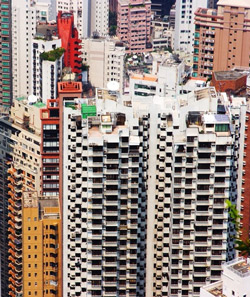

Hong Kong Authorities Move to Prevent Real Estate Bubble

HONG KONG, Oct. 26 – Hong Kong’s Monetary Authority released a circular aimed at tempering the territory’s hot high-end property market by increasing the minimum down payment on luxury homes from 30 percent to 40 percent effective immediately.

HONG KONG, Oct. 26 – Hong Kong’s Monetary Authority released a circular aimed at tempering the territory’s hot high-end property market by increasing the minimum down payment on luxury homes from 30 percent to 40 percent effective immediately.

This hopes to prevent the market from reaching unsustainable high prices after reports that a luxury flat in the territory sold for an astonishing HK$767,000 dollars per square meter or a total of HK$439 million dollars for 572 square meters, setting a world record for price.

According to the circular, for residential properties valued at HK$20 million or more, the loan to value ratio will be capped at 60 percent while properties valued below HK$20 million will maintain its 70 percent loan to value ratio with the maximum loan amount capped at HK$12 million.

Chief Executive of the HKMA, Norman Chan, said in a statement: “These are prudential measures designed in the interest of maintaining banking stability, to enhance banks’ risk management on mortgage lending to high-end residential properties. The lower LTV ratio for high-end properties will be helpful to banks in the management of the credit risks in lending against such properties.”

Hong Kong real estate prices have been on an upswing compared to decreasing real estate prices around the world because of the territory’s low interest rates and a flood of investment coming from mainland China. Mainland investors riding on Beijing’s massive four trillion-yuan stimulus plan have been looking at diversifying assets outside the mainland.

The Wall Street Journal reports that the real estate developers say that mainland buyers accounted for as much as 40 percent of new-home sales.

- Previous Article Customs Increase Emphasis on Dutiable Value, HS Classification and Country of Origin

- Next Article China Joint Ventures as Strategic Investment