Jiangsu Province Clarifies Tax Collection Standards

Jun. 10 – Jiangsu’s Municipal Tax Bureau released the “Announcement on Tax Collection Standards (sudishuigui [2013] No.2, hereinafter referred to as the ‘Announcement’)” on May 31, which unifies the tax collection standards across the province. The Announcement includes eight types of tax collection rules, and clarifies the cost-profit ratios, tax rates of taxable income, and verified percentages in tax collection. Detailed information can be found below.

Cost-Profit Ratio

According to the Announcement, the cost-profit ratios as stipulated in Article 20 of the “Implementation Regulations for the Provisional Regulations of the People’s Republic of China on Business Tax” have been determined as the following:

- Sales of immovable property: 15 percent

- Other taxable activities: 5 percent

Such ratios will come into effect on July 1, 2013.

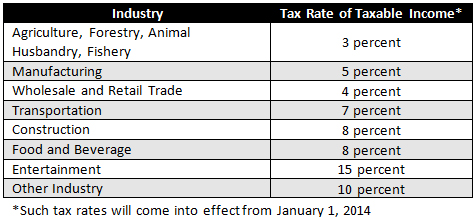

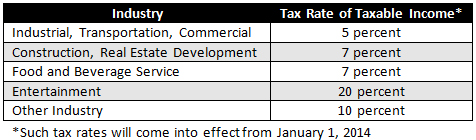

Tax Rate of Taxable Income

The tax rates of taxable income as stipulated in the Article 8 of the “Measures for Verification and Collection of Corporate Income Tax” have been determined as the following:

The tax rates of taxable income as stipulated in the Article 9 of the “Provisions on the Collection of Individual Income Tax on Investors in Sole Proprietorship Enterprises and Partnership Enterprises” have been determined as the following:

Verified Percentage

The verified percentages as stipulated in the Article 4 of the “Circular on Issues Concerning the Reinforcement of Administration on Stamp Tax Collection” have been determined as the following:

Industrial Industry

- Taxable certificate: Purchase and sales contracts

- Determination of tax basis: Product sales revenue

- Verified percentage: 80 percent

Commercial Industry

- Taxable certificate: Purchase and sales contracts

- Determination of tax basis: Product sales revenue

- Verified percentage: 50 percent

Real Estate Development Industry

- Taxable certificate: Documents on transferring of property rights

- Determination of tax basis: Real estate business income

- Verified percentage: 100 percent

Construction and Installation Industry

- Taxable certificate: Contracts for construction and installation projects

- Determination of tax basis: Settlement income of the projects

- Verified percentage: 100 percent

Transportation Industry

- Taxable certificate: Goods transportation contracts

- Determination of tax basis: Settlement income of the projects

- Verified percentage: 100 percent

Insurance Industry

- Taxable certificate: Property insurance contracts

- Determination of tax basis: Premium income

- Verified percentage: 100 percent

Financial Industry

- Taxable certificate: Loan contracts

- Determination of tax basis: Loan amount

- Verified percentage: 100 percent

The above-mentioned percentages will come into effect on July 1, 2013.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across China by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

This edition of the China Tax Guide, updated for 2013, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China operations.

Suzhou Details Foreigners’ Mandatory Social Insurance Participation

Jiangsu Province Adopts New Labor Contract Rules

China Clarifies Tax Policies for Venture Capital Enterprises in Suzhou Industrial Park

Jiangsu Province Issues Guidance on General Taxpayer Recognition

- Previous Article MOC: China is Mulling E-Commerce Tax

- Next Article China Law Deskbook Legal Update – May/June 2013