Internationalizing Your China WFOE

Transferring WFOE Equity Ownership To Hong Kong or Singapore Companies Provides Far More Trade Flexibility

Op-Ed Commentary: Chris Devonshire-Ellis

In the rush to get into China over the past decade, many foreign investors established WFOEs – either as trading and services companies, or as manufacturing entities in their own right. For many, this is a policy that has worked very well – the legal and regulatory structures are well defined and understood. Today though, as foreign investors start to eye other markets in Asia, the China WFOE is starting to prove awkward as a base from which to launch into Asia. There are a number of reasons for this:

- China WFOEs are geographically limited in their trading scope as the RMB is not an internationally traded currency, meaning treasury issues arise with funding essentially restricted to China only;

- It can be extremely difficult if not impossible to establish overseas subsidiaries of a China WFOE, despite the fact it is a limited liability company in its own right.

This problem is further compounded if the WFOE has been set up directly, with individuals as shareholders. It may also be awkward to change the trading capabilities of the WFOE if any holding company used is essentially a shelf company (as is common with BVI and similar offshore entities). The WFOE works well as a China-focused entity, but has limitations when it comes to developing it into a more regional or international structure. However, there are steps that can be taken.

The obvious failing of a WFOE is its inability to access international funds quickly and efficiently – the treasury function. With the RMB not internationally traded, the State Administration of Tax is also highly aggressive when it comes to monitoring the flow of RMB funds out of China, making the WFOE structure alone insufficient. This can be alleviated by changing the WFOE ownership structure and putting in place a holding company that can access international funds – and ideally with no tax penalty in doing so.

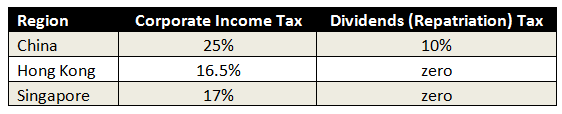

To do this, the equity in a WFOE needs to be transferred to a separate legal entity. For expanding into Asia, the ideal choices would be Hong Kong or Singapore as neither levy tax on profits realised outside of their own borders. Whichever jurisdiction is chosen however, the company itself needs to be fully up and running and in possession of operational bank accounts. That means if the WFOE is already owned by an effectively dormant holding company, the company needs to be “woken up” and go through the process of establishing bank accounts. If no such company exists, then the process for transferring the WFOE equity to another company outside of China (including Hong Kong) is as follows (some regional variations may apply):

- WFOE Share Transfer Agreement – Preparation and Execution

- MOFCOM Approval

- Tax Compliance (can be at the time of AIC update)

- AIC Update

- Post-Licensing Updates

The issue here is that the Tax Compliance step needs the approval of the State Administration of Tax (SAT). How this is treated is currently a matter of some inconsistency in China, as the SAT may require that the WFOE be valued. That is easy enough to arrange; however, the SAT may not accept the book or net value of the WFOE, and we have noted some inconsistences here from different SAT offices as concerns the tax treatment in this regard. If the SAT opinion is that tax is required to be paid, if the shareholder is tax resident then the gain on sale of the shares is classed as taxable income for Chinese tax purposes. If a non-resident – such as a Hong Kong or Singapore company – then a withholding tax of 10 percent on the gain could be payable. This payment is made by the WFOE on account of the non-resident.

Once the WFOE shares have been transferred, the new parent company may open its own bank accounts and better manage the treasury function and flow of money. It is also relatively easy for that company to establish other companies or representative offices in its own right elsewhere. This means that the focal point of the WFOE’s trading capabilities has been shifted to outside of China, and with full access to international funds, a potentially reduced corporate income tax bill (depending upon how the overall business income is now structured), and the ability to set up other subsidiaries.

Changing your WFOE ownership to a Company located in Hong Kong or Singapore internationalises your overall business structure and allows much more regional flexibility in and with your China trade. With both Hong Kong and Singapore now significant RMB trading hubs, there is much to be gained by providing your China WFOE with the mechanism to allow it to become, relatively easily, part of a wider regional Asian trading structure.

Chris Devonshire-Ellis is the Founding Partner of Dezan Shira & Associates – a specialist foreign direct investment practice providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam, in addition to alliances in Indonesia, Malaysia, Philippines and Thailand, as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download our brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Using China WFOEs in the Service and Manufacturing Industries

Using China WFOEs in the Service and Manufacturing Industries

In this issue of China Briefing Magazine, we provide a detailed overview of the WFOE establishment procedures as well as outline the typical costs associated with running these entities in China. We hope that this information will give foreign investors contemplating entry into the Chinese market a better understanding of the time and costs involved.

The Gateway to ASEAN: Singapore Holding Companies

The Gateway to ASEAN: Singapore Holding Companies

In this issue of Asia Briefing Magazine, we highlight and explore Singapore’s position as a holding company location for outbound investment, most notably for companies seeking to enter ASEAN and other emerging markets in Asia. We explore the numerous FTAs, DTAs and tax incentive programs that make Singapore the preeminent destination for holding companies in Southeast Asia, in addition to the requirements and procedures foreign investors must follow to establish and incorporate a holding company.

Expanding Your China Business to India and Vietnam

Expanding Your China Business to India and Vietnam

In this issue of Asia Briefing Magazine, we discuss why China is no longer the only solution for export-driven businesses, and how the evolution of trade in Asia is determining that locations such as Vietnam and India represent competitive alternatives. With that in mind, we examine the common purposes as well as the pros and cons of the various market entry vehicles available for foreign investors interested in Vietnam and India. We also examine the advantages of using Hong Kong and Singapore as corporate bases to reach out to Asia’s emerging markets. Finally, we comment on how the proposed Trans-Pacific Partnership will affect both China-based and Vietnam-based manufacturers.

Leveraging ASEAN to Sell More China Manufactured Products

Leveraging India to Sell More China Manufactured Products

- Previous Article China Announces Preferential Policies for Three Development Zones

- Next Article China Extends Tax Breaks for Entrepreneurial Startups