for China Investment

- Previous Article China Law Deskbook Legal Update – September/October 2012

- Next Article Preliminary Data Issued on China’s Balance of International Payments