Hong Kong Budget 2025-26: What Businesses Need to Know

Hong Kong Budget 2025-26 represents a forward-looking strategy designed to secure the city’s economic and social future. With a strong emphasis on fiscal sustainability, strategic investment in public services, and robust measures to stimulate economic recovery, the Budget 2025-26 sets the foundation for a resilient and competitive Hong Kong.

On February 26, 2025, the Financial Secretary of the Hong Kong Special Administrative Region (SAR), Paul Chan, released the government budget for the fiscal year 2025-26 (“Budget 2025-26”). This year’s budget speech was delivered amid ongoing global uncertainties and domestic challenges, setting the stage for a new fiscal year focused on sustainable growth, social well-being, and economic resilience. Among others, the Budget 2025-26 outlines strategic measures designed to bolster fiscal stability, stimulate economic recovery, and enhance public services, all while ensuring Hong Kong remains a competitive global hub.

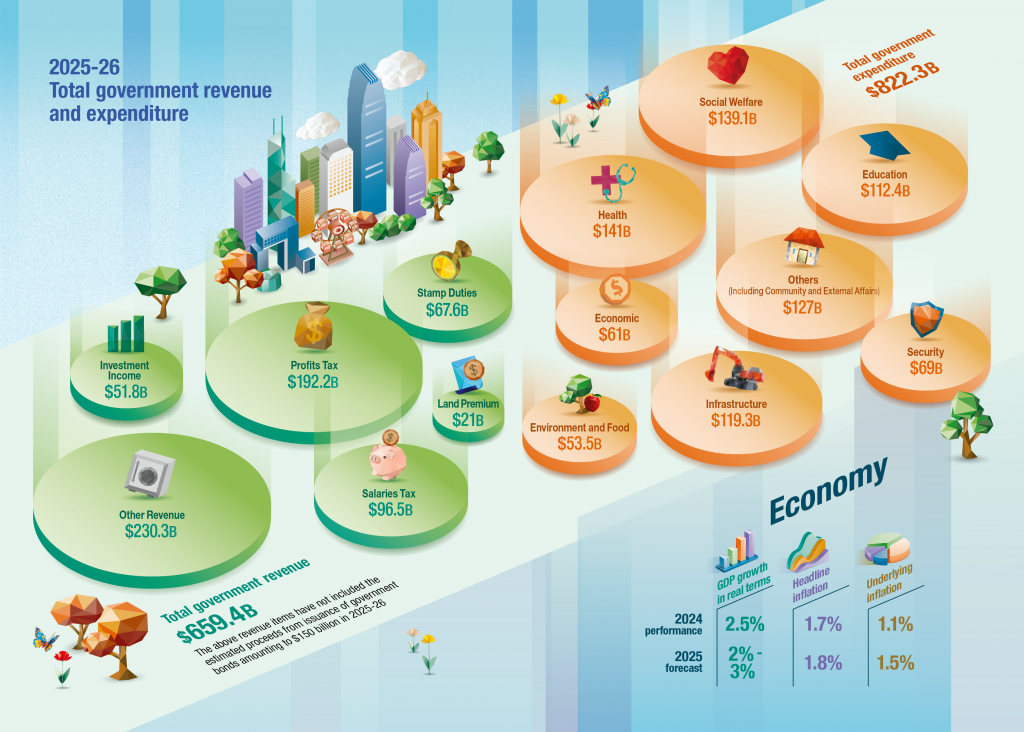

Hong Kong’s Economy in 2024 at a Glance

- Moderate growth: The economy grew by 2.5% despite global challenges.

- Export growth: Total goods exports increased by 4.7%.

- Tourism boost: Visitor numbers rose by 30% to 45 million, enhancing travel and transport services.

- Investment increase: Overall investment expenditure grew by 2.4%.

- Consumption decline: Private consumption expenditure slightly declined by 0.6%.

- Low unemployment: The unemployment rate remained low at 3.1%.

- Wage growth: Median monthly employment earnings increased by 4.8%.

- Mild inflation: The underlying consumer price inflation rate was 1.1%.

- Asset market improvement: The stock market saw an 18% rise in the Hang Seng Index and a 26% increase in average daily turnover.

- Property market: Residential property transactions increased by 23%, while prices fell by 7%; the non-residential market remained stagnant.

Overview of the 2025-26 Hong Kong Budget

In response to persistent global economic headwinds, Budget 2025-26 lays out a robust agenda to stimulate economic recovery. The government plans to introduce financial incentives aimed at small and medium enterprises (SMEs) and to streamline regulatory processes to encourage entrepreneurship. Strategic support for emerging industries, especially technology and innovation, is set to create a more dynamic business environment. By attracting international talent and fostering local start-ups, these measures are designed to drive long-term growth and enhance Hong Kong’s economic resilience.

The Hong Kong 2025-26 Budget introduces a “reinforced version” of the fiscal consolidation program, setting a clear pathway toward restoring fiscal balance while safeguarding public services and citizens’ livelihoods. A central component of this strategy is a planned cumulative reduction of government recurrent expenditure by seven percent from now through the fiscal year 2027-28. This disciplined approach emphasizes the need to contain public expenditure strictly, yet it advocates for a steady and prudent process that carefully balances the diverse impacts on essential services and social well-being.

Key highlights of the Budget 2025-26 include:

- Fiscal consolidation and sustainability: A targeted seven percent reduction in recurrent expenditure aims to restore fiscal balance in the Operating Account. The government is committed to laying a sustainable fiscal foundation for future development, ensuring that the cost-cutting measures do not undermine the quality of public services.

- Strategic investment in innovation and infrastructure: Recognizing the rapid advancement of technology and innovation, the Budget 2025-26 places significant emphasis on accelerating the development of the Northern Metropolis. This initiative is viewed as an investment in the future, creating long-term economic opportunities and driving regional growth.

- Flexible financing through bond issuance: With the prerequisite of maintaining healthy public finances, the Budget 2025-26 outlines a strategy to expand the size of bond issuance suitably. Funds raised through this mechanism will be deployed flexibly to invest in critical infrastructure, innovative projects, and other areas that generate societal value.

Overall, the Budget 2025-26 represents an all-out effort to balance fiscal consolidation with strategic investments that foster economic resilience. By adopting a cautious yet forward-looking stance, the government aims to minimize the impact on public services while positioning Hong Kong to capitalize on future growth opportunities. This approach not only ensures a stable fiscal environment in the near term but also supports a vibrant, sustainable economy in the years to come.

Tax measures proposed in Hong Kong Budget 2025-26

Tax policy remains a crucial lever in shaping the economic landscape. Hong Kong’s Budget 2025-26 introduces a series of comprehensive tax measures designed to reinforce fiscal consolidation while preserving the city’s reputation as a low-tax, business-friendly jurisdiction.

It introduces targeted reforms to further enhance Hong Kong’s attractiveness as an investment destination. The proposed tax reforms are split into two main categories: public finance initiatives aimed at revenue enhancement and targeted support measures for individuals and key industries.

Public finance initiatives

The government’s strategy in the public finance realm is focused on maintaining fiscal discipline and ensuring a sustainable revenue base:

- Departure tax increase: Starting from October 2025, the departure tax for air passengers will be raised from HK$120 to HK$200, generating an additional annual revenue of approximately HK$1.6 billion (US$205 million).

- Global minimum tax implementation: To address base erosion and profit shifting (BEPS 2.0), the Budget 2025-26 includes a plan to implement a global minimum tax, which is projected to bring in an extra annual revenue of HK$15 billion (US$1.92 billion).

- Enhanced digital tools: New digital technologies are being deployed to streamline tax filing, improve transparency, and strengthen overall compliance, contributing to a more efficient revenue system.

Support measures for tax relief and incentives

To alleviate the tax burden on individuals and stimulate economic activity, the Budget 2025-26 outlines several support measures:

| Category | Details | |

| Individual and corporate tax reductions for 2024/25 | Salaries tax | A 100% reduction in salaries tax for the 2024/25 tax year, capped at HK$1,500 per case. For married individuals filing jointly, the cap is HK$1,500 combined. |

| Profits tax | A 100% reduction in profits tax for the 2024/25 tax year, capped at HK$1,500 per case. | |

| Property transaction incentives | Stamp duty exemption | For both residential and non-residential property transactions, the exemption threshold for a stamp duty of HK$100 is raised. Properties valued at HK$4 million or below will benefit from this exemption, effective immediately. |

| Rates concessions | Concessions for both domestic and non-domestic properties for the first quarter of 2025/26, with each property type subject to a HK$500 ceiling. | |

| Additional social support | Allowance enhancements | An extra half-month allowance for standard CSSA payments, Old Age Allowance, Old Age Living Allowance, or Disability Allowance. Similar arrangements for the Working Family Allowance. |

| Tax relief for combined liabilities | Taxpayers liable for both salaries tax and profits tax will receive the proposed tax relief on both, calculated according to the specific conditions of their income and profit assessments. | |

Enhancing key industries through tax incentives

Beyond general tax relief, the Budget 2025-26 targets strategic sectors with tailored incentives to spur growth and innovation. These measures are expected to not only stimulate domestic investment but also attract international capital to Hong Kong.

- Innovation and technology: The government will review and potentially enhance tax deduction arrangements for the purchase of intellectual property rights and related transactions, supporting technological advancements and research.

- Financial sector: Plans are in place to optimize tax incentives specifically for funds and single-family offices, ensuring that Hong Kong remains an attractive hub for financial services.

- Shipping sector: A proposed half-tax concession for eligible commodity traders is on the agenda, with corresponding legislation expected to be introduced next year. This measure aims to bolster the shipping industry’s competitiveness.

- Green development: Tax exemptions for green methanol used as fuel are proposed, supporting the broader governmental objective of promoting environmentally friendly practices within key industries.

Measures to attract more enterprises to establish in Hong Kong

In a bold move to bolster economic growth and reinforce Hong Kong’s status as a global business hub, the government has unveiled a series of strategic initiatives designed to attract more enterprises and high-profile events to the city. These measures, integral to the Budget 2025-26, aim to create new job opportunities, drive investment, and further enhance the city’s international appeal. Key elements of this plan include:

- OASES announcement: Next month, OASES will introduce a new batch of over ten strategic enterprises. Combined with previously announced projects, these companies are set to invest approximately HK$50 billion in Hong Kong, generating more than 20,000 jobs over the coming years.

- Enterprise re‑domiciliation mechanism: The government is actively working to attract both Mainland and global enterprises to establish their headquarters or regional divisions in Hong Kong. To facilitate this, a bill has been submitted to the Legislative Council to introduce a company re‑domiciliation mechanism, easing the transition for overseas companies relocating to the city.

- IOMed headquarters: In a significant development, the headquarters of the International Organization for Mediation (IOMed) is scheduled to open by the end of this year. As the first international inter‑governmental organization to establish its headquarters in Hong Kong—and the first of its kind specializing in international dispute resolution through mediation—this move underscores Hong Kong’s emerging role as the capital for global mediation.

- Kai Tak Sports Park: Set to officially open in three days, Kai Tak Sports Park offers a world‑class venue for hosting international mega‑events. This state‑of‑the‑art facility will not only drive the development of culture, sports, and tourism industries in Hong Kong but also serve as one of the event venues for the National Games.

- WTCF Tourism Summit: For the first time, Hong Kong will host the World Tourism Cities Federation (WTCF)’s 2025 Fragrant Hills Tourism Summit in April. Expected to attract representatives from approximately 40 countries and regions, the summit is poised to enhance Hong Kong’s profile as a premier destination for global tourism and business engagement.

Support for SMEs

Budget 2025-26 introduces a series of targeted measures to support the dynamic SME sector in Hong Kong, enhancing liquidity, boosting export capabilities, and driving digital transformation. The government is injecting HK$1.5 billion (US$192.95 million) into both the BUD Fund and the Export Marketing and Trade and Industrial Organization Support Fund while streamlining application arrangements to ensure easier access to these resources.

Key initiatives include:

- Enhanced financing support: The SME Financing Guarantee Scheme now features a principal moratorium application period extended until November 2025, offering critical relief amid economic uncertainties. Participating banks in the Taskforce on SME Lending have committed over HK$390 billion (US$50.7 billion) in dedicated funds, reinforcing the robust credit support available to SMEs.

- Digital and market development initiatives: The HKTDC will launch the E-Commerce Express to provide consultation services tailored to Hong Kong enterprises, helping them harness digital platforms effectively. Additionally, the second edition of the Hong Kong Shopping Festival will be organized to promote SME participation in local and international markets.

Together, these measures underscore the government’s commitment to fostering a resilient and competitive SME ecosystem that is well-equipped to seize emerging opportunities and drive sustainable growth in Hong Kong.

Charting the way forward

Despite its ambitious agenda, Budget 2025-26 comes at a time when Hong Kong faces multiple challenges. The global economic climate remains unpredictable, with trade tensions and geopolitical uncertainties continuing to influence market conditions. Domestically, issues such as income inequality and the pressures of an aging demographic require thoughtful, targeted responses. Nevertheless, the government’s comprehensive approach—combining fiscal prudence with strategic investments and policy reforms—aims to navigate these complexities effectively. By prioritizing both revenue stability and targeted social spending, the Budget 2025-26 seeks to create a balanced framework that supports long-term prosperity.

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article China’s Fertility Services Market: Navigating Growth, Challenges, and Opportunities

- Next Article Le industrie cinesi da monitorare nel 2025