How to Legally Reduce Labor Costs in China During the Coronavirus Outbreak

Author: Allan Xu, Shanghai Office and Hazel Wang, Beijing Office, Dezan Shira & Associates

Editor: Zoey Zhang

While most businesses in China have restarted – many employers, especially small business owners, remain under big pressure to manage operating costs and maintain cash flow after being hit by the COVID-19 coronavirus outbreak.

To kickstart the economy, Chinese central and local governments have been rolling out a range of measures.

Among them, the Ministry of Human Resources and Social Security (MHRSS) issued a series of policies, aimed at reducing the labor cost burden of enterprises while stabilizing labor relations and employment.

Reducing labor costs in China – Government position

On February 7, 2020, the MHRSS issued an important document – the Opinions on Stabilizing Employment Relationship during the Epidemic to Support Enterprises in Resuming Work and Production (Ren She Bu Fa [2020] No.8)(EN). The document states:

“(V) Support enterprises with difficulties in the negotiation of wages and benefits. For enterprises that are affected by the epidemic that lead to difficulties in production and management, we encourage them to negotiate with their employees through democratic procedures to stabilize work posts by adjusting salaries, rotation of posts and leaves, shortening working hours and other means; for enterprises that are temporarily unable to pay wages, we should guide them to negotiate with trade unions or employee representatives to delay the payment and help them reduce the pressure of capital turnover.”

To many employers, the issuance of the Ren She Bu Fa [2020] No.8 is of great significance:

- It guides enterprises to solve temporary difficulties in salary payment;

- It provides policy support for the enterprise to implement flexible working policies;

- It reduces the risk of bankruptcy for the employer who cannot pay their workers;

- It helps prevent the employees from terminating their labor contract as a result of the employer’s “failure to pay the labor remuneration on time and in full”, and thus avoid the payment of economic compensation to employees.

- It helps avoid the employees taking action to report to relevant administrative authorities or apply for arbitration as a result of the employer’s “failure to pay laborer salary according to the agreement”, and thus avoid the consequent punishment and fines imposed on the employer.

Legal recourse for entities hiring in China

In the face of the ongoing pandemic, how can employers legitimately take action to reduce their labor costs and keep the company afloat? This article offers nine practical legal-based solutions.

1) Making use of annual leave, welfare leave, and compensatory leave

The Ren She Bu Fa [2020] No.8 has stipulated that:

“Where the employees cannot arrive at their posts on time or the enterprises cannot start the production due to the epidemic, the enterprises shall be guided to proactively communicate with their employees, and the qualified enterprises may arrange for their employees to work at home and complete the work assignments by flexible working methods via telephone and network; the enterprises not meeting the remote working conditions shall negotiate with their employees on the priority to take various kinds of paid annual leave and welfare leave given by the enterprises themselves.”

By law, China’s annual leave can be 5 days, 10 days, or 15 days – depending on the length of service of the employee. But in practice, in order to give employees better welfare treatment, many foreign-invested companies (FIEs) also provide welfare annual leave on top of the statutory annual leave. Because the paid leave is also part of the fixed labor cost of companies, negotiating with the employees on the priority of taking paid annual leave or welfare leave during an epidemic can help companies reduce expenses.

Some enterprises stipulate in their contracts that employees can get compensatory leave if they worked overtime during employment. If the enterprise has not resumed work, it can communicate with employees and arrange them to take the compensatory leave.

What’s more, in Beijing, the Municipal Bureau of Human Resources and Social Security allows local enterprises to adjust rest days (for example, weekends) of 2020. Since employees’ salary of rest days is already included in their monthly salary, if companies can schedule rest days off in advance during the epidemic, it will not have to pay extra salary when employees later make up the working hours. Although this policy is not widely adopted in other provinces, it is still a big step forward in relaxing employment policies for employers.

2) Taking advantage of salary structure

Generally, enterprises develop different salary structures based on the work content, job nature, and the interests of the enterprise. Some firms may pay a fixed monthly wage, while others divide the salary into different components – such as fixed basic salary or post wage and variable performance pay or bonus.

During an outbreak, companies can avail of the salary structure to pay employees according to their working conditions. For example, for the employees who need to be isolated and cannot return to work, companies can just pay the fixed salary according to the provisions of the labor contract and company rules and regulations. Performance-related salaries and bonuses may not need to be paid.

However, before you do this, please carefully review the company’s internal rules and regulations regarding payroll to avoid situations where it is not applicable.

3) Paying salary for effective working hours

At present, there are still some enterprises that are unable to fully resume production and operation, or employees who work remotely from home are performing less productive. Given the above situations, the enterprise can establish a telecommuting system. Under the system, the employer can pay the employees by the hour according to the effective time the employees put in their work.

4) Adjusting working hours and adopting work shifts

Due to the sharp drop in business volume in some industries, especially foreign trade, the workload of some companies have decreased. Faced with such a situation, the company can consider reducing the working hours of the employees through negotiation – for example, reducing workdays from 5 days a week to 3 days a week – and correspondingly reduce the salary of employees. Alternately, the company can arrange shifts for employees who are in the same or similar positions and accordingly reduce their salary.

If the standard working hour system is not applicable to the employees, it is suggested that enterprises apply to the local human resources and social security bureau for adopting other working hour systems, such as comprehensive working hour system and non-fixed working hour system, to meet the employment needs of enterprises.

5) Reducing the salary

Currently, many companies are enforcing pay cuts, such as 30 percent for the management and 20 percent for the staff. By making pay cuts, the enterprise can maintain certain cash flow. But of course, the measures must also be understood and agreed upon by employees, otherwise unilateral decisions may bring greater legal risks to the company.

6) Suspension of labor contract

At present, China’s national laws do not have very clear provisions on the suspension of a labor contract, but on the principle of civil law, both parties can temporarily suspend the labor contract due to special matters, such as force majeure, or through consensus. During the suspension of the labor contract, the payment of labor remuneration and welfare benefits can be determined by both parties through negotiation. However, it is not recommended that the enterprise unilaterally suspend the performance of the labor contract with employees so as to avoid labor disputes.

7) Workforce sharing

During the epidemic, many companies created a new form of recruitment to ease the pressure on labor costs. Enterprises with a labor shortage and those businesses with a temporary labor surplus due to suspended or reduced operations were able to share their workforce. To some degree, this has been a win-win solution as it improves the efficiency of human resources allocation.

“Workforce sharing” does not change the labor relationship between the original employer and employees. The original employer should still protect the basic rights and interests of the employees on secondment and urge the new employer to provide necessary labor protection and reasonable arrangement of working hours and tasks for the employees, to ensure the physical and mental health of the employee. Enterprises that have established this kind of cooperation may enter into a civil agreement to clarify the rights and obligations of both parties.

To be noted, the MHRSS has emphasized that employers are not allowed to lend its employees for profit-making. Neither the former employer nor the new employer is allowed to engage in illegal labor dispatching under the name of “workforce sharing” or induce workers to register as individual industrial and commercial households in an attempt to avoid employment responsibilities. The statement of the MHRSS also provides compliance implications for the new employment modes in special periods.

8) Suspension of production and operation

Due to the COVID-19 outbreak, China’s central and local governments extended the holiday for the Lunar New Year and ordered factories and stores to close until the epidemic was brought under control. On the other side, in a bid to stabilize labor relations during the special period, the Ren She Bu Fa [2020] No.8 was released by the MHRSS to clarify the issue of wage payment during the suspension of work and production and support enterprises to negotiate with employees on wage payment:

“… the enterprise shall be guided to negotiate with them (employees) with reference to the relevant provisions of the State on wage payment during the suspension of work and production, and pay wages to them under the standard stipulated in the labor contract within a wage payment cycle; where a wage payment cycle is exceeded, living expenses shall be paid pursuant to the relevant provisions.”  Based on the Ren She Bu Fa [2020] No.8, we’ve also referred to the central and local laws on wage payment during the suspension of work and production, which actually share a lot of similarities.

Based on the Ren She Bu Fa [2020] No.8, we’ve also referred to the central and local laws on wage payment during the suspension of work and production, which actually share a lot of similarities.

Our observation is that basically, in the first salary payment cycle during the suspension, the salary should be paid following the agreement between both parties. After the first payment circle, if the worker provides labor, companies will have a chance to negotiate a new wage scale with the worker. If no labor is provided, living allowance will be paid pursuant to local payment standards.

9) Deferring salary payment

Employers can also consider deferring salary payment in accordance with the law.

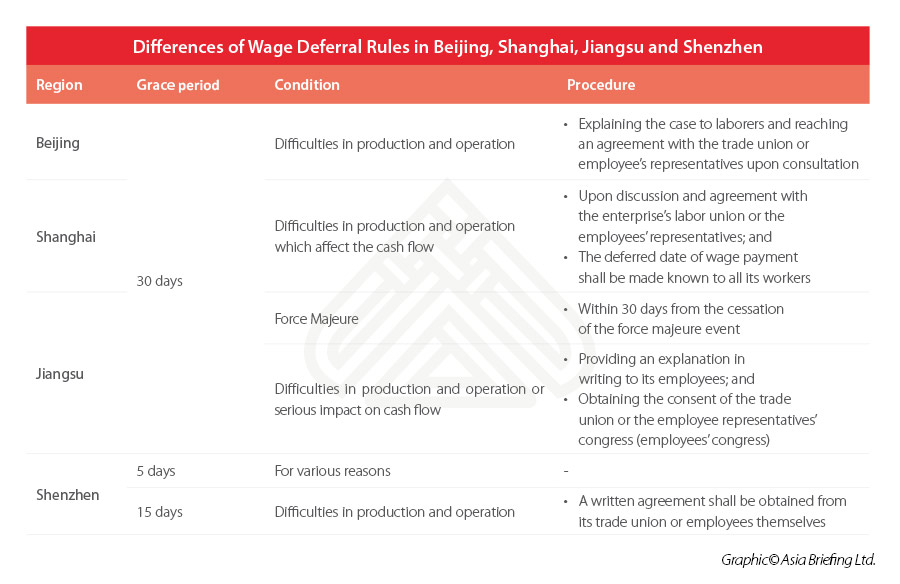

The document Lao Bu Fa [1994] No.489 stipulated that wages should be paid at least once a month. In other words, normally, the maximum period of wage payment is one month. Based on this rule, local legislatures have formulated regional provisions on the wage payment cycle, which indicate wage deferral rules. By comparing the local provinces of Beijing, Shanghai, Shenzhen, and Jiangsu, we found the similarities and differences.

Similarities in rules across China

- All four localities have paid attention to the labor and capital conditions of enterprises facing difficulties. While advocating “democratic” procedures in labor relations, they have given these enterprises a policy basis and operational guidance on implementing deferred wage payments.

- In most areas, the maximum grace period is 30 days (one month).

Differences in policy approach

We provide the following table to showcase the differences in approach across the regions.

Observations from our experts

Dezan Shira & Associates fully understands the difficulties and concerns of foreign enterprises in the face of the epidemic. In our efforts to provide you with professional legal support, we also hope that you can pay attention to the following points:

- The “democratic procedure” is a procedure that is highly valued in labor relations, which is not only reflected in the company’s formulation of internal rules and regulations but also reflected in the company’s adjustment of measures “directly related to the vital interests of workers”.

- For employers who cannot identify “force majeure“, you are welcome to consult us regarding whether the payment of wages can be delayed under specific circumstances.

- Although regional provisions have made clear that under the premise of “production and operation difficulties”, enterprises can delay the payment of wages, how to identify “production and operation difficulties” still needs to be judged following local standards and cannot be generalized.

- Likewise, when identifying the “reasons” of deferred way payment (in Shenzhen’s Regulation on Wage Payment to Employees) or the “(serious) impact on cash flow” (in regulations of Suzhou and Shanghai), employers should also factor in local practices.

If you have any further query about the applicable laws and regulations, legal procedures, implementation strategies of abovementioned solutions, please feel free to contact us at china@dezshira.com.

About Us China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, and Thailand in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article China Issues Consumption Coupons to Boost Retail Recovery After Coronavirus Shutdown Ends

- Next Article How to Handle Your Foreign Employee’s Work and Residence Permit: China’s COVID-19 Travel Ban Series